This version of the form is not currently in use and is provided for reference only. Download this version of

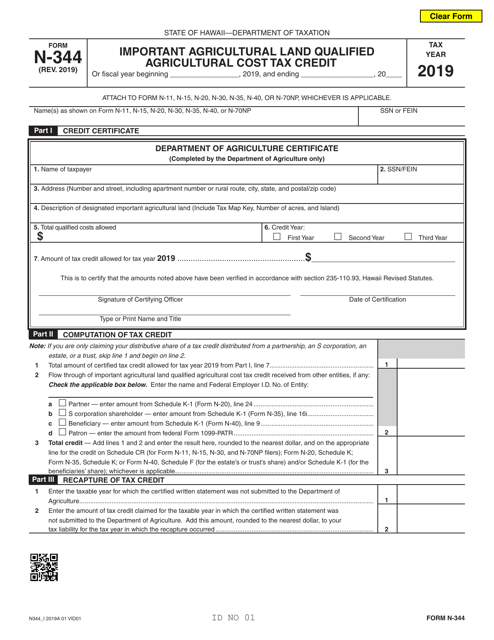

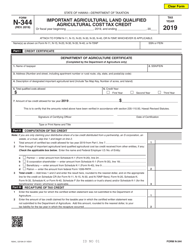

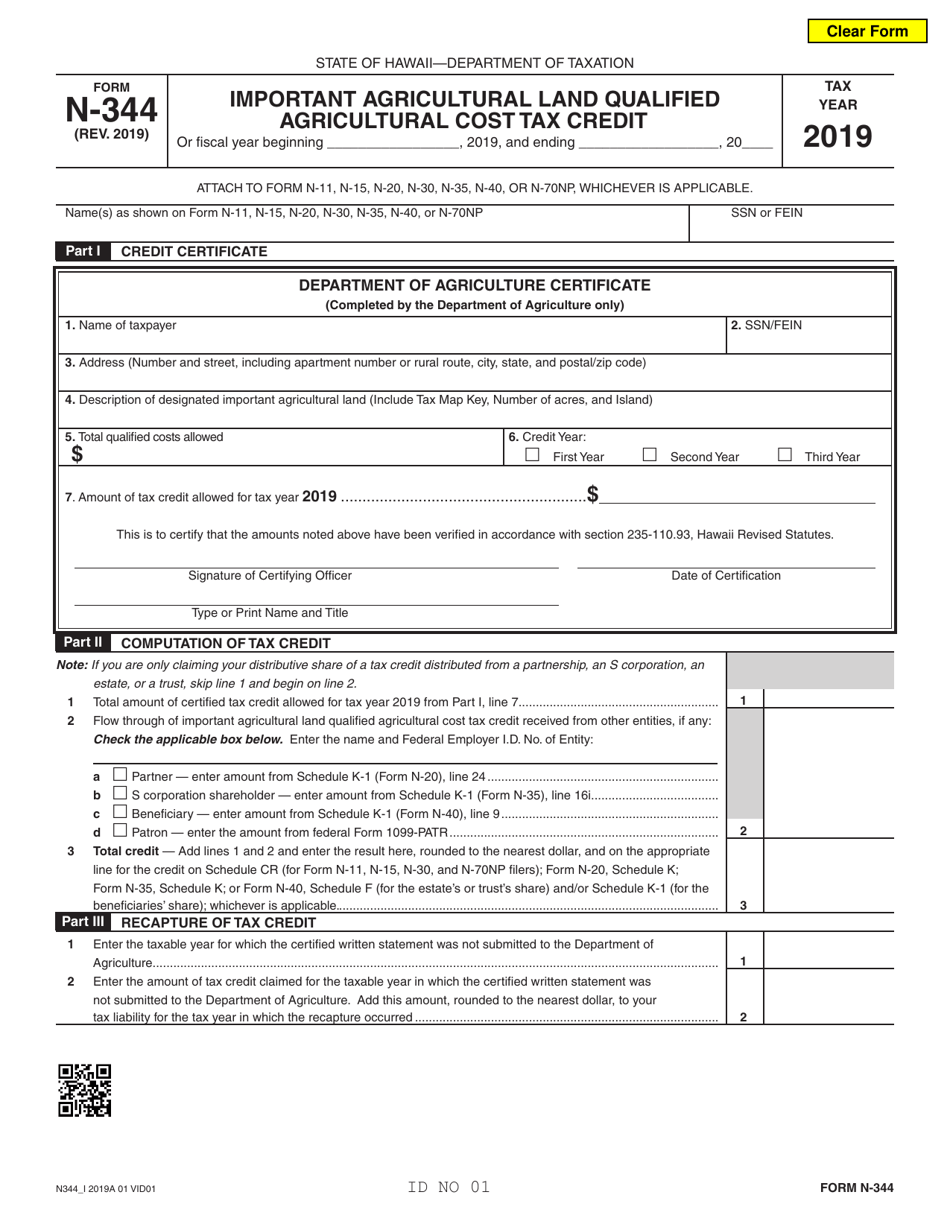

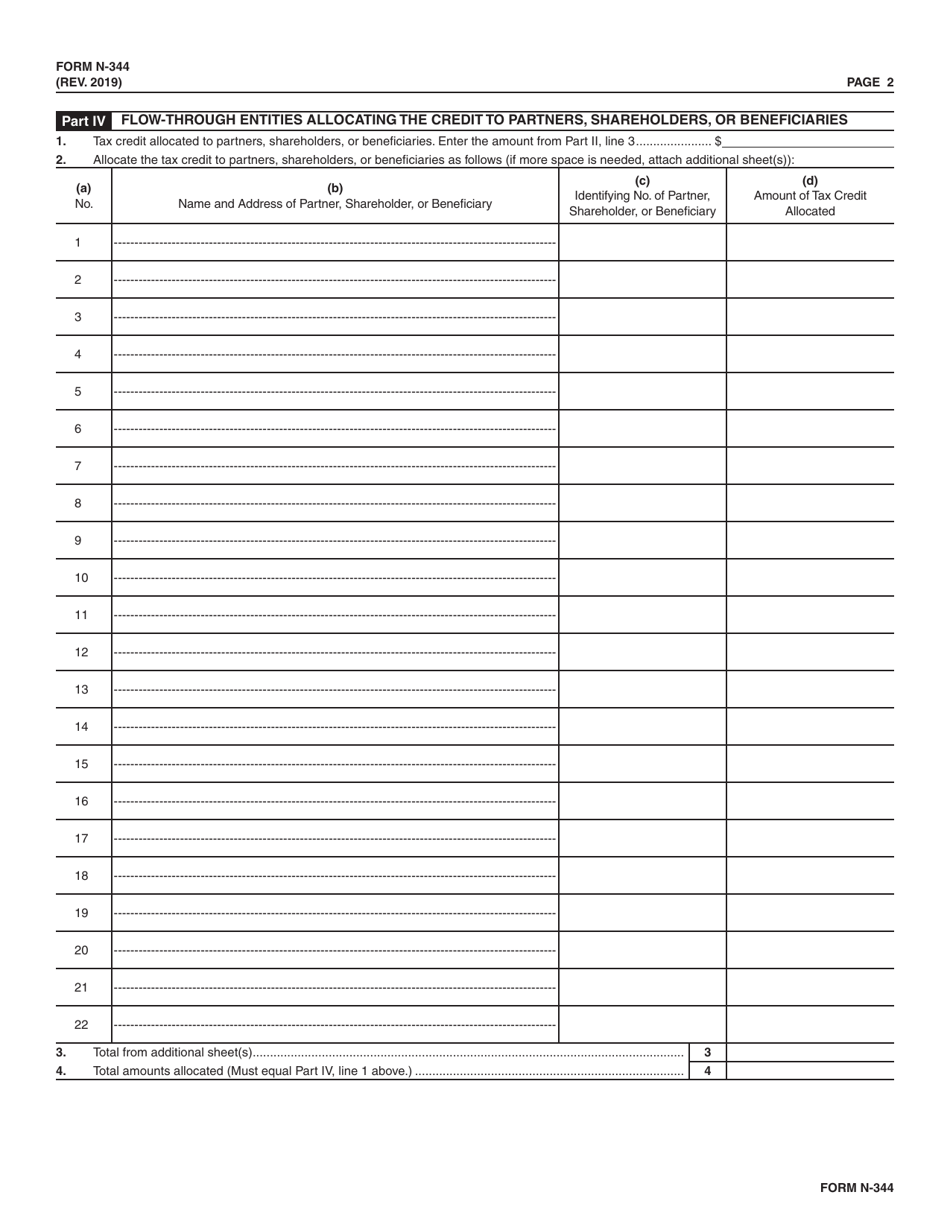

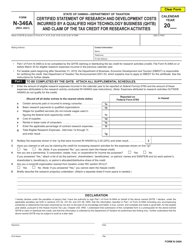

Form N-344

for the current year.

Form N-344 Important Agricultural Land Qualified Agricultural Cost Tax Credit - Hawaii

What Is Form N-344?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-344?

A: Form N-344 is a tax form in Hawaii related to the Important Agricultural Land Qualified Agricultural Cost Tax Credit.

Q: What is the Important Agricultural Land Qualified Agricultural Cost Tax Credit?

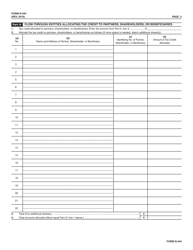

A: The Important Agricultural Land Qualified Agricultural Cost Tax Credit is a program in Hawaii that provides tax credits to landowners for certain qualified agricultural costs on important agricultural lands.

Q: Who is eligible for the Important Agricultural Land Qualified Agricultural Cost Tax Credit?

A: Landowners who have land designated as important agricultural lands in Hawaii may be eligible for this tax credit.

Q: What are qualified agricultural costs?

A: Qualified agricultural costs include expenses such as the purchase of machinery and equipment, soil and water conservation measures, agricultural research and development, and more.

Q: How can I claim the Important Agricultural Land Qualified Agricultural Cost Tax Credit?

A: To claim the tax credit, landowners must file Form N-344 with the Hawaii Department of Taxation and meet all the specified requirements.

Q: Are there any limitations on the tax credit?

A: Yes, there are limitations on the amount of the tax credit that can be claimed per year. It is important to review the specific rules and regulations of the program.

Q: What is the deadline for filing Form N-344?

A: The deadline for filing Form N-344 is typically April 20th of the following year for most taxpayers, but it is advisable to check with the Hawaii Department of Taxation for the most current deadline information.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-344 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.