This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form N-352

for the current year.

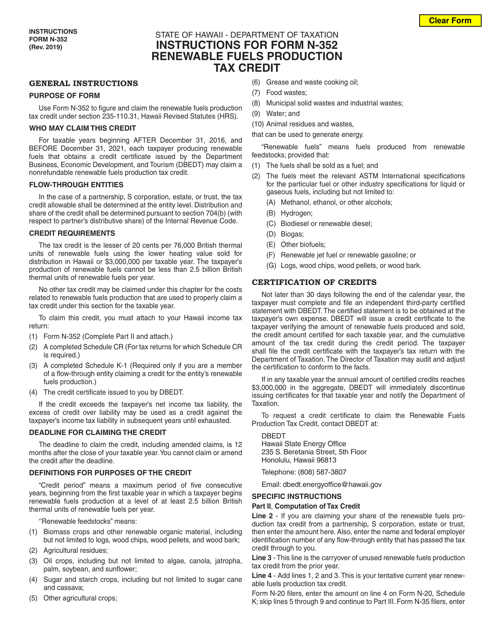

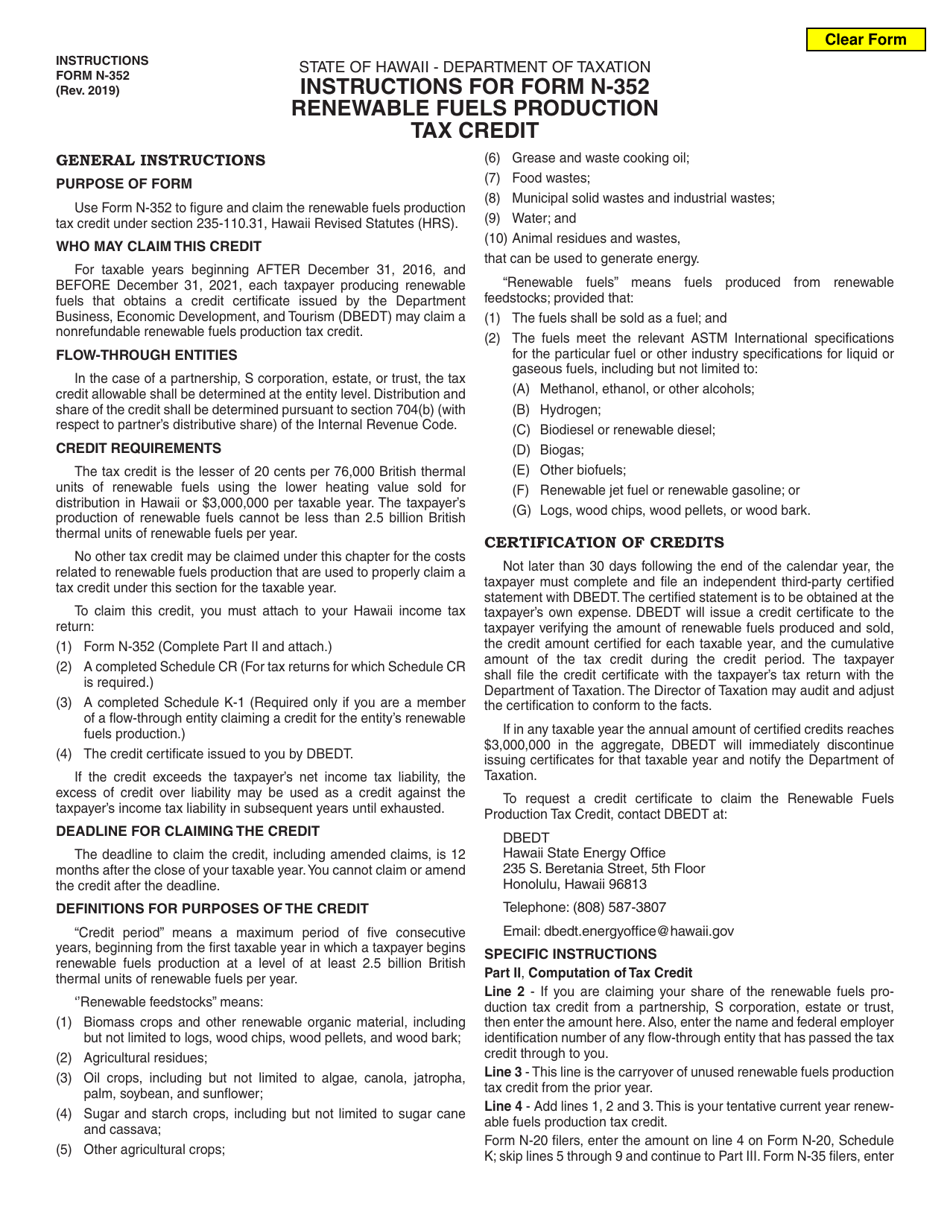

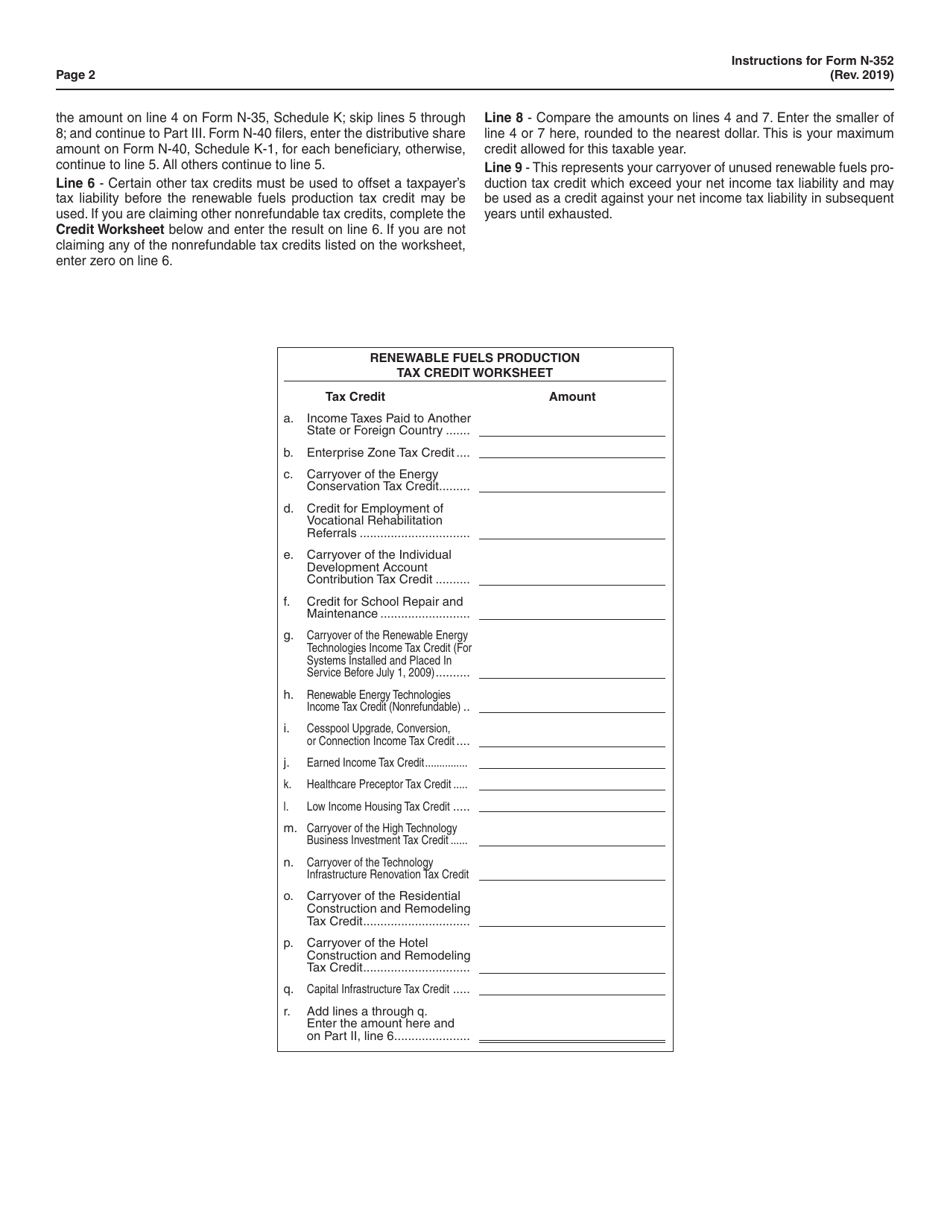

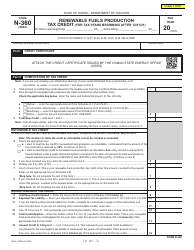

Instructions for Form N-352 Renewable Fuels Production Tax Credit - Hawaii

This document contains official instructions for Form N-352 , Renewable Fuels Production Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-352 is available for download through this link.

FAQ

Q: What is Form N-352?

A: Form N-352 is a tax form related to the Renewable Fuels Production Tax Credit in Hawaii.

Q: What is the Renewable Fuels Production Tax Credit?

A: The Renewable Fuels Production Tax Credit is a tax credit offered in Hawaii for the production of renewable fuels.

Q: Who is eligible for the tax credit?

A: Individuals, corporations, and partnerships engaged in renewable fuels production in Hawaii may be eligible for the tax credit.

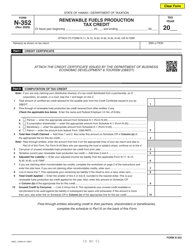

Q: What should be included in the Form N-352?

A: Form N-352 should include information about the renewable fuels production activities and the total amount of tax credit being claimed.

Q: Is there a deadline for filing Form N-352?

A: Yes, Form N-352 must be filed on or before the due date of the Hawaii income tax return for the taxable year.

Q: Are there any supporting documents required with Form N-352?

A: Yes, supporting documents such as production records and receipts may be required to substantiate the claim for the tax credit.

Q: How much is the Renewable Fuels Production Tax Credit?

A: The tax credit amount varies depending on the type of renewable fuel produced and the production capacity.

Q: Can the tax credit be carried forward or refunded?

A: Yes, unused tax credits can be carried forward for up to five years or refunded if certain conditions are met.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.