This version of the form is not currently in use and is provided for reference only. Download this version of

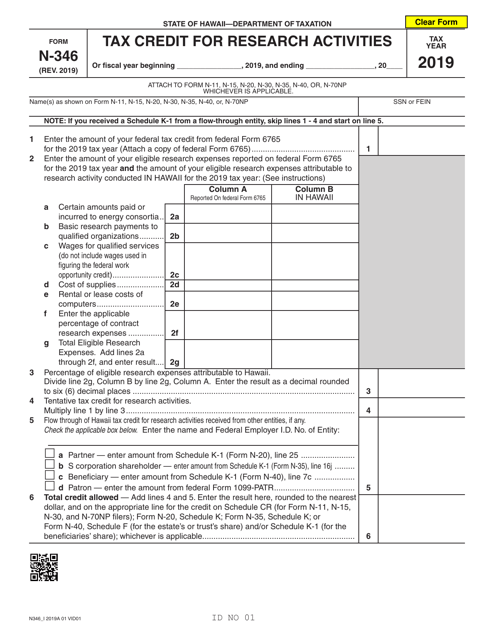

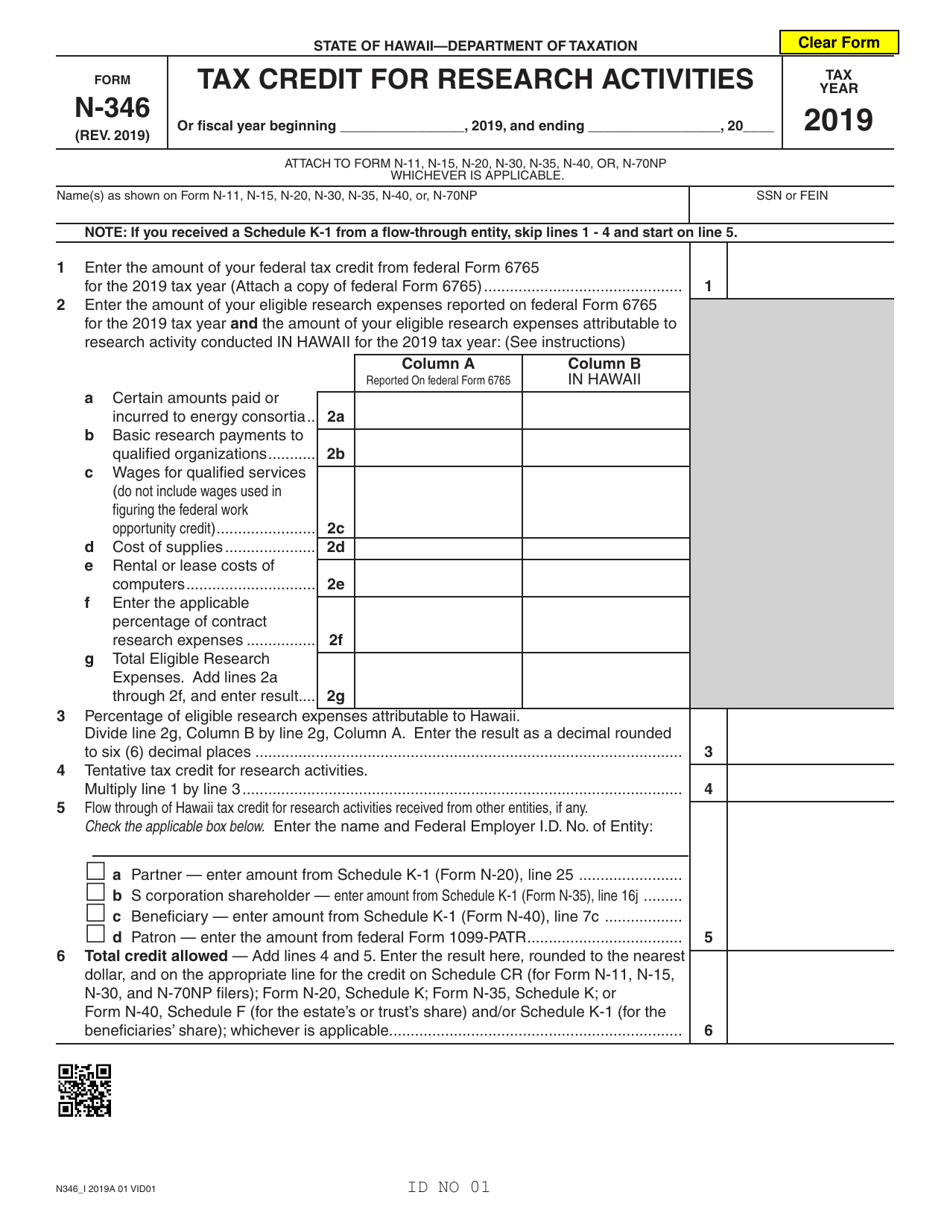

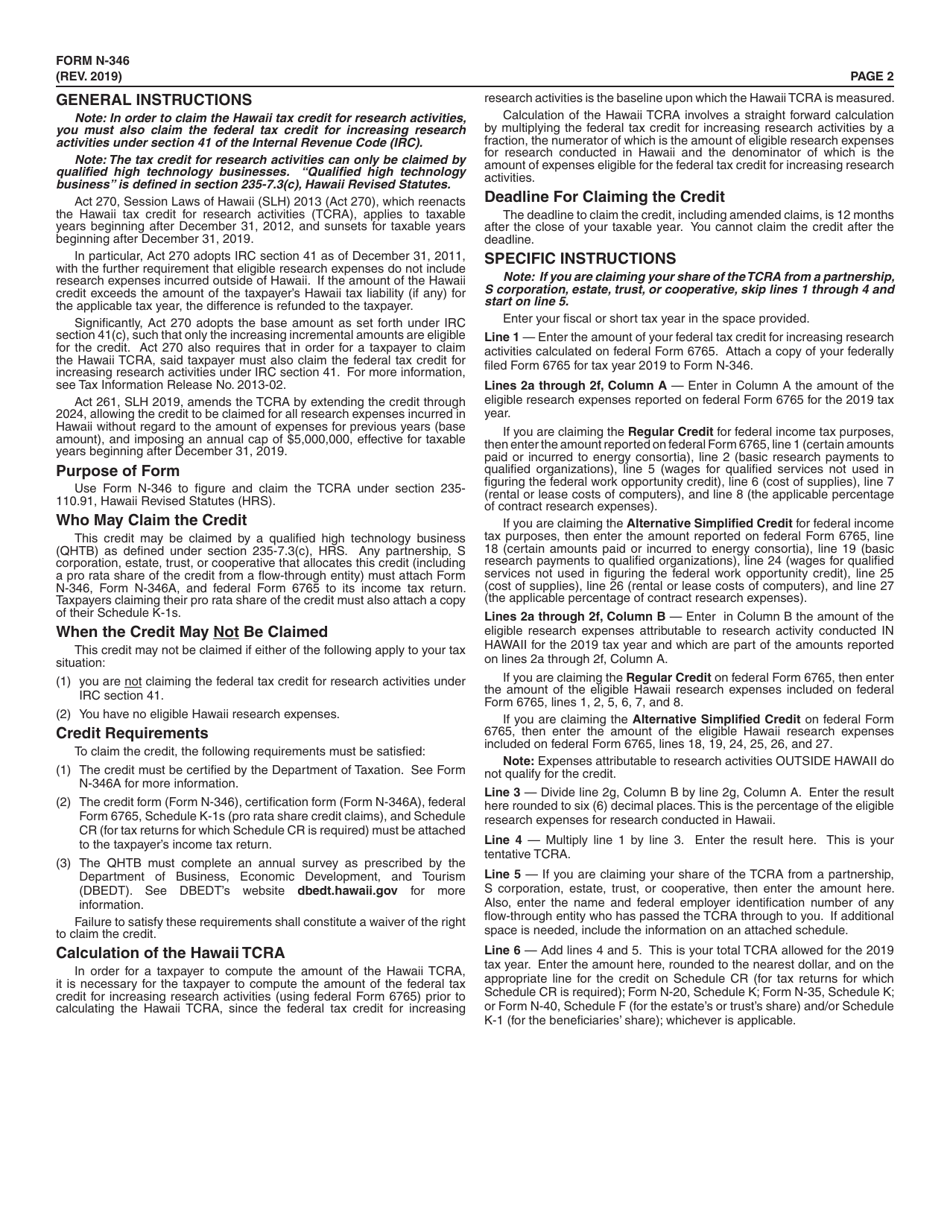

Form N-346

for the current year.

Form N-346 Tax Credit for Research Activities - Hawaii

What Is Form N-346?

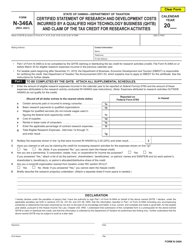

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-346?

A: Form N-346 is a tax form for claiming the Tax Credit for Research Activities in the state of Hawaii.

Q: What is the Tax Credit for Research Activities?

A: The Tax Credit for Research Activities is a tax incentive provided by the state of Hawaii to encourage research and development activities.

Q: Who is eligible to claim the Tax Credit for Research Activities?

A: Taxpayers who conduct qualified research activities in Hawaii and meet other specified criteria are eligible to claim the tax credit.

Q: What expenses can be included in the calculation of the tax credit?

A: Eligible expenses for the tax credit include wages, supplies, and contract research expenses related to qualified research activities.

Q: How much is the tax credit?

A: The tax credit is generally equal to 20% of the qualified research expenses incurred in Hawaii.

Q: Can the tax credit be carried over or transferred?

A: Yes, any unused portion of the tax credit can be carried forward for up to 20 years or transferred to another taxpayer.

Q: How do I claim the Tax Credit for Research Activities?

A: To claim the tax credit, you must complete Form N-346 and attach it to your Hawaii state tax return.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-346 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.