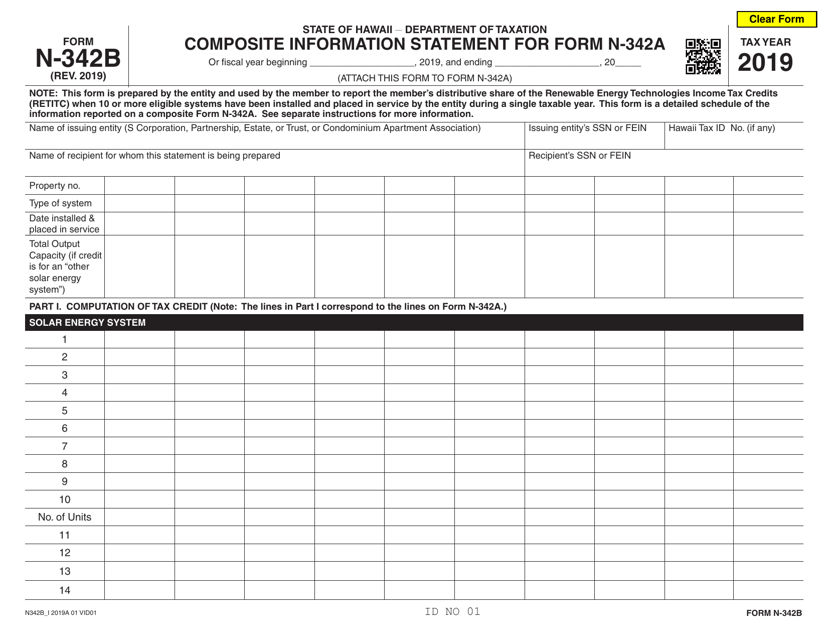

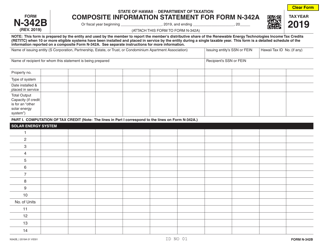

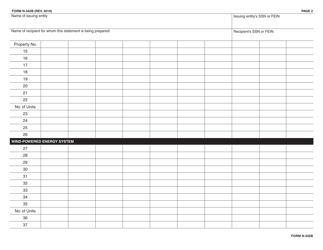

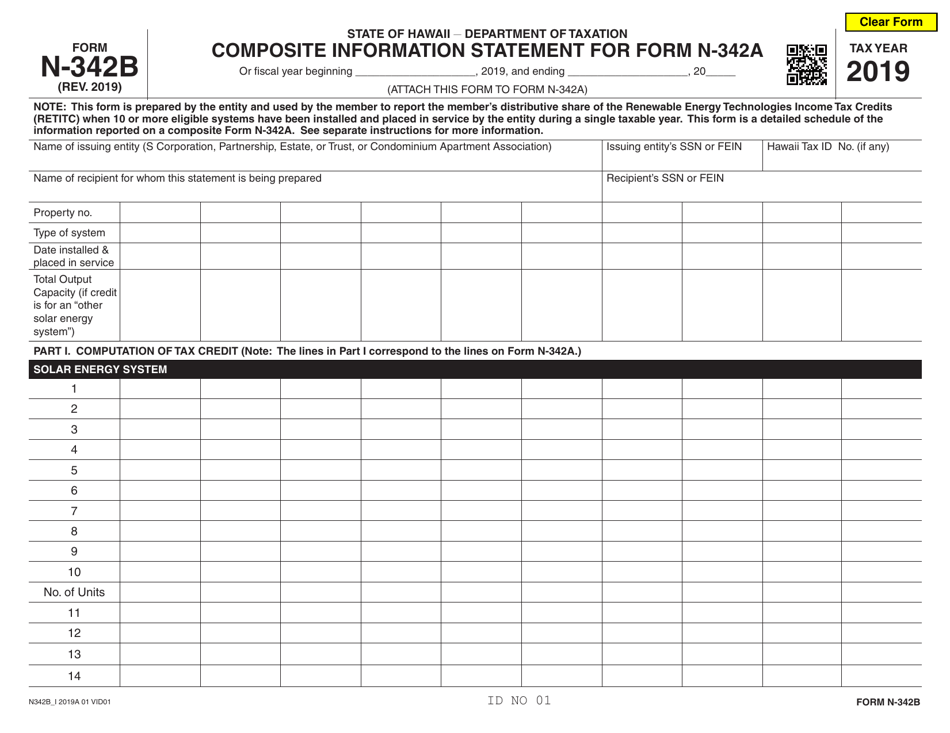

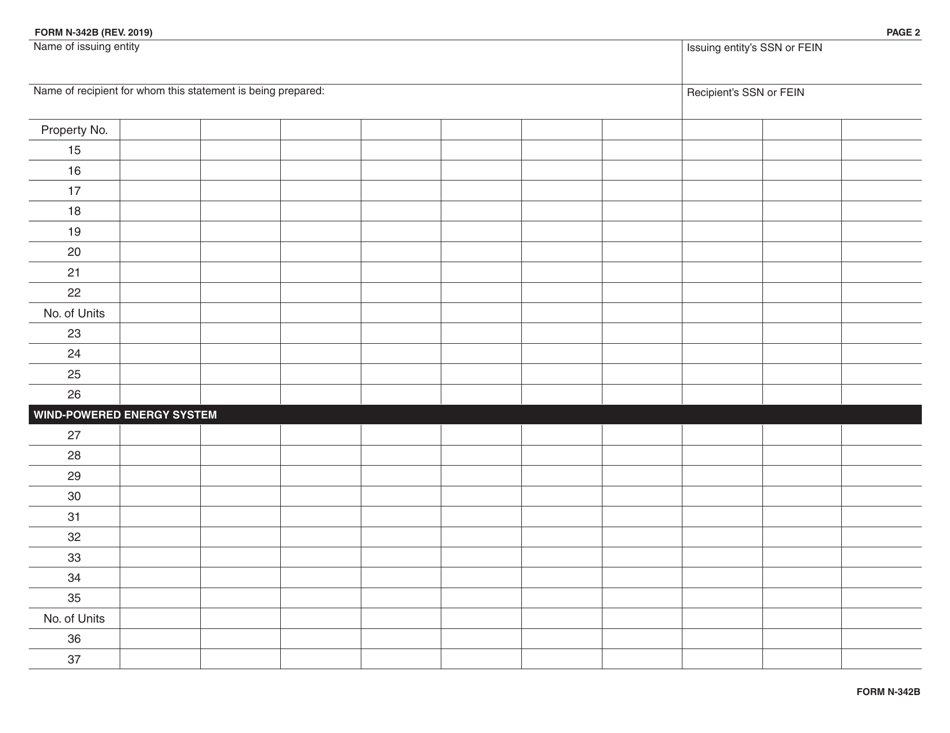

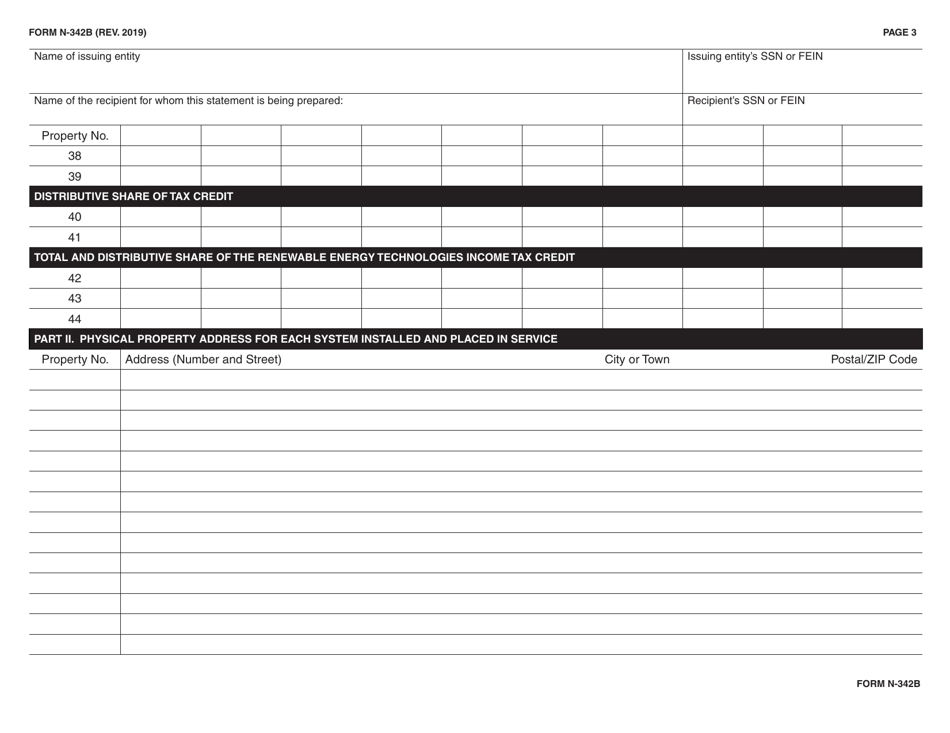

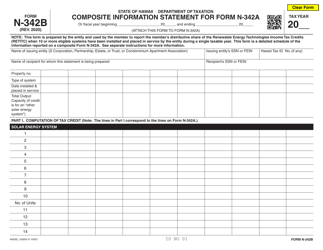

Form N-342B Composite Information Statement for Form N-342a - Hawaii

What Is Form N-342B?

This is a legal form that was released by the Hawaii Department of Transportation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-342B?

A: Form N-342B is the Composite Information Statement for Form N-342A for the state of Hawaii.

Q: What is Form N-342A?

A: Form N-342A is a tax form specific to the state of Hawaii.

Q: Who needs to file Form N-342B?

A: Individuals or entities who have filed Form N-342A in Hawaii need to file Form N-342B as well.

Q: What is the purpose of Form N-342B?

A: Form N-342B is used to report composite income tax on behalf of nonresident individuals or entities.

Q: When is the deadline to file Form N-342B?

A: The deadline for filing Form N-342B is the same as the deadline for filing Form N-342A in Hawaii.

Q: Are there any penalties for late filing of Form N-342B?

A: Penalties may apply for late filing of Form N-342B, so it's important to file on time.

Q: What information is required on Form N-342B?

A: Form N-342B requires information such as the names and Social Security numbers of the nonresident individuals, the amounts of composite income, and the calculation of tax.

Q: Can I file Form N-342B electronically?

A: As of now, Form N-342B cannot be filed electronically and must be filed by mail.

Q: Is Form N-342B required for residents of Hawaii?

A: No, Form N-342B is specifically for nonresident individuals or entities in Hawaii.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-342B by clicking the link below or browse more documents and templates provided by the Hawaii Department of Transportation.