This version of the form is not currently in use and is provided for reference only. Download this version of

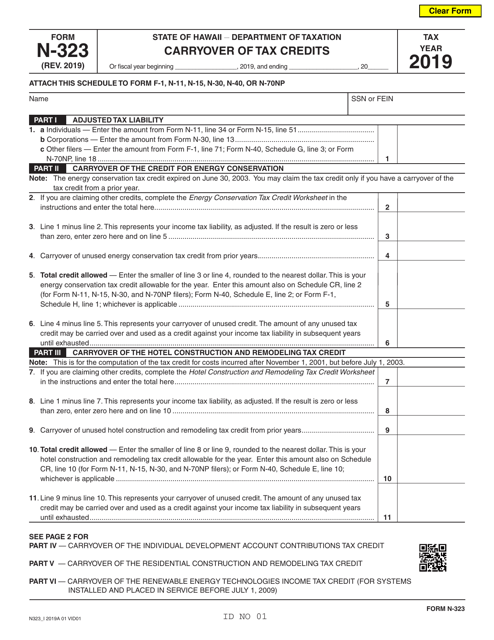

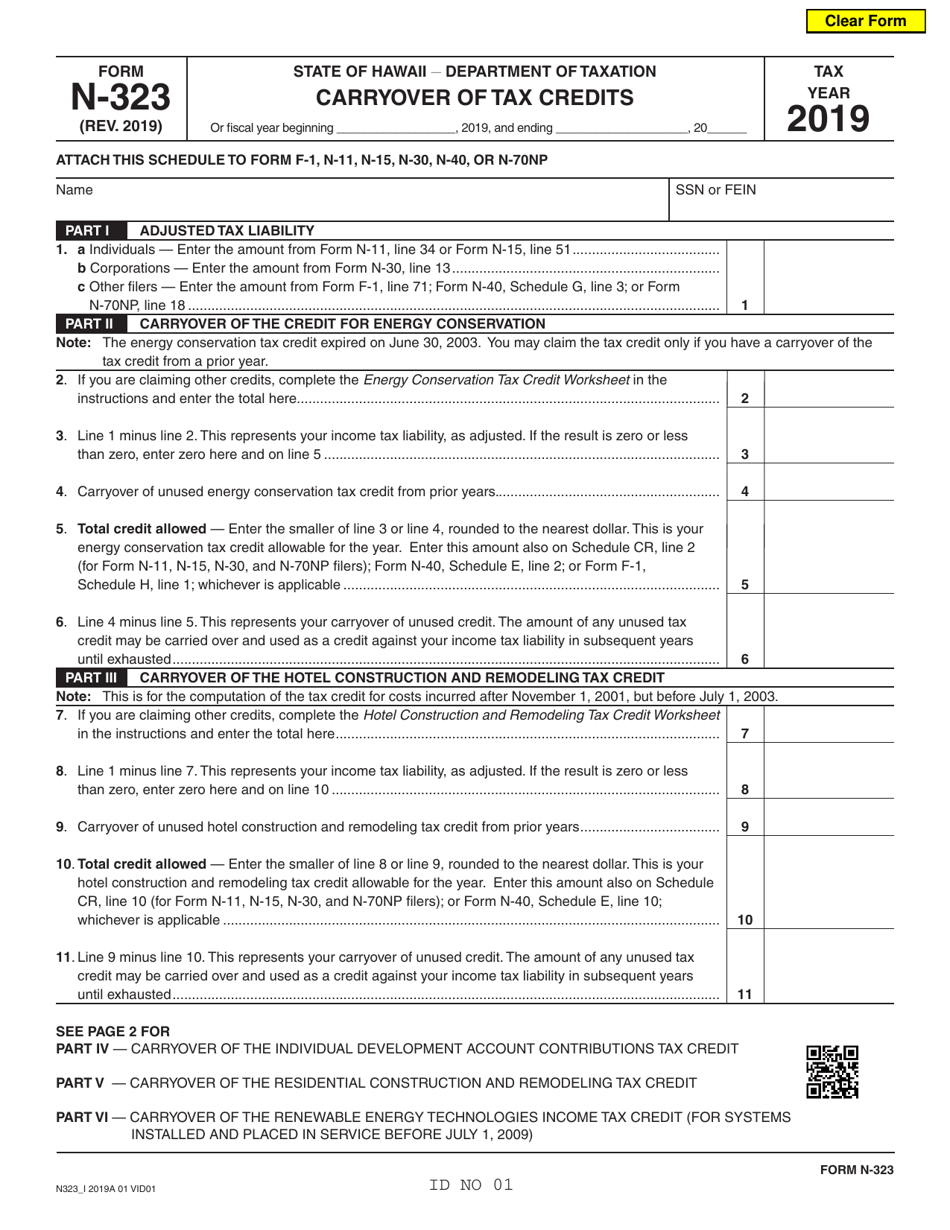

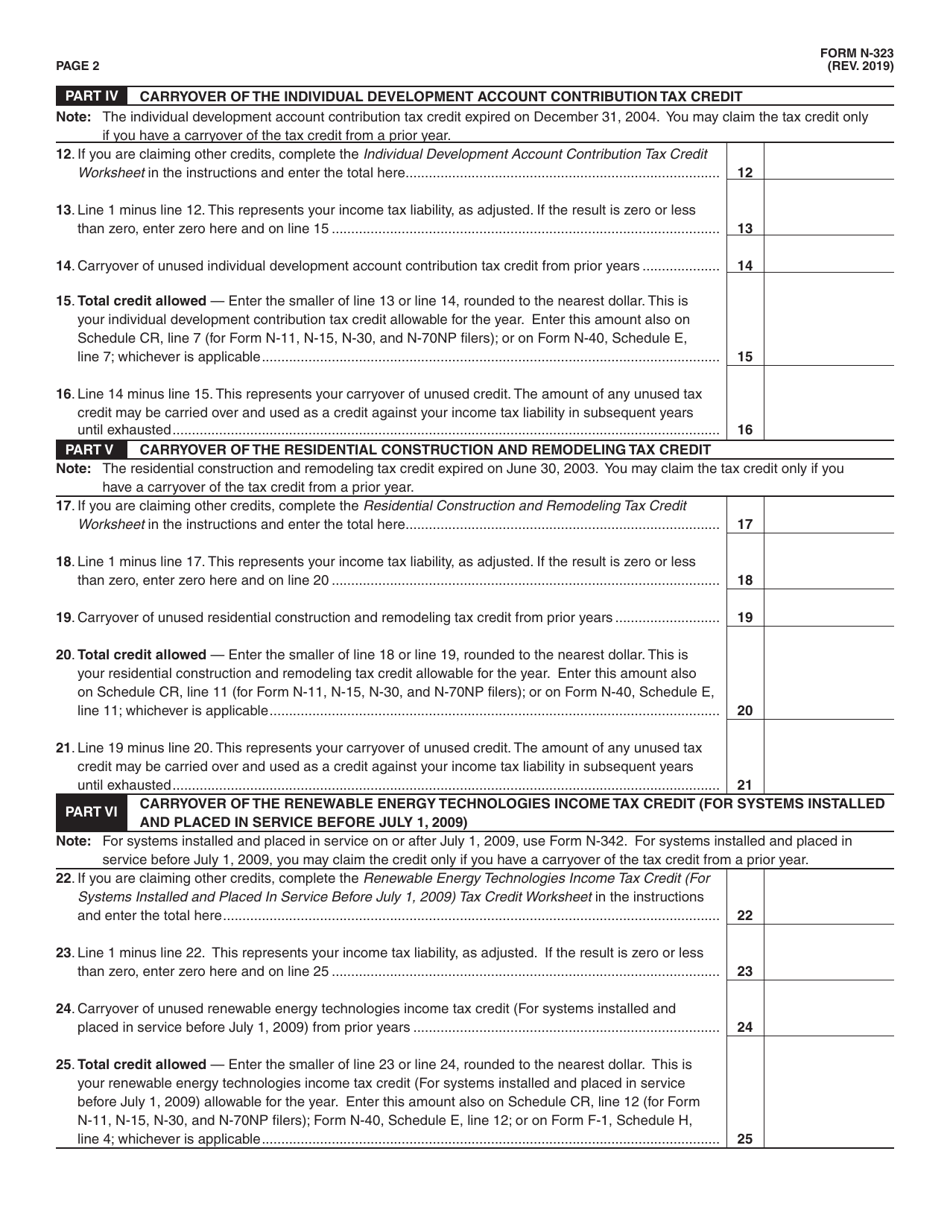

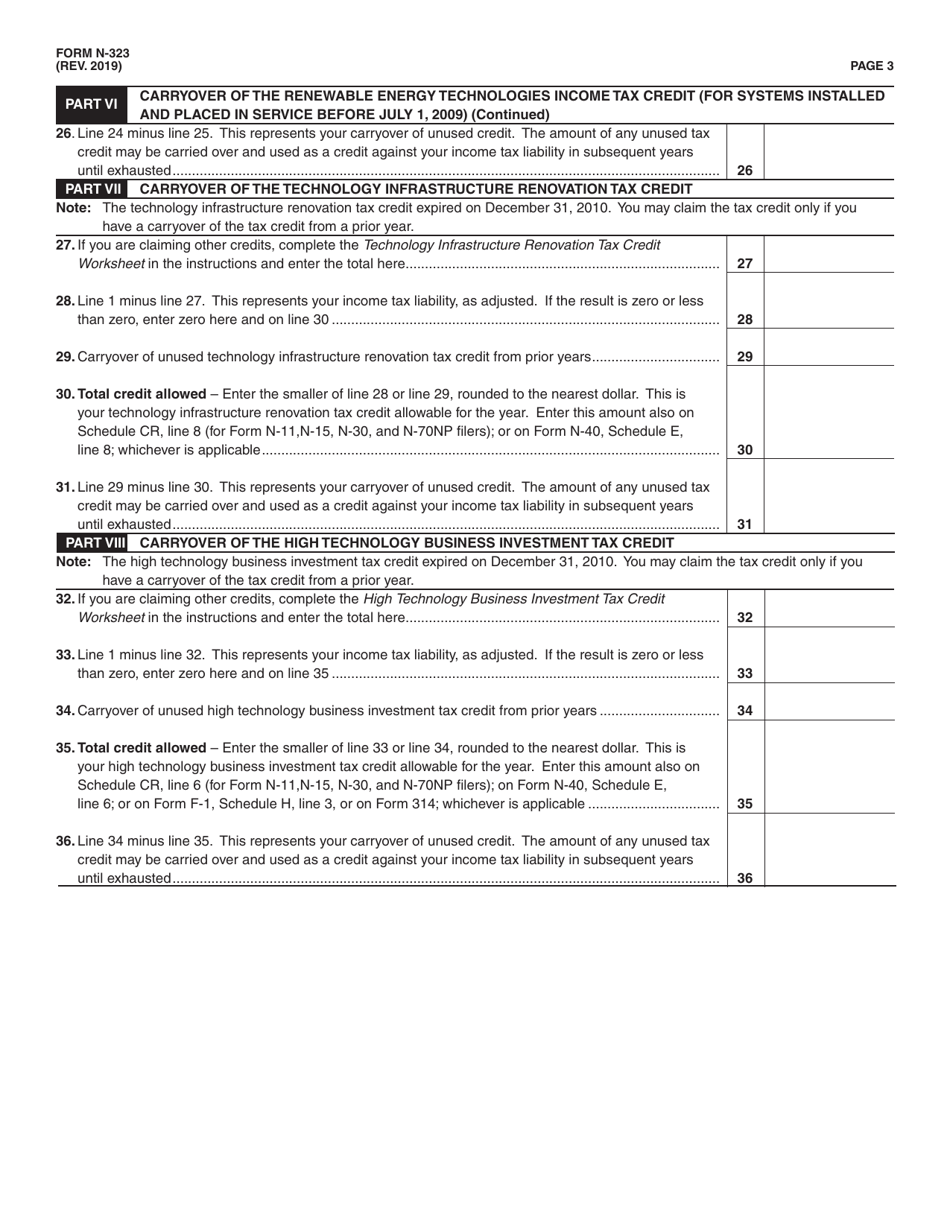

Form N-323

for the current year.

Form N-323 Carryover of Tax Credit - Hawaii

What Is Form N-323?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-323?

A: Form N-323 is a form used in the state of Hawaii to claim a carryover of tax credits.

Q: What is a tax credit?

A: A tax credit is a dollar-for-dollar reduction in the amount of tax you owe.

Q: What does it mean to carryover a tax credit?

A: Carrying over a tax credit means applying any unused portion of the credit to future tax years.

Q: Who is eligible to use Form N-323?

A: Taxpayers in Hawaii who have unused tax credits from a previous year may be eligible to use Form N-323.

Q: What information is required on Form N-323?

A: Form N-323 requires the taxpayer's name, social security number, contact information, and details about the tax credit being carried over.

Q: Is there a deadline for filing Form N-323?

A: Yes, Form N-323 must be filed by the due date of your state tax return for the year in which you are claiming the carryover.

Q: Do I need to include any supporting documents with Form N-323?

A: It is generally not necessary to include supporting documents with Form N-323, but you should keep them for your records in case of an audit.

Q: Can I claim a carryover of tax credits if I did not have any unused credits from a previous year?

A: No, in order to claim a carryover of tax credits, you must have unused credits from a previous year.

Q: Can I claim a carryover of tax credits on my federal tax return?

A: No, Form N-323 is specific to the state of Hawaii and cannot be used on a federal tax return.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-323 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.