This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form N-344

for the current year.

Instructions for Form N-344 Important Agricultural Land Qualified Agricultural Cost Tax Credit - Hawaii

This document contains official instructions for Form N-344 , Important Agricultural Land Qualified Agricultural Cost Tax Credit - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-344 is available for download through this link.

FAQ

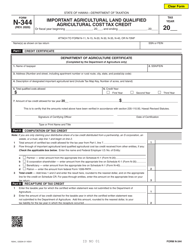

Q: What is Form N-344?

A: Form N-344 is a tax form used in Hawaii for claiming the Important Agricultural Land Qualified Agricultural Cost Tax Credit.

Q: What is the Important Agricultural Land Qualified Agricultural Cost Tax Credit?

A: The Important Agricultural Land Qualified Agricultural Cost Tax Credit is a tax credit in Hawaii that provides incentives for agricultural activities on important agricultural lands.

Q: Who is eligible to claim the tax credit?

A: Individuals and corporations who meet the requirements specified in the form are eligible to claim the tax credit.

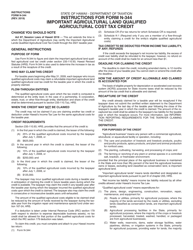

Q: What are important agricultural lands?

A: Important agricultural lands are designated areas in Hawaii that have significant agricultural value and are protected under state law.

Q: What expenses qualify for the tax credit?

A: Qualifying expenses include costs related to agricultural activities on important agricultural lands, such as equipment, supplies, and labor.

Q: How much is the tax credit?

A: The amount of the tax credit varies and is based on eligible expenses and the taxpayer's net income.

Q: Is there a limit to the amount of tax credit that can be claimed?

A: Yes, there is a limit to the amount of tax credit that can be claimed. The maximum credit allowed is $2,500 per acre of important agricultural land.

Q: Are there any deadlines for filing Form N-344?

A: Yes, the form must be filed with the Hawaii Department of Agriculture by July 1st of the year following the tax year in which the expenses were incurred.

Q: Are there any supporting documents required to be submitted with the form?

A: Yes, supporting documents such as receipts and invoices for the qualifying expenses must be submitted with the form.

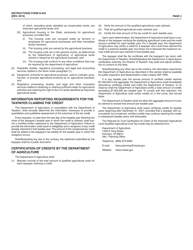

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.