This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-330

for the current year.

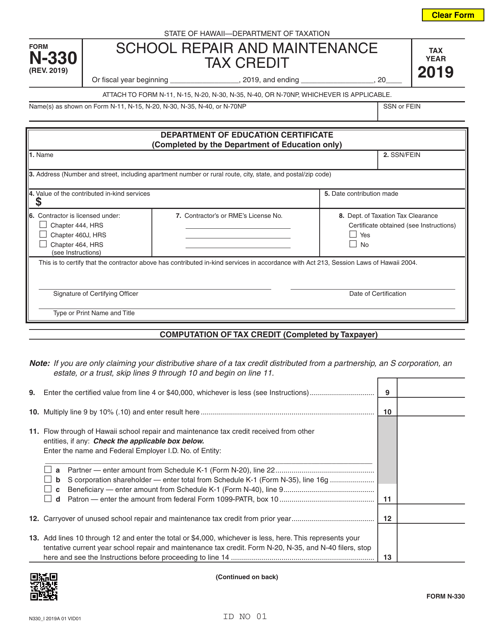

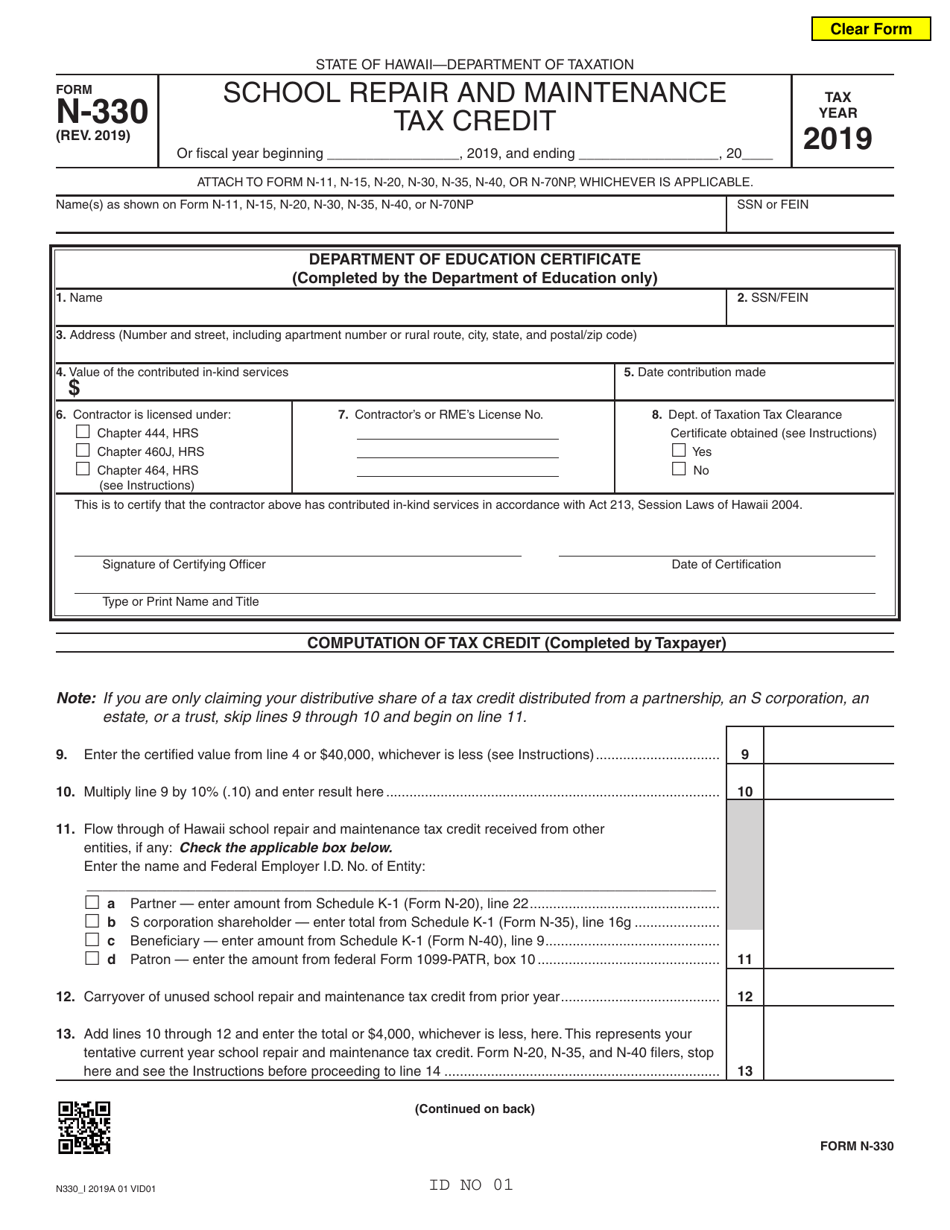

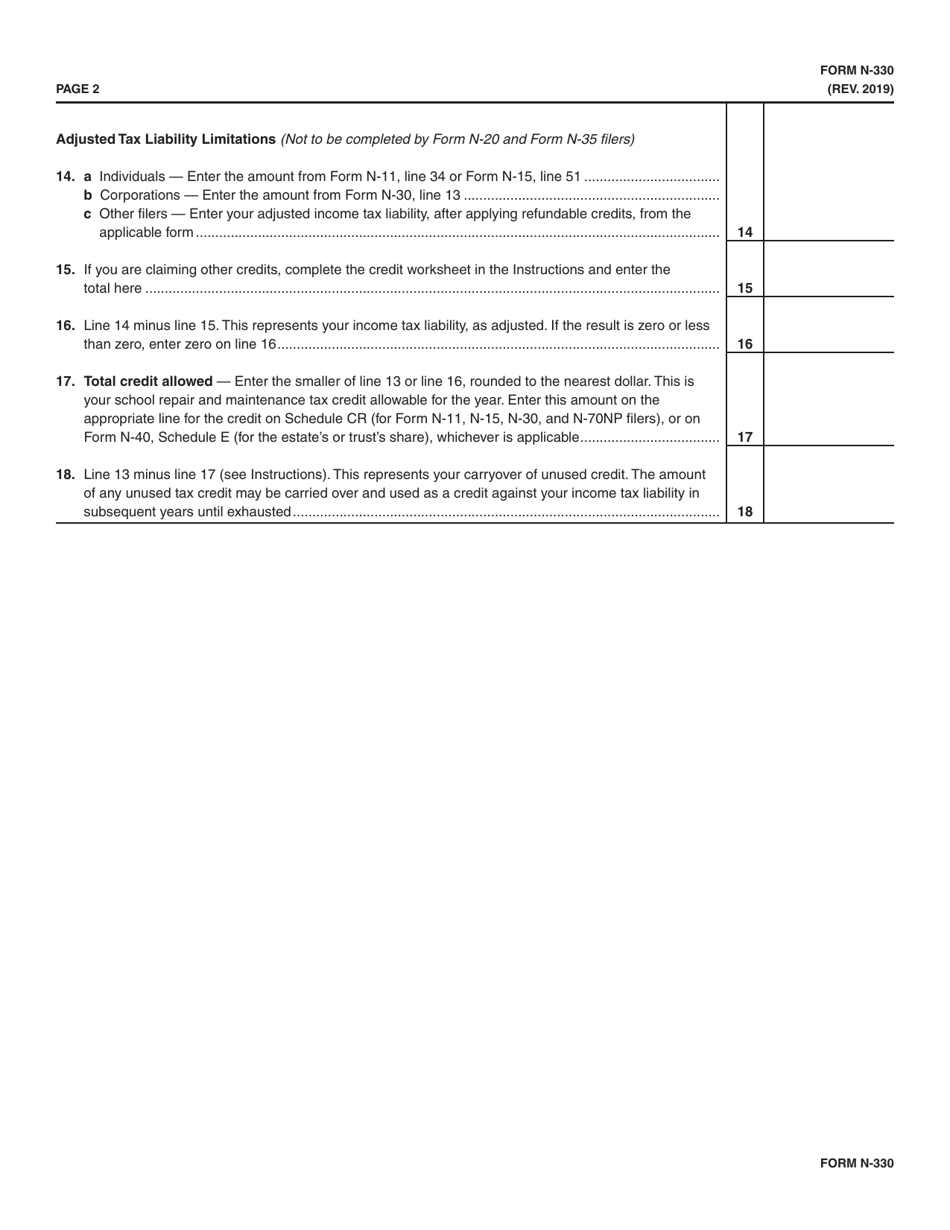

Form N-330 School Repair and Maintenance Tax Credit - Hawaii

What Is Form N-330?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-330?

A: Form N-330 is the Hawaiian tax form used to claim the School Repair and Maintenance Tax Credit.

Q: What is the School Repair and Maintenance Tax Credit?

A: The School Repair and Maintenance Tax Credit is a tax benefit in Hawaii that allows taxpayers to claim a credit for expenses paid for eligible school repair and maintenance projects.

Q: Who is eligible to claim the School Repair and Maintenance Tax Credit?

A: Taxpayers who have paid expenses for eligible school repair and maintenance projects in Hawaii are eligible to claim the tax credit.

Q: What expenses qualify for the School Repair and Maintenance Tax Credit?

A: Expenses for eligible repair and maintenance projects, such as materials, labor, and equipment, may qualify for the tax credit.

Q: How much is the School Repair and Maintenance Tax Credit?

A: The tax credit amount is equal to 100% of the qualified expenses paid, up to a maximum credit of $150 per individual or $300 per married couple filing jointly.

Q: How do I claim the School Repair and Maintenance Tax Credit?

A: To claim the tax credit, you need to complete and file Form N-330 with your Hawaii state tax return.

Q: Are there any limitations or restrictions for the School Repair and Maintenance Tax Credit?

A: Yes, the tax credit is subject to certain limitations and restrictions, such as a maximum credit amount per taxpayer and a cap on the total credits allowed in a tax year.

Q: When is the deadline to file Form N-330?

A: The deadline to file Form N-330 is the same as the deadline for filing your Hawaii state tax return, typically April 20th.

Q: Can I claim the School Repair and Maintenance Tax Credit if I am not a Hawaii resident?

A: No, the tax credit is only available to Hawaii residents who have paid expenses for eligible school repair and maintenance projects in the state.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-330 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.