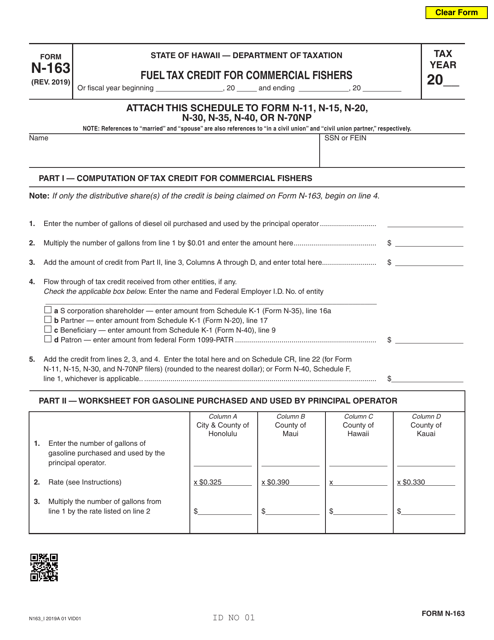

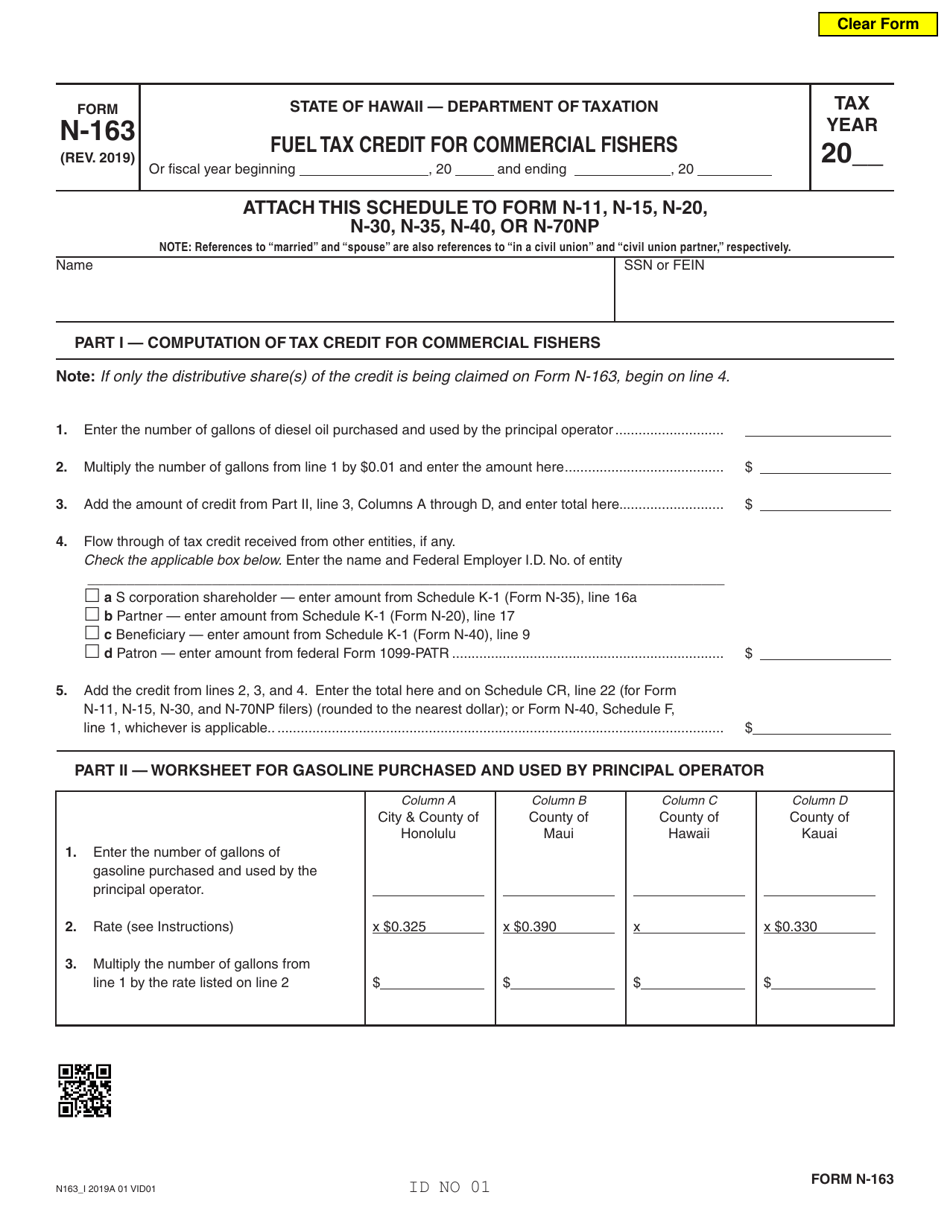

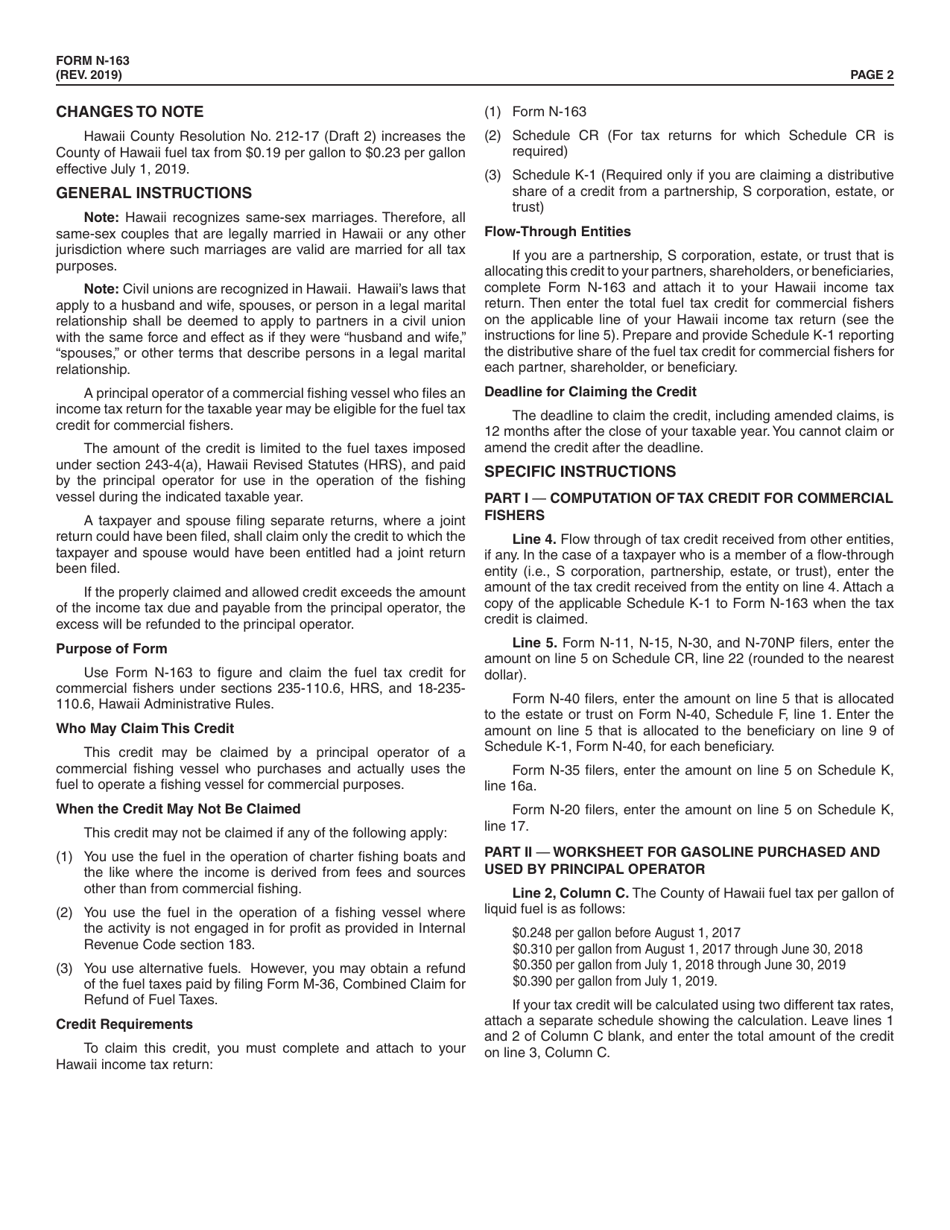

Form N-163 Fuel Tax Credit for Commercial Fishers - Hawaii

What Is Form N-163?

This is a legal form that was released by the Hawaii Department of Transportation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-163?

A: Form N-163 is a tax form used by commercial fishers in Hawaii to claim fuel tax credits.

Q: Who can use Form N-163?

A: Commercial fishers in Hawaii can use Form N-163 to claim fuel tax credits.

Q: What is the purpose of Form N-163?

A: The purpose of Form N-163 is to provide commercial fishers in Hawaii with a way to claim fuel tax credits.

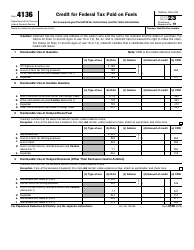

Q: What is a fuel tax credit?

A: A fuel tax credit is a tax benefit that allows commercial fishers to claim a credit for the fuel they use in their fishing operations.

Q: How do I qualify for a fuel tax credit?

A: To qualify for a fuel tax credit, you must be a commercial fisher in Hawaii and meet the specific eligibility requirements outlined by the Hawaii Department of Taxation.

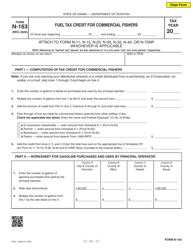

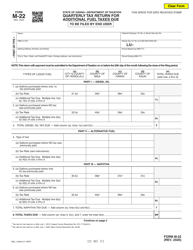

Q: What expenses can I include in my fuel tax credit claim?

A: You can include expenses related to the purchase of fuel used in your fishing operations, as well as any state or county tax paid on the fuel.

Q: When is the deadline to file Form N-163?

A: The deadline to file Form N-163 is typically April 20th of the year following the tax year for which you are claiming the credit.

Q: How long does it take to process a fuel tax credit claim?

A: The processing time for a fuel tax credit claim varies, but it generally takes several weeks to receive a refund or credit.

Q: Are there any limitations or restrictions on the fuel tax credit?

A: Yes, there are limitations and restrictions on the fuel tax credit, such as caps on the amount of fuel that can be claimed and requirements for proper documentation of fuel purchases.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-163 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Transportation.