This version of the form is not currently in use and is provided for reference only. Download this version of

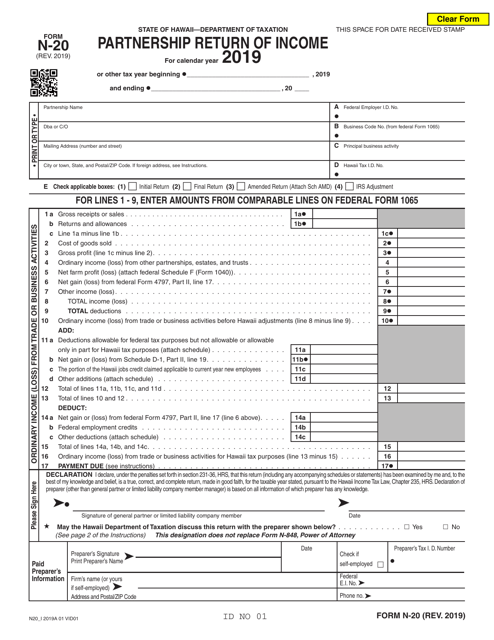

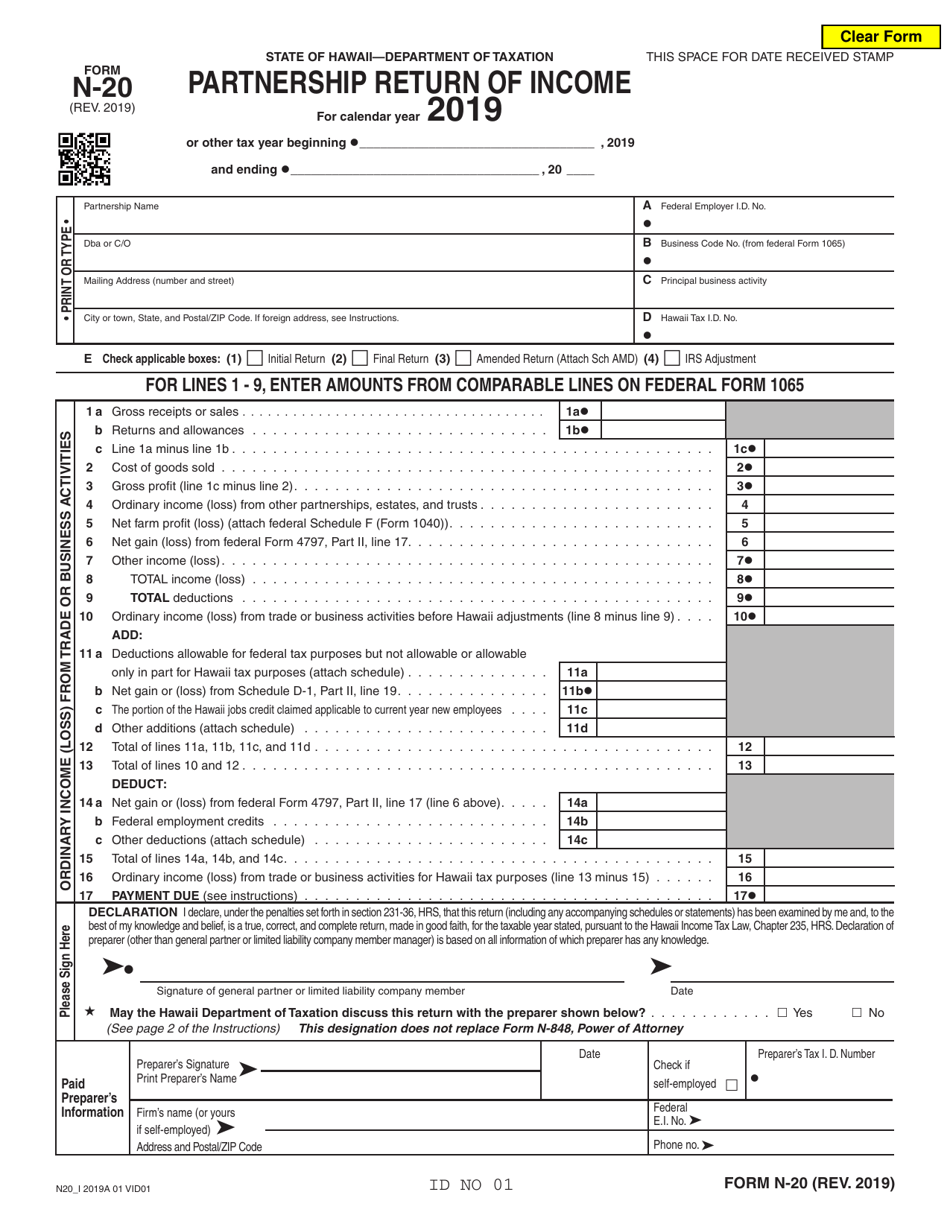

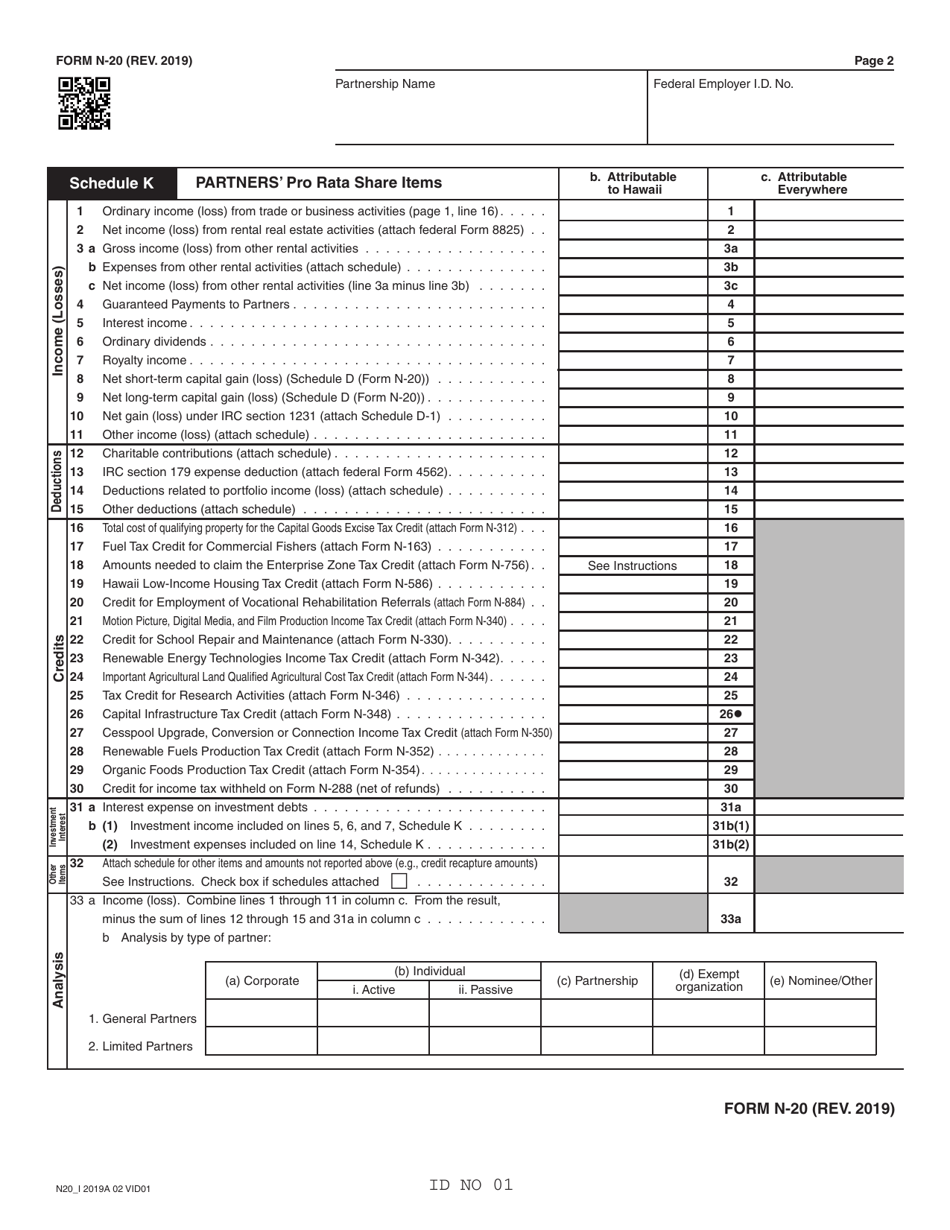

Form N-20

for the current year.

Form N-20 Partnership Tax Return - Hawaii

What Is Form N-20?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-20?

A: Form N-20 is the Partnership Tax Return specific to the state of Hawaii.

Q: Who needs to file Form N-20?

A: Partnerships doing business in Hawaii need to file Form N-20.

Q: What is the purpose of Form N-20?

A: Form N-20 is used to report the income, deductions, and credits of a partnership in Hawaii.

Q: When is the deadline to file Form N-20?

A: The deadline to file Form N-20 is on or before the 20th day of the fourth month following the close of the partnership's tax year.

Q: Are there any filing fees associated with Form N-20?

A: Yes, there is a $10 filing fee for Form N-20.

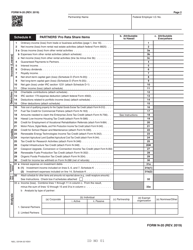

Q: What should I include with Form N-20?

A: Along with Form N-20, you should include all necessary schedules, attachments, and supporting documentation.

Q: What happens if I don't file Form N-20?

A: Failure to file Form N-20 or late filing may result in penalties and interest charges.

Q: Are there any special considerations when filling out Form N-20?

A: It is recommended to consult a tax professional or the instructions provided with Form N-20 to ensure accurate and complete filing.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-20 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.