This version of the form is not currently in use and is provided for reference only. Download this version of

Form M-20A

for the current year.

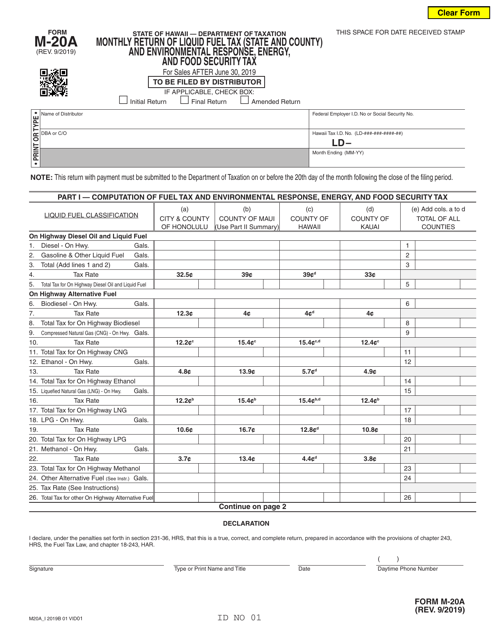

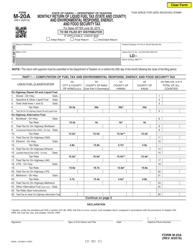

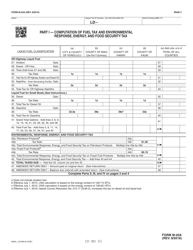

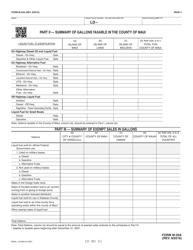

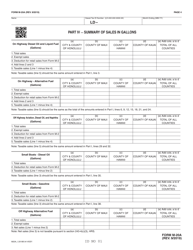

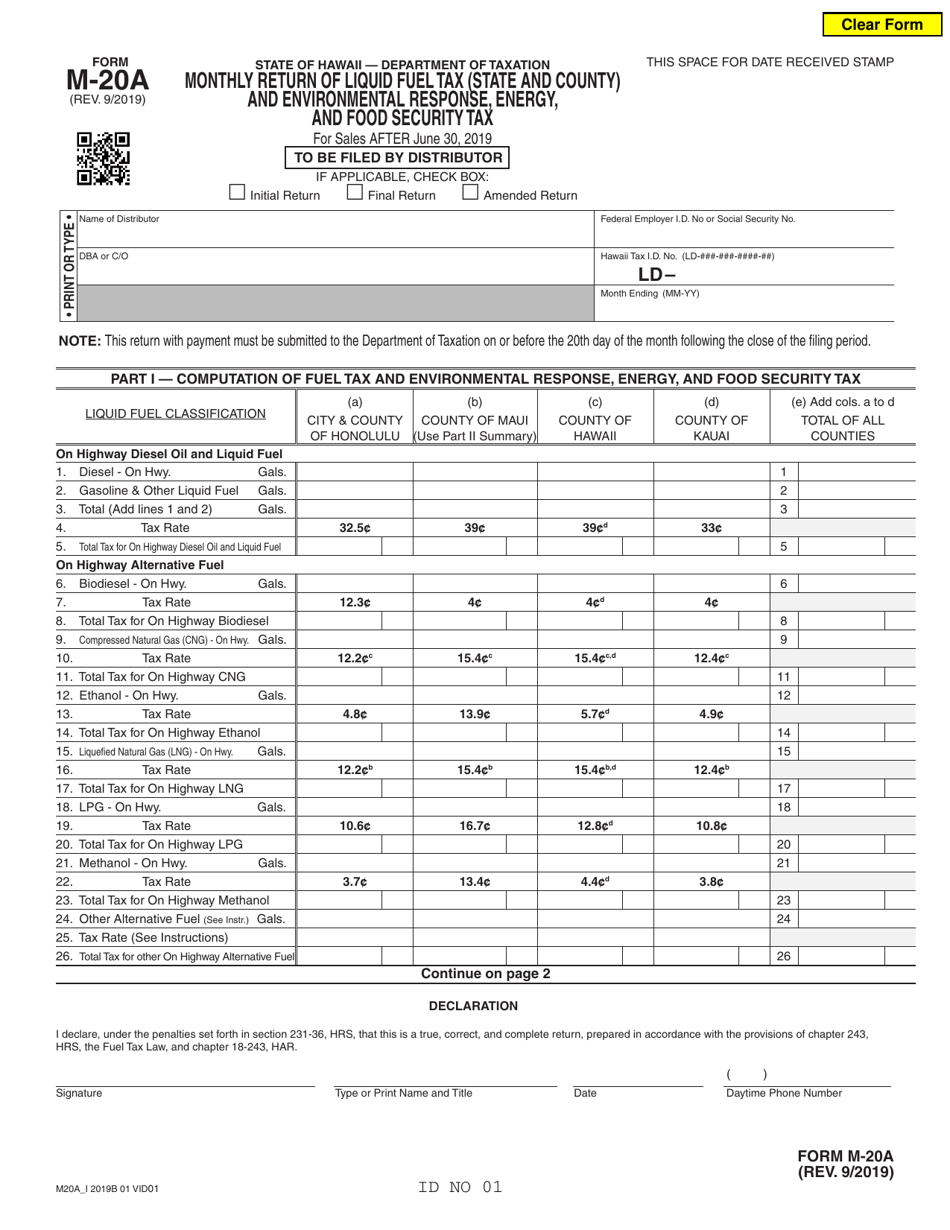

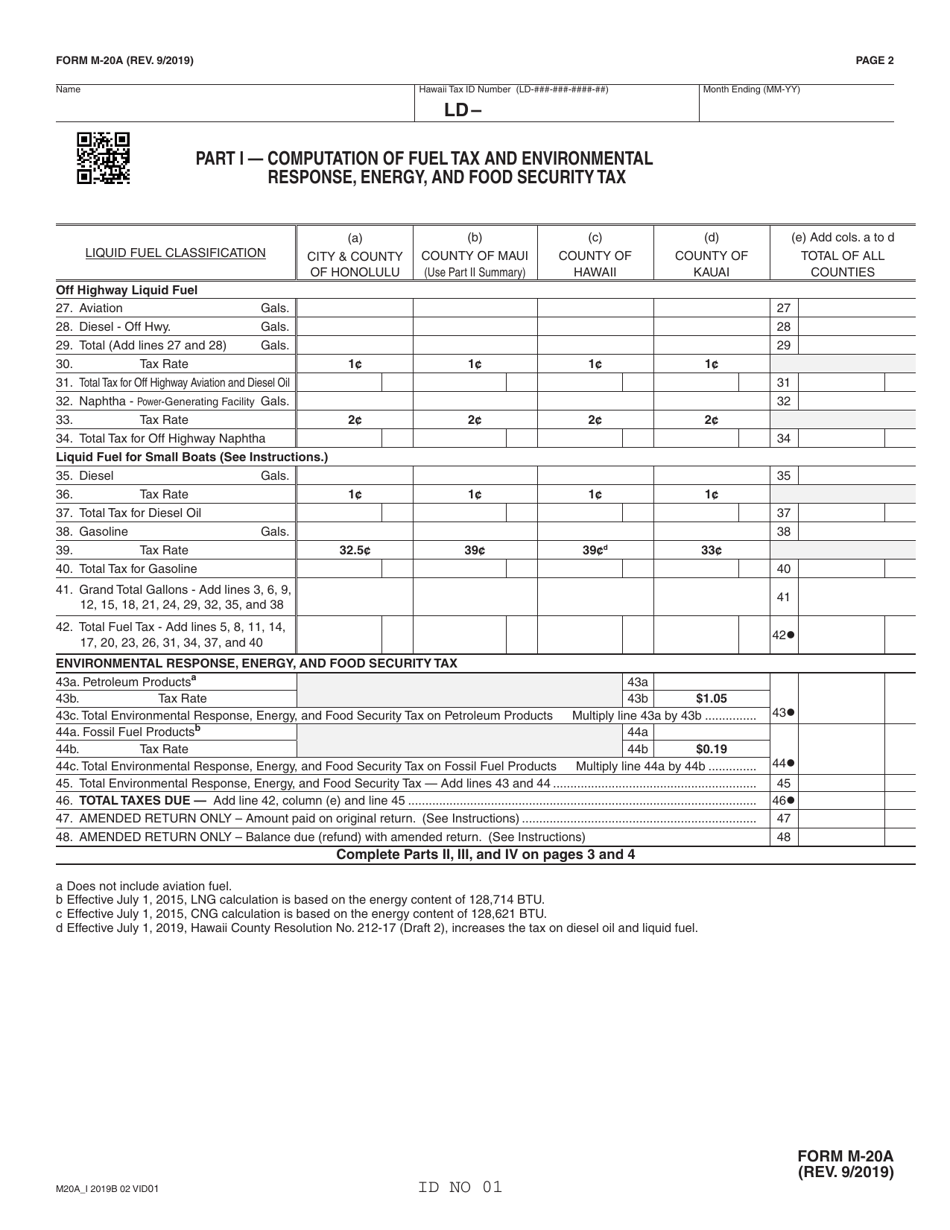

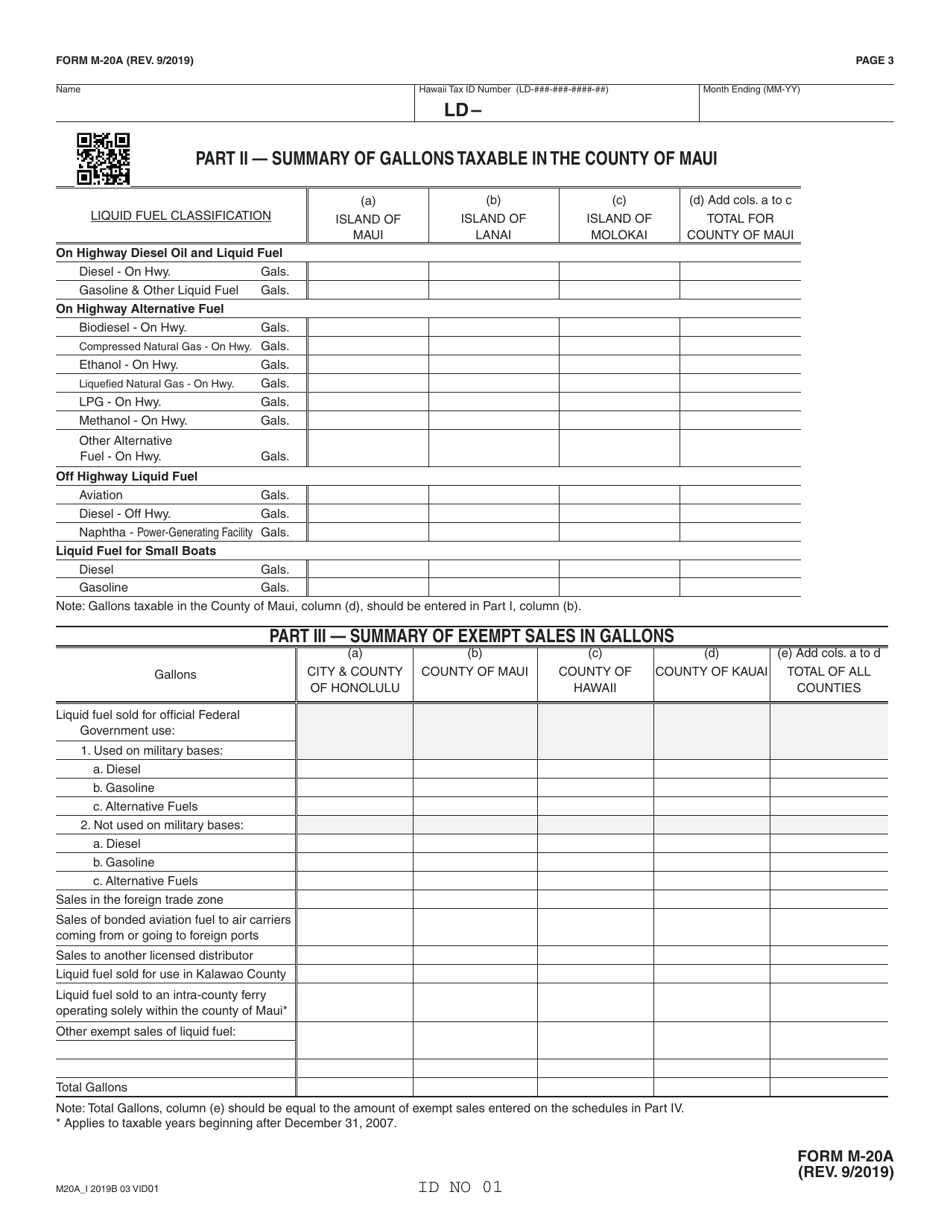

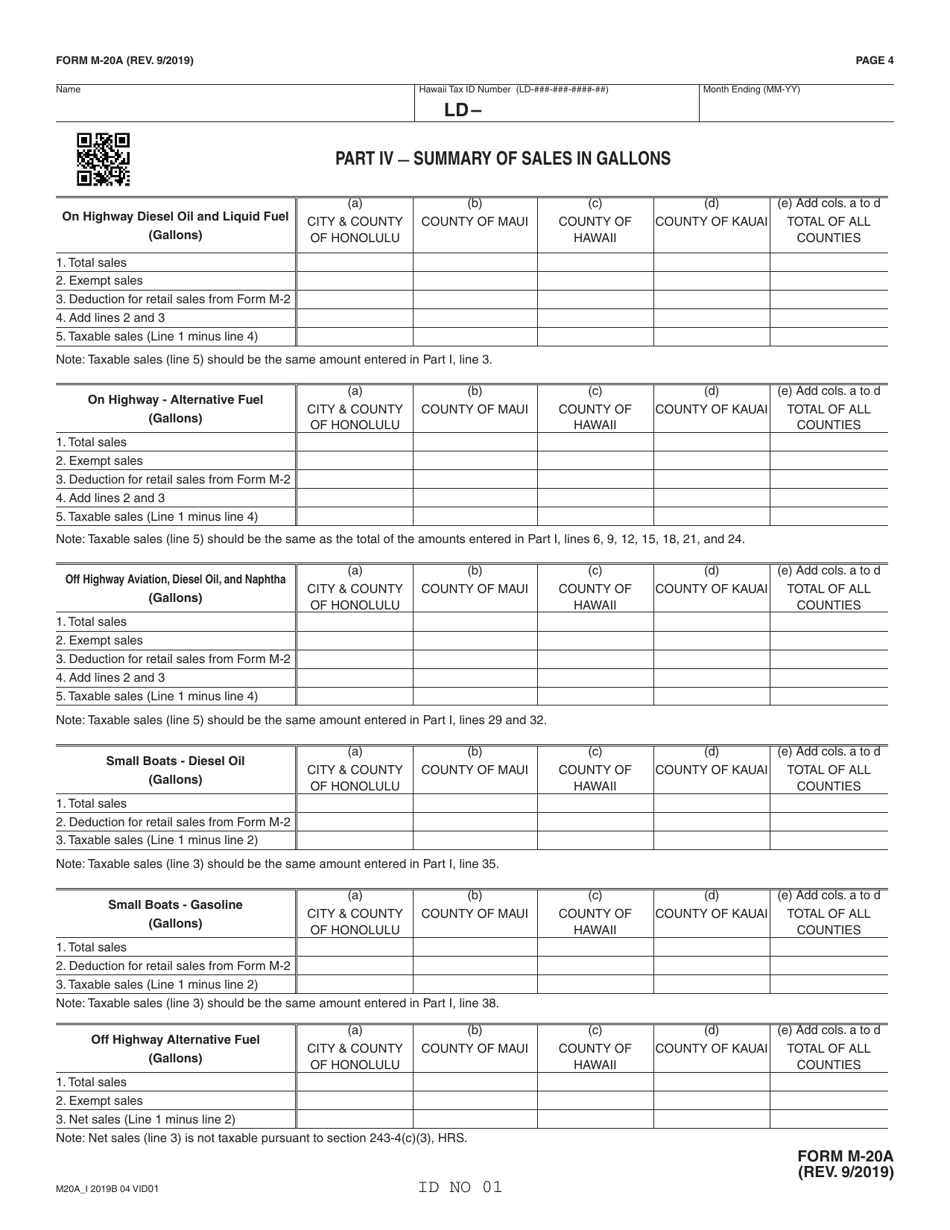

Form M-20A Monthly Return of Liquid Fuel Tax (State and County) and Environmental Response, Energy, and Food Security Tax - Hawaii

What Is Form M-20A?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form M-20A?

A: Form M-20A is the Monthly Return of Liquid Fuel Tax (State and County) and Environmental Response, Energy, and Food Security Tax in Hawaii.

Q: What is the purpose of Form M-20A?

A: The purpose of Form M-20A is to report and remit the liquid fuel tax and the environmental response, energy, and food security tax in Hawaii.

Q: Who needs to file Form M-20A?

A: Businesses or individuals engaged in activities subject to liquid fuel tax and environmental response, energy, and food security tax in Hawaii need to file Form M-20A.

Q: How often is Form M-20A filed?

A: Form M-20A is filed monthly.

Q: What taxes are reported on Form M-20A?

A: Form M-20A is used to report the liquid fuel tax (state and county) and the environmental response, energy, and food security tax in Hawaii.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-20A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.