This version of the form is not currently in use and is provided for reference only. Download this version of

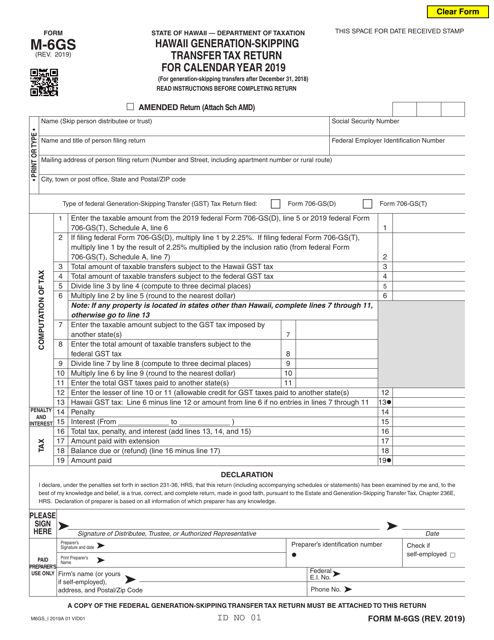

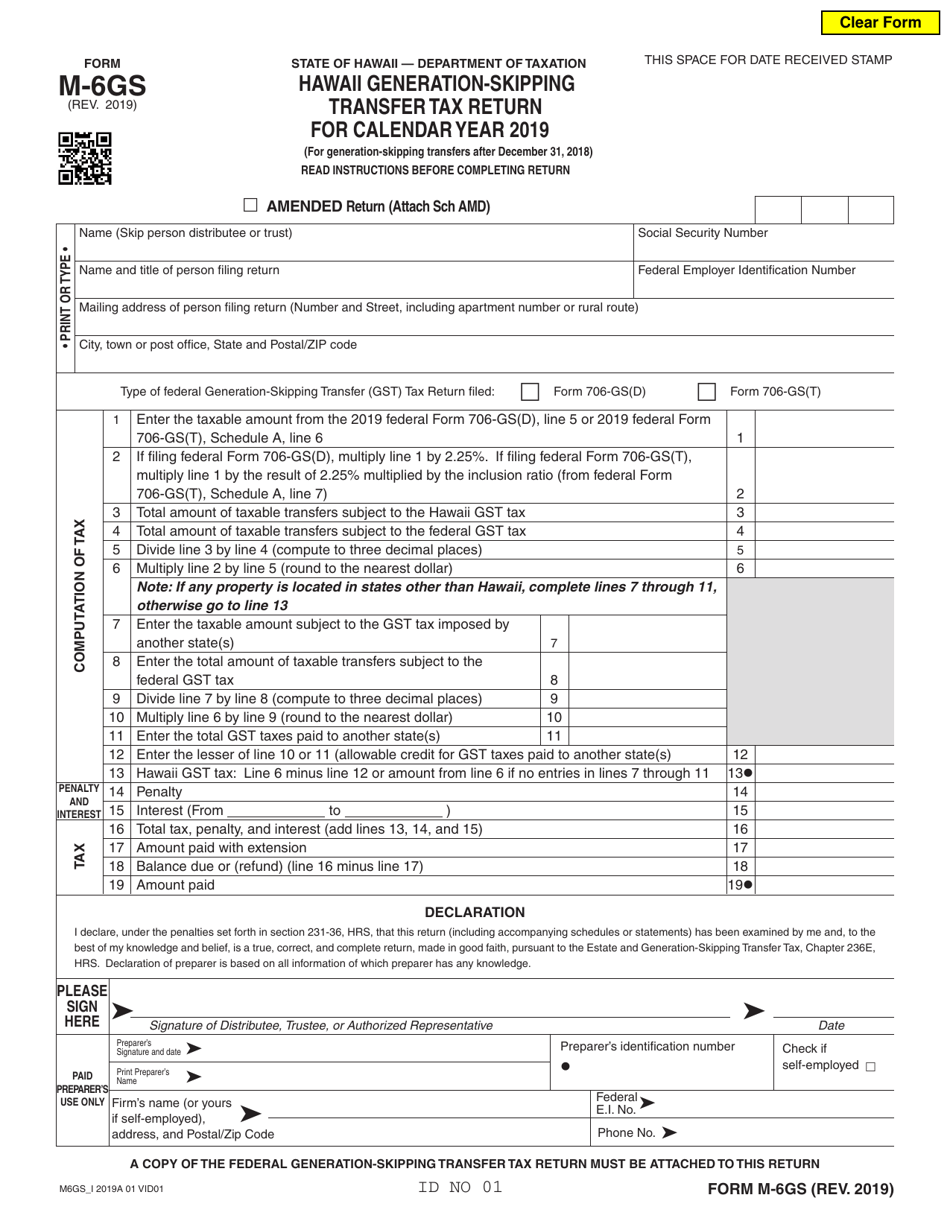

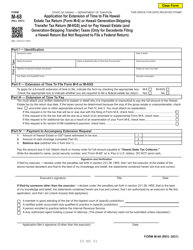

Form M-6GS

for the current year.

Form M-6GS Hawaii Generation-Skipping Transfer Tax Return - Hawaii

What Is Form M-6GS?

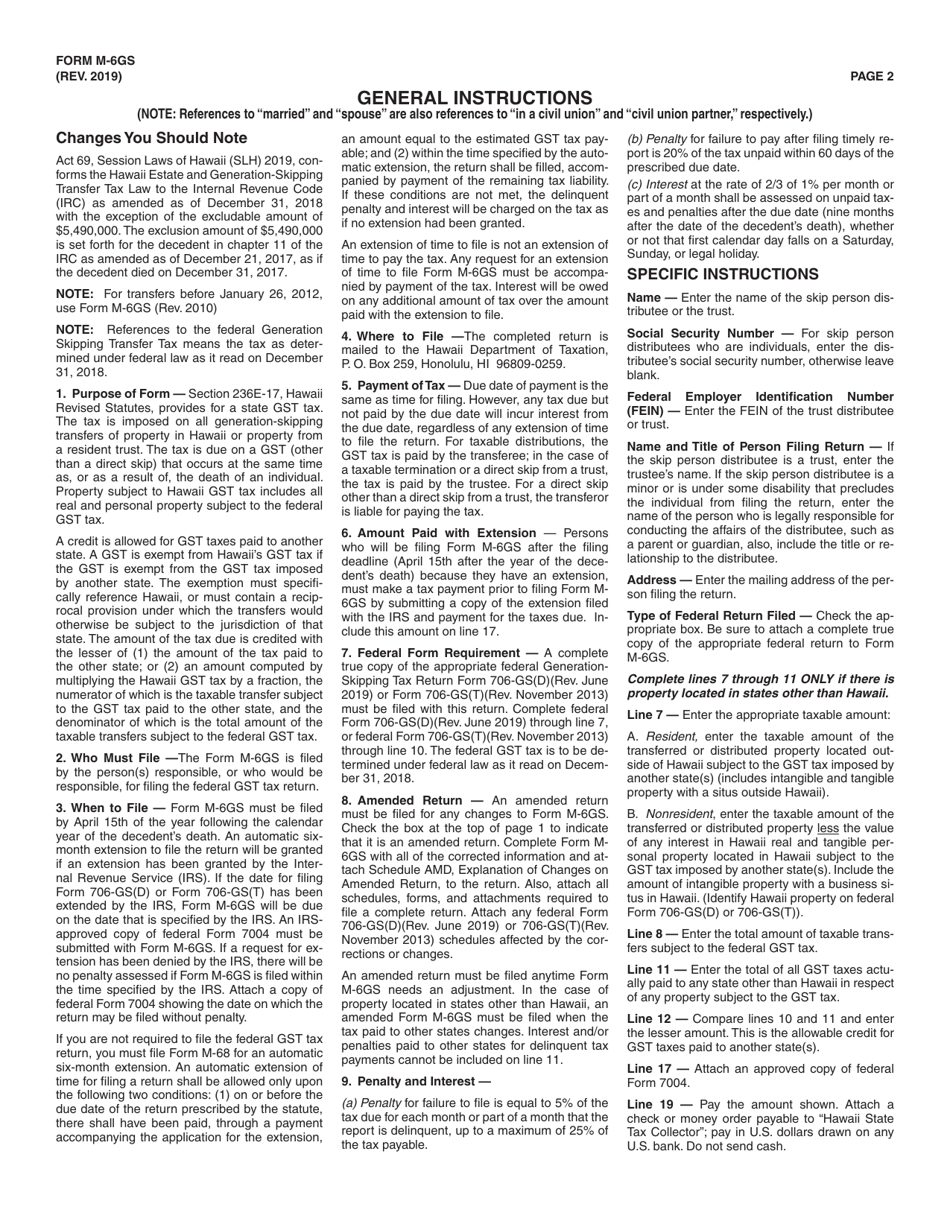

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-6GS?

A: Form M-6GS is the Generation-Skipping Transfer Tax Return specifically for the state of Hawaii.

Q: What is the Generation-Skipping Transfer Tax?

A: The Generation-Skipping Transfer Tax is a tax imposed on certain transfers of property to a person who is more than one generation below the transferor.

Q: Who needs to file Form M-6GS?

A: Individuals who are subject to the Generation-Skipping Transfer Tax in Hawaii are required to file Form M-6GS.

Q: What is the purpose of Form M-6GS?

A: The purpose of Form M-6GS is to report and pay the Generation-Skipping Transfer Tax in Hawaii.

Q: What information is required on Form M-6GS?

A: Form M-6GS requires information such as the transferor's and beneficiary's names, relationship, and value of the property transferred.

Q: When is Form M-6GS due?

A: Form M-6GS is due on the same date as the federal estate tax return, which is usually nine months after the decedent's date of death.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-6GS by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.