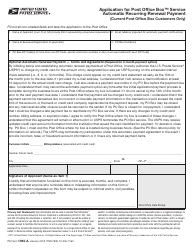

This version of the form is not currently in use and is provided for reference only. Download this version of

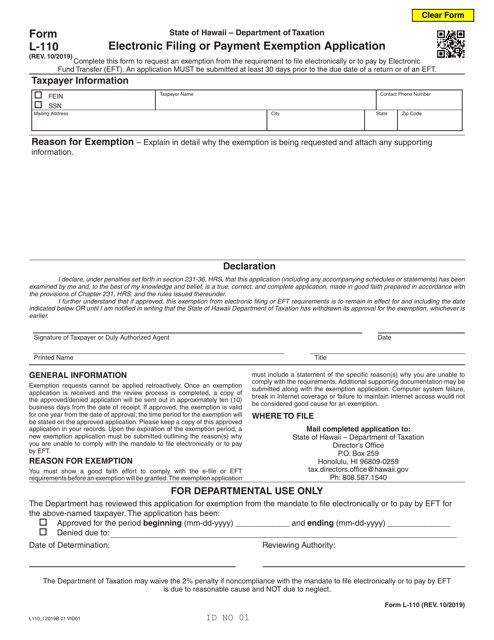

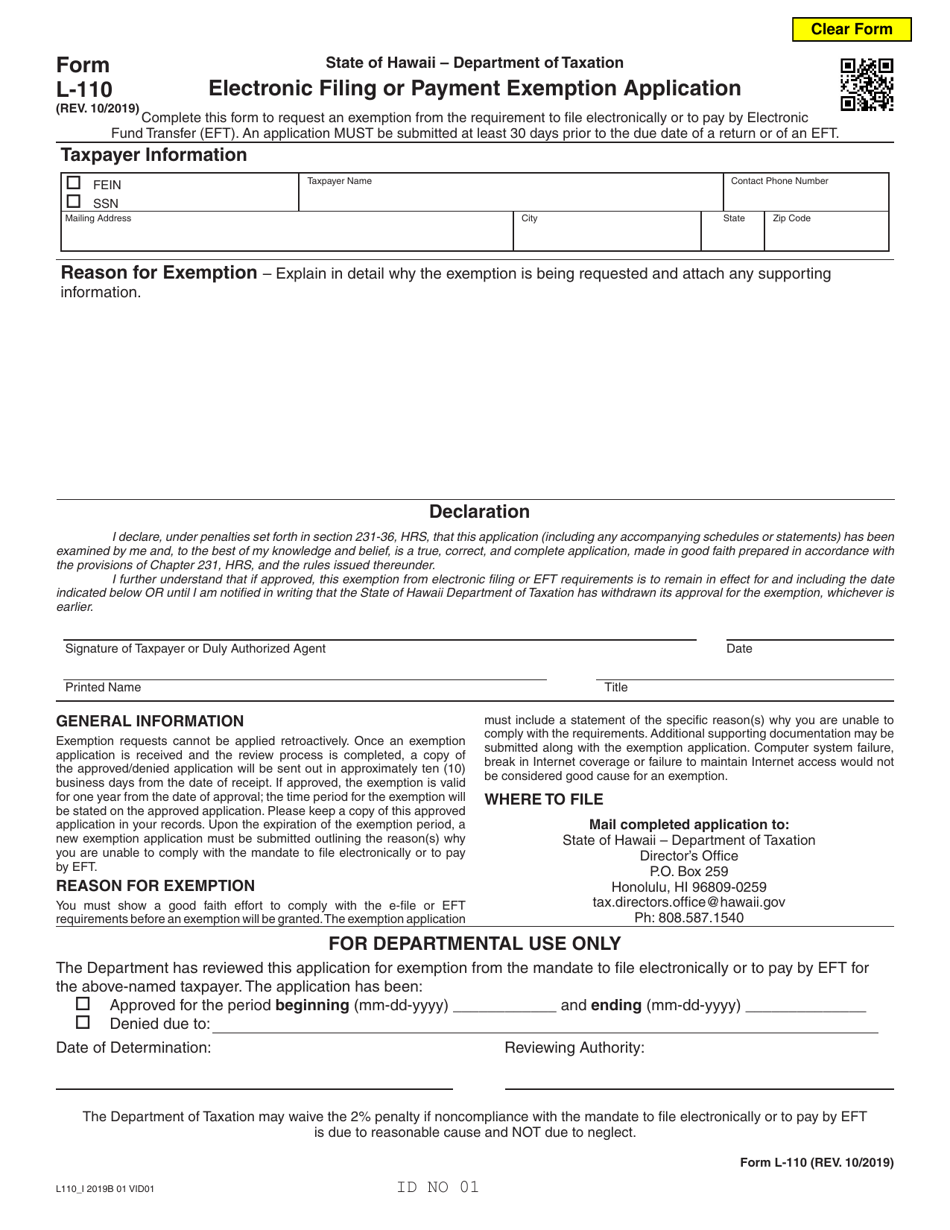

Form L-110

for the current year.

Form L-110 Electronic Filing or Payment Exemption Application - Hawaii

What Is Form L-110?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-110?

A: Form L-110 is the Electronic Filing or Payment Exemption Application for the state of Hawaii.

Q: What is the purpose of Form L-110?

A: The purpose of Form L-110 is to apply for an exemption from electronic filing or payment requirements in Hawaii.

Q: Who needs to file Form L-110?

A: Anyone who wishes to request an exemption from electronic filing or payment requirements in Hawaii needs to file Form L-110.

Q: What information do I need to provide on Form L-110?

A: You will need to provide your contact information, taxpayer identification number, and a reason for requesting the exemption on Form L-110.

Q: When is Form L-110 due?

A: The due date for filing Form L-110 varies, so you should check the instructions or contact the Hawaii Department of Taxation for the specific deadline.

Q: Is there a fee for filing Form L-110?

A: No, there is no fee for filing Form L-110.

Q: What happens after I submit Form L-110?

A: After you submit Form L-110, the Hawaii Department of Taxation will review your application and notify you of their decision.

Q: Can I request multiple exemptions on Form L-110?

A: Yes, you can request multiple exemptions on Form L-110 by providing the necessary information for each exemption you are seeking.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-110 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.