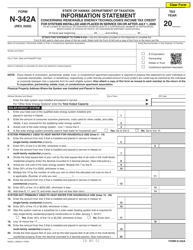

This version of the form is not currently in use and is provided for reference only. Download this version of

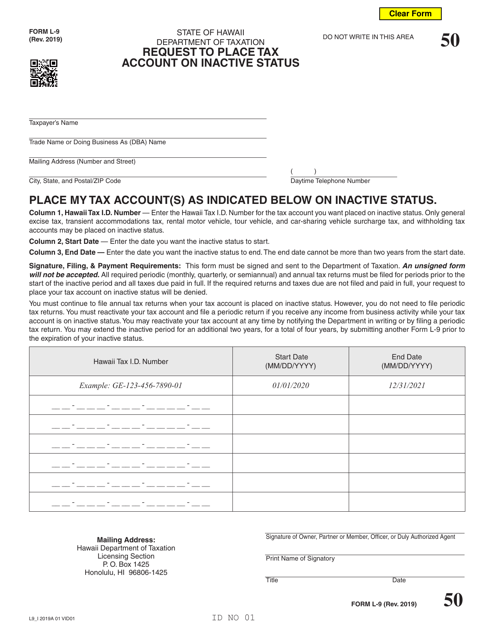

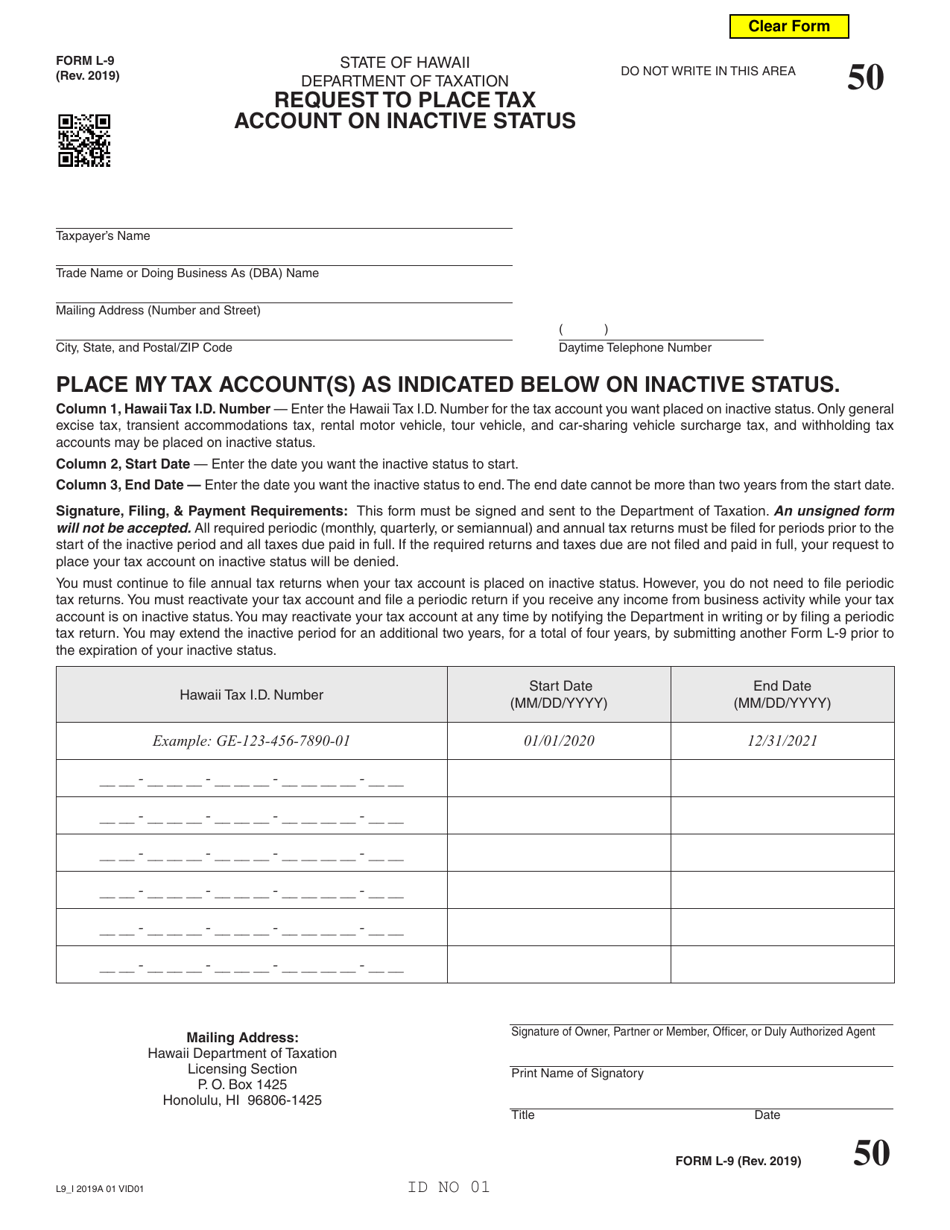

Form L-9

for the current year.

Form L-9 Request to Place Tax Account on Inactive Status - Hawaii

What Is Form L-9?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-9?

A: Form L-9 is a request form to place a tax account on inactive status in Hawaii.

Q: When is Form L-9 used?

A: Form L-9 is used when a taxpayer wants to temporarily suspend their tax account activity.

Q: How do I fill out Form L-9?

A: You need to enter your tax account information and provide the reason for requesting inactive status.

Q: Is there a fee to submit Form L-9?

A: No, there is no fee to submit Form L-9.

Q: How long does inactive status last?

A: Inactive status can last for up to one year.

Q: Can I reactivate my tax account after placing it on inactive status?

A: Yes, you can reactivate your tax account by submitting a written request to the Department of Taxation.

Q: What happens if I don't reactivate my tax account after one year?

A: If you don't reactivate your tax account after one year, it will be permanently closed.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-9 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.