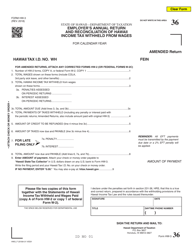

This version of the form is not currently in use and is provided for reference only. Download this version of

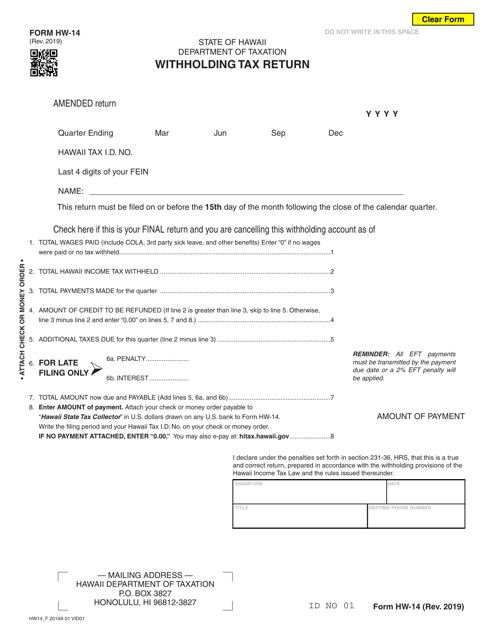

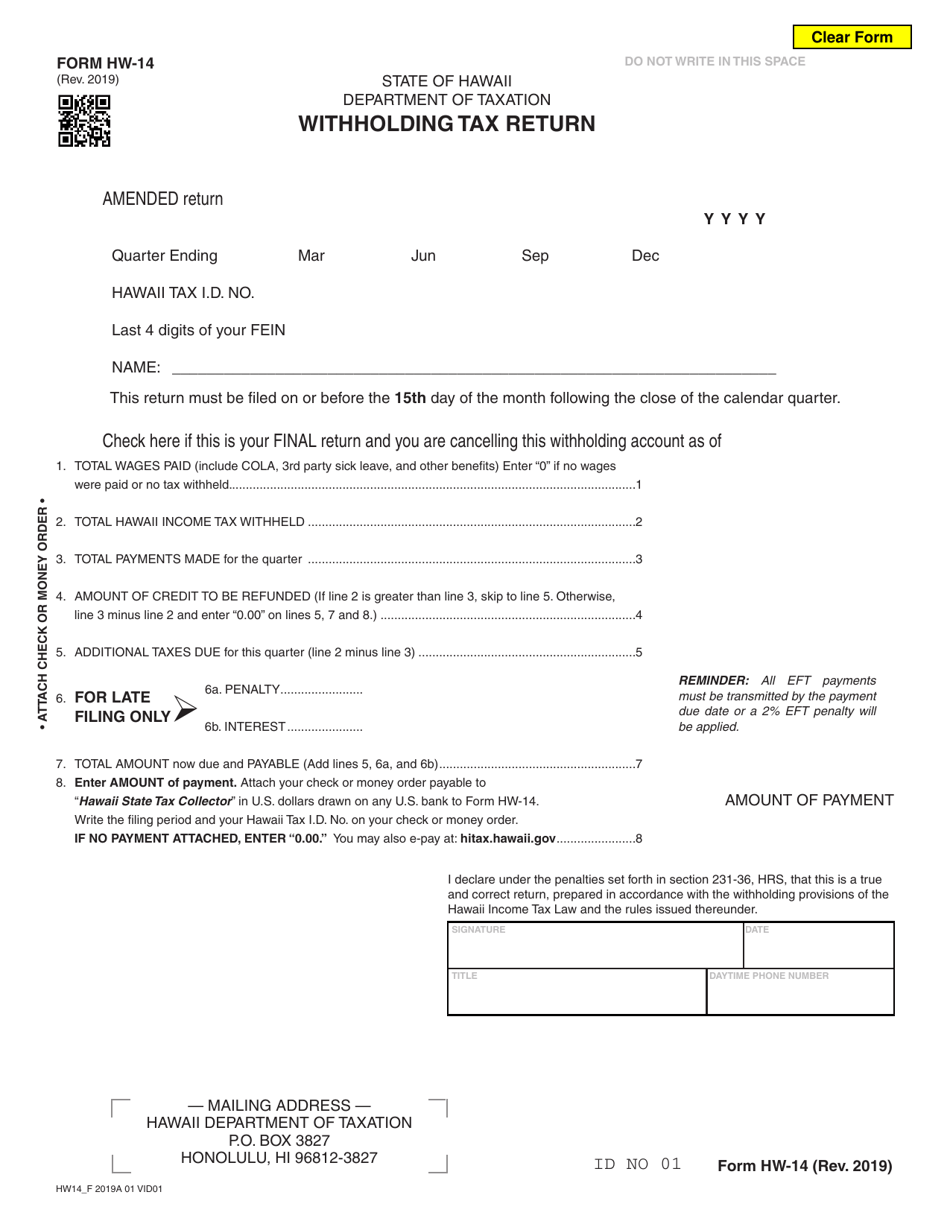

Form HW-14

for the current year.

Form HW-14 Withholding Tax Return - Hawaii

What Is Form HW-14?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form HW-14?

A: Form HW-14 is the Withholding Tax Return for the state of Hawaii.

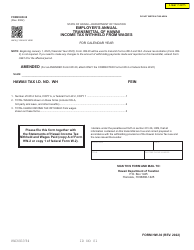

Q: Who needs to file Form HW-14?

A: Employers in Hawaii who have withheld income tax from their employees' wages must file Form HW-14.

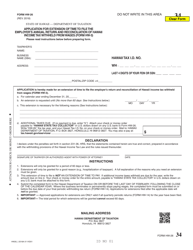

Q: When is Form HW-14 due?

A: Form HW-14 is due on a quarterly basis. The due dates are April 30, July 31, October 31, and January 31.

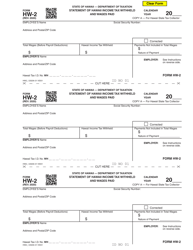

Q: What information do I need to complete Form HW-14?

A: You will need to provide information about your business, the amount of income tax withheld, and details about your employees.

Q: Are there any penalties for not filing Form HW-14?

A: Yes, there are penalties for failure to file Form HW-14 or for filing it late. It is important to file on time to avoid these penalties.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form HW-14 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.