This version of the form is not currently in use and is provided for reference only. Download this version of

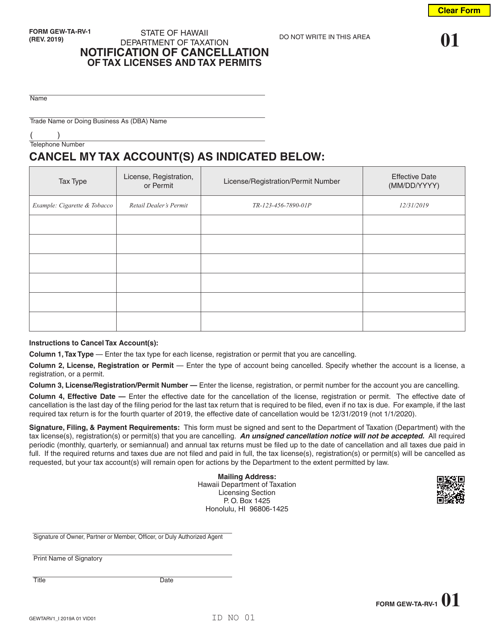

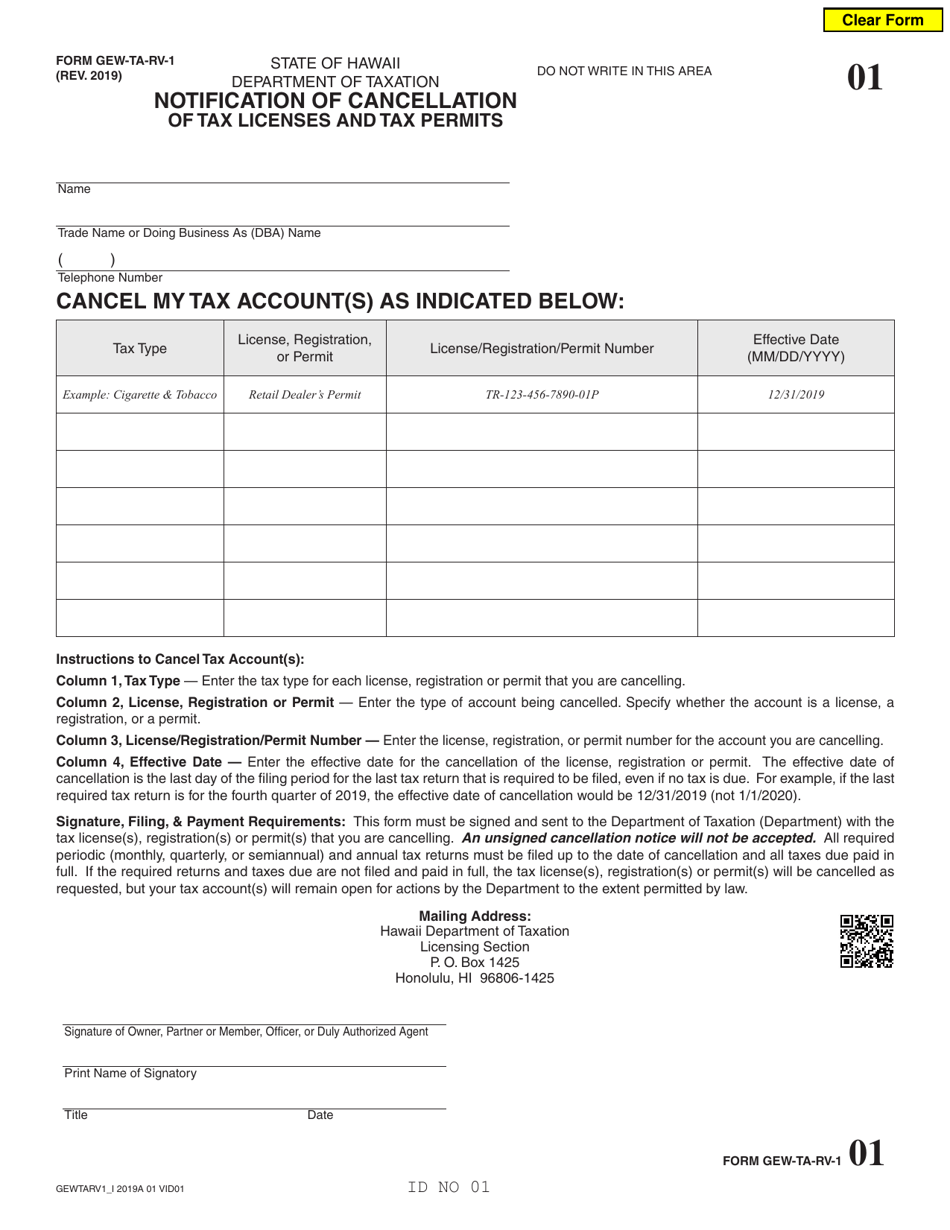

Form GEW-TA-RV-1

for the current year.

Form GEW-TA-RV-1 Notification of Cancellation of Tax Licenses and Tax Permits - Hawaii

What Is Form GEW-TA-RV-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form GEW-TA-RV-1?

A: Form GEW-TA-RV-1 is the Notification of Cancellation of Tax Licenses and Tax Permits form for Hawaii.

Q: What is the purpose of Form GEW-TA-RV-1?

A: The purpose of Form GEW-TA-RV-1 is to notify the Hawaii Department of Taxation about the cancellation of tax licenses and tax permits.

Q: Who needs to use Form GEW-TA-RV-1?

A: Form GEW-TA-RV-1 needs to be used by individuals or businesses in Hawaii who are canceling their tax licenses and tax permits.

Q: Are there any fees associated with submitting Form GEW-TA-RV-1?

A: No, there are no fees associated with submitting Form GEW-TA-RV-1.

Q: What information is required on Form GEW-TA-RV-1?

A: Form GEW-TA-RV-1 requires information such as the taxpayer's name, address, tax identification number, and details about the cancellation of tax licenses and tax permits.

Q: What is the deadline for submitting Form GEW-TA-RV-1?

A: There is no specific deadline for submitting Form GEW-TA-RV-1, but it should be submitted as soon as possible after the cancellation of tax licenses and tax permits.

Q: Is it mandatory to submit Form GEW-TA-RV-1?

A: Yes, it is mandatory to submit Form GEW-TA-RV-1 when canceling tax licenses and tax permits in Hawaii.

Q: What if I need help with filling out Form GEW-TA-RV-1?

A: If you need help with filling out Form GEW-TA-RV-1, you can contact the Hawaii Department of Taxation for assistance.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GEW-TA-RV-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.