This version of the form is not currently in use and is provided for reference only. Download this version of

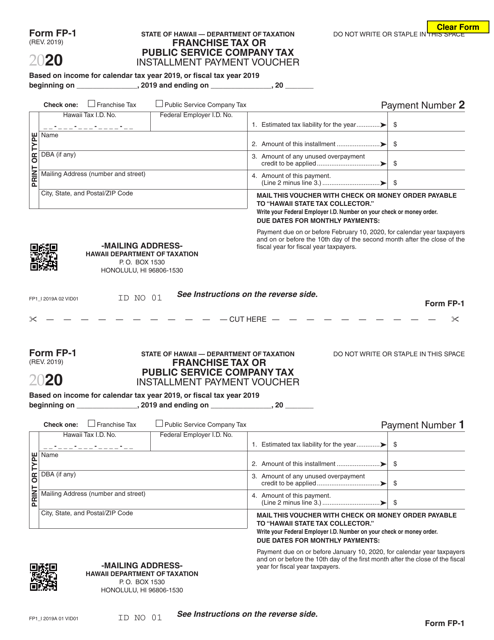

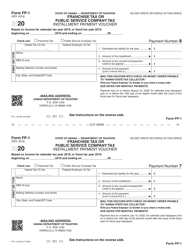

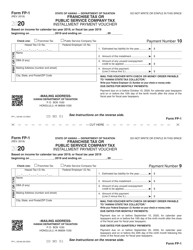

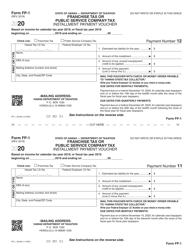

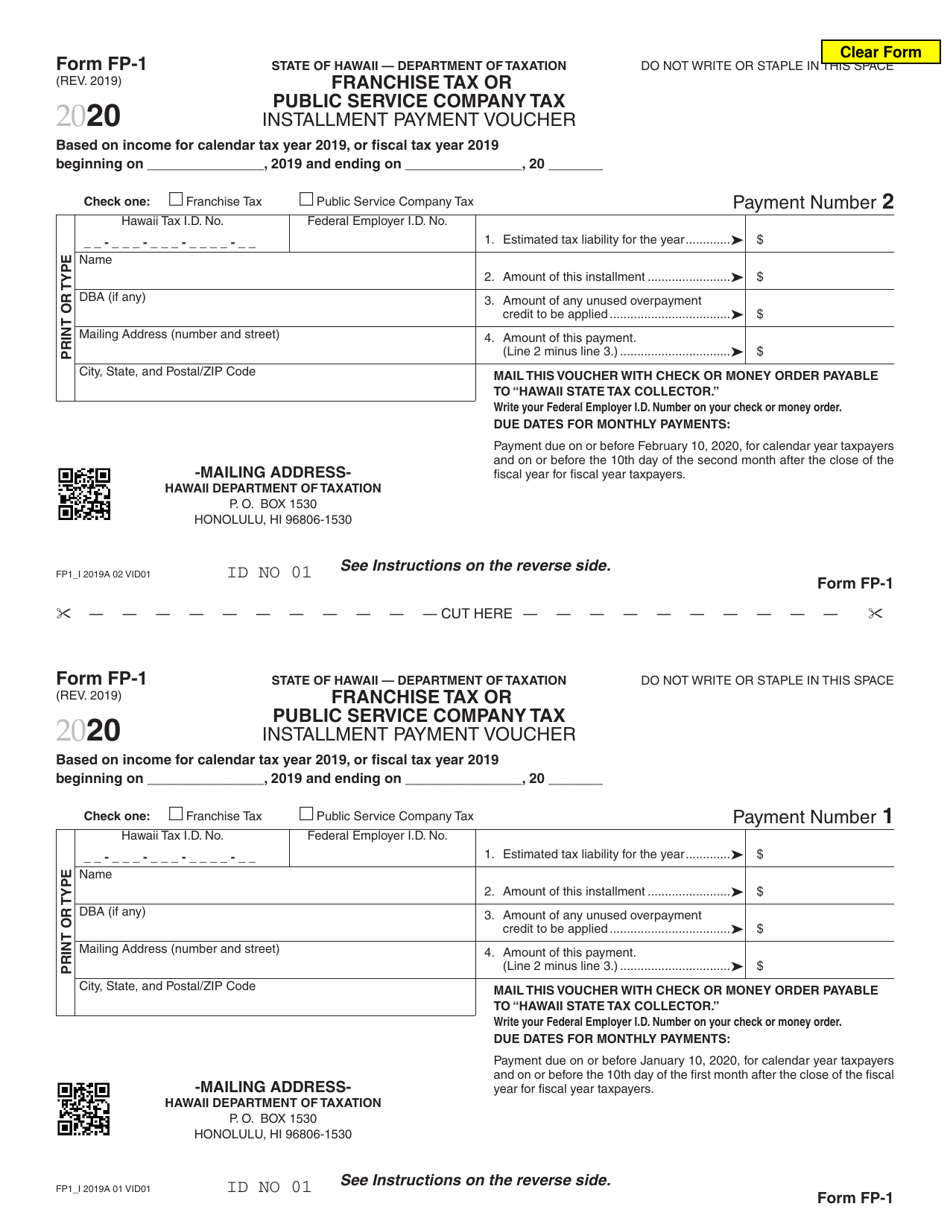

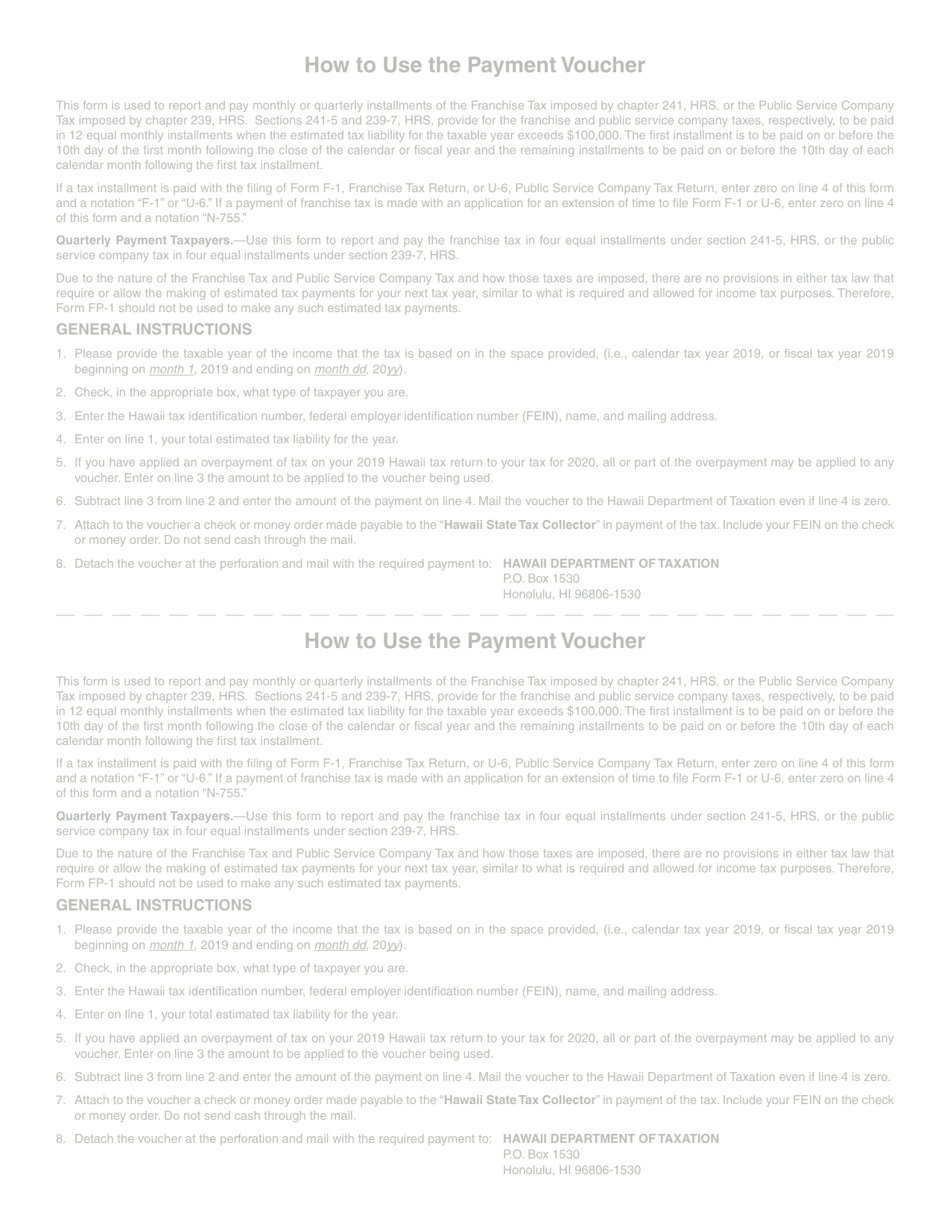

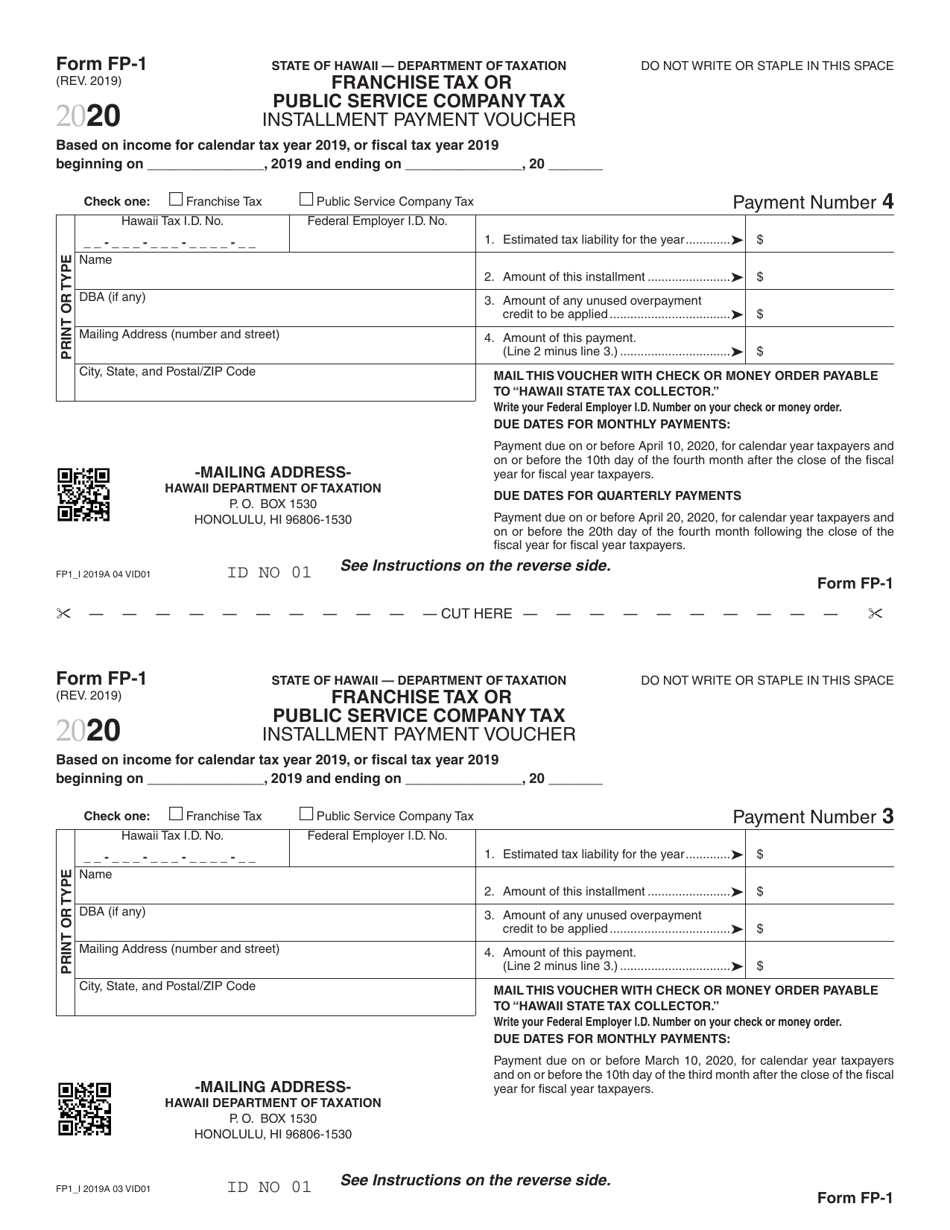

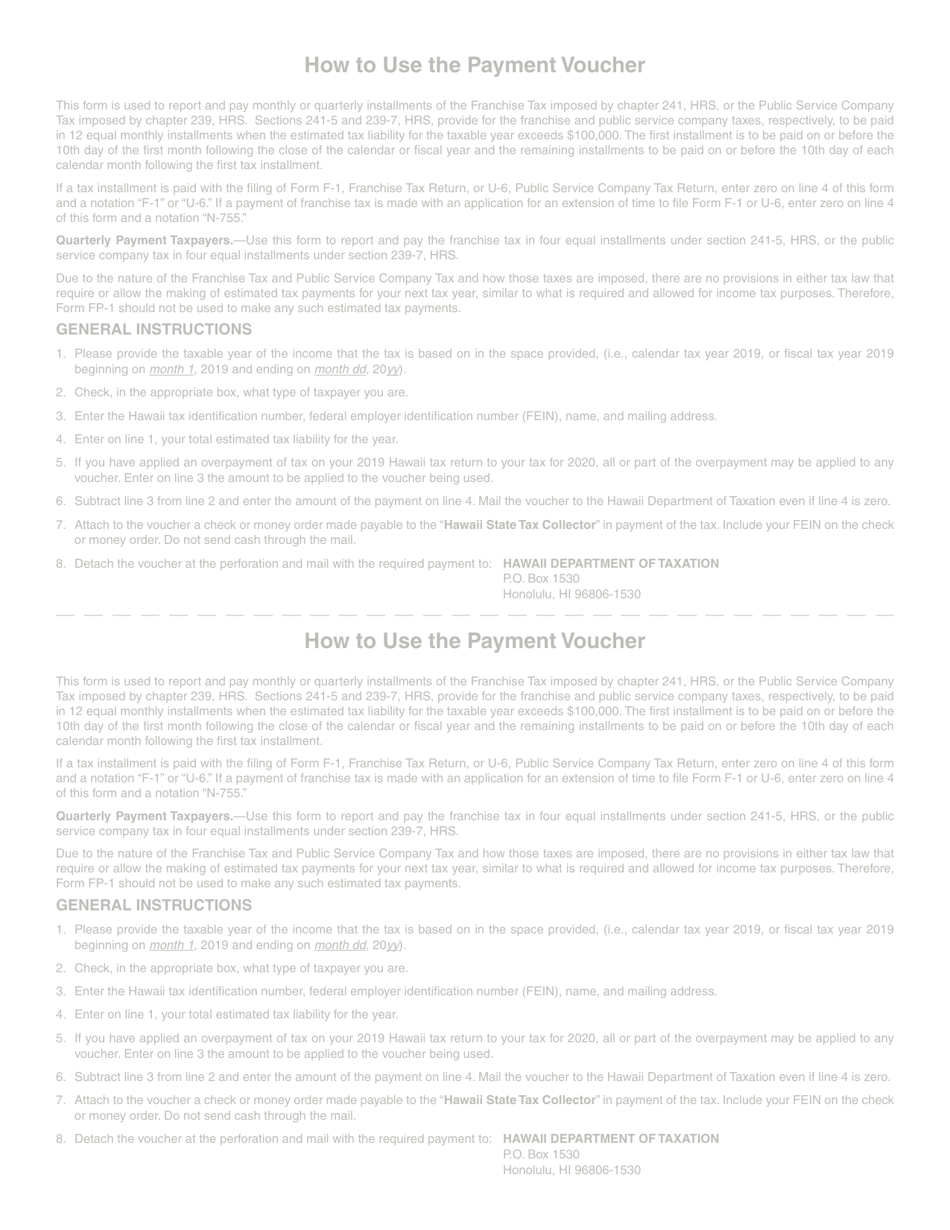

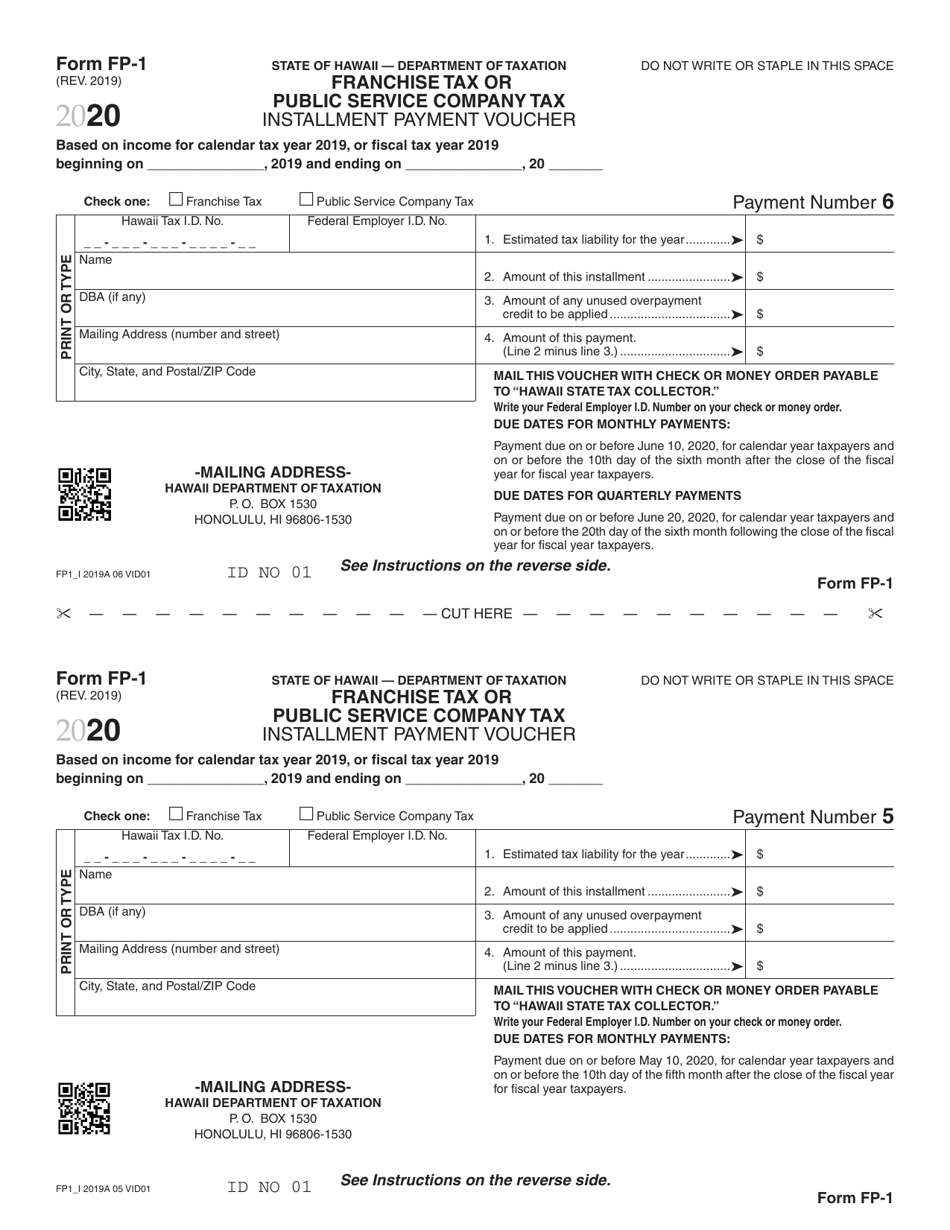

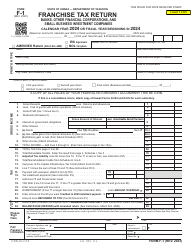

Form FP-1

for the current year.

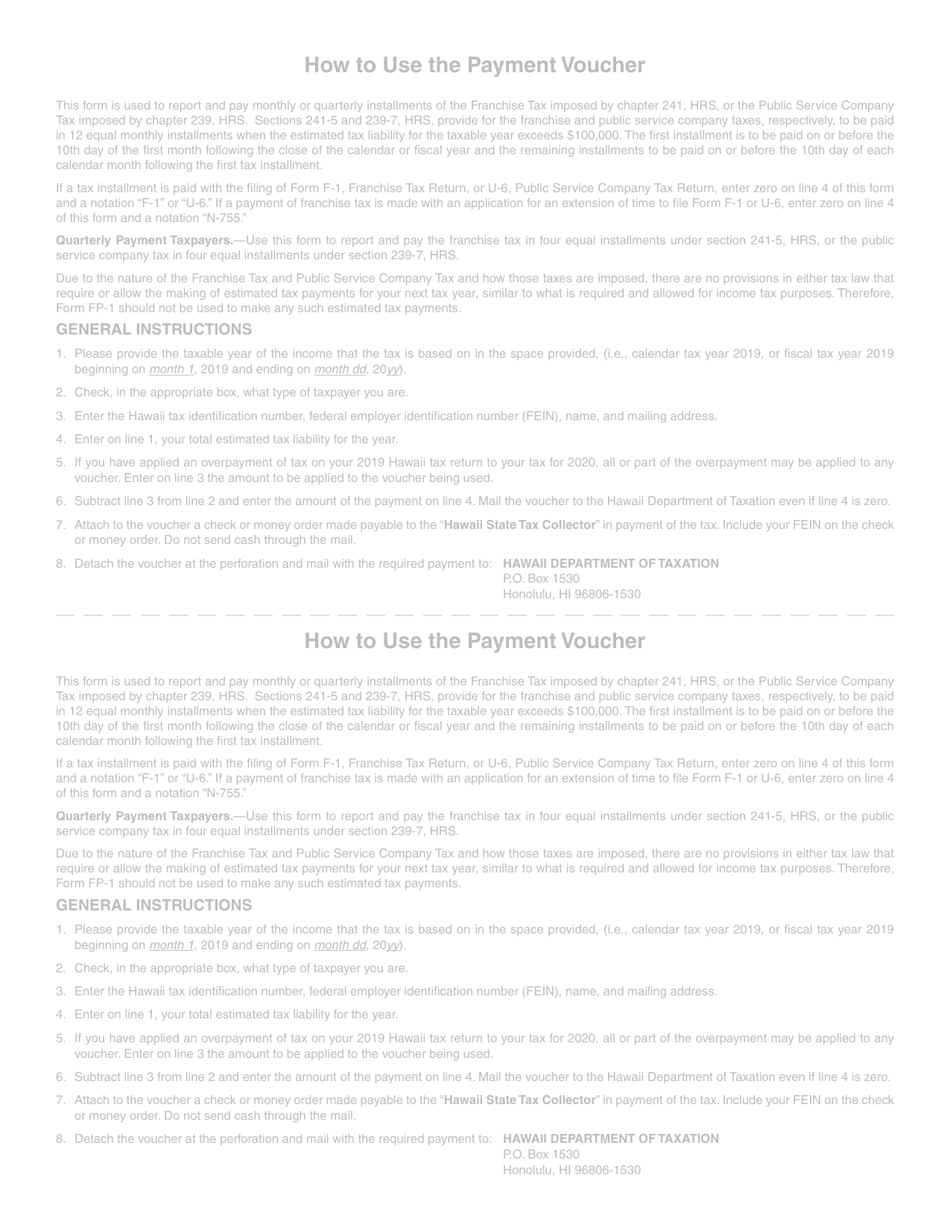

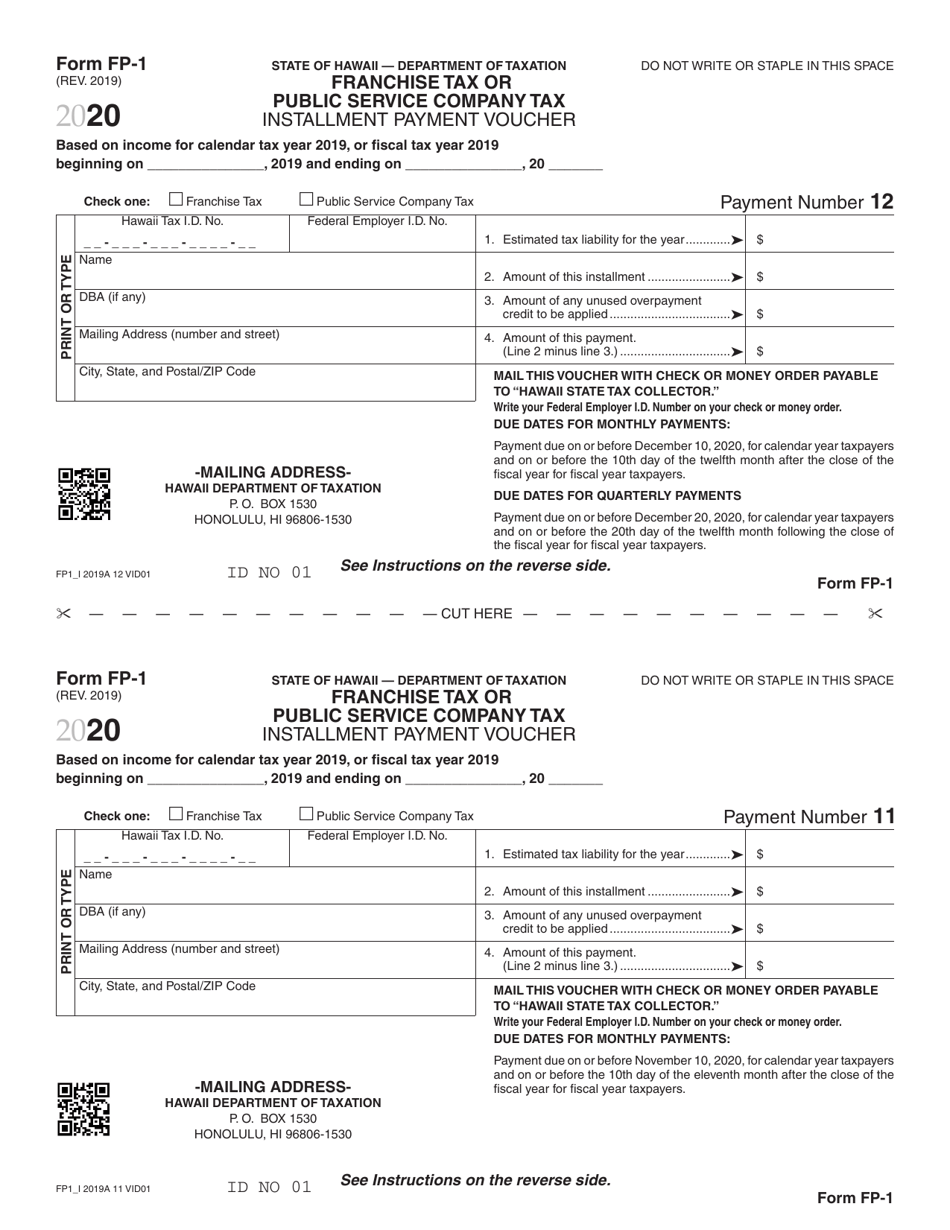

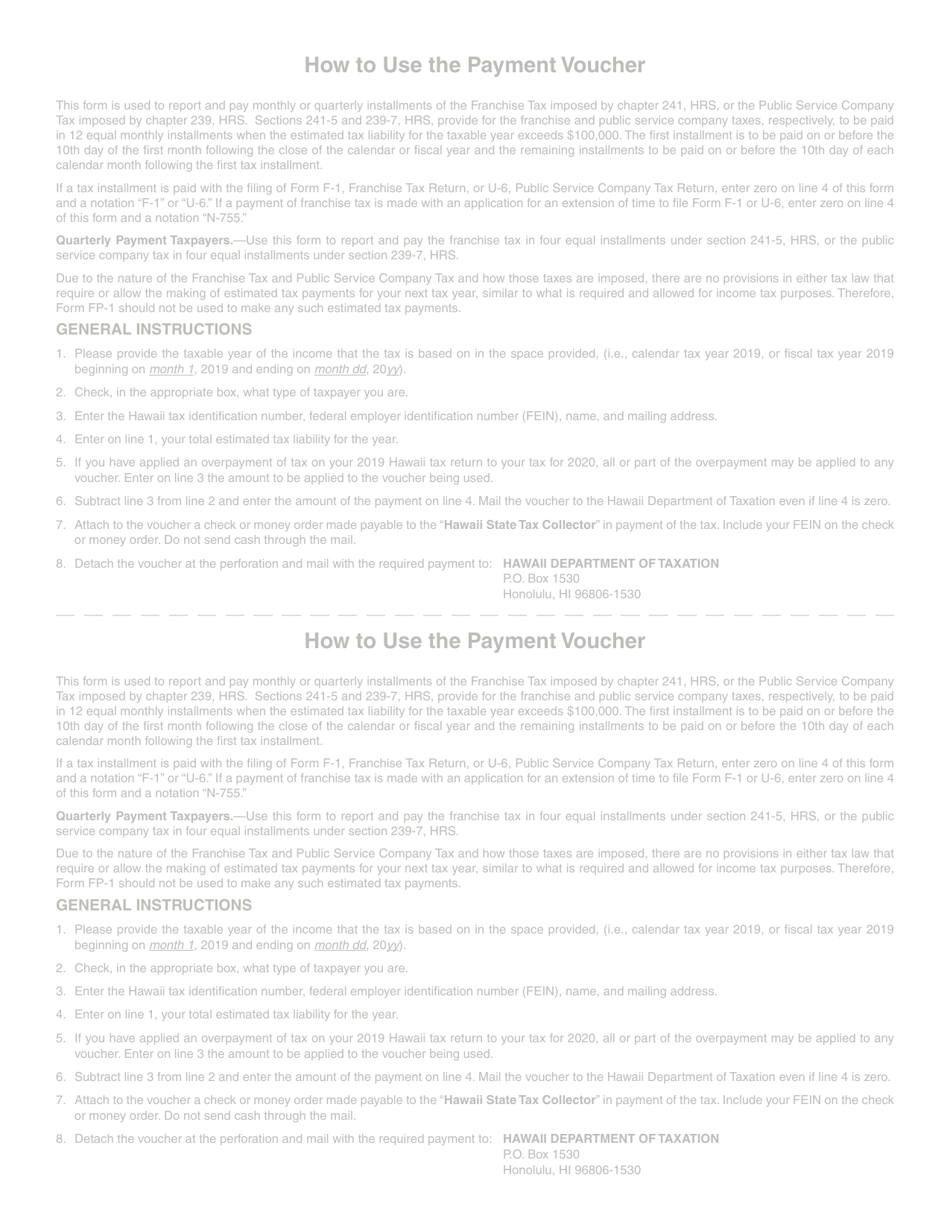

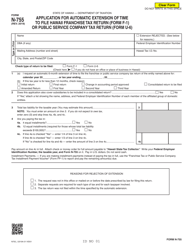

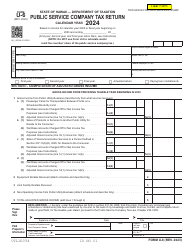

Form FP-1 Franchise Tax or Public Service Company Tax Installment Payment Voucher - Hawaii

What Is Form FP-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

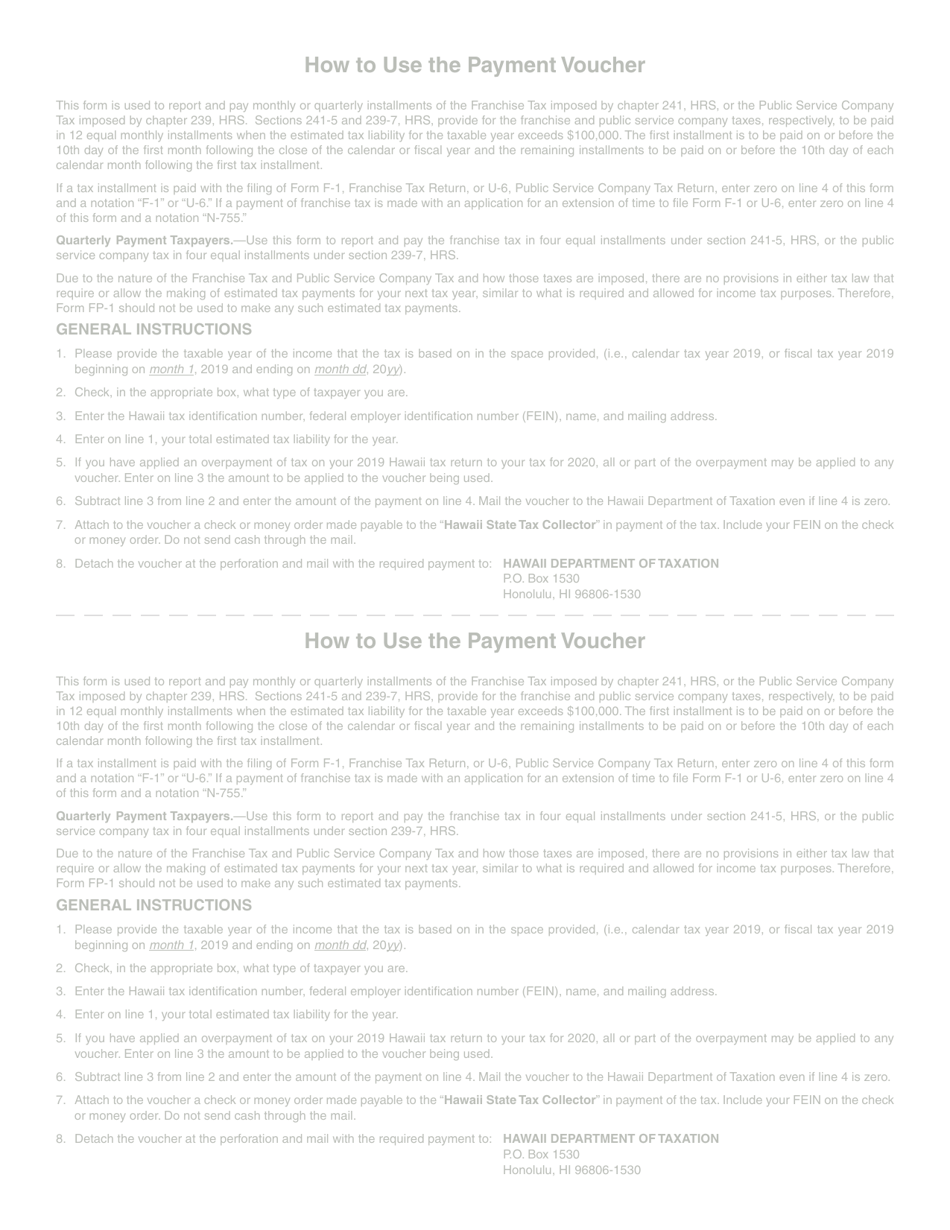

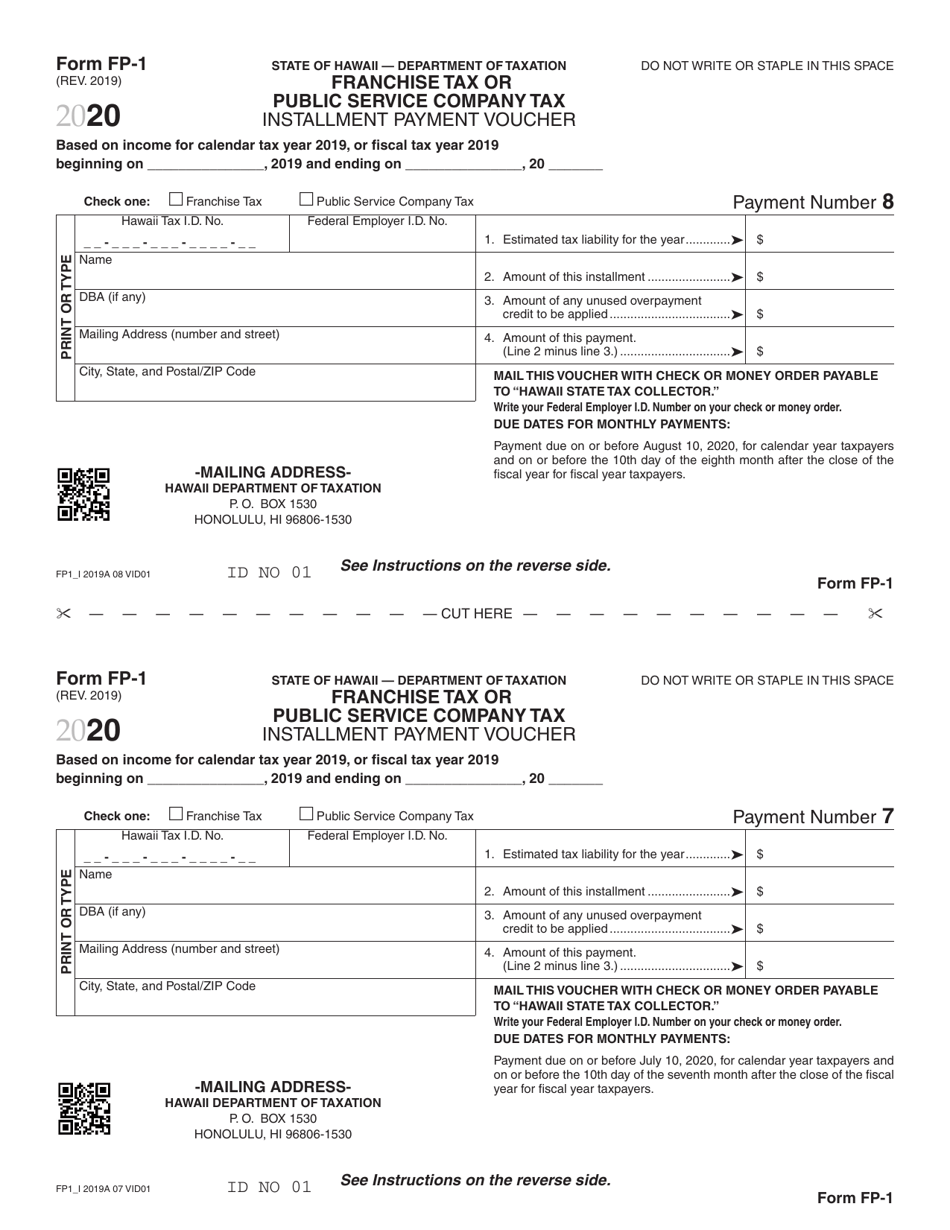

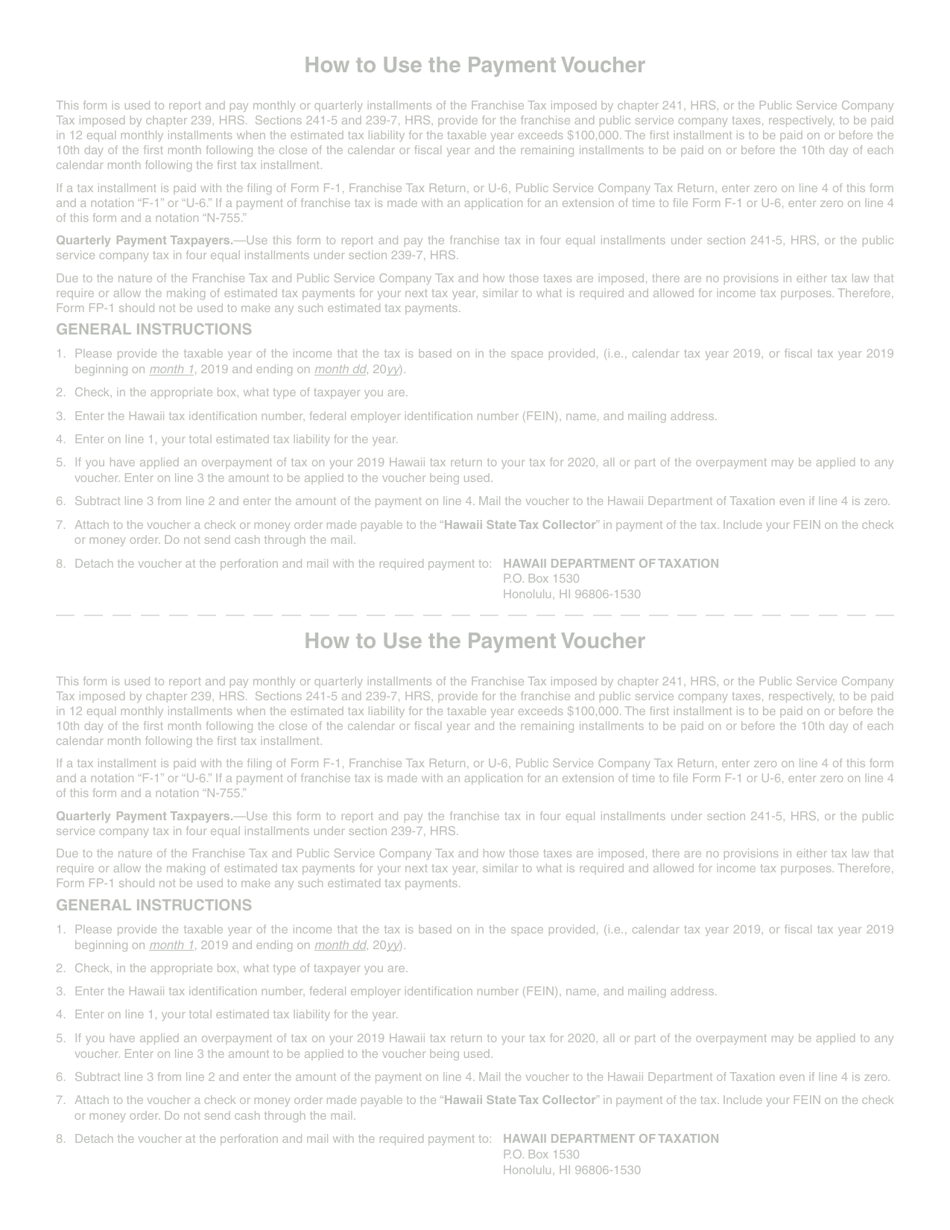

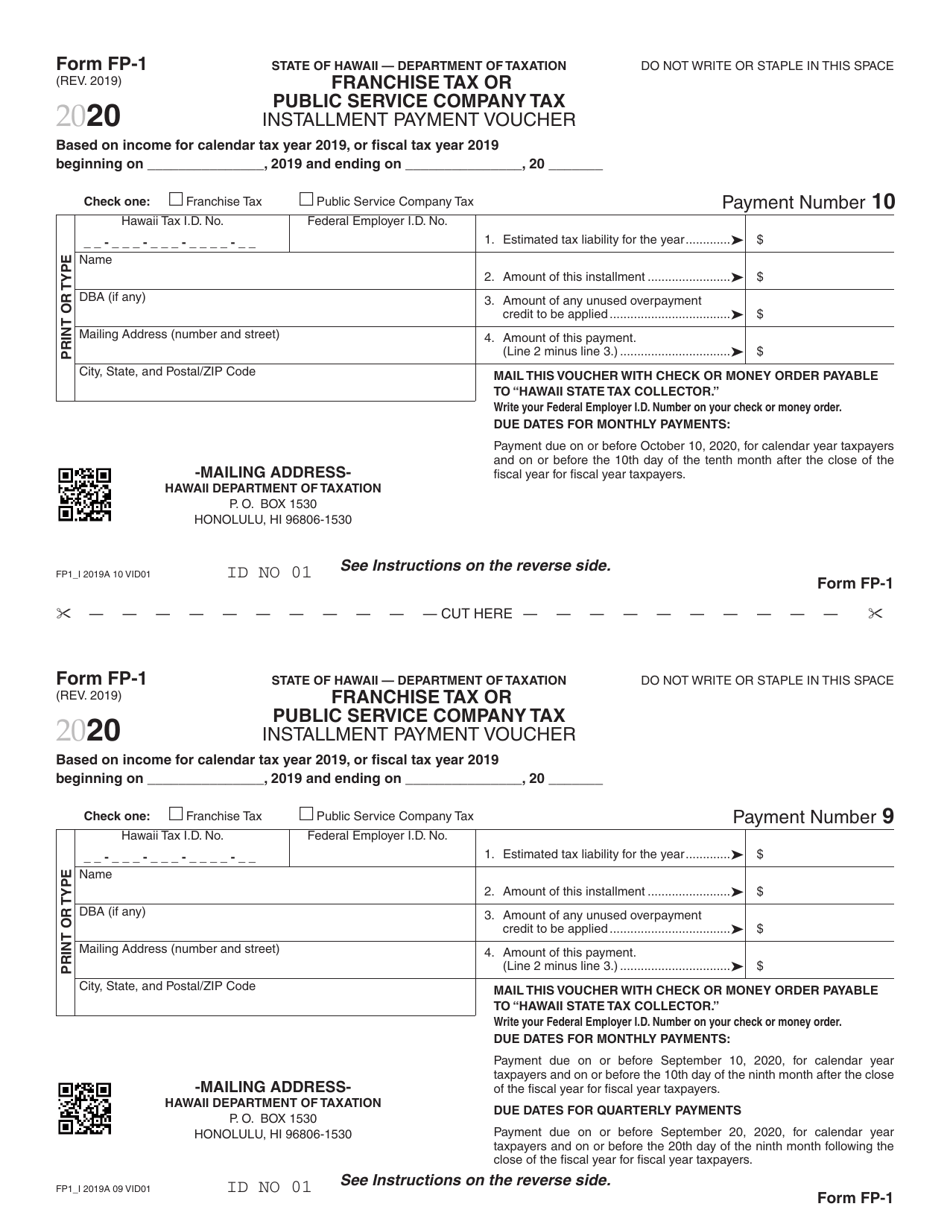

Q: What is Form FP-1?

A: Form FP-1 is the Franchise Tax or Public Service Company Tax Installment Payment Voucher for Hawaii.

Q: What is the purpose of Form FP-1?

A: The purpose of Form FP-1 is to make installment payments for Franchise Tax or Public Service Company Tax in Hawaii.

Q: When is Form FP-1 used?

A: Form FP-1 is used when making installment payments for Franchise Tax or Public Service Company Tax in Hawaii.

Q: Who needs to use Form FP-1?

A: Individuals or companies who are required to make installment payments for Franchise Tax or Public Service Company Tax in Hawaii need to use Form FP-1.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FP-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.