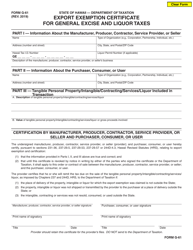

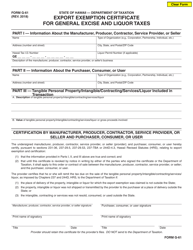

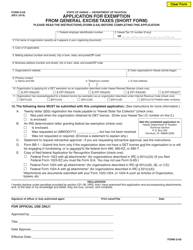

Form G-61 Export Exemption Certificate for General Excise and Liquor Taxes - Hawaii

What Is Form G-61?

This is a legal form that was released by the Hawaii Department of Public Safety - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-61?

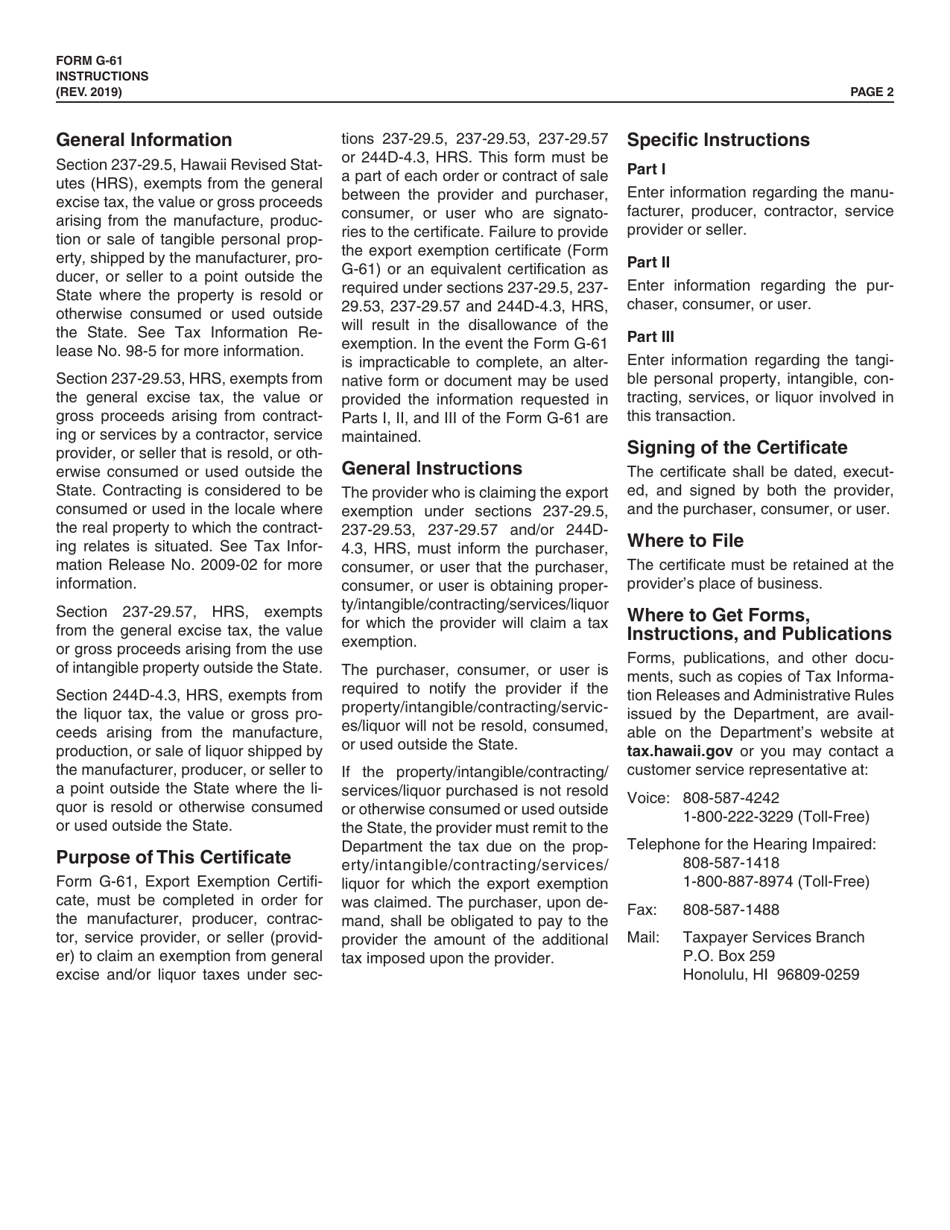

A: Form G-61 is an Export Exemption Certificate for General Excise and Liquor Taxes in Hawaii.

Q: What is the purpose of Form G-61?

A: The purpose of Form G-61 is to claim an exemption from the General Excise and Liquor Taxes in Hawaii for goods that are exported out of the state.

Q: Who needs to file Form G-61?

A: Any person or business that exports goods out of Hawaii and wishes to claim an exemption from the General Excise and Liquor Taxes needs to file Form G-61.

Q: What information is required on Form G-61?

A: Form G-61 requires information such as the exporter's name, address, and tax identification number, a description of the exported goods, and the destination of the goods.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Public Safety;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-61 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Public Safety.