This version of the form is not currently in use and is provided for reference only. Download this version of

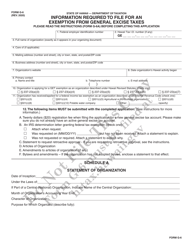

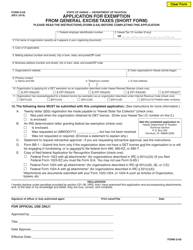

Form G-45 (G-49) Schedule GE

for the current year.

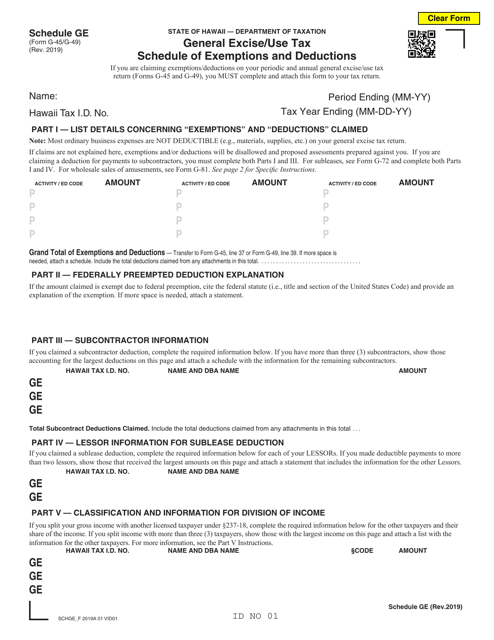

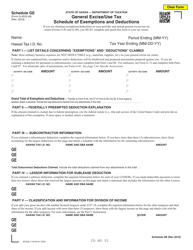

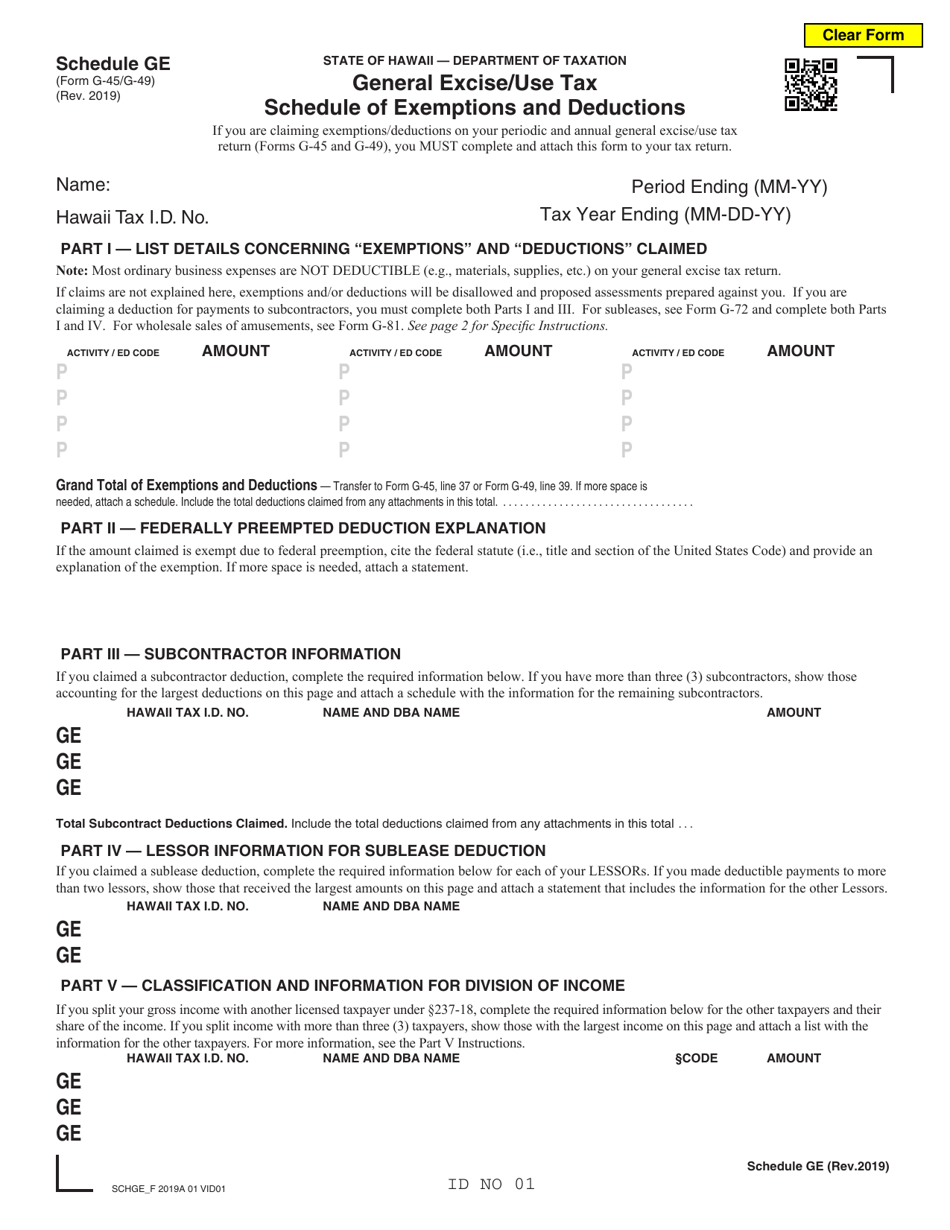

Form G-45 (G-49) Schedule GE General Excise / Use Tax Schedule of Exemptions and Deductions - Hawaii

What Is Form G-45 (G-49) Schedule GE?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form G-45, and Form G-49. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-45 (G-49)?

A: Form G-45 (G-49) is the General Excise / Use Tax Schedule of Exemptions and Deductions in Hawaii.

Q: What is the purpose of Form G-45 (G-49)?

A: The purpose of Form G-45 (G-49) is to report any exemptions and deductions related to general excise or use tax in Hawaii.

Q: What is the General Excise Tax (GET)?

A: The General Excise Tax (GET) is a tax on business activity in Hawaii.

Q: What is the Use Tax?

A: The Use Tax is a tax on the use of goods or services in Hawaii that were purchased without paying the General Excise Tax.

Q: Who needs to file Form G-45 (G-49)?

A: Individuals or businesses that are subject to the General Excise Tax or Use Tax in Hawaii may need to file Form G-45 (G-49).

Q: What types of exemptions and deductions can be claimed on Form G-45 (G-49)?

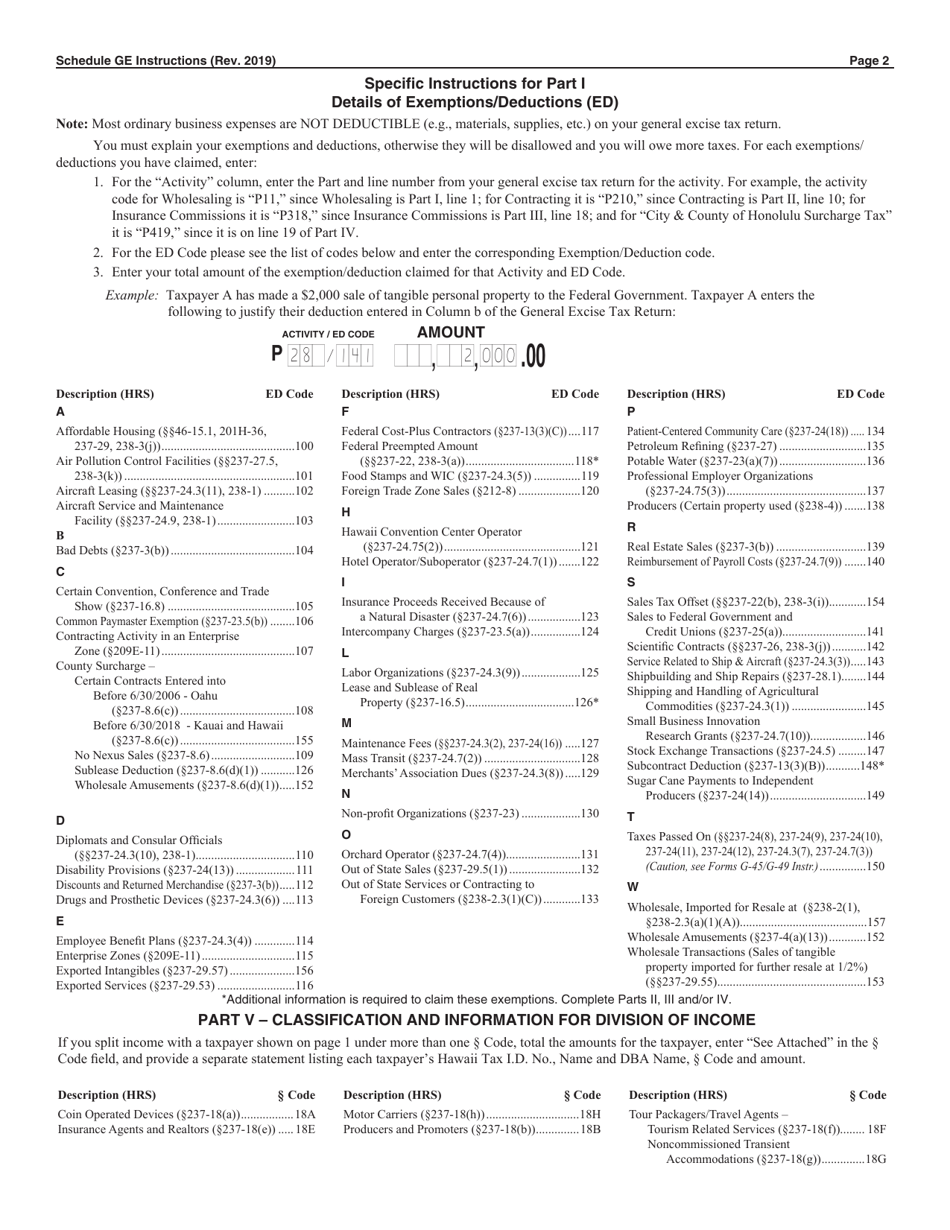

A: Form G-45 (G-49) allows for exemptions and deductions related to specific activities, products, or services that are exempt from or eligible for a reduced general excise or use tax rate in Hawaii.

Q: Are there any deadlines for filing Form G-45 (G-49)?

A: Yes, you must file Form G-45 (G-49) by the 20th day of the month following the end of the reporting period.

Q: Do I need to include any supporting documents when filing Form G-45 (G-49)?

A: In some cases, you may need to include supporting documents with your Form G-45 (G-49) to substantiate your claimed exemptions or deductions.

Q: What happens if I don't file Form G-45 (G-49) or pay the required taxes?

A: Failure to file Form G-45 (G-49) or pay the required taxes may result in penalties and interest being assessed by the Department of Taxation in Hawaii.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-45 (G-49) Schedule GE by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.