This version of the form is not currently in use and is provided for reference only. Download this version of

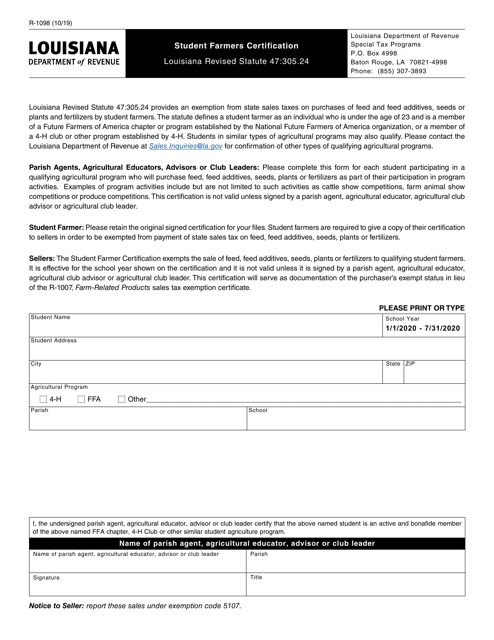

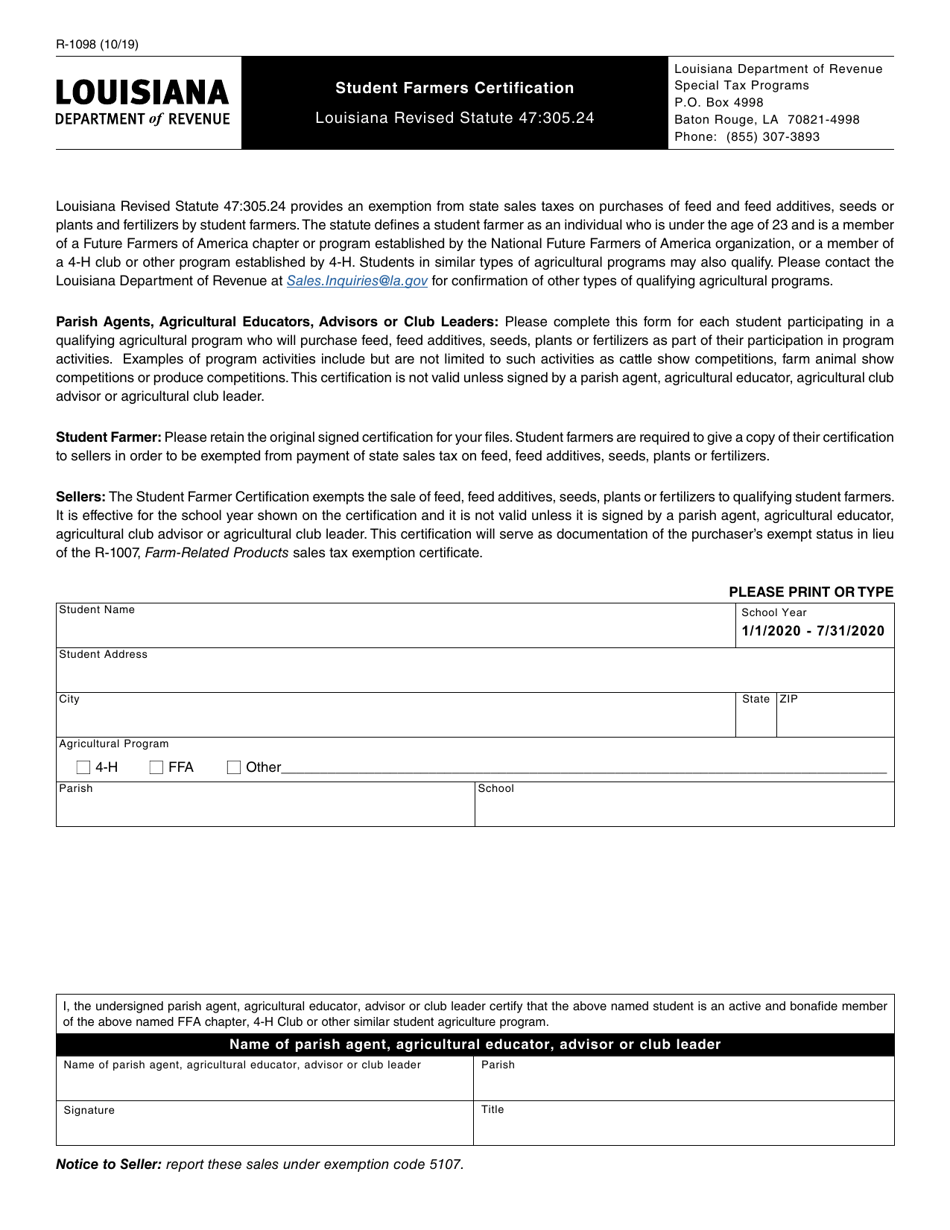

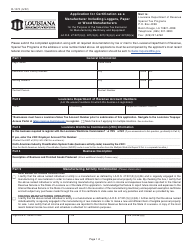

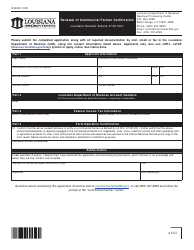

Form R-1098

for the current year.

Form R-1098 Student Farmers Certification - Louisiana

What Is Form R-1098?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1098?

A: Form R-1098 is the Student Farmers Certification required for Louisiana residents.

Q: Who needs to complete Form R-1098?

A: Louisiana residents who qualify as student farmers need to complete Form R-1098.

Q: What is the purpose of Form R-1098?

A: Form R-1098 is used to certify a student farmer's eligibility for certain tax benefits and exemptions.

Q: What tax benefits and exemptions are available for student farmers in Louisiana?

A: Student farmers in Louisiana may be eligible for sales tax exemptions, income tax deductions, and other benefits.

Q: When is Form R-1098 due?

A: Form R-1098 is typically due by April 15th of each year.

Q: Are there any fees associated with filing Form R-1098?

A: There are no fees associated with filing Form R-1098.

Q: Can I file Form R-1098 electronically?

A: As of now, Form R-1098 cannot be filed electronically and must be filed by mail.

Q: What supporting documents do I need to include with Form R-1098?

A: You may be required to provide documentation such as proof of student status and income verification.

Q: Who can I contact for more information or assistance with Form R-1098?

A: For more information or assistance with Form R-1098, you can contact the Louisiana Department of Revenue.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1098 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.