This version of the form is not currently in use and is provided for reference only. Download this version of

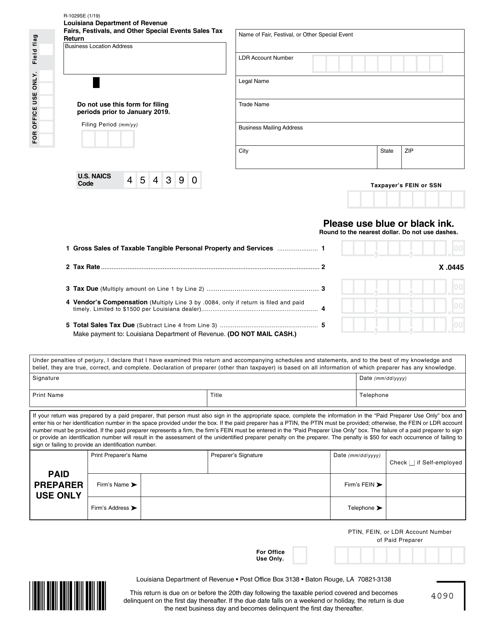

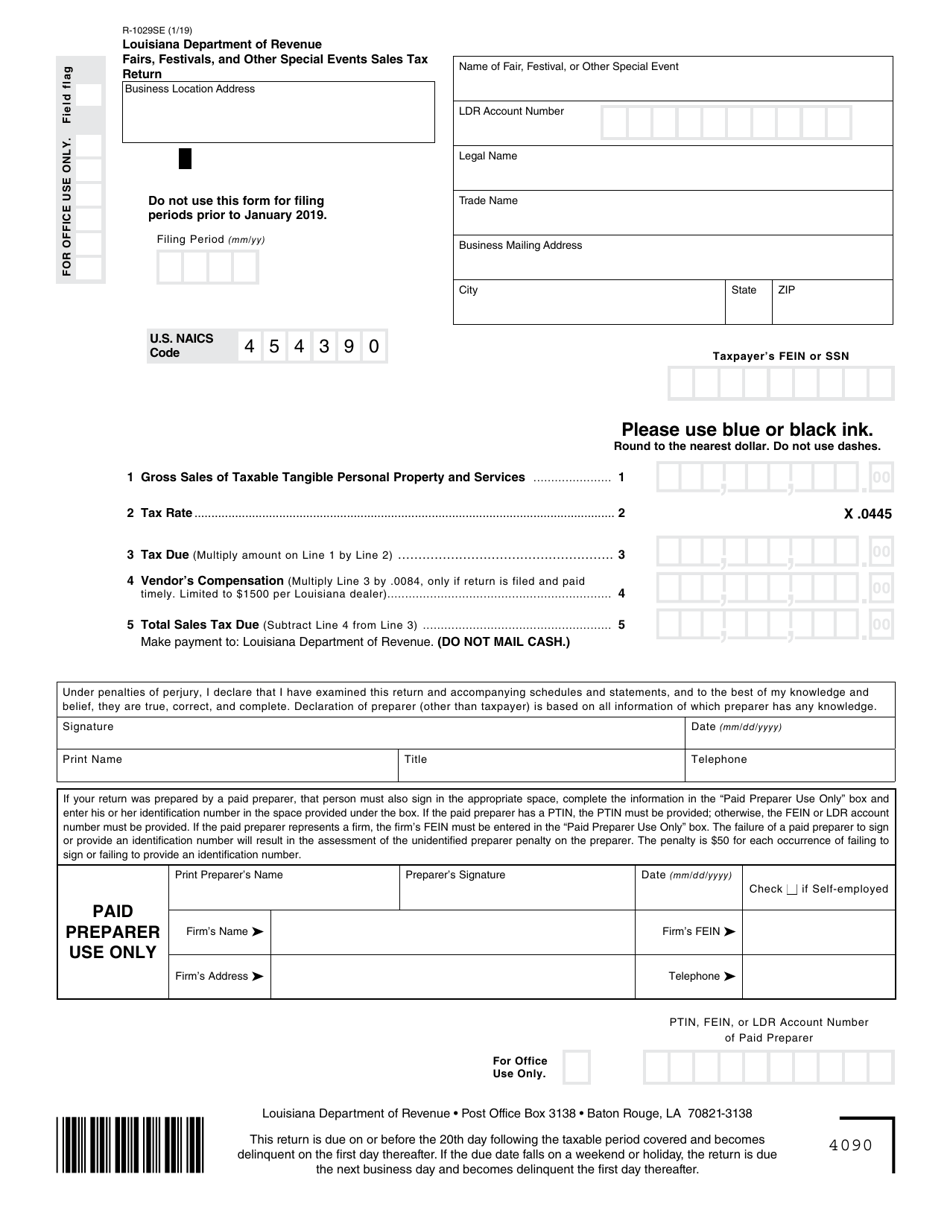

Form R-1029SE

for the current year.

Form R-1029SE Fairs, Festivals, and Other Special Events Sales Tax Return - Louisiana

What Is Form R-1029SE?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1029SE?

A: Form R-1029SE is the Fairs, Festivals, and Other Special Events Sales Tax Return in Louisiana.

Q: What is the purpose of Form R-1029SE?

A: The purpose of Form R-1029SE is to report and remit sales taxes for fairs, festivals, and other special events in Louisiana.

Q: Who needs to file Form R-1029SE?

A: Organizers or operators of fairs, festivals, and other special events in Louisiana need to file Form R-1029SE.

Q: How often should Form R-1029SE be filed?

A: Form R-1029SE should be filed for each fair, festival, or special event within 30 days after the event's end date.

Q: What information is required on Form R-1029SE?

A: Form R-1029SE requires information such as event details, gross receipts from sales, and calculation of the sales tax due.

Form Details:

- Released on January 1, 2019;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1029SE by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.