This version of the form is not currently in use and is provided for reference only. Download this version of

Form PTA201

for the current year.

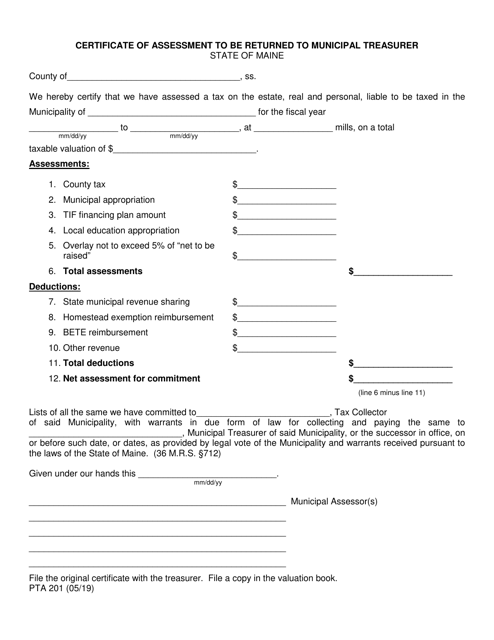

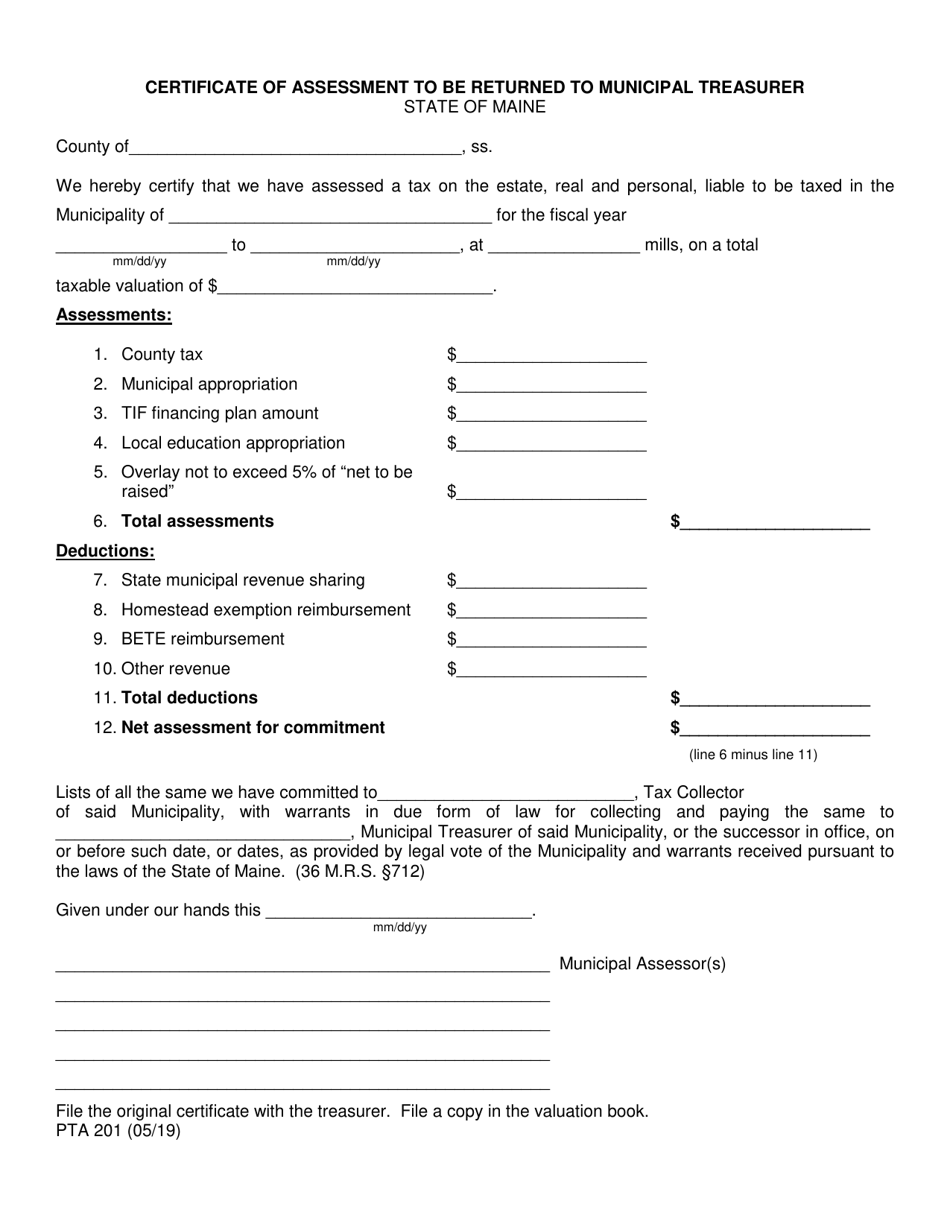

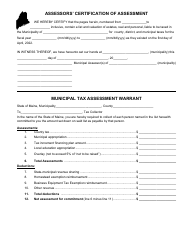

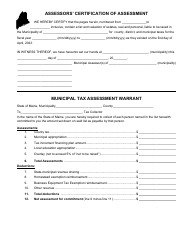

Form PTA201 Certificate of Assessment to Be Returned to Municipal Treasurer - Maine

What Is Form PTA201?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTA201 Certificate of Assessment?

A: Form PTA201 is a certificate of assessment that needs to be filled out and returned to the municipal treasurer in Maine.

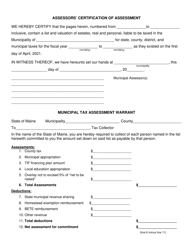

Q: Why do I need to fill out Form PTA201?

A: You need to fill out Form PTA201 to provide information about the assessed value of your property for tax purposes.

Q: Who should I return Form PTA201 to?

A: You should return Form PTA201 to the municipal treasurer in your town or city in Maine.

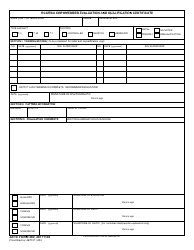

Q: What information do I need to provide on Form PTA201?

A: You need to provide information about your property, including its address, assessed value, and any exemptions or abatements applied.

Q: When is the deadline to return Form PTA201?

A: The deadline to return Form PTA201 varies by municipality, so you should check with your local municipal treasurer for the specific deadline.

Q: What happens if I don't return Form PTA201?

A: If you don't return Form PTA201, your property may be assessed at a higher value or you may lose out on any applicable exemptions or abatements.

Q: Are there any fees associated with Form PTA201?

A: There are typically no fees associated with submitting Form PTA201, but you should check with your local municipal treasurer to confirm.

Q: Can I make changes to Form PTA201 after submitting it?

A: Once you have submitted Form PTA201, you may need to contact your municipal treasurer to make any changes or corrections.

Form Details:

- Released on May 1, 2019;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTA201 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.