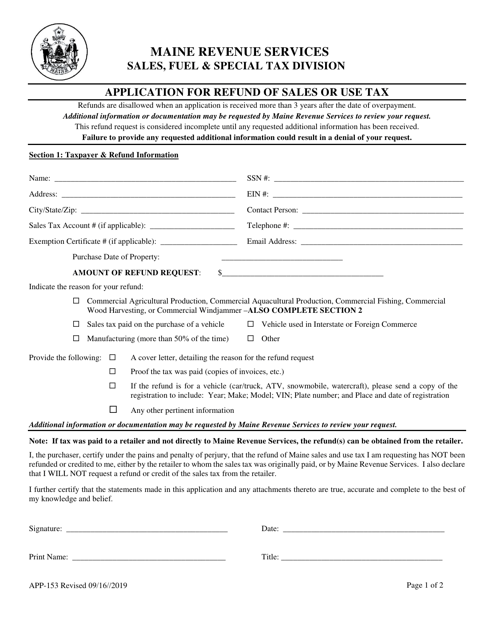

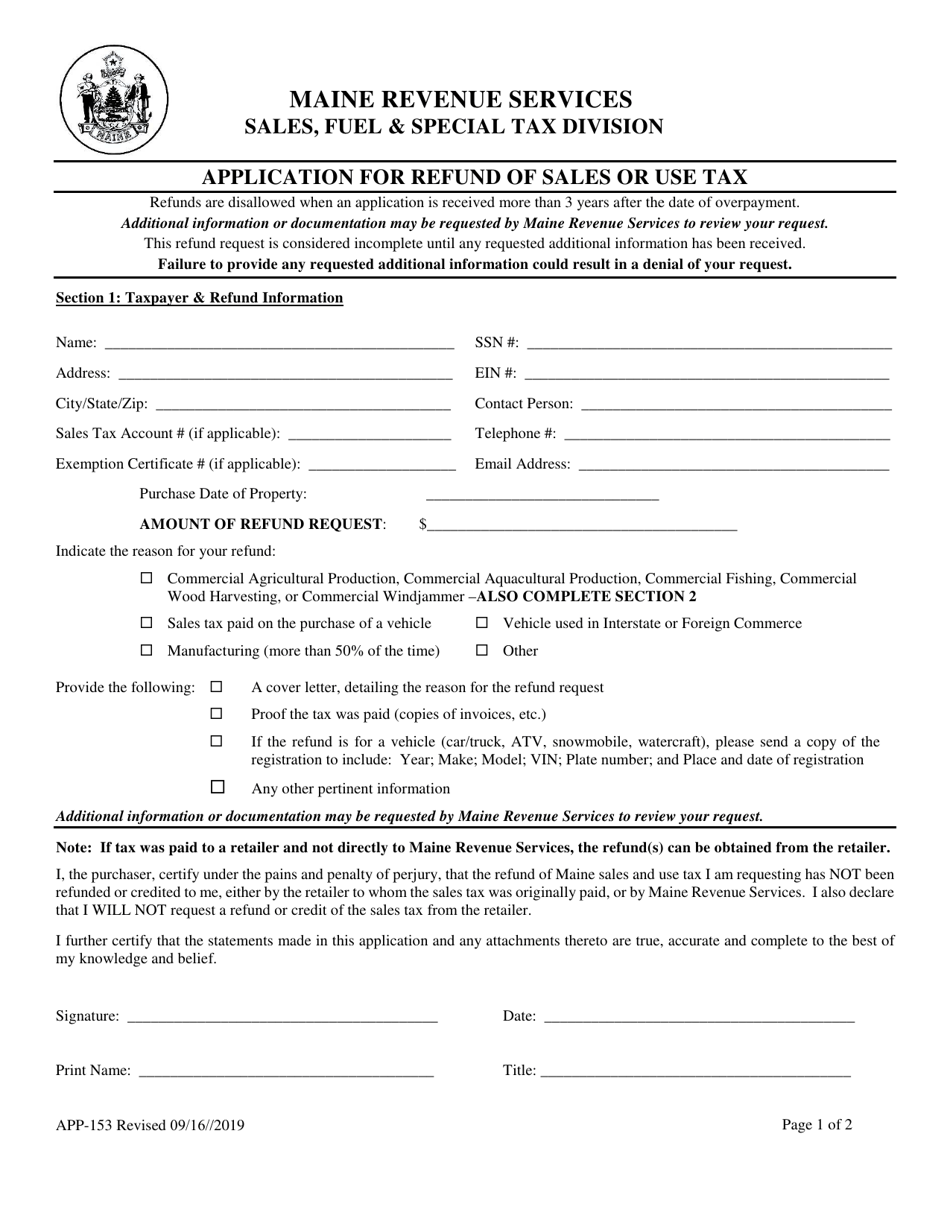

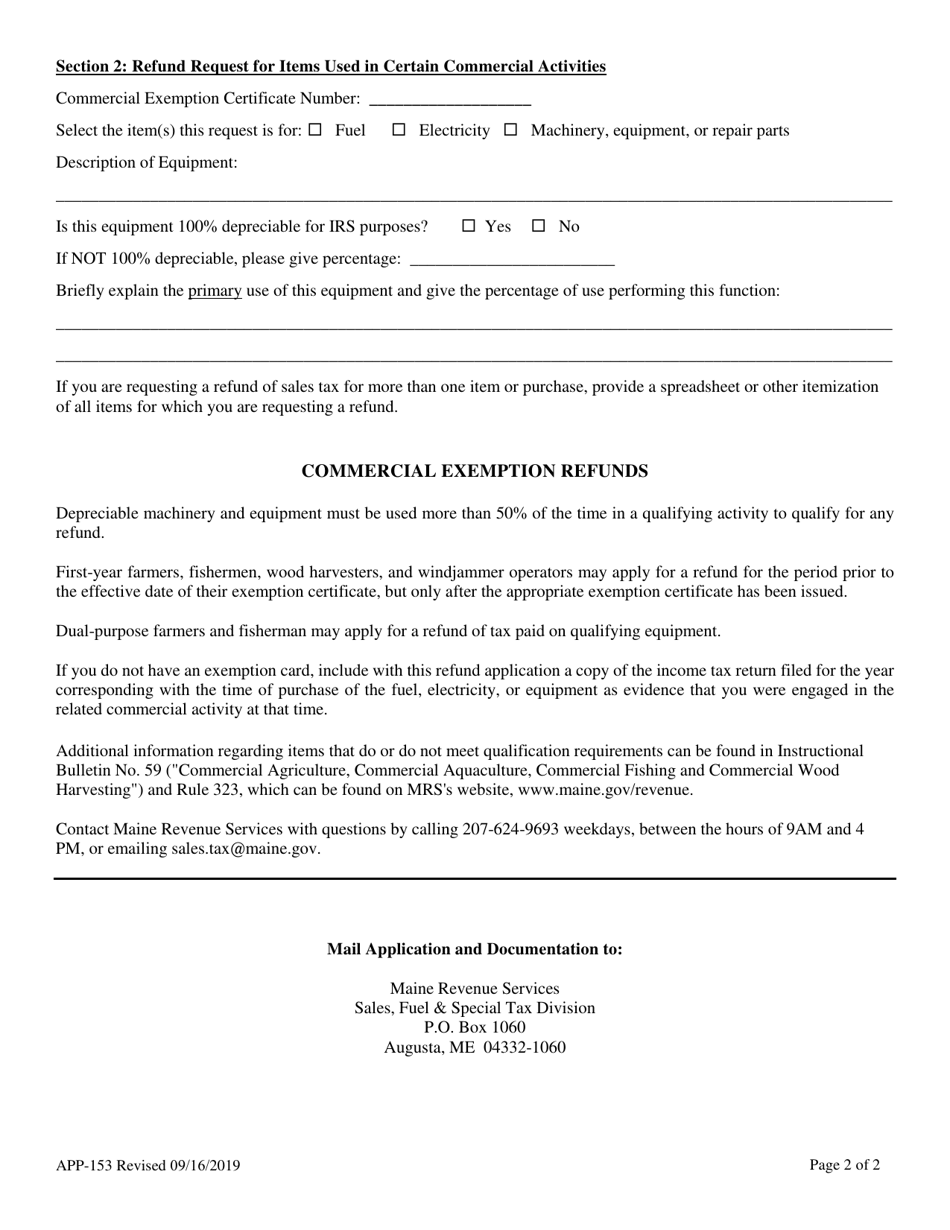

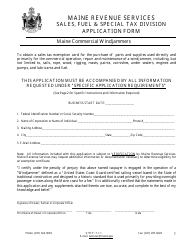

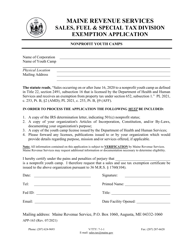

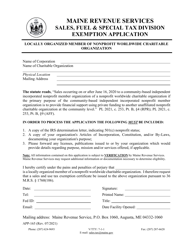

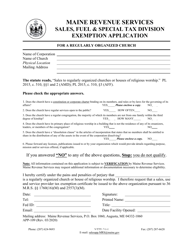

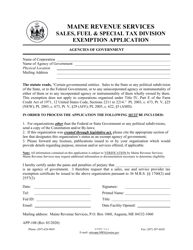

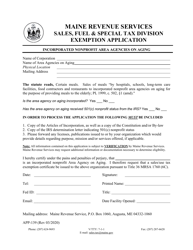

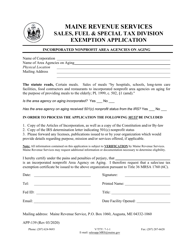

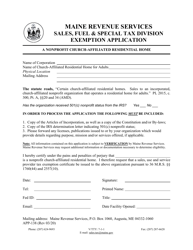

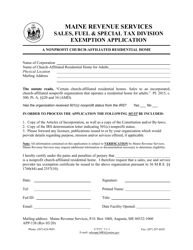

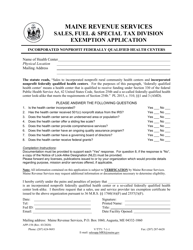

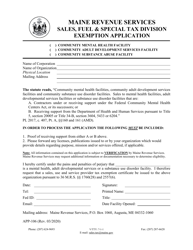

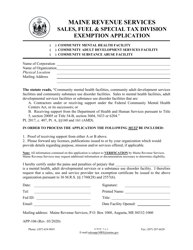

Form APP-153 Application for Refund of Sales or Use Tax - Maine

What Is Form APP-153?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is APP-153?

A: APP-153 is the Application for Refund of Sales or Use Tax in Maine.

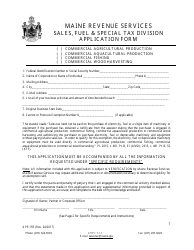

Q: Who can use APP-153?

A: Any person or business that believes they have overpaid sales or use tax in Maine can use APP-153 to apply for a refund.

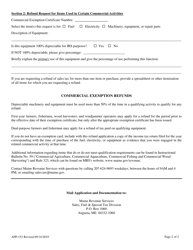

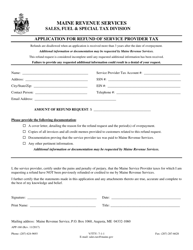

Q: What information do I need to complete APP-153?

A: You will need to provide your name, address, Social Security number or federal employer identification number, the type and amount of tax paid, and a detailed explanation of why you believe you are entitled to a refund.

Q: Are there any fees associated with filing APP-153?

A: No, there are no fees for filing APP-153.

Q: How long does it take to process a refund claim filed through APP-153?

A: Processing times may vary, but generally it takes around 4 to 6 weeks for a refund claim to be processed.

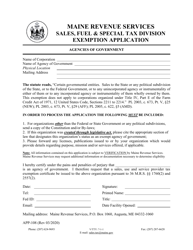

Q: What happens after I submit my completed APP-153?

A: After you submit your completed APP-153, it will be reviewed by the Maine Revenue Services, and if your claim is approved, you will receive a refund.

Q: Can I track the status of my refund claim?

A: Yes, you can track the status of your refund claim by contacting the Maine Revenue Services.

Q: What should I do if my refund claim is denied?

A: If your refund claim is denied, you have the right to appeal the decision. The instructions forfiling an appeal will be provided with the denial notice.

Q: Is there a deadline for filing an APP-153?

A: Yes, you must file your APP-153 within 3 years from the date the tax was paid or due, whichever is later.

Form Details:

- Released on September 16, 2019;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form APP-153 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.