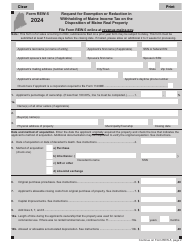

This version of the form is not currently in use and is provided for reference only. Download this version of

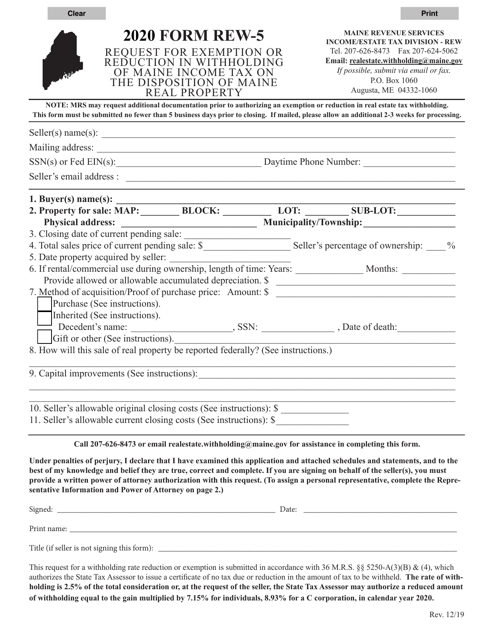

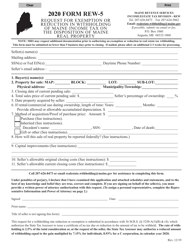

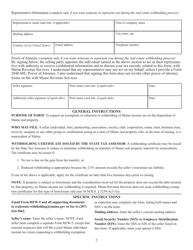

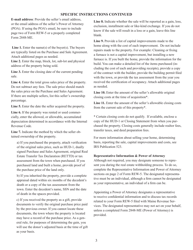

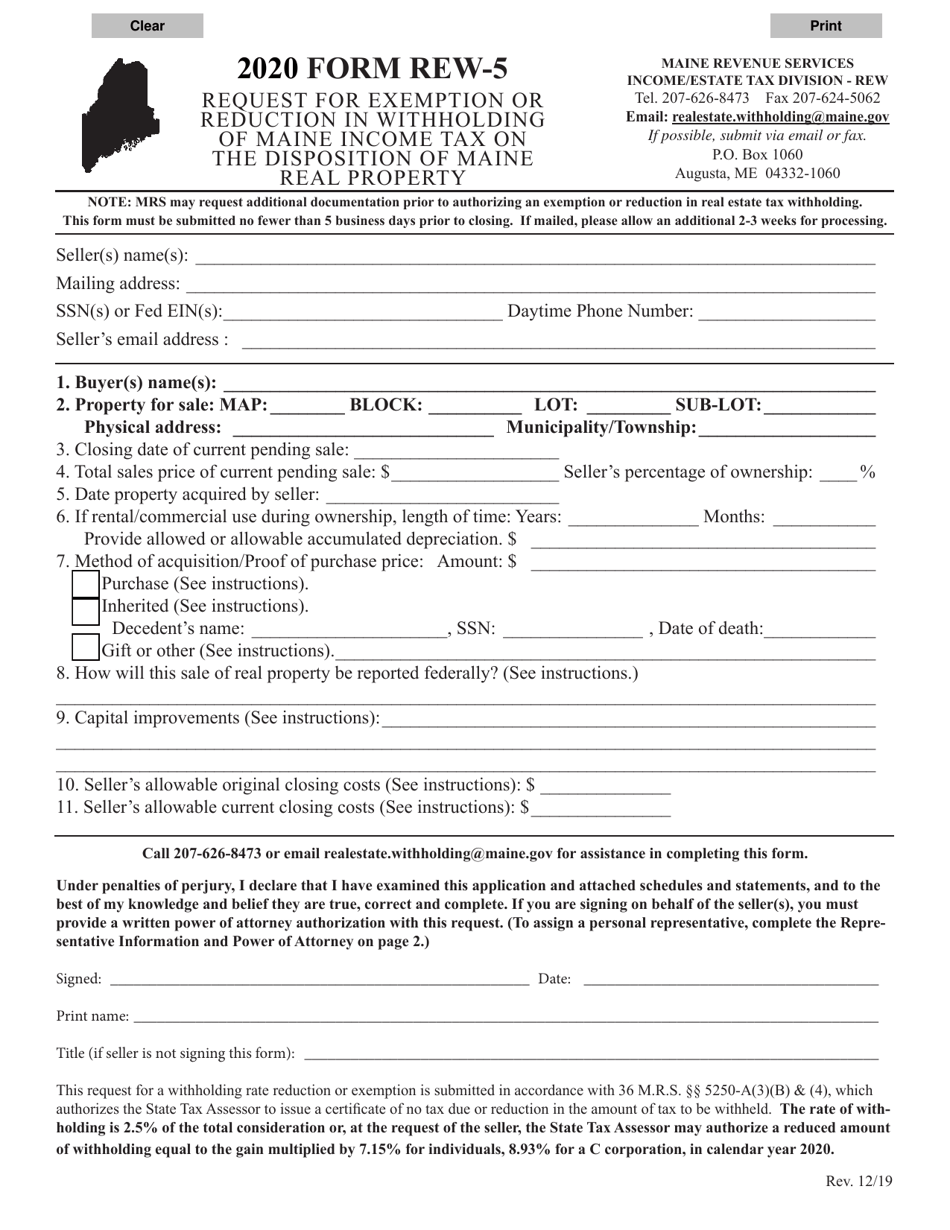

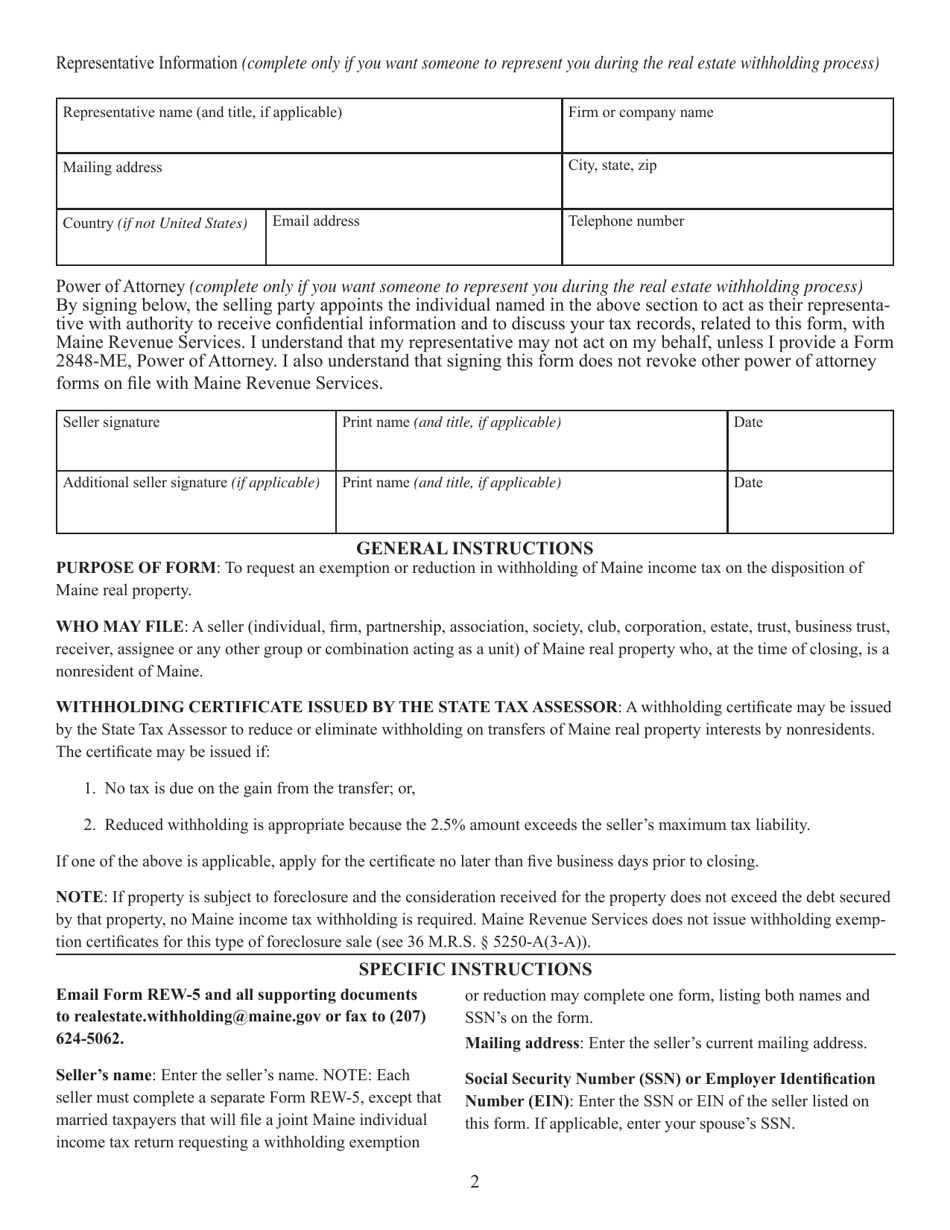

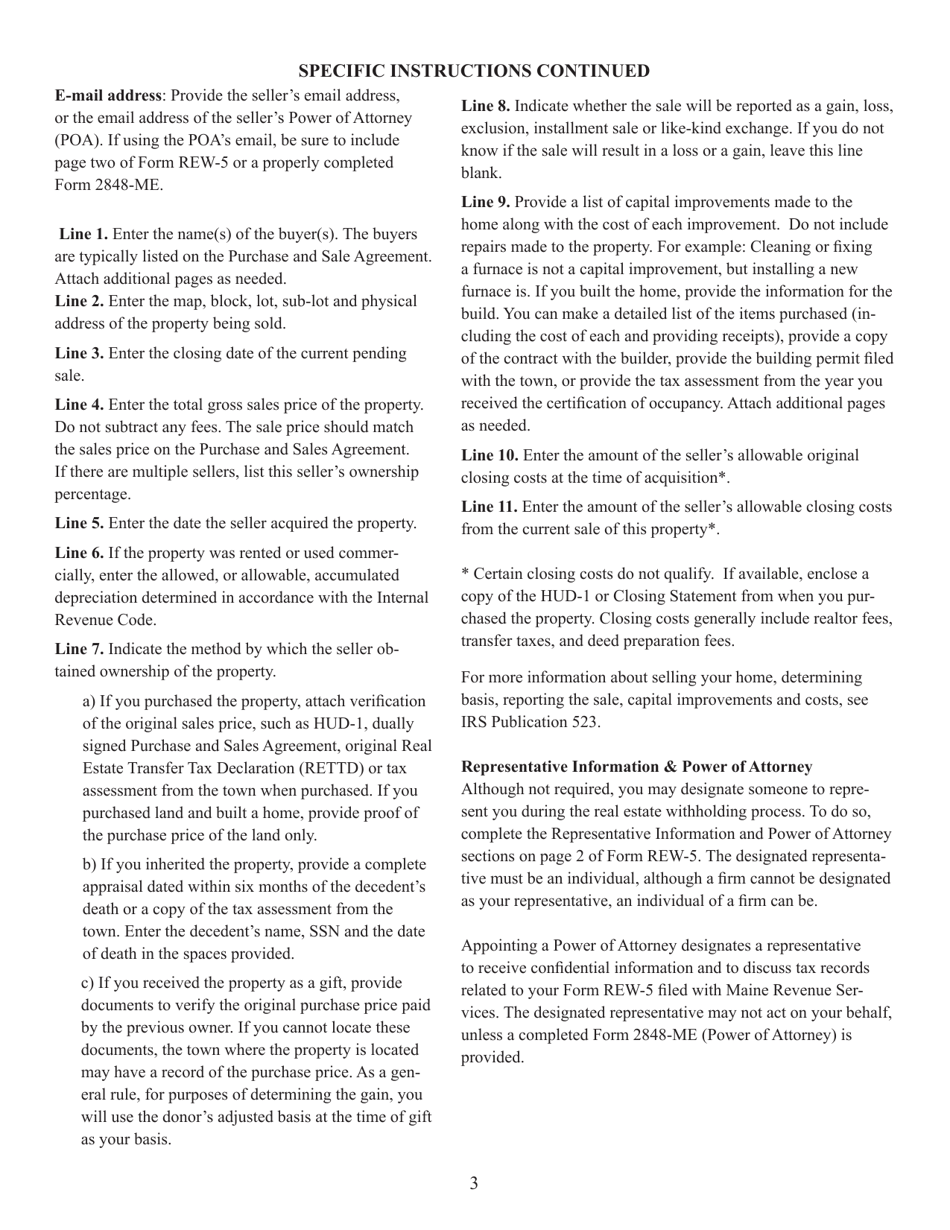

Form REW-5

for the current year.

Form REW-5 Request for Exemption or Reduction in Withholding of Maine Income Tax on the Disposition of Maine Real Property - Maine

What Is Form REW-5?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REW-5?

A: Form REW-5 is the Request for Exemption or Reduction in Withholding of Maine Income Tax on the Disposition of Maine Real Property.

Q: Who needs to file Form REW-5?

A: Anyone who is selling Maine real property and wants to request an exemption or reduction in withholding of Maine income tax needs to file Form REW-5.

Q: What is the purpose of Form REW-5?

A: The purpose of Form REW-5 is to request an exemption or reduction in withholding of Maine income tax on the sale of Maine real property.

Q: What information is required on Form REW-5?

A: Form REW-5 requires information about the seller, the buyer, the property being sold, and the requested exemption or reduction in withholding.

Q: When should Form REW-5 be filed?

A: Form REW-5 should be filed at least 10 business days before the date of sale or transfer of the Maine real property.

Q: Are there any fees associated with filing Form REW-5?

A: No, there are no fees associated with filing Form REW-5.

Q: What happens after Form REW-5 is filed?

A: After Form REW-5 is filed, the Maine Revenue Services will review the request and notify the seller and buyer of their decision.

Q: Is Form REW-5 specific to Maine?

A: Yes, Form REW-5 is specific to Maine and is used for requesting exemptions or reductions in withholding of Maine income tax on the disposition of Maine real property.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REW-5 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.