This version of the form is not currently in use and is provided for reference only. Download this version of

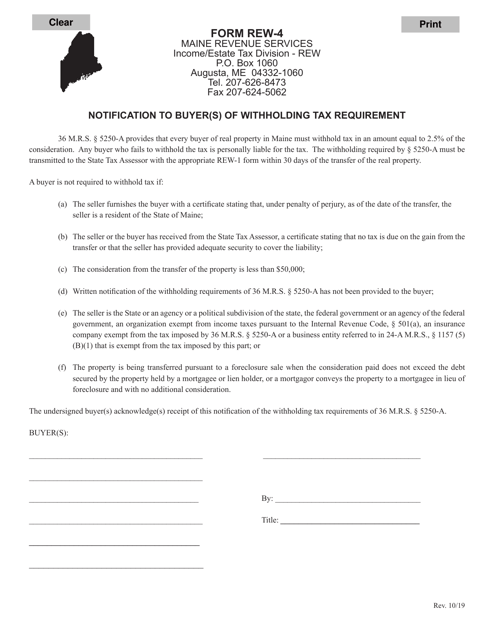

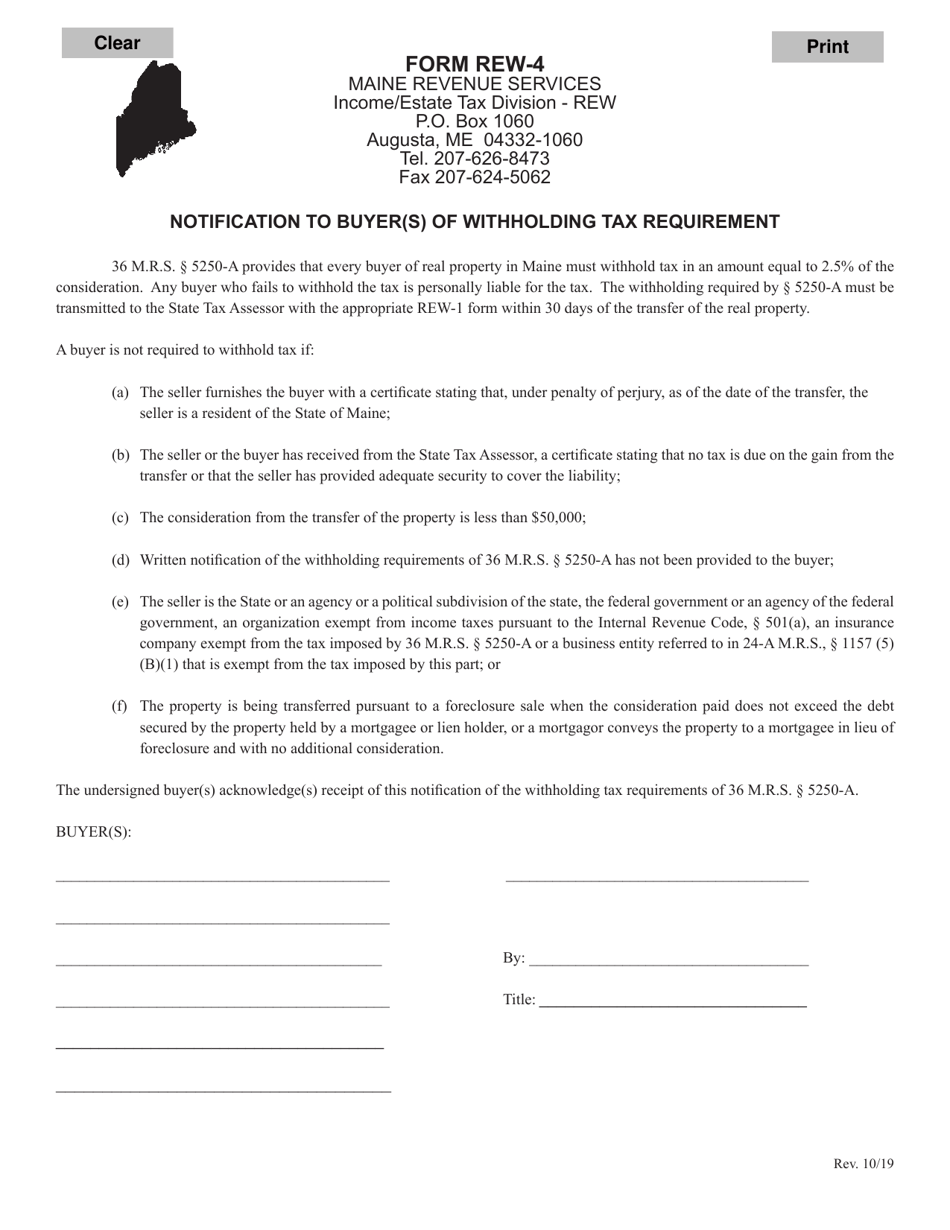

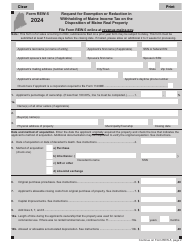

Form REW-4

for the current year.

Form REW-4 Notification to Buyer(S) of Withholding Tax Requirement - Maine

What Is Form REW-4?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form REW-4?

A: Form REW-4 is the Notification to Buyers of Withholding Tax Requirement for the state of Maine.

Q: Who needs to use Form REW-4?

A: Buyers in Maine who are purchasing real estate from non-resident sellers are required to use Form REW-4 to notify the sellers of their withholding tax obligation.

Q: What is the purpose of Form REW-4?

A: The purpose of Form REW-4 is to inform non-resident sellers of real estate in Maine about their withholding tax obligation and to provide the necessary information for the buyer to comply with the withholding requirement.

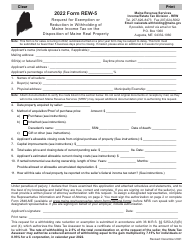

Q: What information is required on Form REW-4?

A: Form REW-4 requires the buyer to provide information about the real estate transaction, the seller, and the buyer's withholding tax calculation.

Q: When should Form REW-4 be submitted?

A: Form REW-4 should be submitted to the Maine Revenue Services no later than 10 days after the closing of the real estate transaction.

Q: Is there a fee for filing Form REW-4?

A: No, there is no fee for filing Form REW-4.

Q: What happens if the buyer fails to submit Form REW-4?

A: If the buyer fails to submit Form REW-4, they may be held personally liable for the non-resident seller's withholding tax obligation.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form REW-4 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.