This version of the form is not currently in use and is provided for reference only. Download this version of

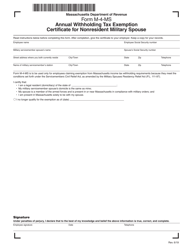

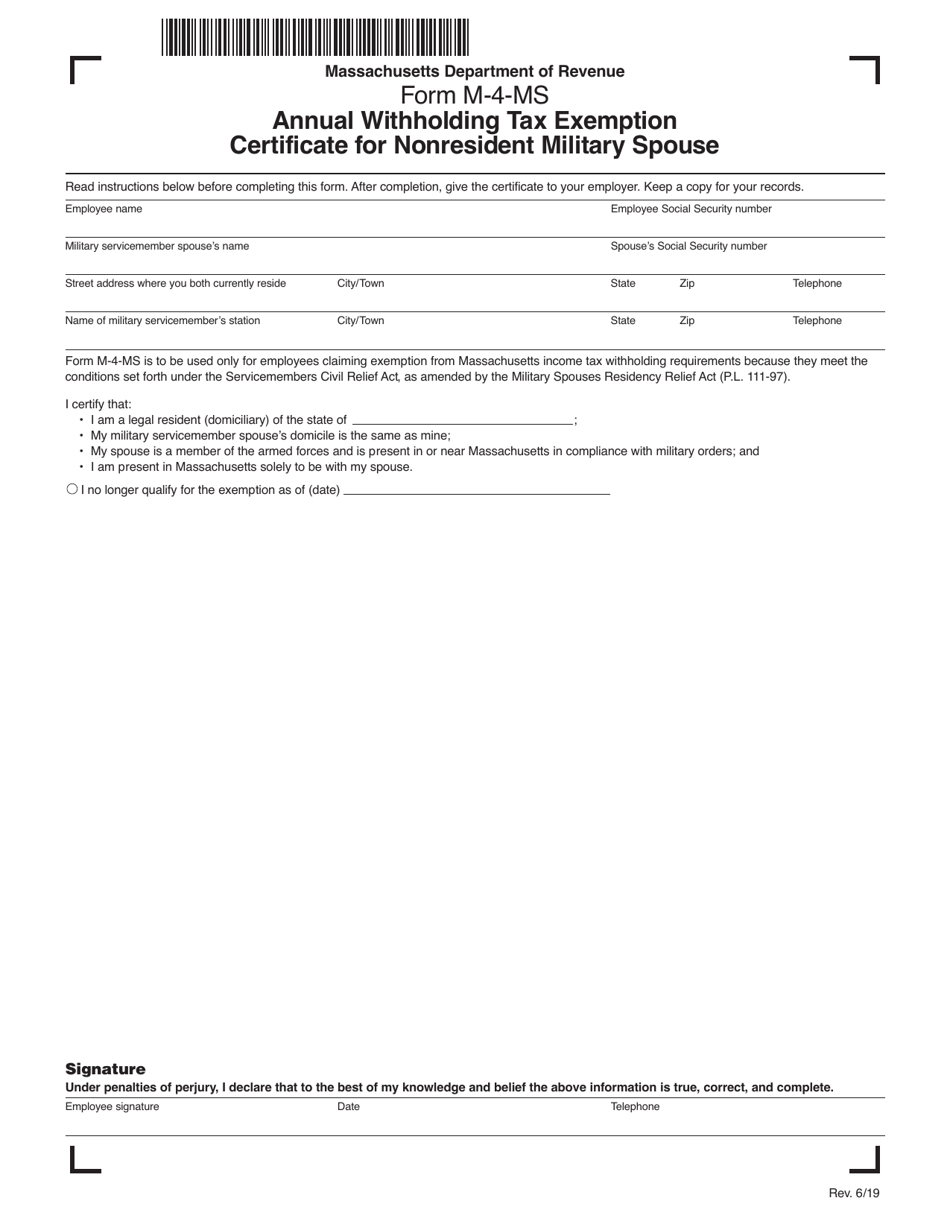

Form M-4-MS

for the current year.

Form M-4-MS Annual Withholding Tax Exemption Certificate for Nonresident Military Spouse - Massachusetts

What Is Form M-4-MS?

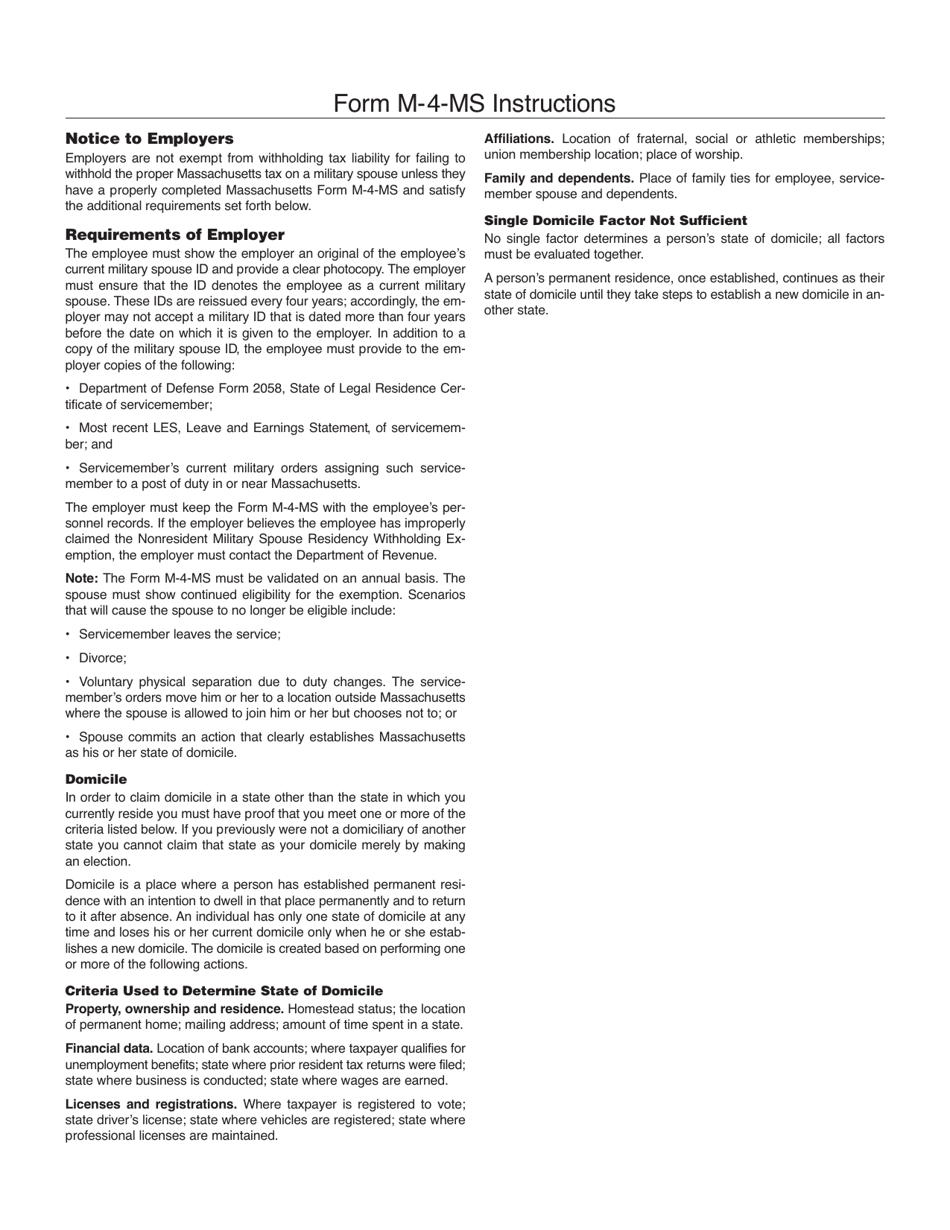

This is a legal form that was released by the Massachusetts Department of Revenue - a government authority operating within Massachusetts. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-4-MS?

A: Form M-4-MS is an Annual Withholding Tax Exemption Certificate for Nonresident Military Spouse in Massachusetts.

Q: Who is eligible to use Form M-4-MS?

A: Nonresident military spouses who meet certain criteria are eligible to use Form M-4-MS.

Q: What is the purpose of Form M-4-MS?

A: The purpose of Form M-4-MS is to exempt nonresident military spouses from Massachusetts withholding tax.

Q: How often do I need to submit Form M-4-MS?

A: Form M-4-MS needs to be submitted annually.

Q: What information is required on Form M-4-MS?

A: Form M-4-MS requires information such as the nonresident military spouse's name, Social Security number, and income details.

Q: What should I do after completing Form M-4-MS?

A: After completing Form M-4-MS, you should submit it to your employer for withholding tax exemption.

Q: Can a nonresident military spouse claim exemptions for multiple states?

A: Yes, a nonresident military spouse can claim exemptions for multiple states.

Q: Is Form M-4-MS applicable for resident military spouses?

A: No, Form M-4-MS is specifically for nonresident military spouses.

Q: Are there any deadlines for submitting Form M-4-MS?

A: There are no specific deadlines mentioned for submitting Form M-4-MS. However, it is recommended to submit it as soon as possible to ensure proper tax withholding exemption.

Form Details:

- Released on June 1, 2019;

- The latest edition provided by the Massachusetts Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form M-4-MS by clicking the link below or browse more documents and templates provided by the Massachusetts Department of Revenue.