This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

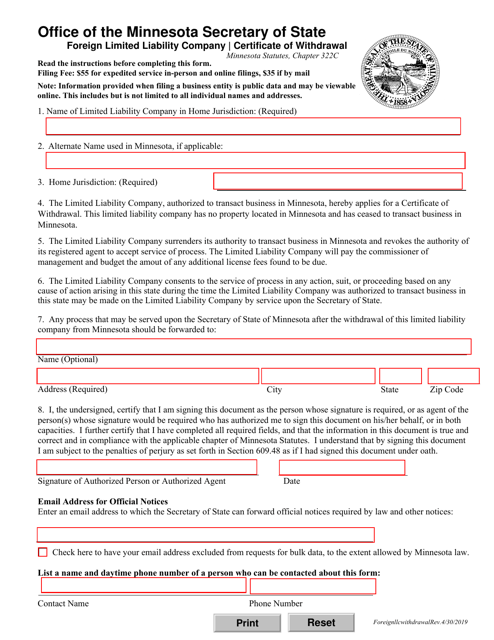

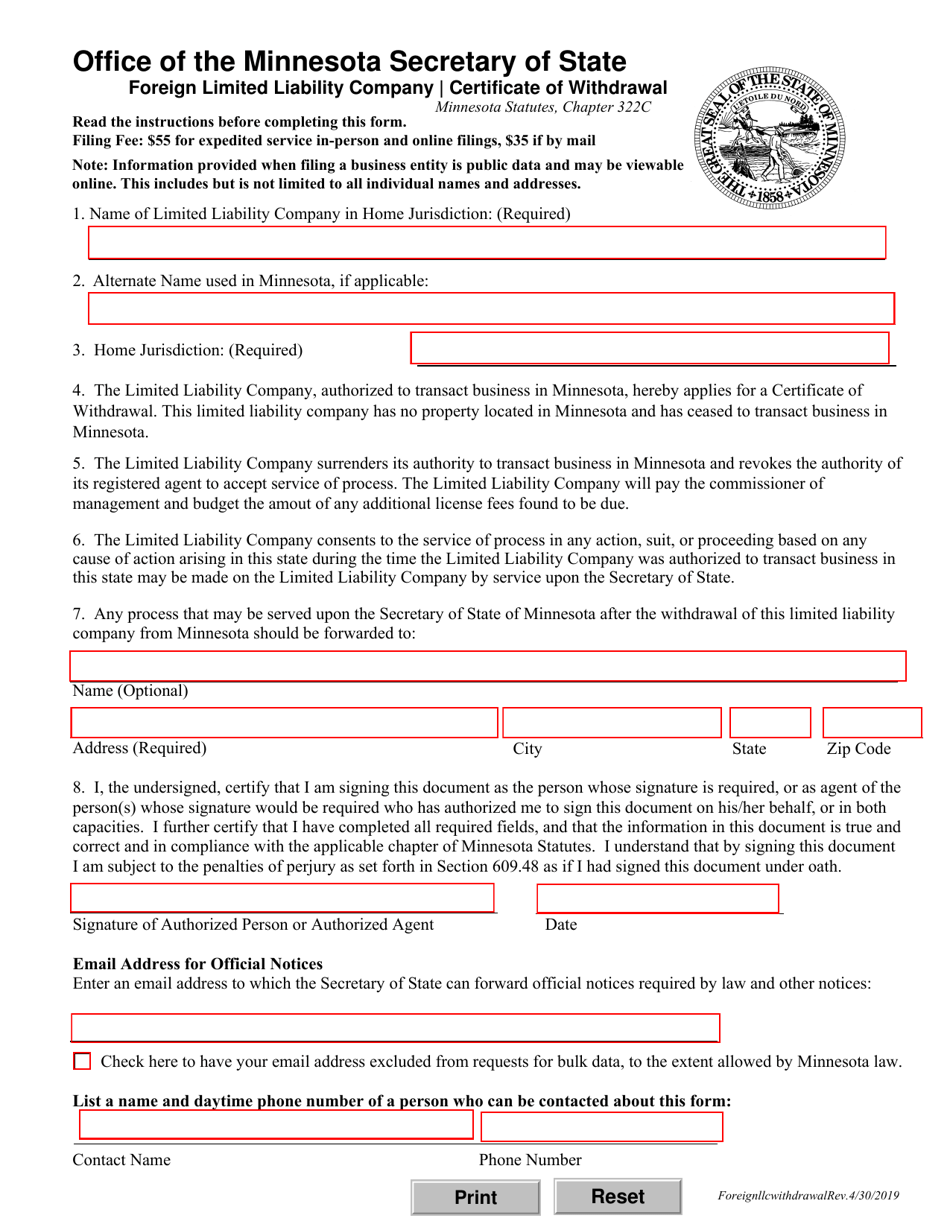

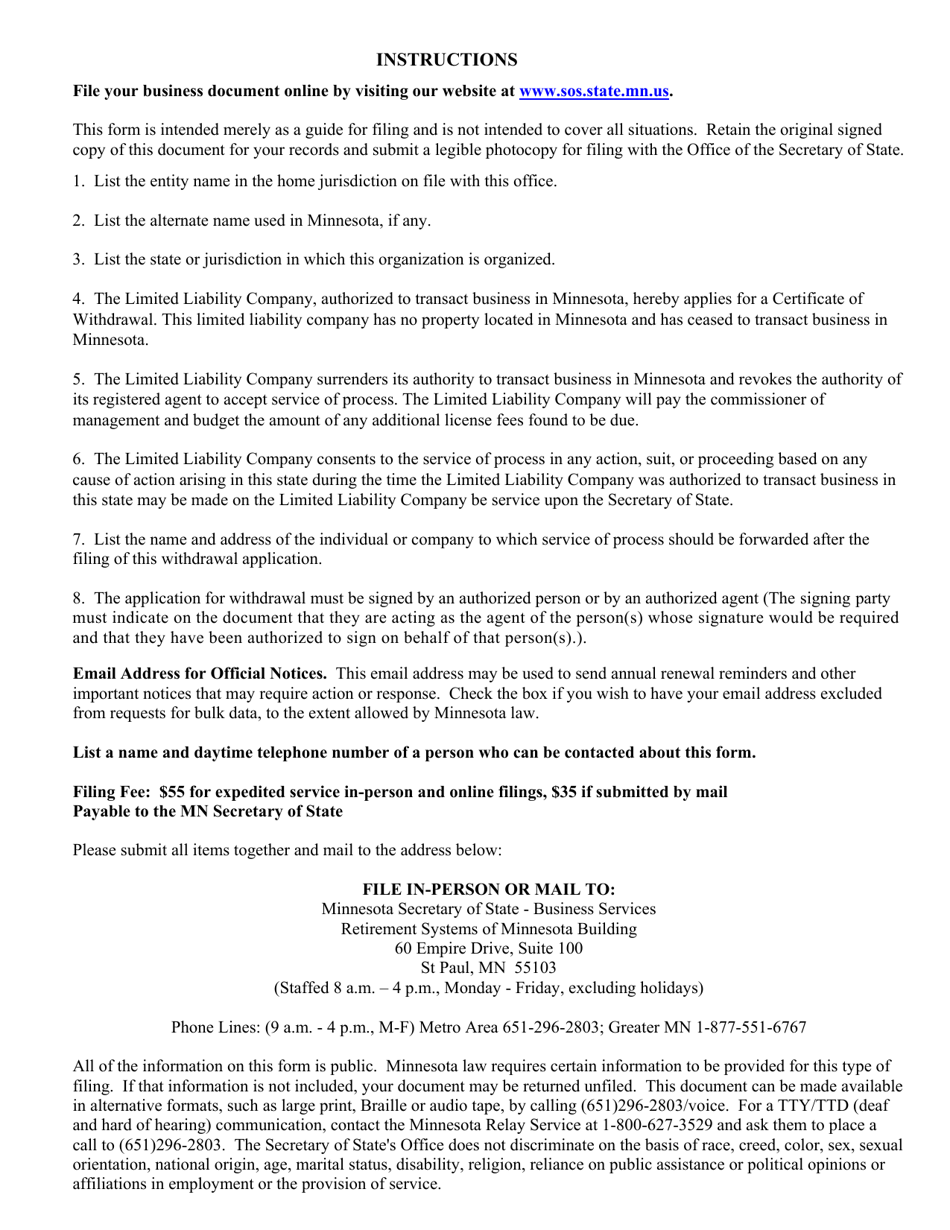

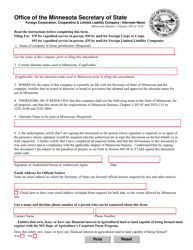

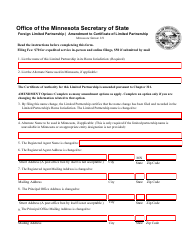

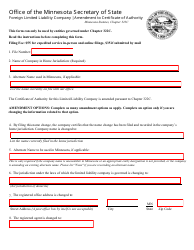

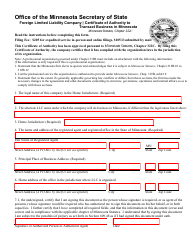

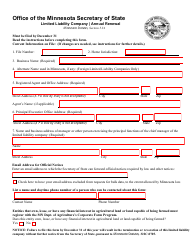

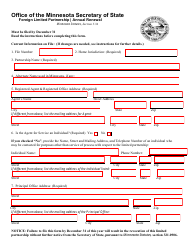

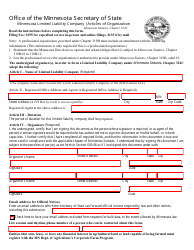

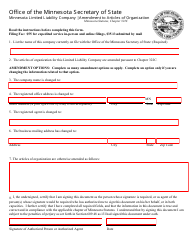

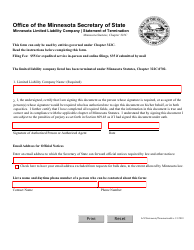

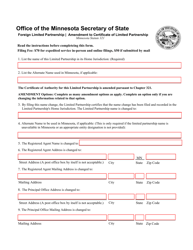

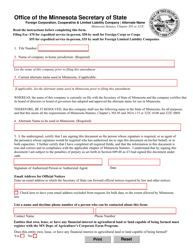

Foreign Limited Liability Company Certificate of Withdrawal - Minnesota

Foreign Limited Liability Company Certificate of Withdrawal is a legal document that was released by the Minnesota Secretary of State - a government authority operating within Minnesota.

FAQ

Q: What is a Foreign Limited Liability Company Certificate of Withdrawal?

A: A Foreign Limited Liability Company Certificate of Withdrawal is a legal document that allows a foreign LLC (limited liability company) to officially withdraw its registration from the state of Minnesota.

Q: Who needs to file a Foreign Limited Liability Company Certificate of Withdrawal in Minnesota?

A: Foreign LLCs that are no longer doing business in Minnesota and wish to terminate their registration need to file a Certificate of Withdrawal.

Q: What is the purpose of filing a Foreign Limited Liability Company Certificate of Withdrawal?

A: The purpose of filing a Certificate of Withdrawal is to formally end the existence of a foreign LLC in the state of Minnesota and to relieve the LLC from any further obligations or liabilities.

Q: How can I obtain a Foreign Limited Liability Company Certificate of Withdrawal in Minnesota?

A: To obtain a Certificate of Withdrawal, you need to file the necessary form with the Minnesota Secretary of State and pay the required filing fee.

Q: What information is required to complete a Foreign Limited Liability Company Certificate of Withdrawal?

A: The form typically requires the LLC's name, state or jurisdiction of formation, date of formation, and a statement declaring that the LLC is no longer doing business in Minnesota.

Q: Is there a deadline for filing a Foreign Limited Liability Company Certificate of Withdrawal in Minnesota?

A: While there is no specific deadline for filing, it is advisable to file the Certificate of Withdrawal as soon as the LLC has ceased conducting business in Minnesota.

Q: What happens after filing a Foreign Limited Liability Company Certificate of Withdrawal?

A: After filing the Certificate of Withdrawal and paying the required fee, the Minnesota Secretary of State will process the withdrawal and update the LLC's status to reflect its termination in the state.

Q: Are there any consequences for not filing a Foreign Limited Liability Company Certificate of Withdrawal in Minnesota?

A: If a foreign LLC fails to file a Certificate of Withdrawal, it may continue to be responsible for annual filings, fees, and tax obligations in Minnesota, even if it is no longer conducting business in the state.

Form Details:

- Released on April 30, 2019;

- The latest edition currently provided by the Minnesota Secretary of State;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Minnesota Secretary of State.