This version of the form is not currently in use and is provided for reference only. Download this version of

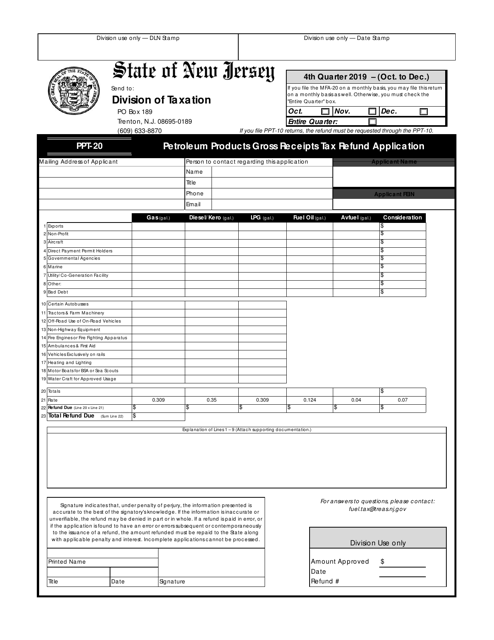

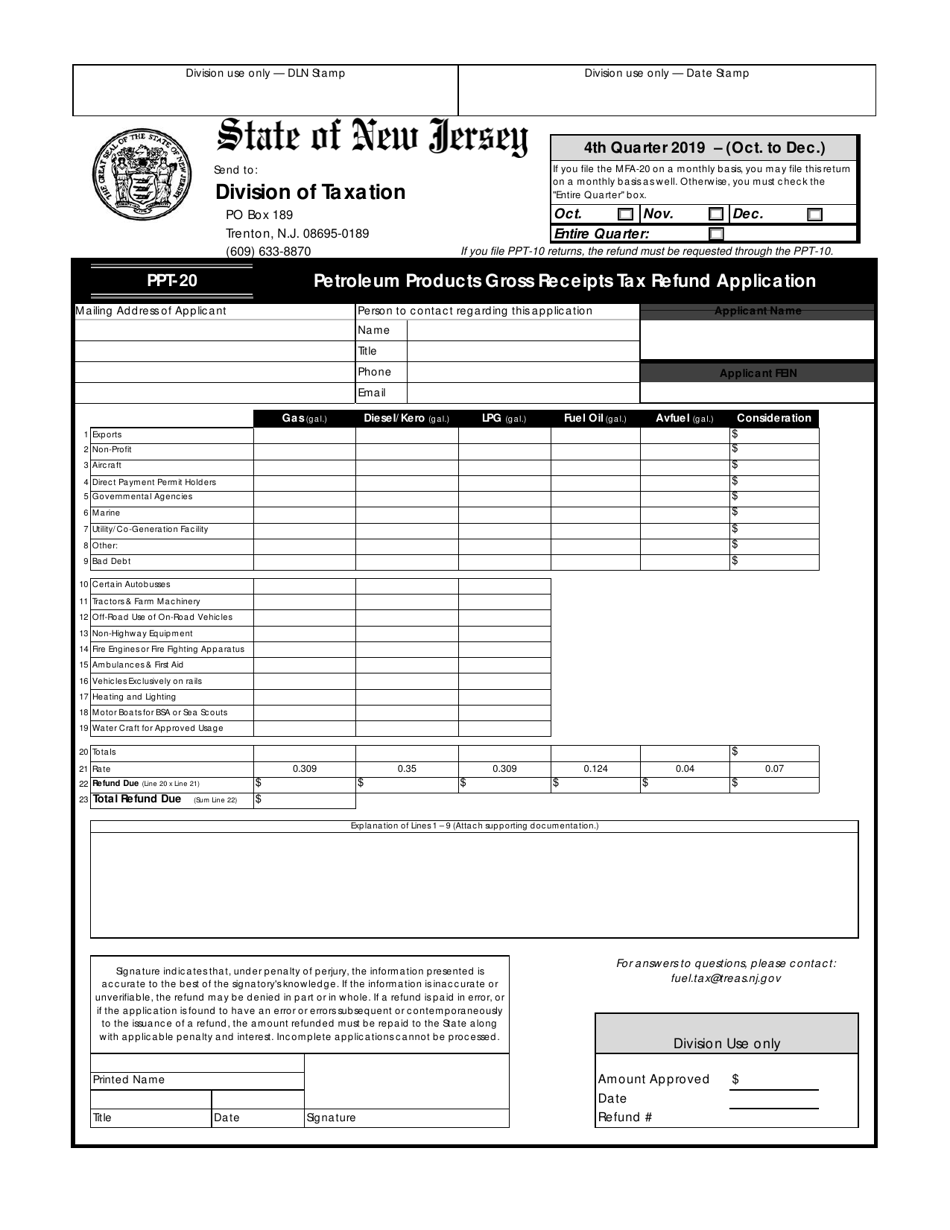

Form PPT-20

for the current year.

Form PPT-20 Petroleum Products Gross Receipts Tax Refund Application - 4th Quarter - New Jersey

What Is Form PPT-20?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PPT-20?

A: Form PPT-20 is the Petroleum ProductsGross Receipts Tax Refund Application for the 4th Quarter in New Jersey.

Q: What is the purpose of Form PPT-20?

A: The purpose of Form PPT-20 is to apply for a refund of the Petroleum Products Gross Receipts Tax for the 4th Quarter in New Jersey.

Q: Who needs to file Form PPT-20?

A: Any person or entity who paid the Petroleum Products Gross Receipts Tax in New Jersey for the 4th Quarter and wants to claim a refund needs to file Form PPT-20.

Q: When is Form PPT-20 due?

A: Form PPT-20 is due on or before the last day of the month following the end of the calendar quarter. For the 4th Quarter, the deadline is January 31st.

Q: Are there any fees associated with filing Form PPT-20?

A: No, there are no fees associated with filing Form PPT-20.

Q: What supporting documents are required to be submitted with Form PPT-20?

A: The supporting documents required to be submitted with Form PPT-20 include sales invoices, summary of tax paid, and any other records as deemed necessary.

Q: How long does it take to receive a refund after filing Form PPT-20?

A: The processing time for a refund after filing Form PPT-20 can vary, but it typically takes 4-6 weeks.

Q: Can Form PPT-20 be electronically filed?

A: No, Form PPT-20 cannot be electronically filed. It must be filed by mail.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PPT-20 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.