This version of the form is not currently in use and is provided for reference only. Download this version of

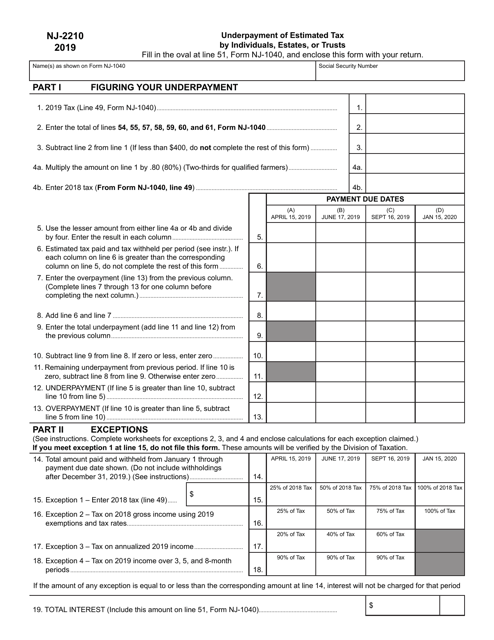

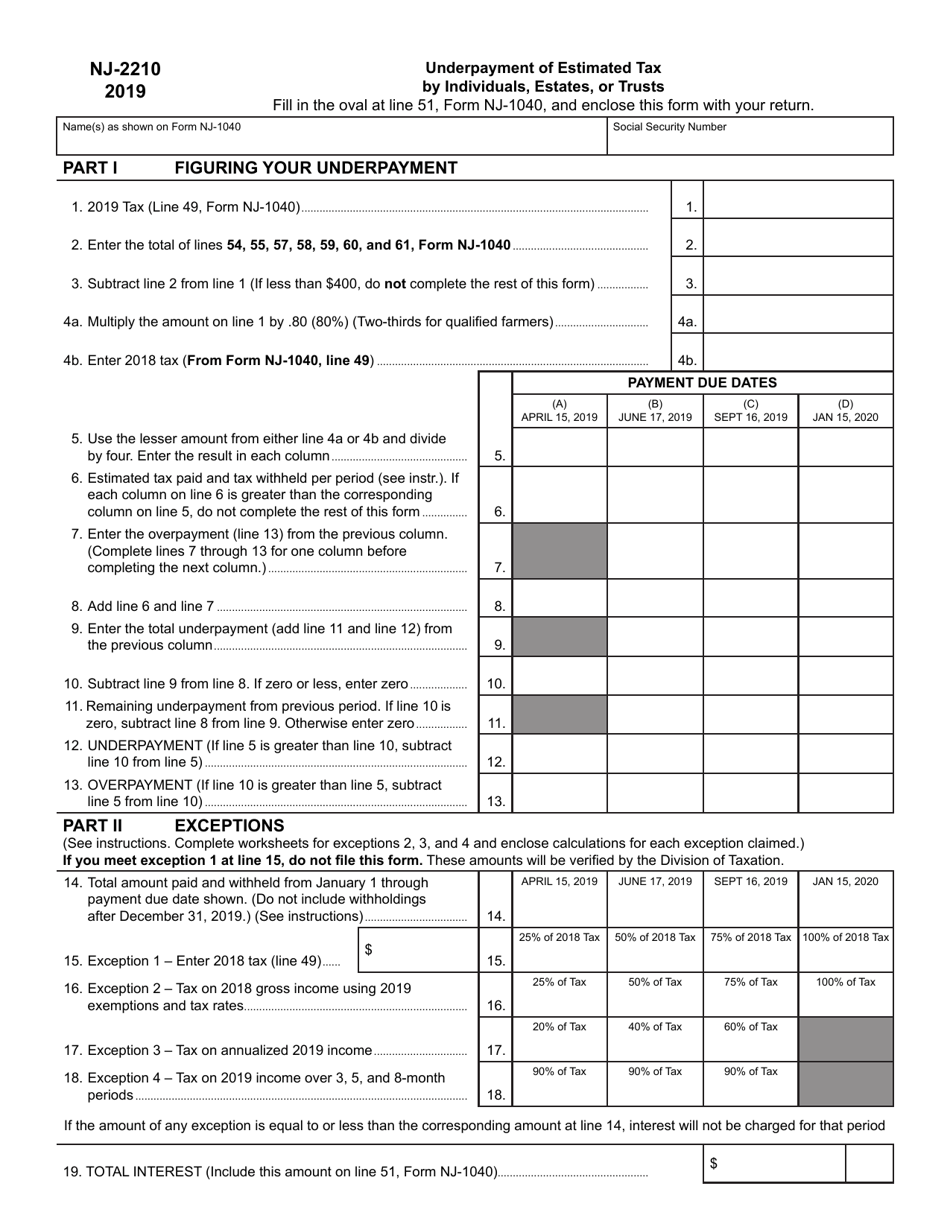

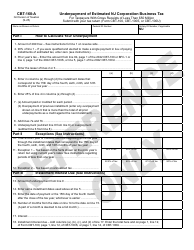

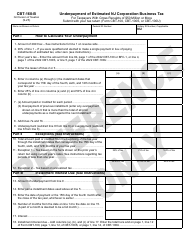

Form NJ-2210

for the current year.

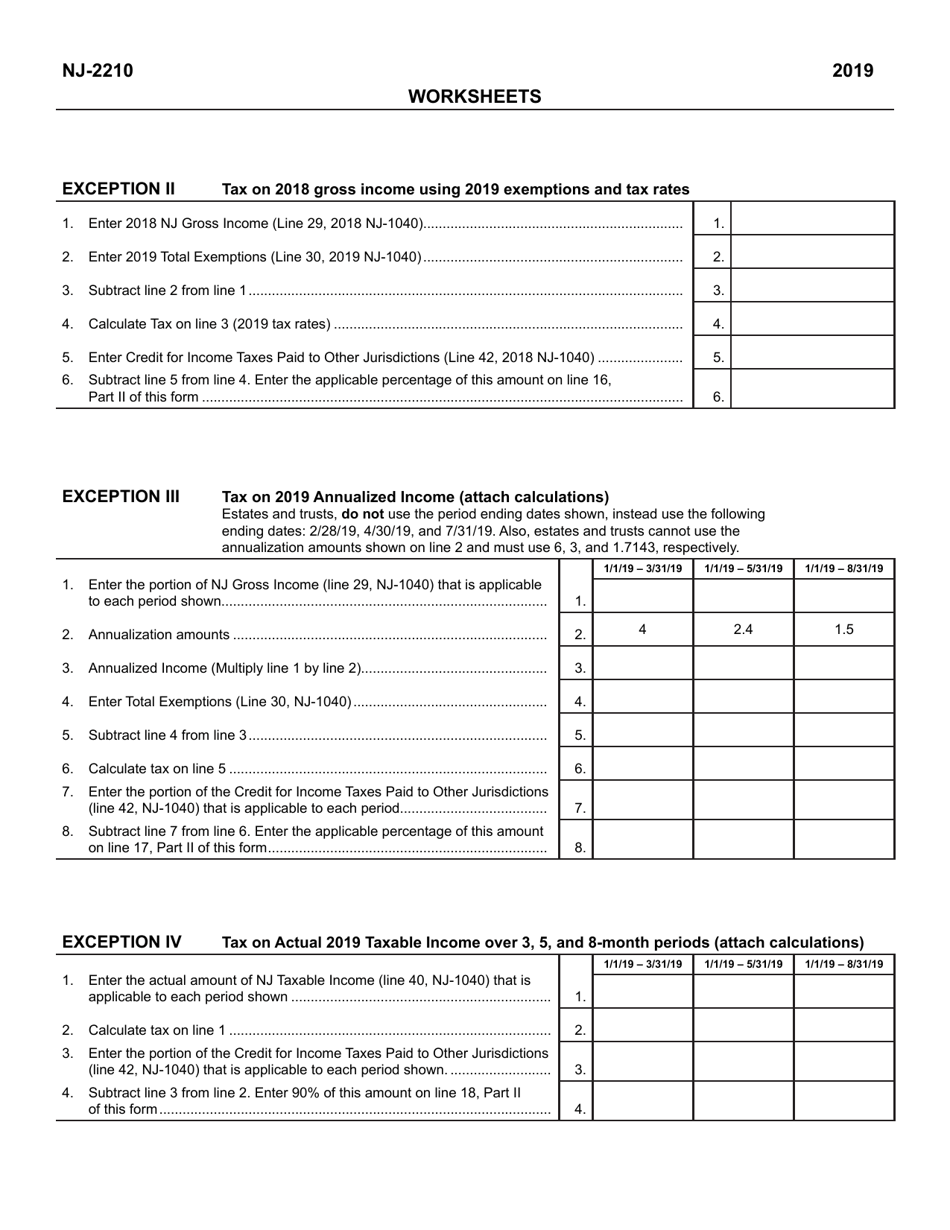

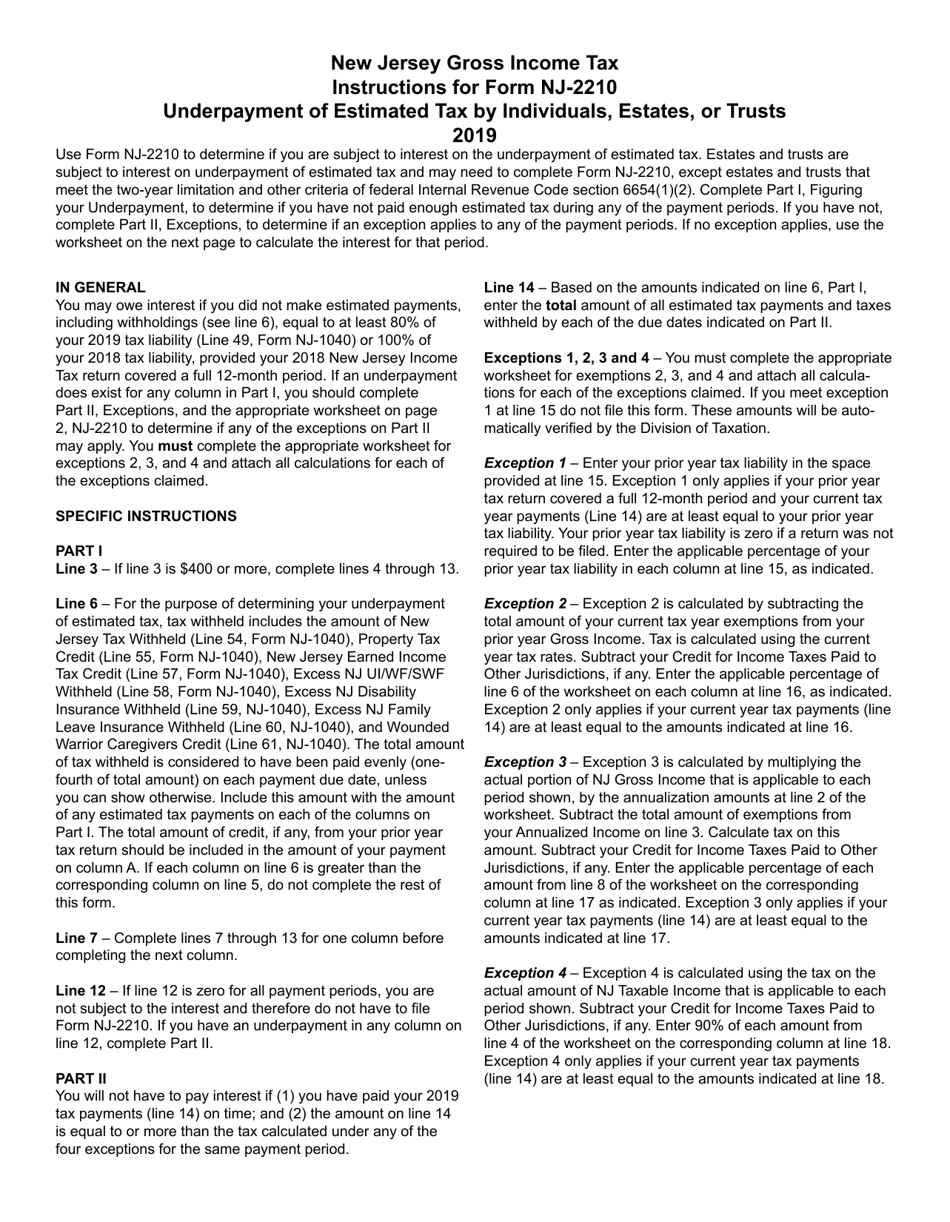

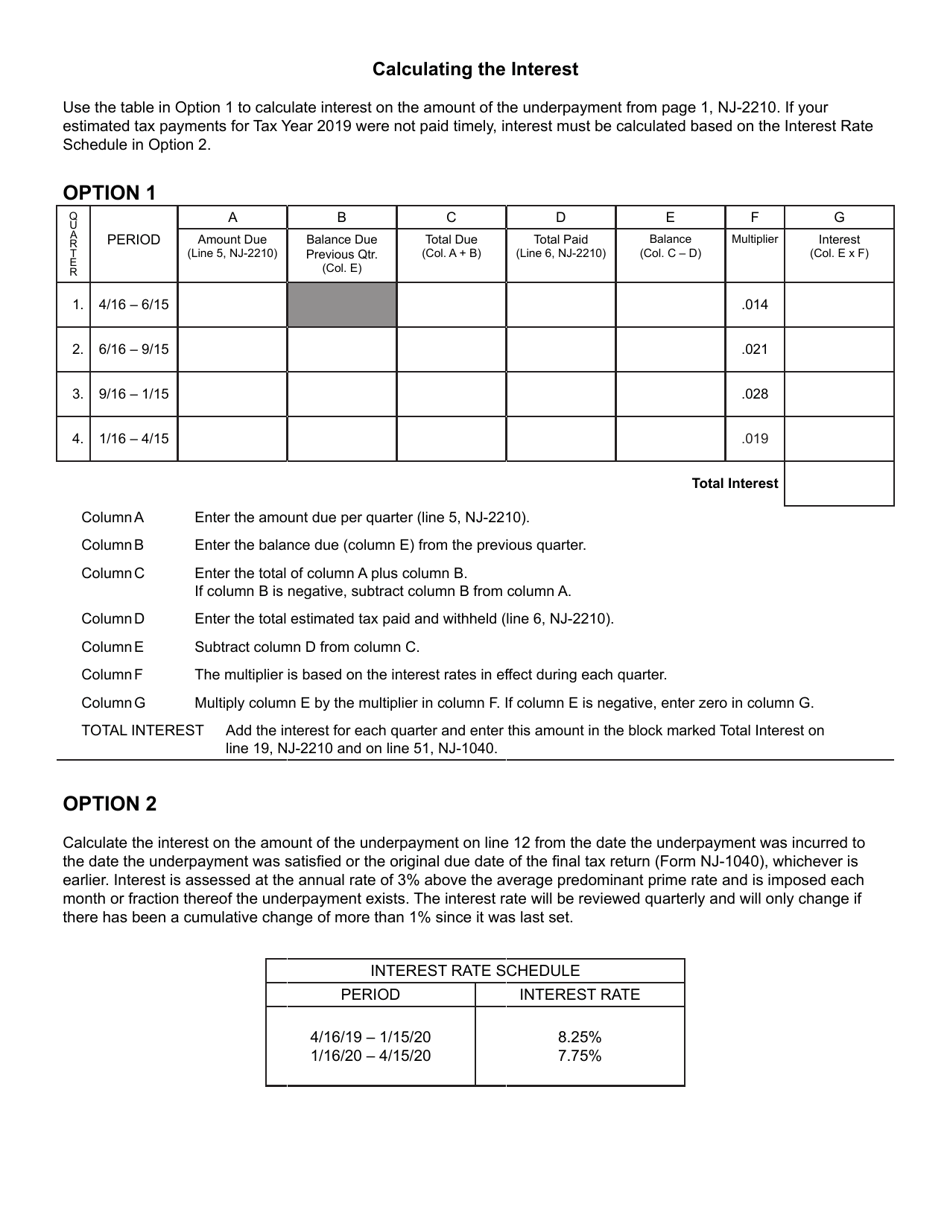

Form NJ-2210 Underpayment of Estimated Tax by Individuals, Estates, or Trusts - New Jersey

What Is Form NJ-2210?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-2210?

A: Form NJ-2210 is used to calculate and report any underpayment of estimated tax by individuals, estates, or trusts in the state of New Jersey.

Q: Who should file Form NJ-2210?

A: Individuals, estates, or trusts in New Jersey who have underpaid their estimated tax should file Form NJ-2210.

Q: What is the purpose of Form NJ-2210?

A: The purpose of Form NJ-2210 is to determine if an individual, estate, or trust owes any interest or penalties for underpayment of estimated tax.

Q: When is Form NJ-2210 due?

A: Form NJ-2210 is due on the same date as your New Jersey income tax return, which is usually April 15th.

Q: What happens if I don't file Form NJ-2210?

A: If you have underpaid your estimated tax and fail to file Form NJ-2210, you may be subject to interest and penalties.

Q: Can I e-file Form NJ-2210?

A: At the moment, New Jersey does not offer e-filing for Form NJ-2210. It must be filed by mail.

Q: What should I do if I made a mistake on Form NJ-2210?

A: If you made a mistake on Form NJ-2210, you should file an amended form as soon as possible with the correct information.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-2210 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.