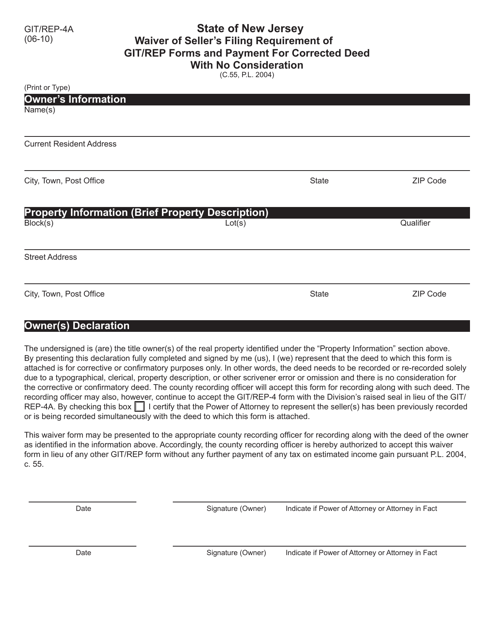

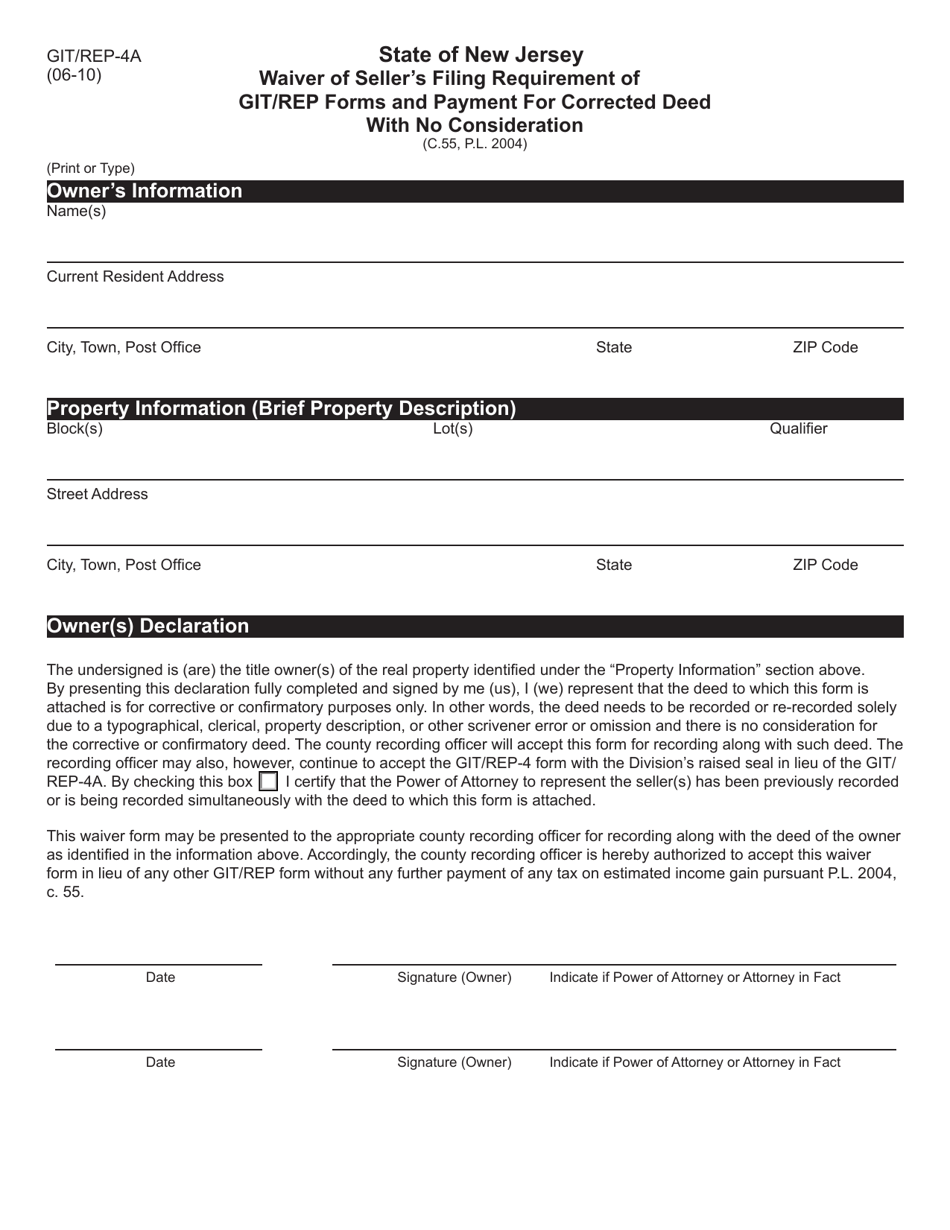

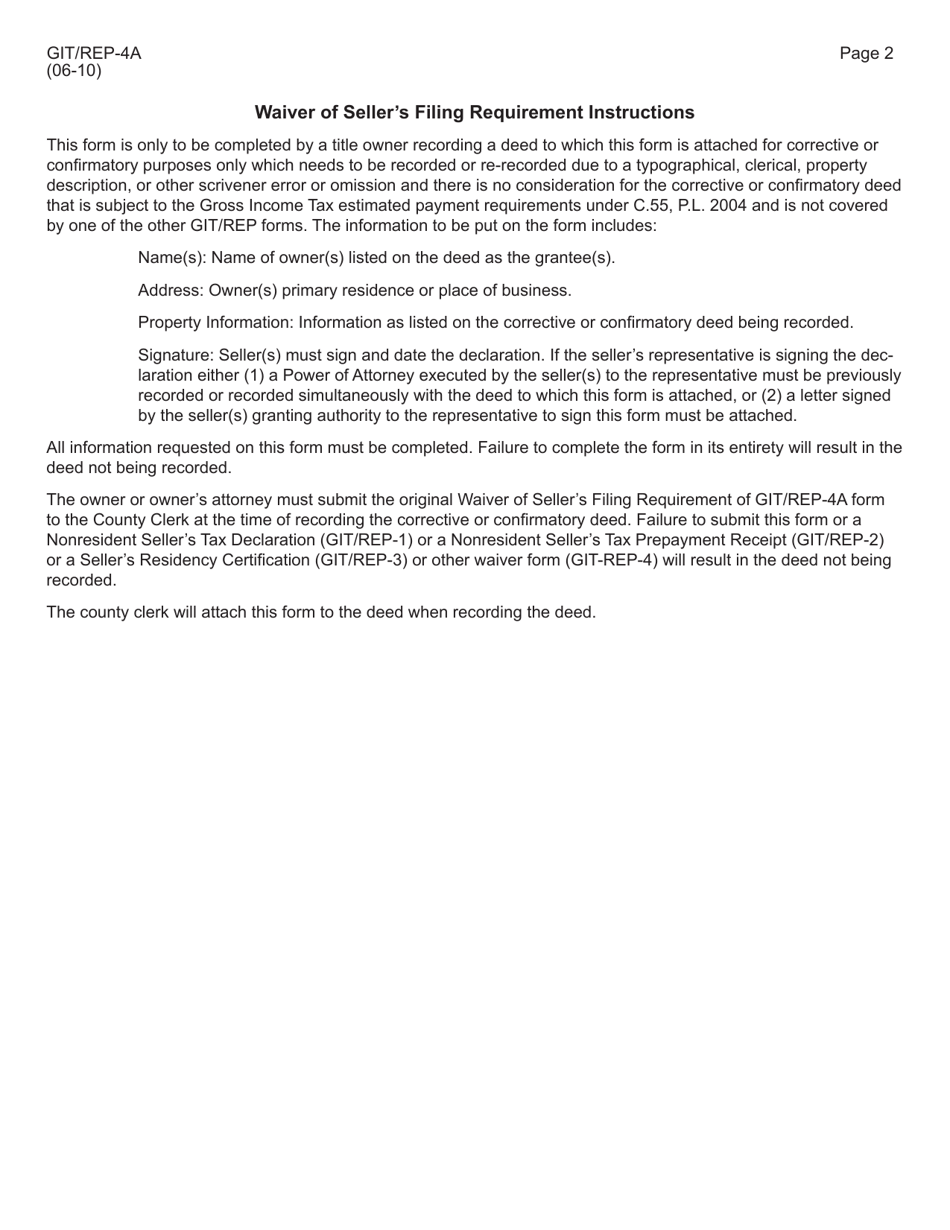

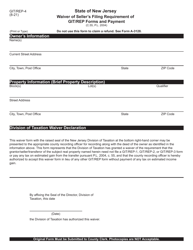

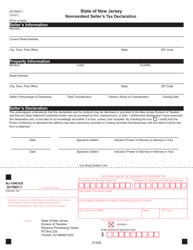

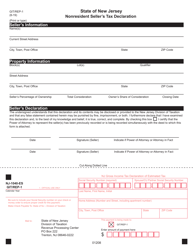

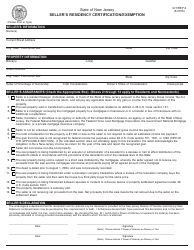

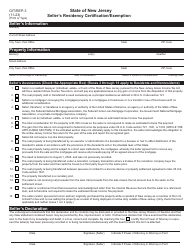

Form GIT / REP-4A Waiver of Seller's Filing Requirement of Git / Rep Forms and Payment for Corrected Deed With No Consideration - New Jersey

What Is Form GIT/REP-4A?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the GIT/REP-4A?

A: The GIT/REP-4A is a form used in New Jersey for waiving the seller's filing requirement of Git/Rep forms and payment for corrected deed with no consideration.

Q: What does the GIT/REP-4A waive?

A: The GIT/REP-4A waives the requirement for the seller to file Git/Rep forms and make payment for a corrected deed with no consideration.

Q: Who needs to complete the GIT/REP-4A?

A: The seller needs to complete the GIT/REP-4A form.

Q: What is the purpose of the GIT/REP-4A?

A: The purpose of the GIT/REP-4A is to waive the filing requirement and payment for corrected deed with no consideration.

Q: Is the GIT/REP-4A specific to New Jersey?

A: Yes, the GIT/REP-4A form is specific to New Jersey.

Form Details:

- Released on June 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT/REP-4A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.