This version of the form is not currently in use and is provided for reference only. Download this version of

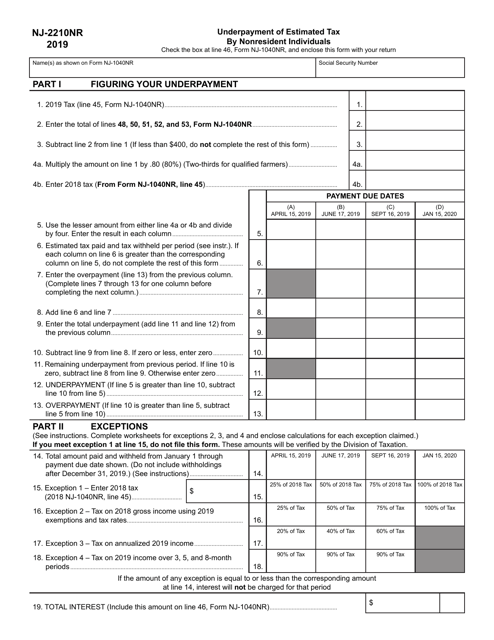

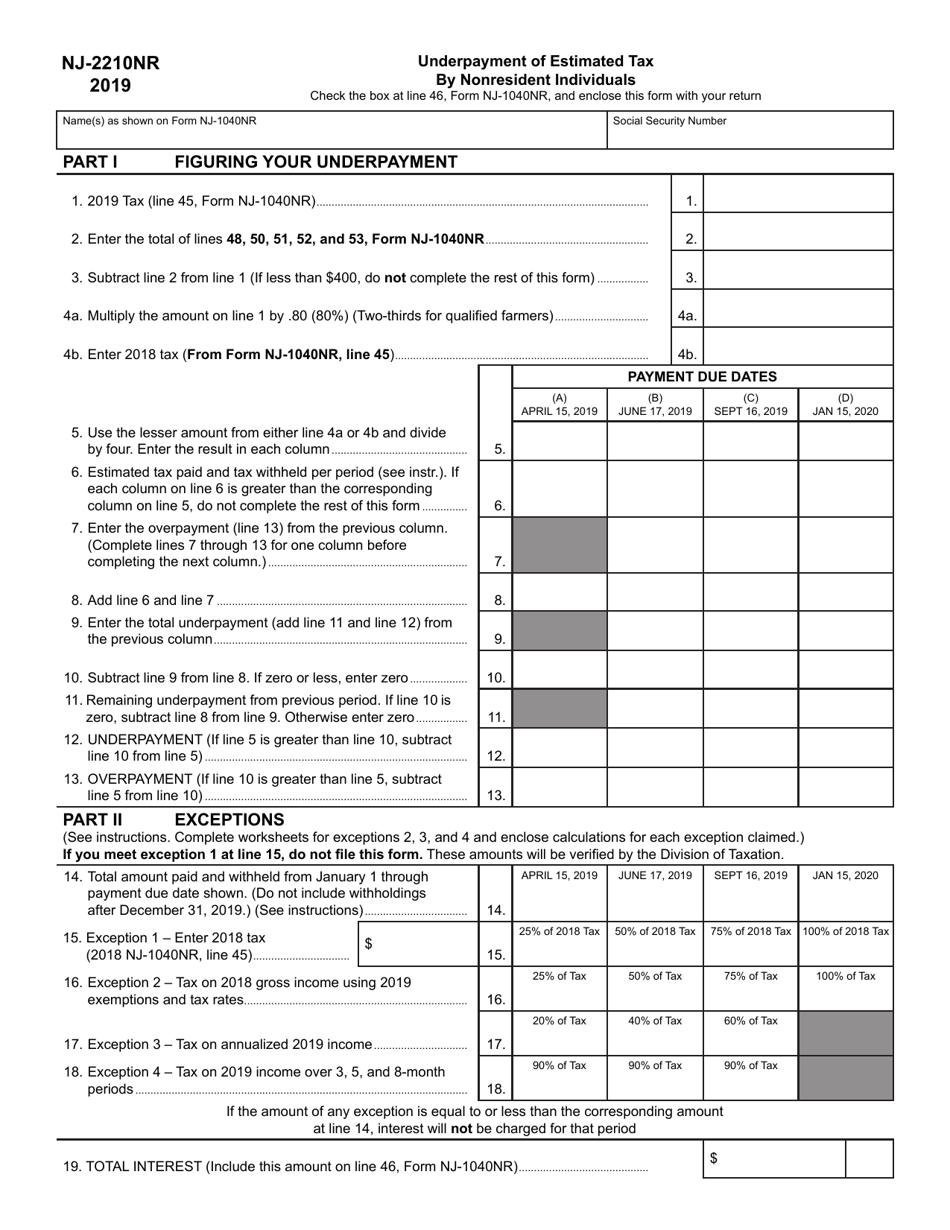

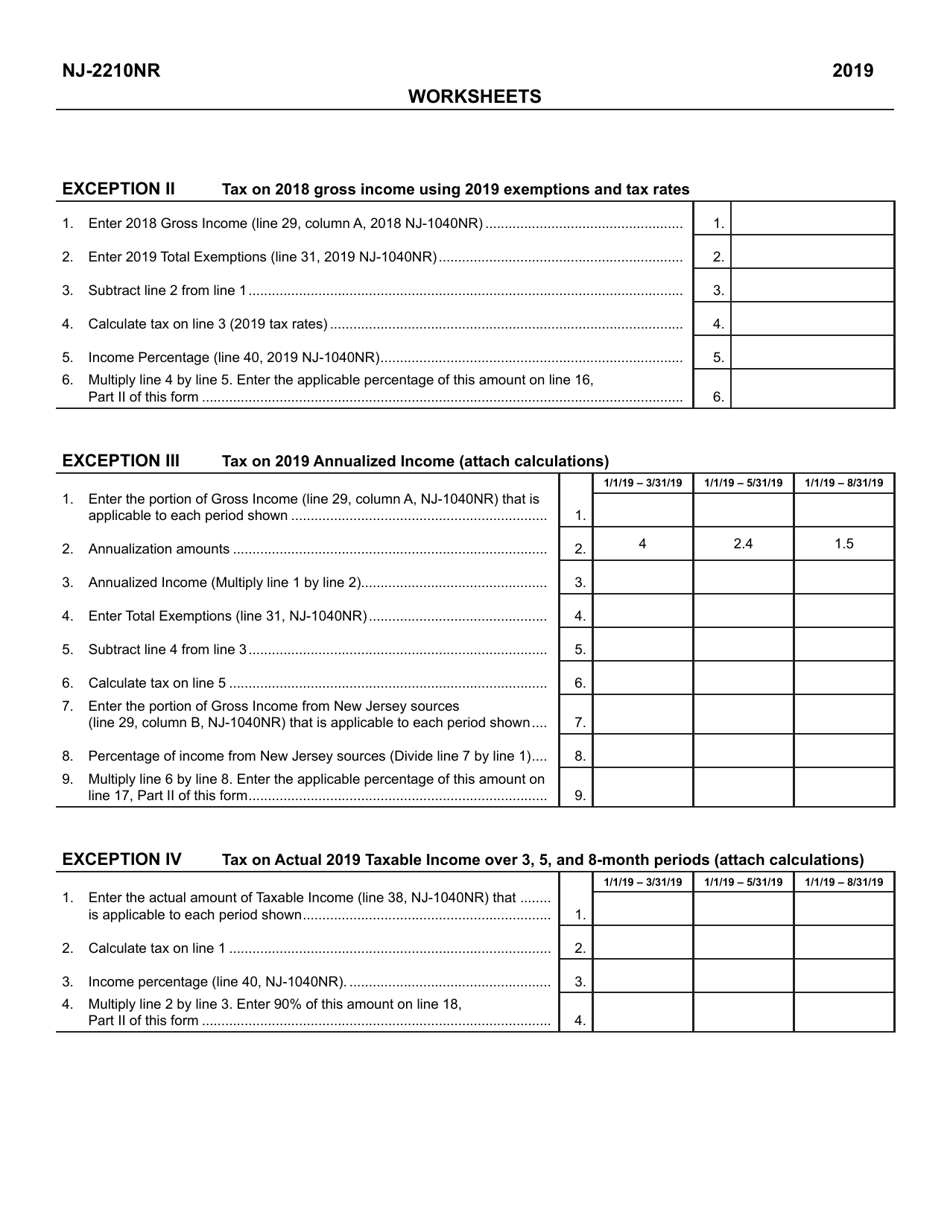

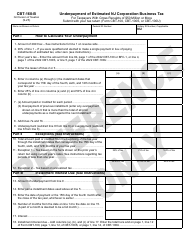

Form NJ-2210NR

for the current year.

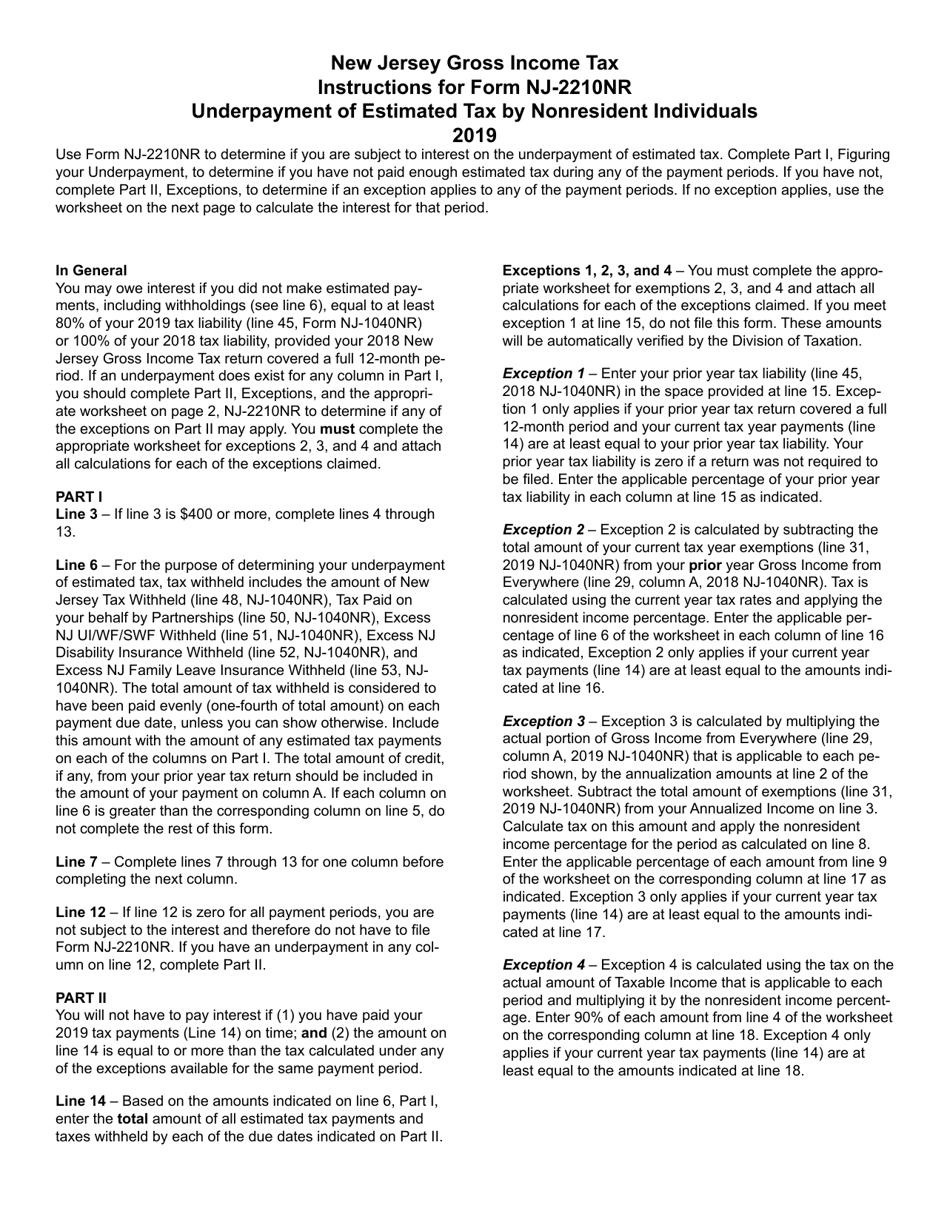

Form NJ-2210NR Underpayment of Estimated Tax by Nonresident Individuals - New Jersey

What Is Form NJ-2210NR?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-2210NR?

A: Form NJ-2210NR is a tax form for nonresident individuals in New Jersey to calculate any underpayment of estimated tax.

Q: Why would I need to file Form NJ-2210NR?

A: You would need to file Form NJ-2210NR if you are a nonresident individual in New Jersey and you have underpaid your estimated tax.

Q: How do I use Form NJ-2210NR?

A: Form NJ-2210NR is used to calculate the amount of underpayment of estimated tax and any penalty that may be owed.

Q: Is Form NJ-2210NR only for nonresident individuals?

A: Yes, Form NJ-2210NR is specifically for nonresident individuals in New Jersey.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-2210NR by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.