This version of the form is not currently in use and is provided for reference only. Download this version of

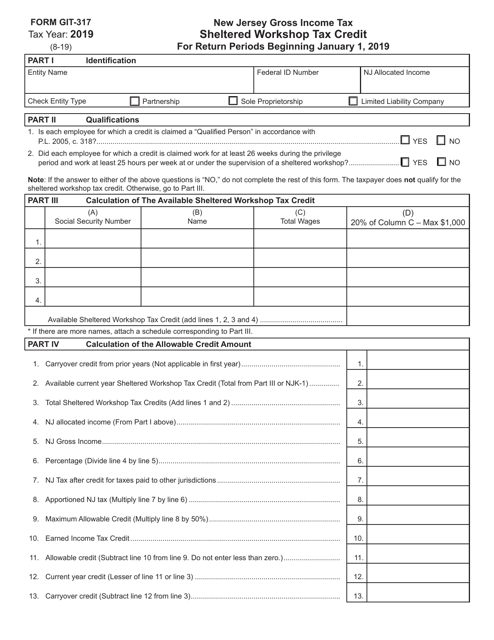

Form GIT-317

for the current year.

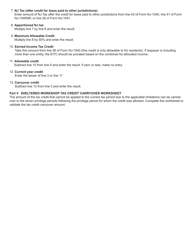

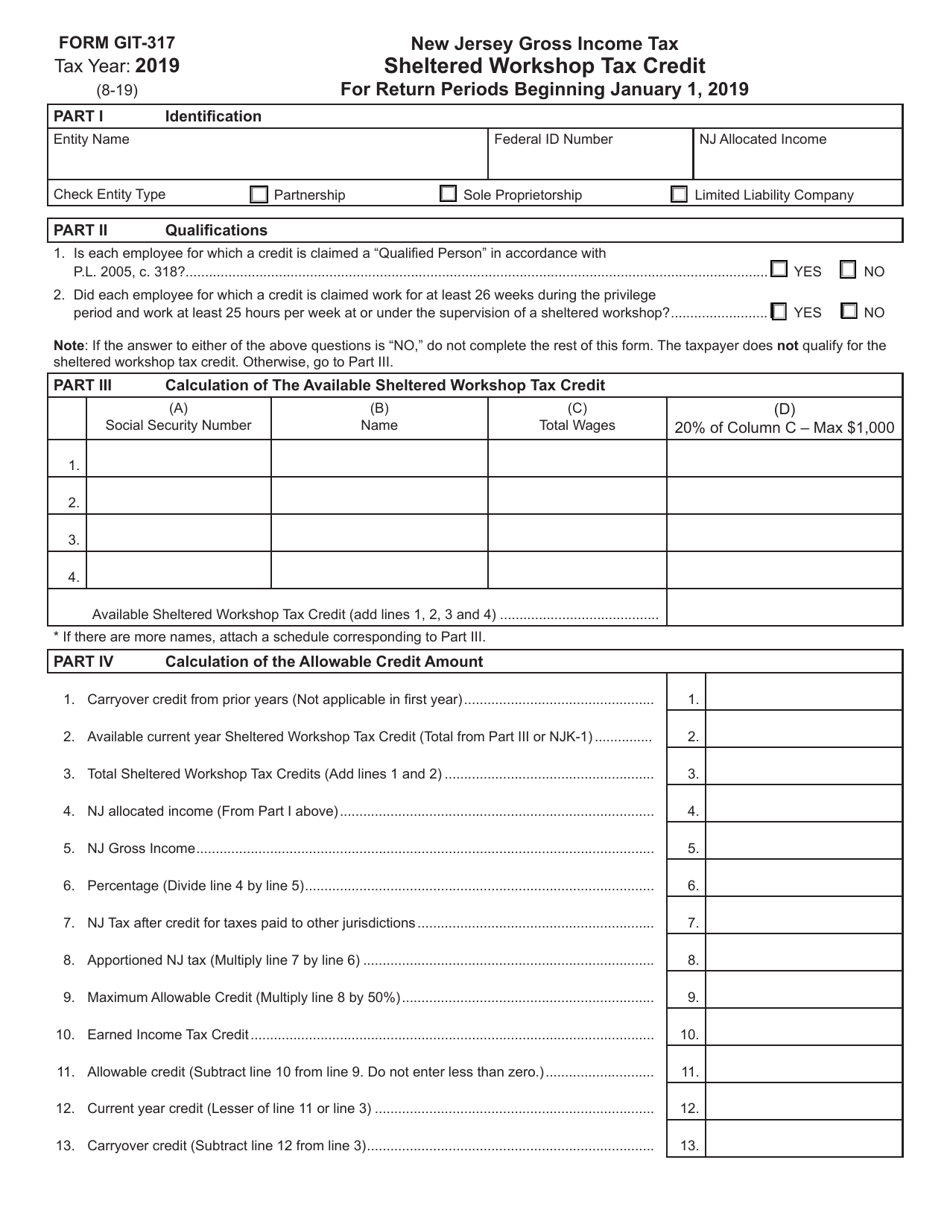

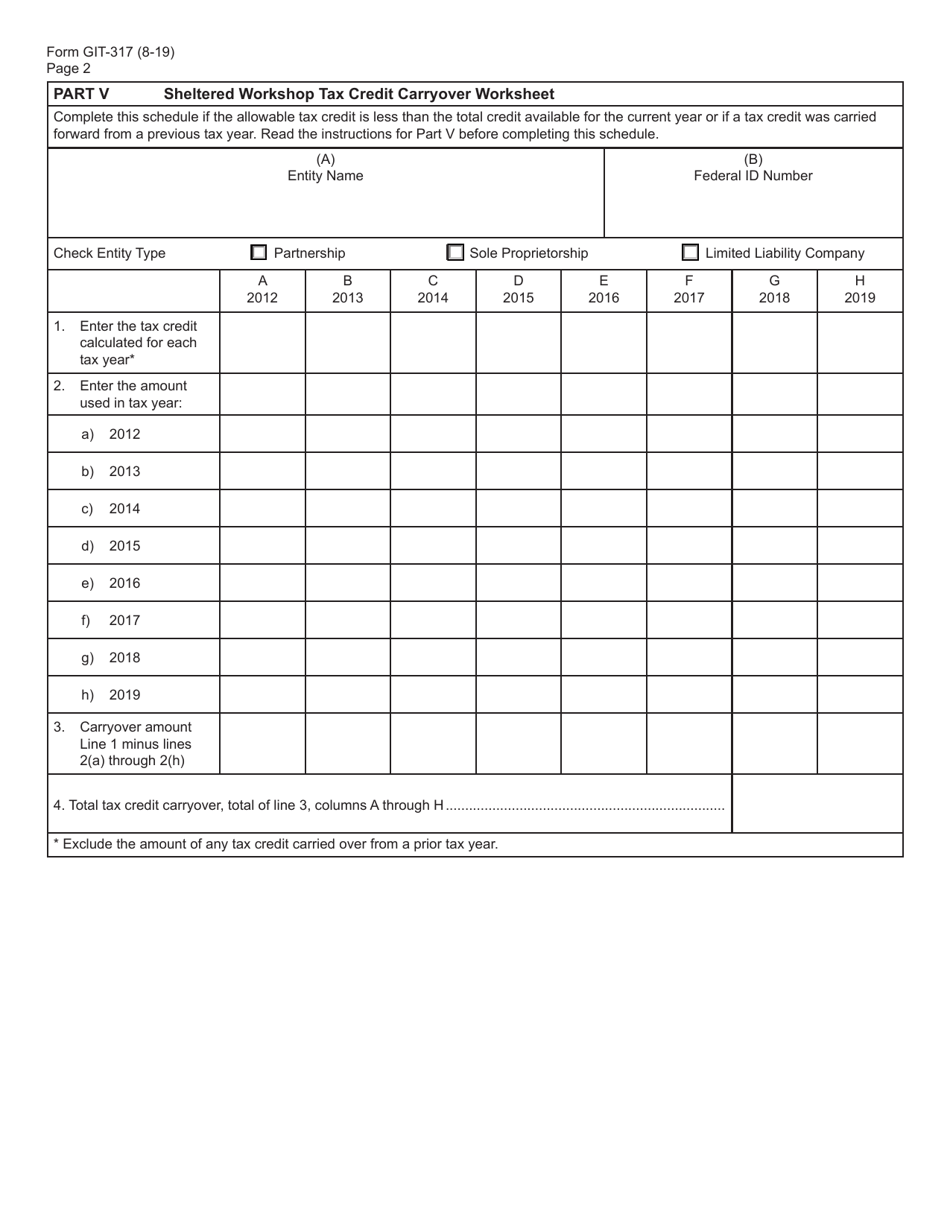

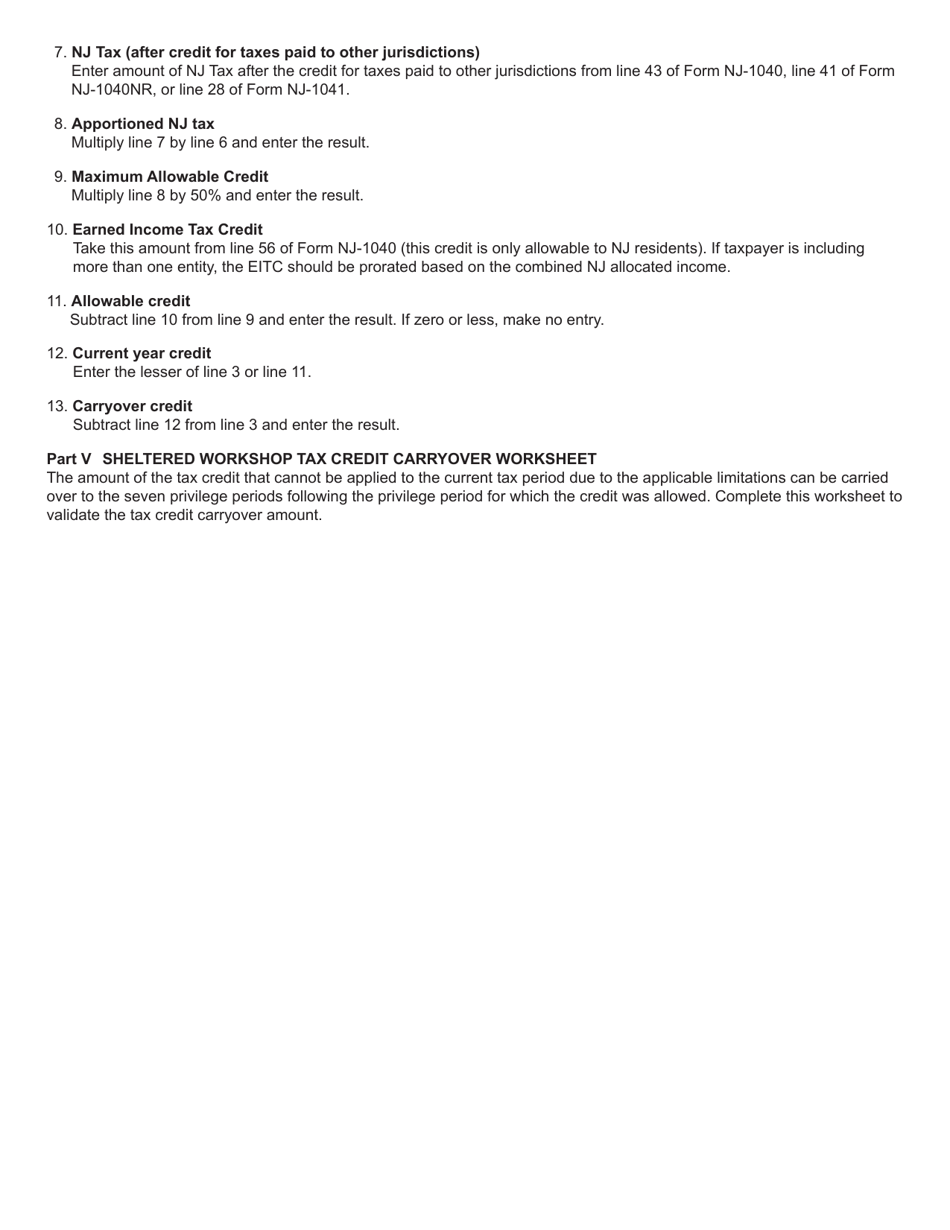

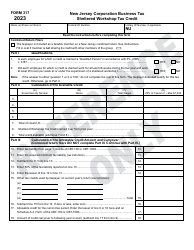

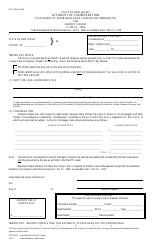

Form GIT-317 Sheltered Workshop Tax Credit - New Jersey

What Is Form GIT-317?

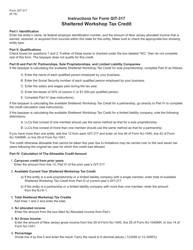

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form GIT-317?

A: Form GIT-317 is the application for the Sheltered Workshop Tax Credit in New Jersey.

Q: What is the Sheltered Workshop Tax Credit?

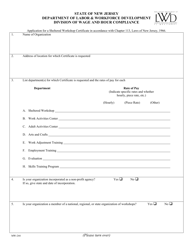

A: The Sheltered Workshop Tax Credit is a tax credit offered by the state of New Jersey to businesses that employ individuals with disabilities in a sheltered workshop.

Q: Who is eligible for the Sheltered Workshop Tax Credit?

A: Businesses in New Jersey that employ individuals with disabilities in a sheltered workshop are eligible for the tax credit.

Q: How do I apply for the Sheltered Workshop Tax Credit?

A: You can apply for the Sheltered Workshop Tax Credit by filling out Form GIT-317 and submitting it to the New Jersey Division of Taxation.

Q: What is the benefit of the Sheltered Workshop Tax Credit?

A: The tax credit allows eligible businesses to offset their state tax liability by a certain percentage of the wages paid to employees in a sheltered workshop.

Q: Are there any requirements or limitations for the Sheltered Workshop Tax Credit?

A: Yes, there are certain requirements and limitations for the tax credit. These include the number of individuals employed, the wages paid, and the certification of the sheltered workshop.

Q: Is the Sheltered Workshop Tax Credit available in other states?

A: No, the Sheltered Workshop Tax Credit is specific to businesses in New Jersey.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form GIT-317 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.