This version of the form is not currently in use and is provided for reference only. Download this version of

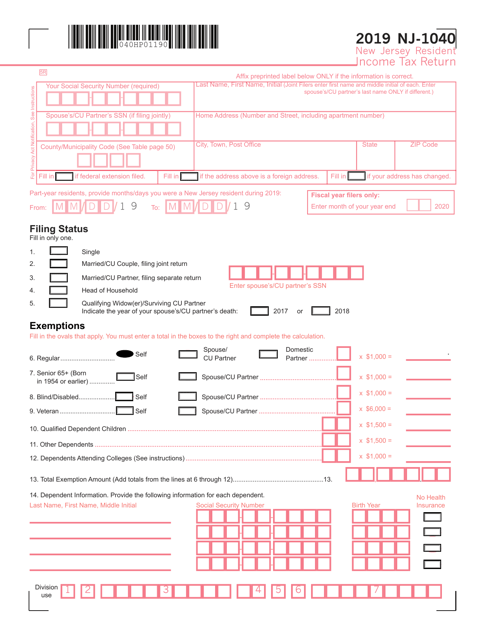

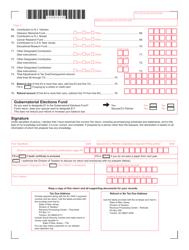

Form NJ-1040

for the current year.

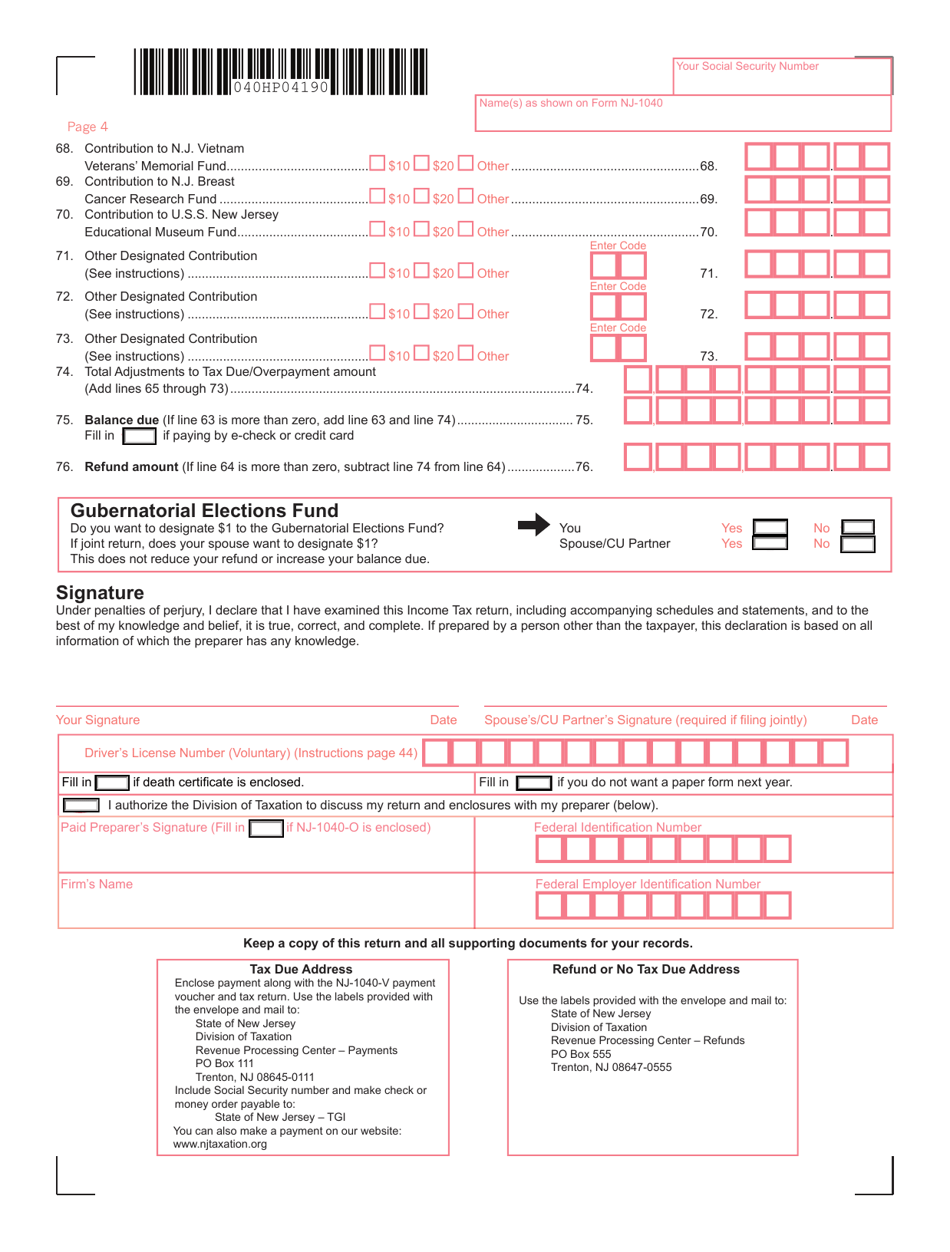

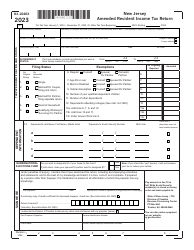

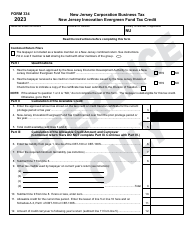

Form NJ-1040 New Jersey Resident Income Tax Return - New Jersey

What Is Form NJ-1040?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

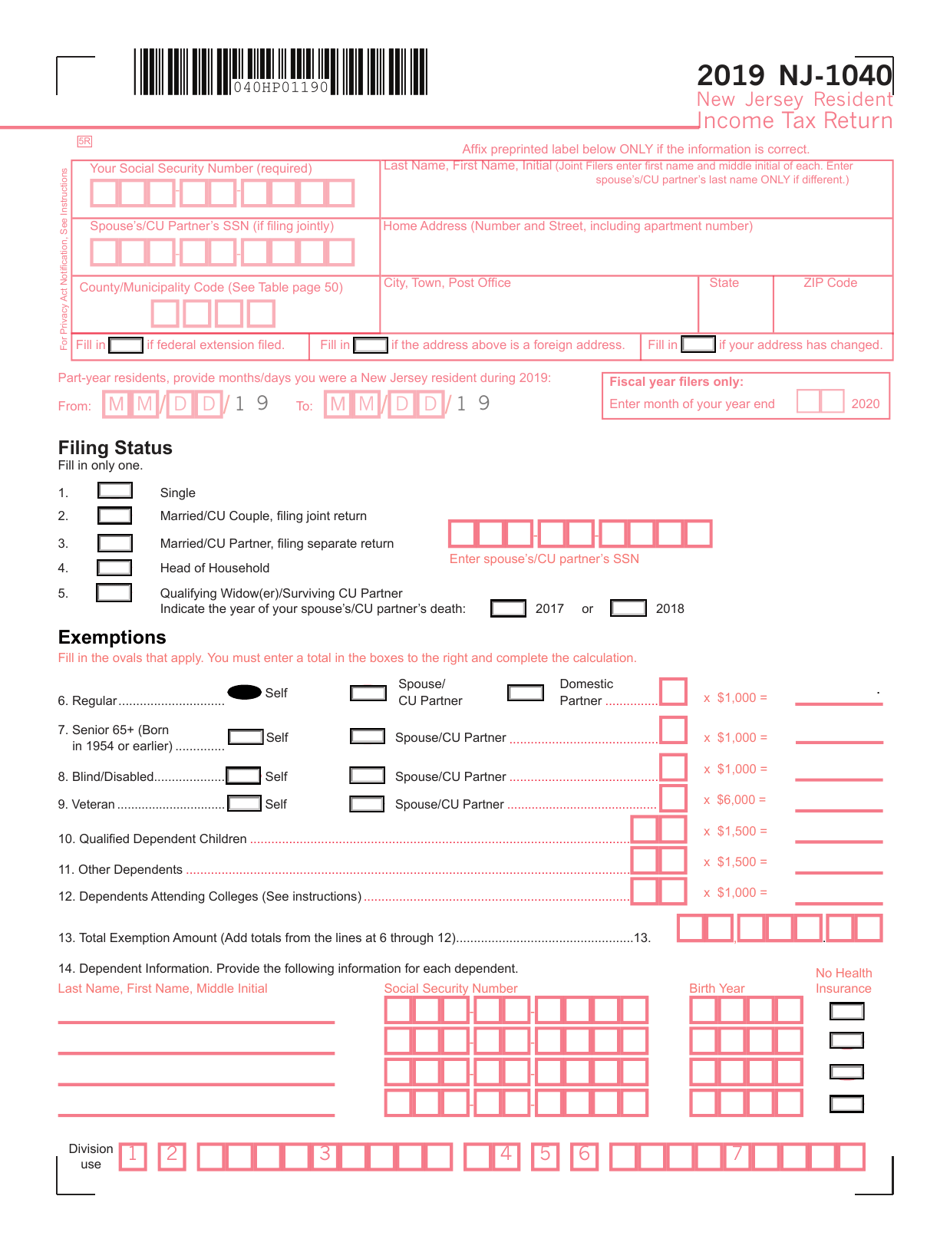

Q: What is Form NJ-1040?

A: Form NJ-1040 is the New Jersey Resident Income Tax Return.

Q: Who needs to file Form NJ-1040?

A: New Jersey residents who earned income, including wages, salaries, tips, and self-employment income, need to file Form NJ-1040.

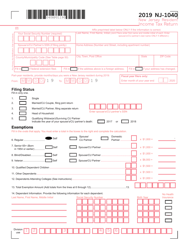

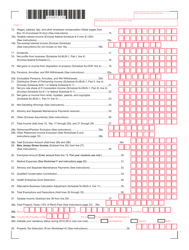

Q: What information is needed to complete Form NJ-1040?

A: To complete Form NJ-1040, you will need your social security number, income information, deductions, and credits.

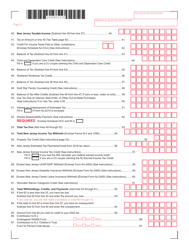

Q: When is the deadline to file Form NJ-1040?

A: The deadline to file Form NJ-1040 is generally April 15th, but it can vary depending on certain circumstances.

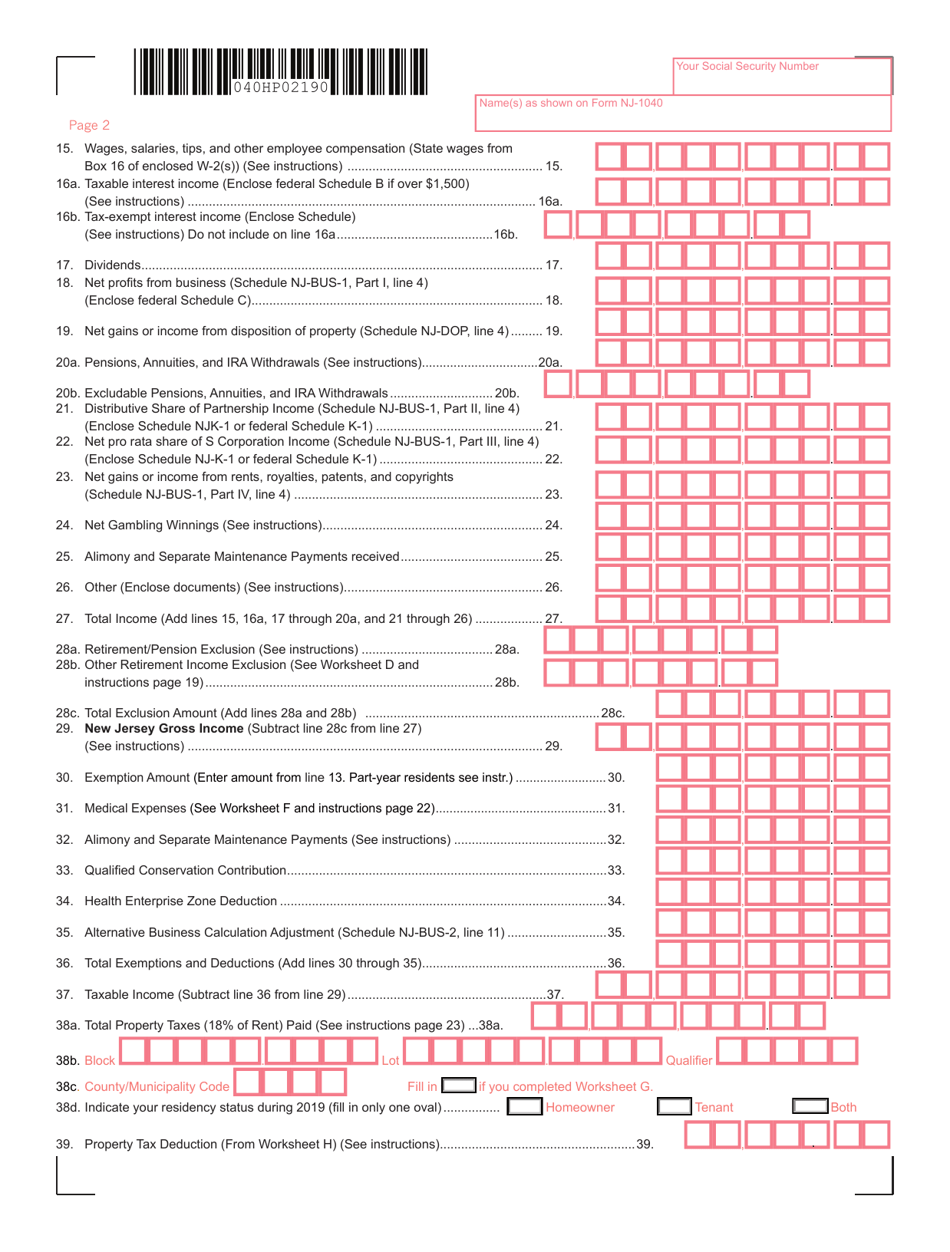

Q: Are there any additional schedules or forms that need to be filed with Form NJ-1040?

A: Yes, depending on your income and specific tax situation, you may need to file additional schedules or forms such as Schedule A, Schedule B, or Schedule NJ-BUS-1.

Q: Can I e-file Form NJ-1040?

A: Yes, you can e-file Form NJ-1040 using approved tax software or through a tax professional.

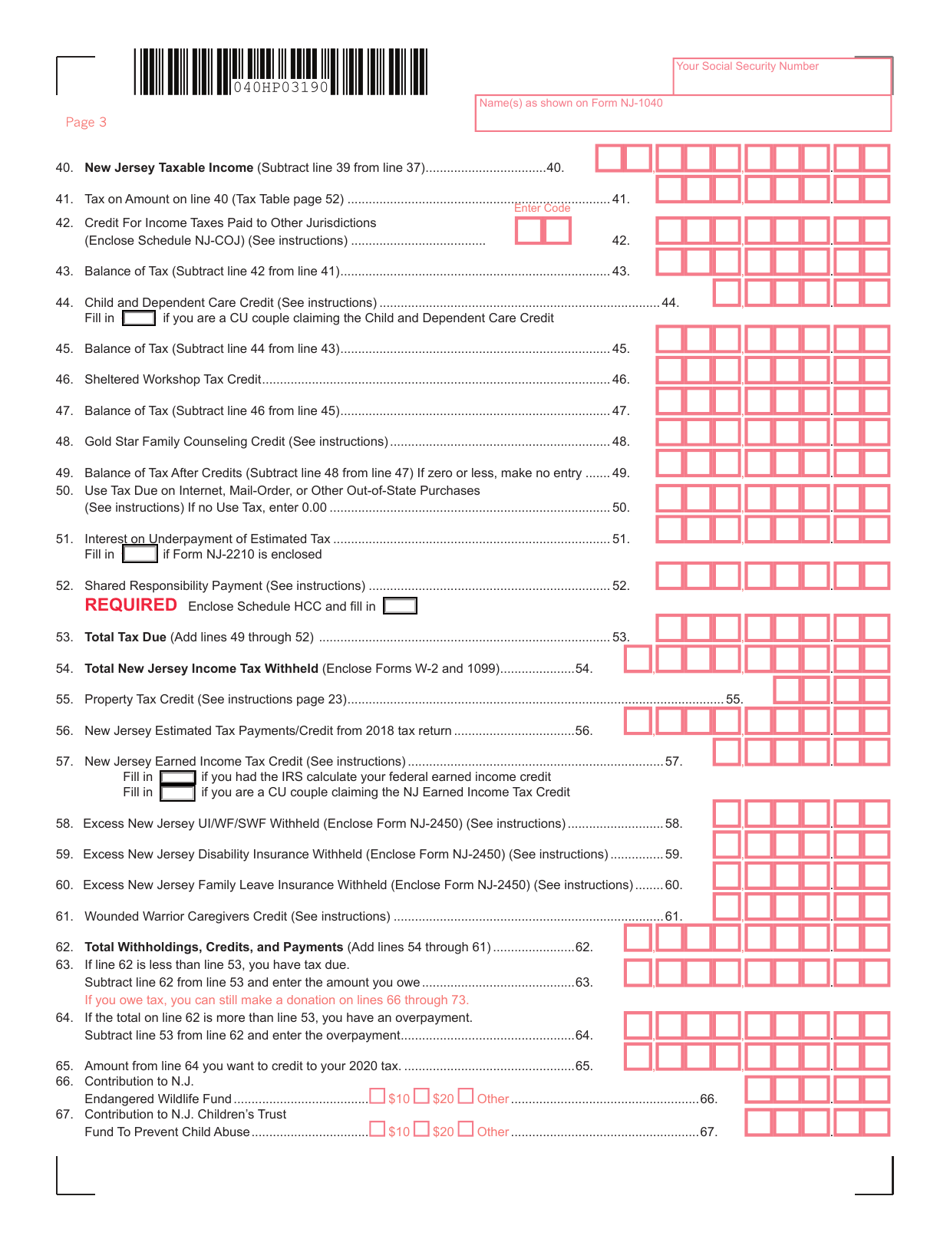

Q: What are the payment options for any taxes owed with Form NJ-1040?

A: You can pay any taxes owed with Form NJ-1040 using various methods such as electronic funds transfer, credit card, or by mailing a check or money order.

Q: Is there a penalty for filing Form NJ-1040 late?

A: Yes, there is a penalty for filing Form NJ-1040 late. It is generally 5% of the tax due per month, up to a maximum of 25%.

Q: Are there any tax credits or deductions available on Form NJ-1040?

A: Yes, there are various tax credits and deductions available on Form NJ-1040, such as the Earned Income Tax Credit (EITC) and the Property Tax Deduction.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.