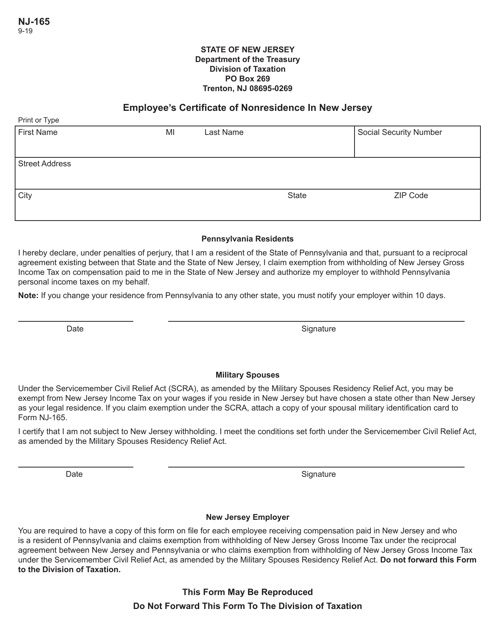

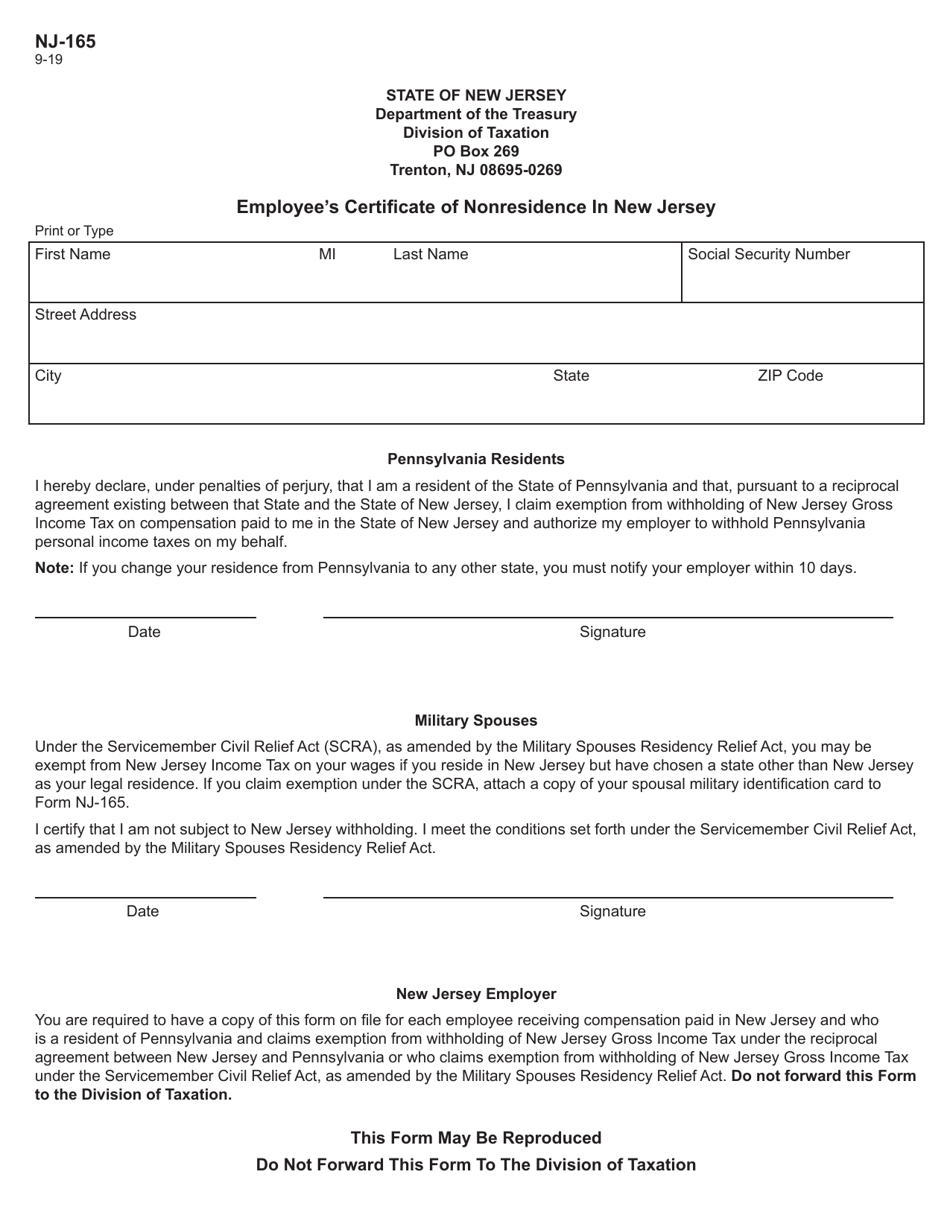

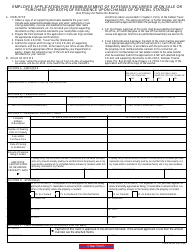

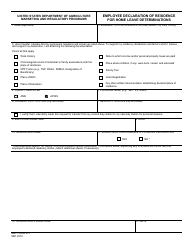

Form NJ-165 Employee's Certificate of Non-residence in New Jersey - New Jersey

What Is Form NJ-165?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

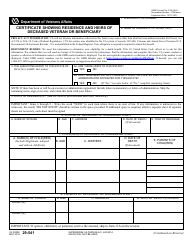

Q: What is Form NJ-165?

A: Form NJ-165 is Employee's Certificate of Non-residence in New Jersey.

Q: What is the purpose of Form NJ-165?

A: The purpose of Form NJ-165 is to certify that an employee is a non-resident of New Jersey for tax purposes.

Q: Who needs to fill out Form NJ-165?

A: Any employee who is a non-resident of New Jersey and is working in the state needs to fill out Form NJ-165.

Q: What information is required on Form NJ-165?

A: Form NJ-165 requires information such as the employee's name, social security number, employer's name and address, and a statement of non-residence.

Q: When should Form NJ-165 be submitted?

A: Form NJ-165 should be submitted to the employer within 15 days of starting employment in New Jersey.

Q: What happens if I don't submit Form NJ-165?

A: If you fail to submit Form NJ-165, your employer may withhold New Jersey income tax from your wages as if you were a resident of the state.

Q: Can I claim a refund for New Jersey income tax withheld if I am a non-resident?

A: Yes, if you are a non-resident and had New Jersey income tax withheld, you may be eligible for a refund by filing a nonresident income tax return with the state.

Q: Do I need to fill out Form NJ-165 every year?

A: No, Form NJ-165 only needs to be filled out once, unless your residency status or employment changes in the future.

Q: Are there any penalties for providing false information on Form NJ-165?

A: Yes, providing false information on Form NJ-165 may result in penalties imposed by the New Jersey Division of Taxation.

Form Details:

- Released on September 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-165 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.