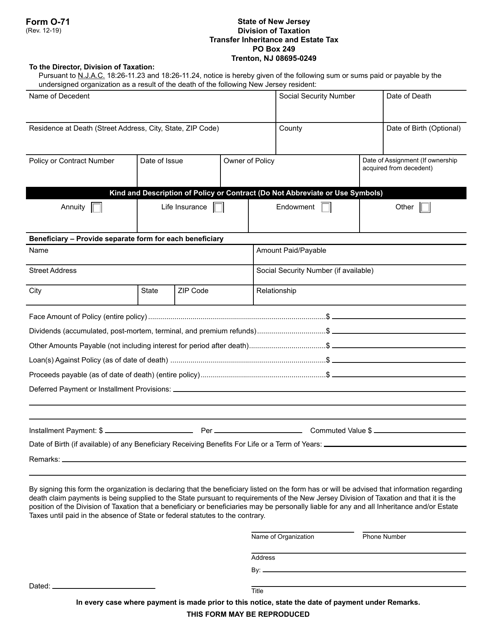

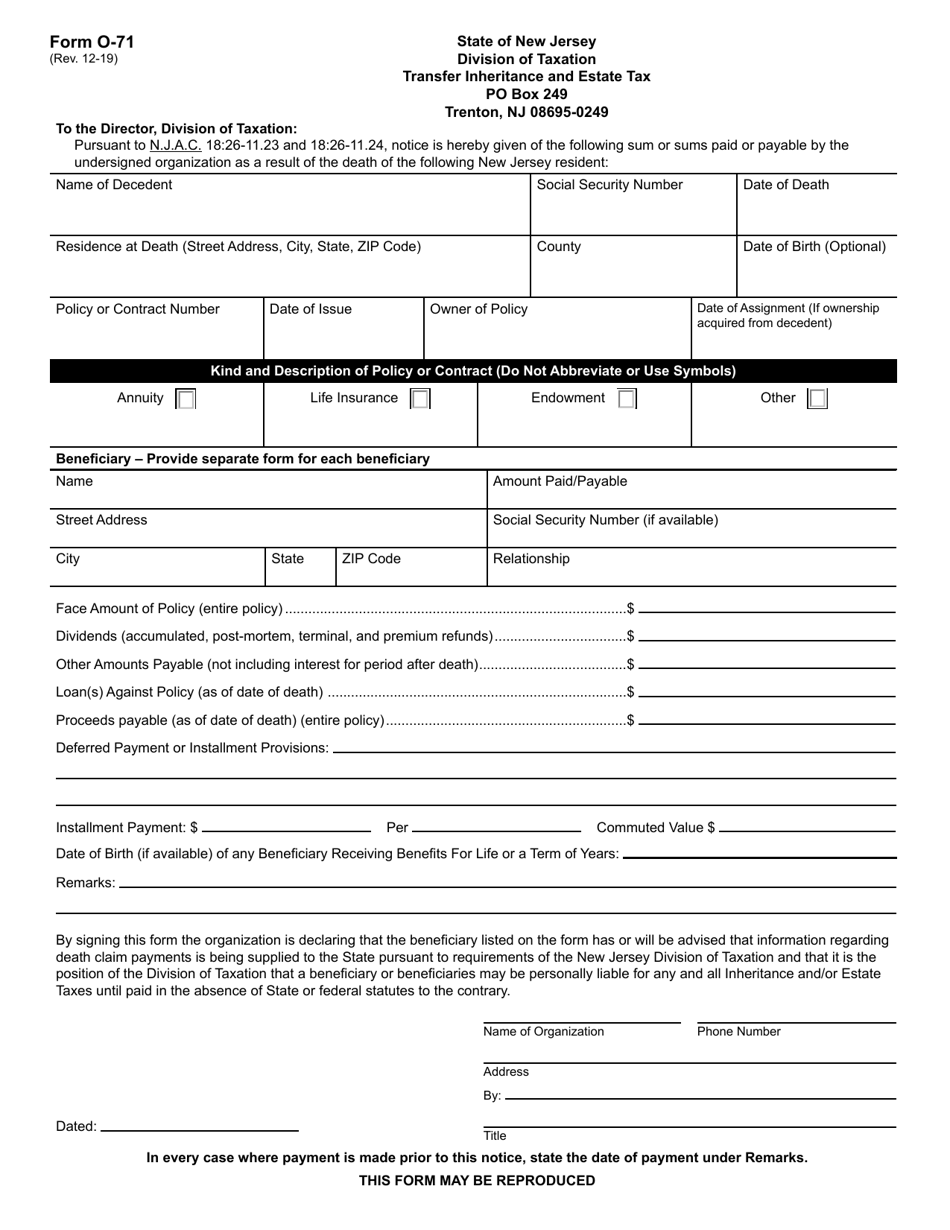

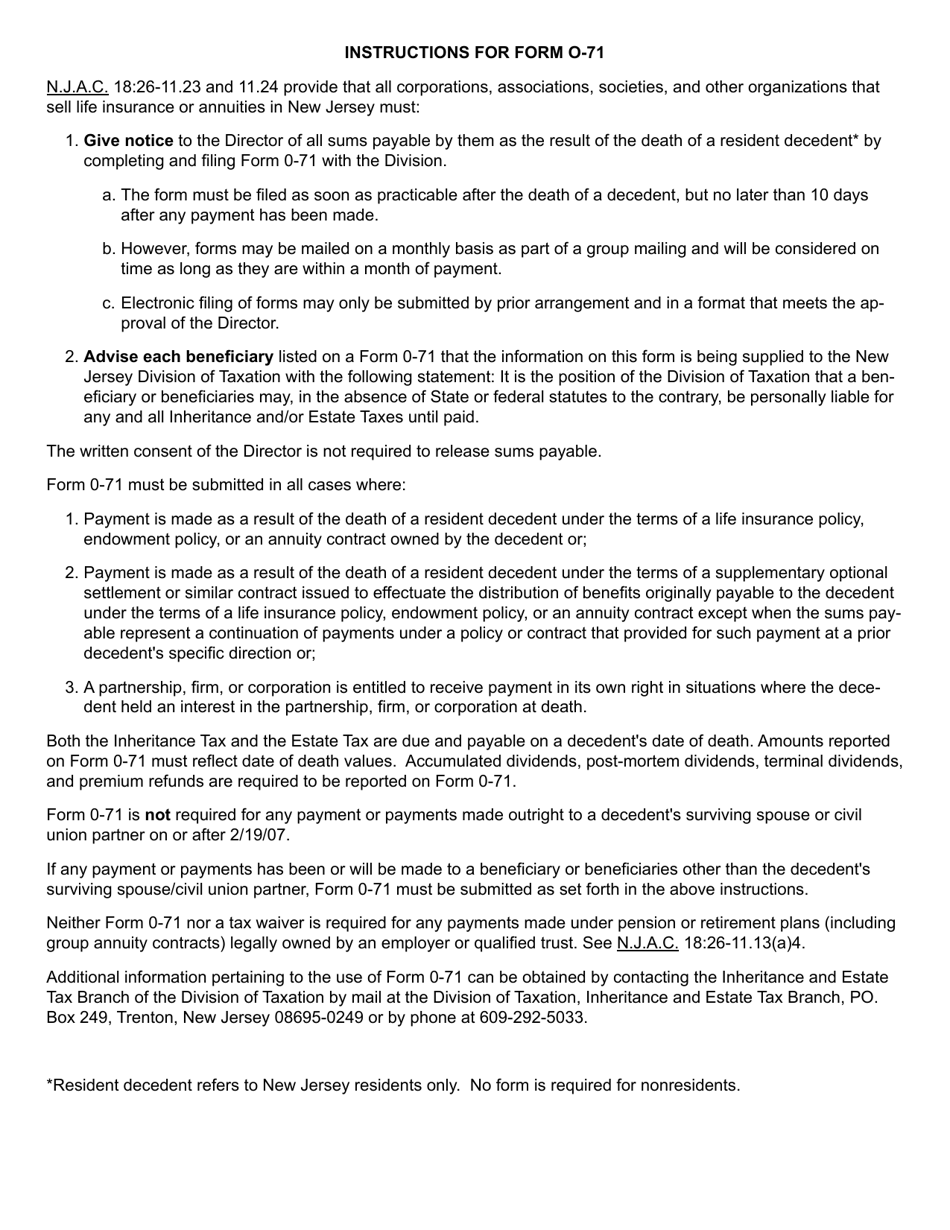

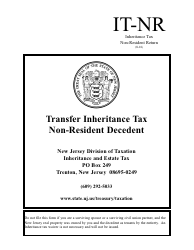

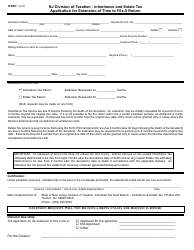

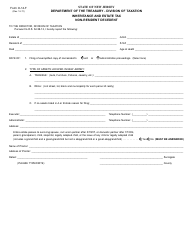

Form O-71 Transfer Inheritance and Estate Tax - New Jersey

What Is Form O-71?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form O-71?

A: Form O-71 is the form used for reporting and paying the Transfer Inheritance and Estate Tax in New Jersey.

Q: What is the Transfer Inheritance and Estate Tax?

A: The Transfer Inheritance and Estate Tax is a tax imposed on the transfer of wealth from a deceased person to their heirs or beneficiaries.

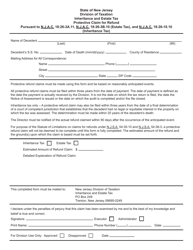

Q: Who is responsible for filing Form O-71?

A: The executor or administrator of the deceased person's estate is responsible for filing Form O-71.

Q: When should Form O-71 be filed?

A: Form O-71 should be filed within 8 months of the decedent's death.

Q: Are there any exemptions or deductions available?

A: Yes, there are certain exemptions and deductions available, such as the spouse exemption and the charitable deduction. These can help reduce the amount of tax due.

Q: What happens if Form O-71 is not filed or if taxes are not paid?

A: Failure to file Form O-71 or pay the taxes due can result in penalties and interest being assessed by the state.

Q: Is there a statute of limitations for the Transfer Inheritance and Estate Tax?

A: Yes, there is a 4-year statute of limitations for assessments of the Transfer Inheritance and Estate Tax. This means that the state generally has 4 years from the date of filing to assess any additional taxes due.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form O-71 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.