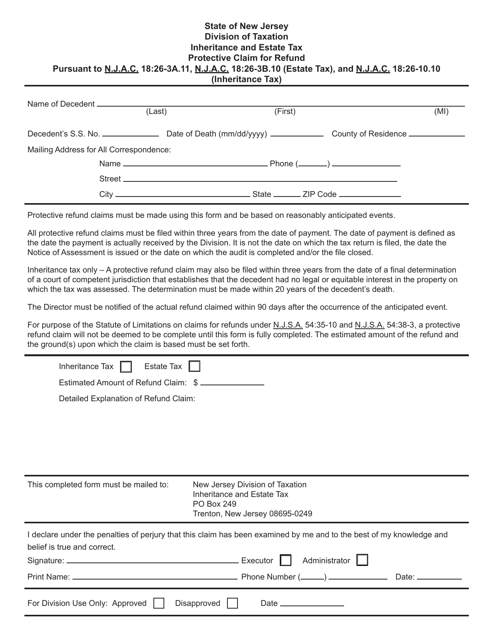

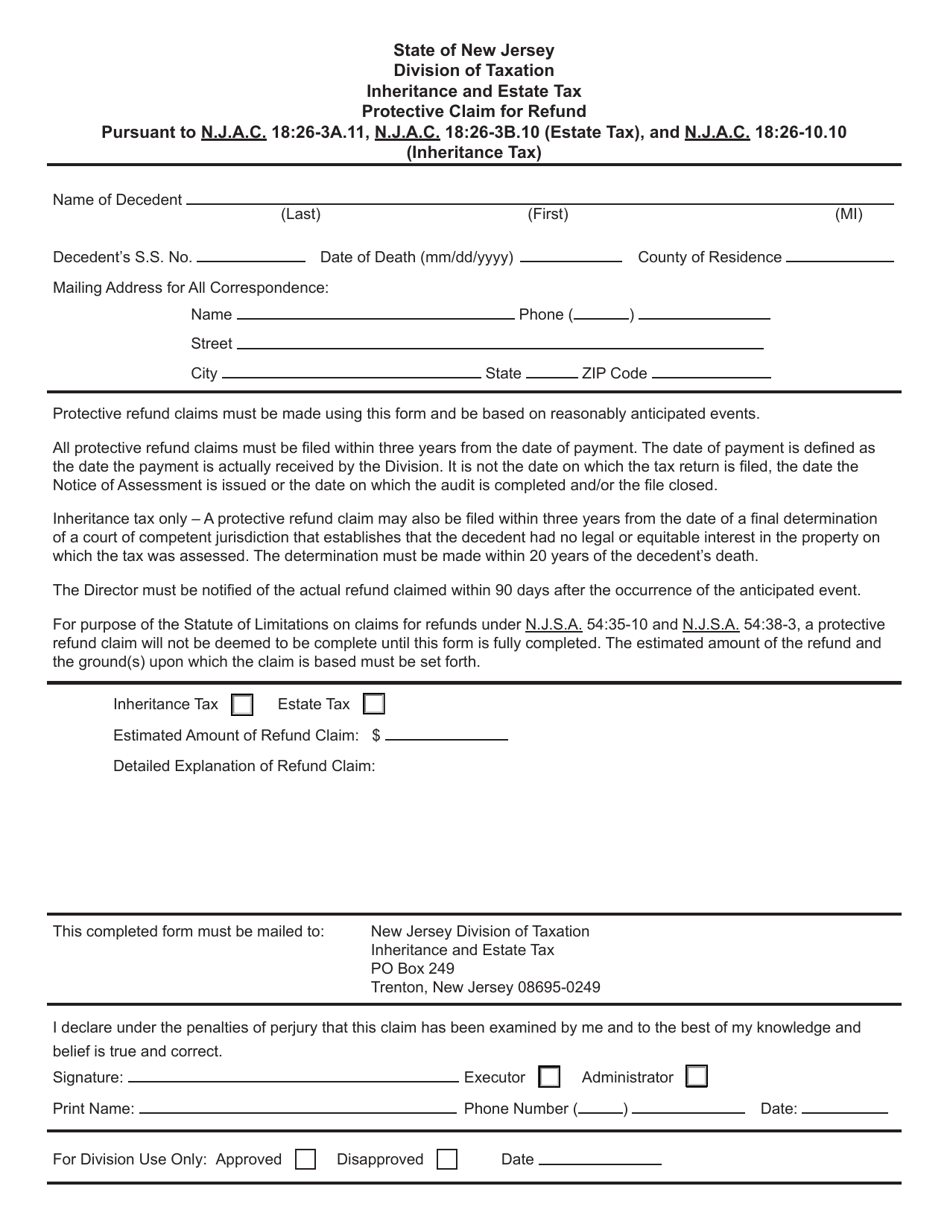

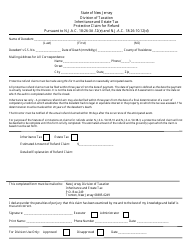

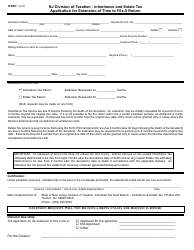

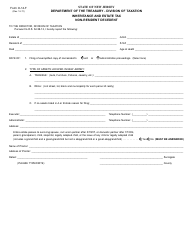

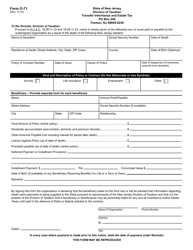

Form IT-PRC Inheritance and Estate Tax Protective Claim for Refund - New Jersey

What Is Form IT-PRC?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form IT-PRC?

A: Form IT-PRC is the Inheritance and Estate Tax Protective Claim for Refund for the state of New Jersey.

Q: What is the purpose of Form IT-PRC?

A: The purpose of Form IT-PRC is to file a protective claim for refund of Inheritance and Estate Tax in New Jersey.

Q: Who needs to file Form IT-PRC?

A: Anyone who believes they may be entitled to a refund of Inheritance and Estate Tax in New Jersey should file Form IT-PRC.

Q: Are there any specific requirements for filing Form IT-PRC?

A: Yes, there are specific requirements for filing Form IT-PRC, including filing within 9 months from the date of the decedent's death or within 9 months from the date of the closing letter.

Q: Can I file Form IT-PRC electronically?

A: No, Form IT-PRC cannot be filed electronically and must be submitted by mail.

Q: What documents do I need to attach to Form IT-PRC?

A: You need to attach a copy of the decedent's death certificate, supporting documentation for the claimed refund, and any relevant tax returns.

Q: What is the deadline for filing Form IT-PRC?

A: Form IT-PRC must be filed within 9 months from the date of the decedent's death or within 9 months from the date of the closing letter.

Q: What happens after I file Form IT-PRC?

A: After filing Form IT-PRC, the New Jersey Division of Taxation will review your claim and notify you of the decision regarding your refund.

Q: Can I appeal if my claim for refund is denied?

A: Yes, if your claim for refund is denied, you have the right to appeal the decision to the New Jersey Tax Court.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-PRC by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.