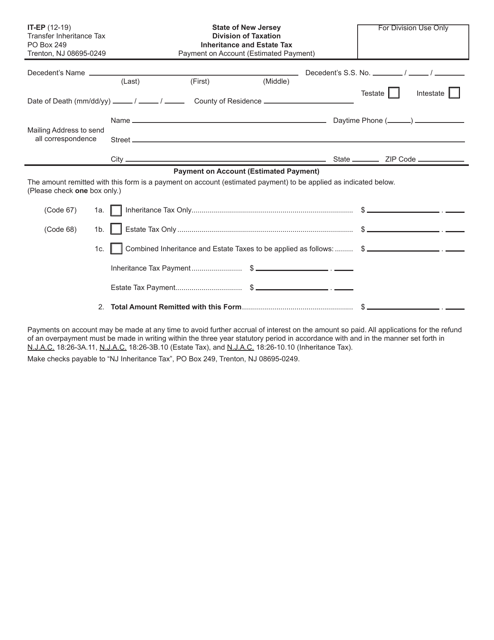

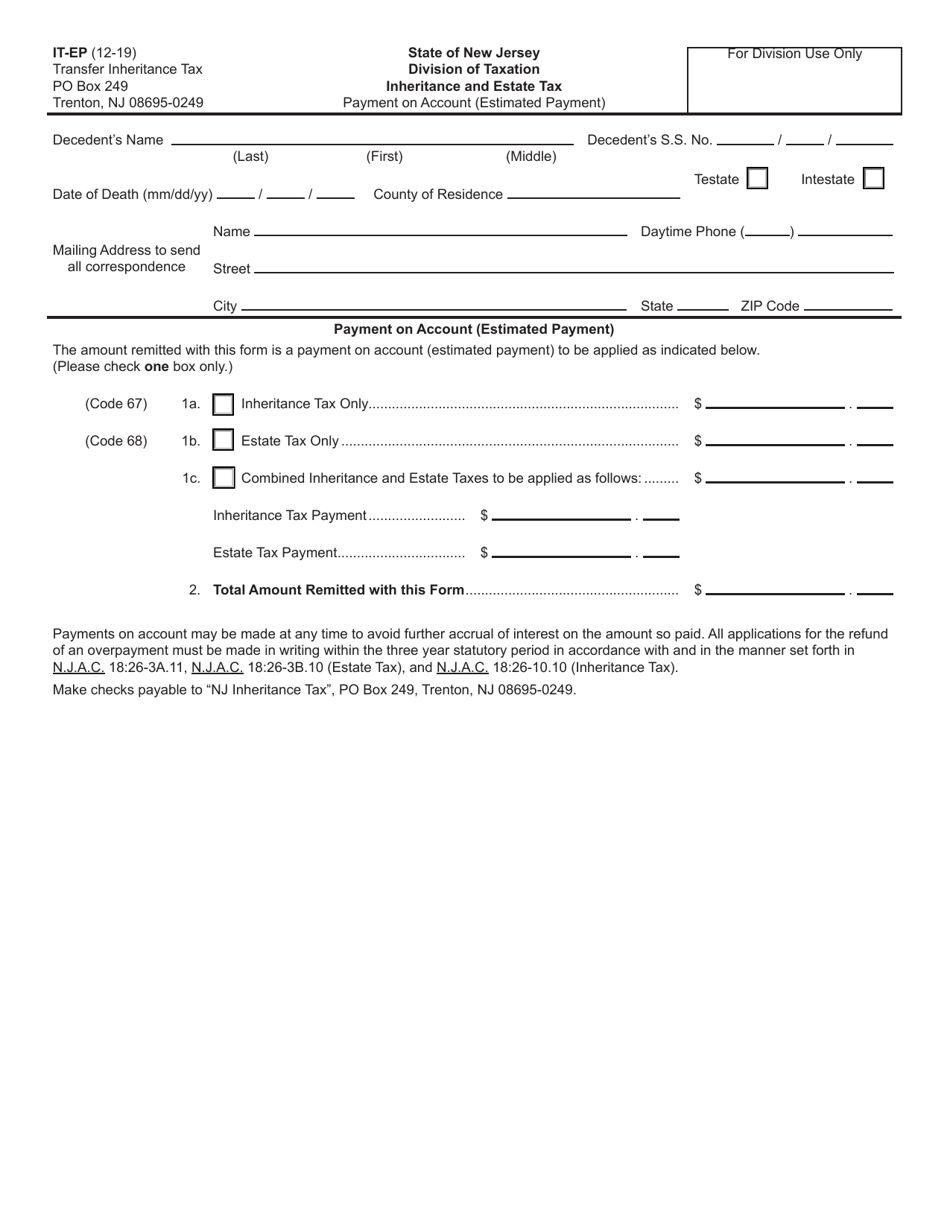

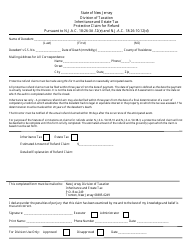

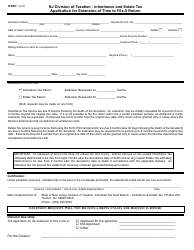

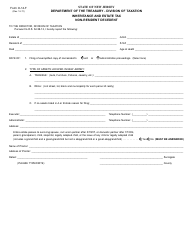

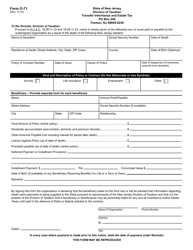

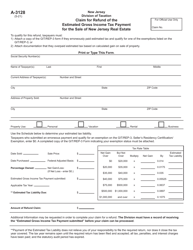

Form IT-EP Inheritance and Estate Tax Payment on Account (Estimated Payment) - New Jersey

What Is Form IT-EP?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

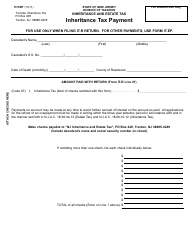

Q: What is Form IT-EP?

A: Form IT-EP is used to make estimated payments for inheritance and estate taxes in New Jersey.

Q: What is the purpose of Form IT-EP?

A: The purpose of Form IT-EP is to make a payment towards inheritance and estate taxes owed to the state of New Jersey.

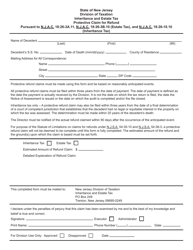

Q: Who needs to file Form IT-EP?

A: Form IT-EP needs to be filed by individuals or entities who owe inheritance or estate taxes in New Jersey.

Q: When is Form IT-EP due?

A: Form IT-EP is typically due on the 10th day of the month following the end of the calendar quarter.

Q: Can I make estimated payments for inheritance and estate taxes in New Jersey?

A: Yes, estimated payments can be made using Form IT-EP to avoid penalties and interest.

Q: What happens if I don't file Form IT-EP?

A: If you don't file Form IT-EP, you may be subject to penalties and interest on any unpaid inheritance or estate taxes.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT-EP by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.