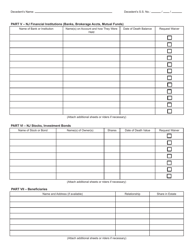

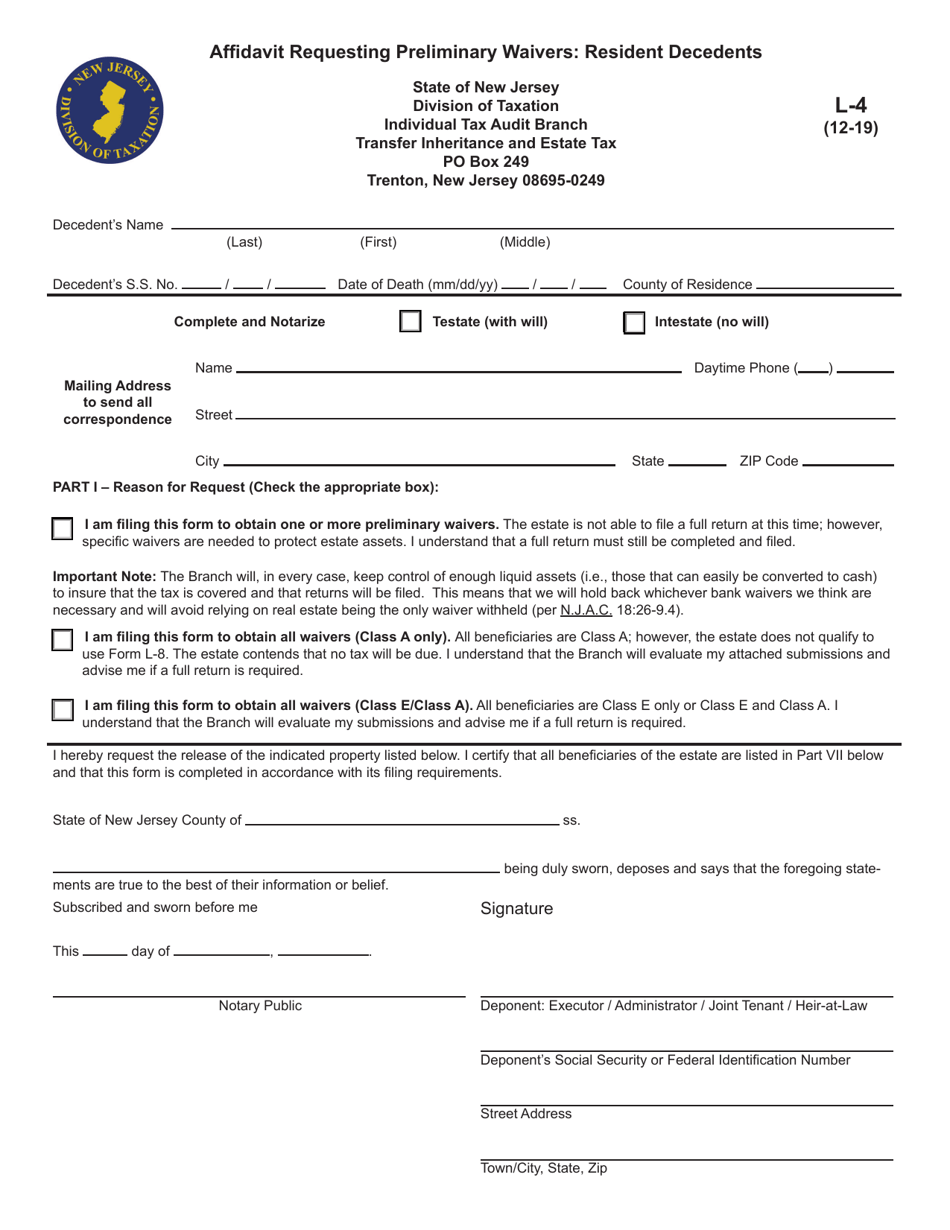

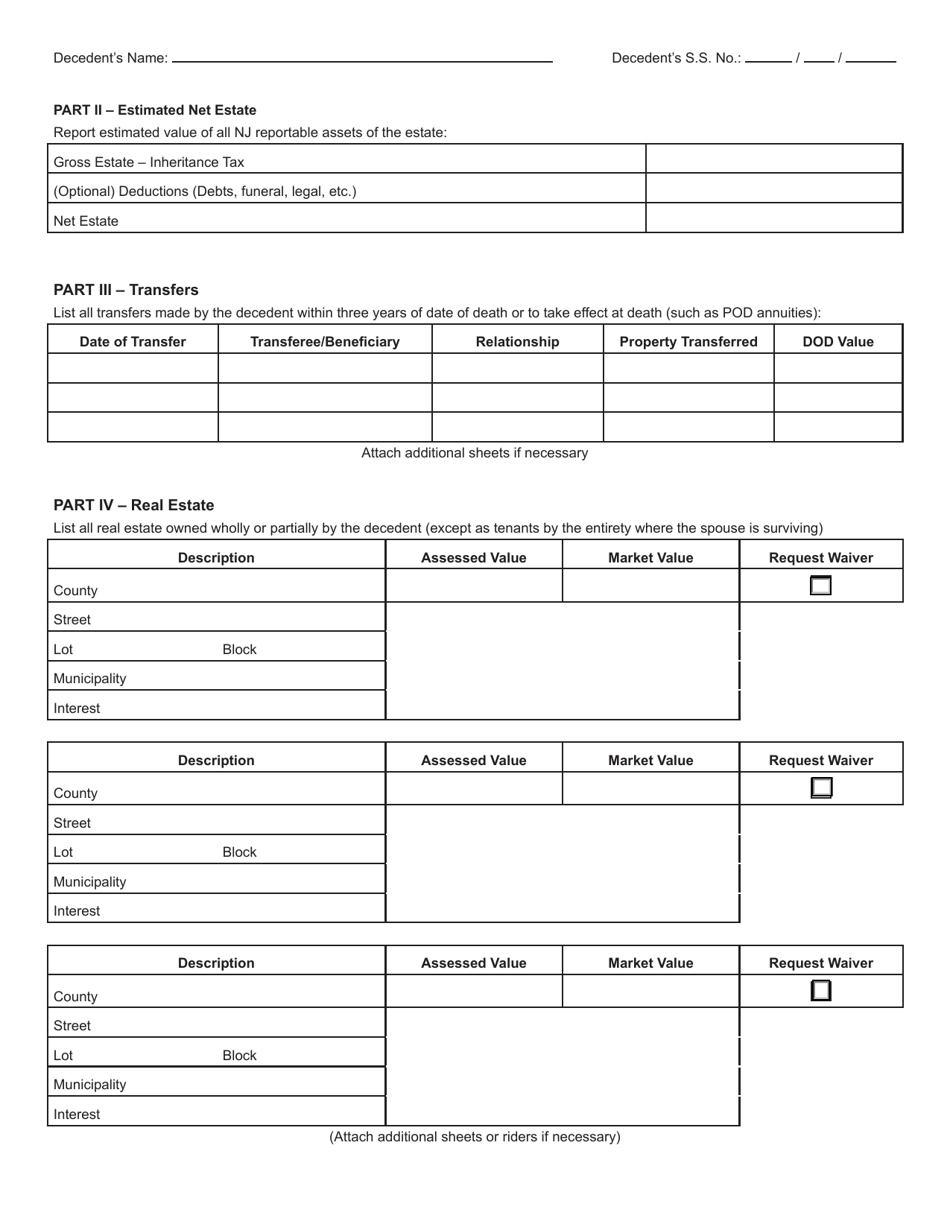

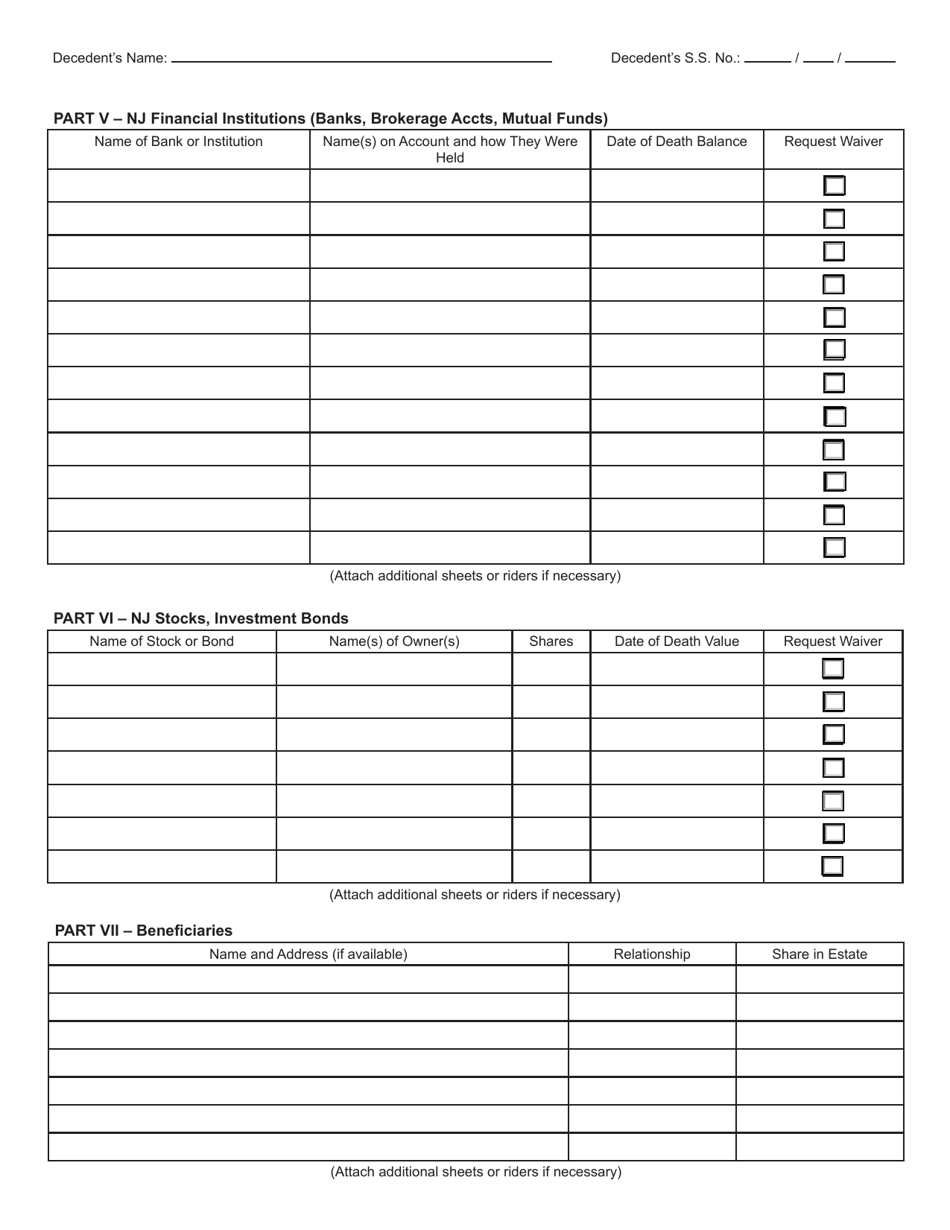

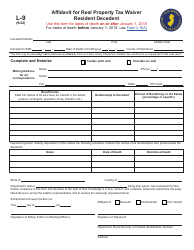

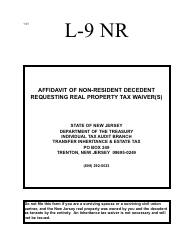

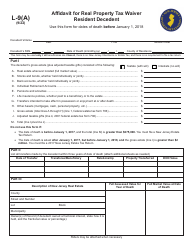

Form L-4 Affidavit Requesting Preliminary Waivers: Resident Decedents - New Jersey

What Is Form L-4?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form L-4?

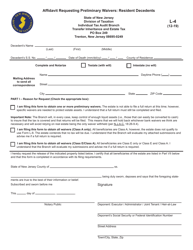

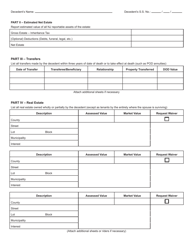

A: Form L-4 is an affidavit used to request preliminary waivers for resident decedents in New Jersey.

Q: Who can use Form L-4?

A: Form L-4 can be used by individuals who are seeking preliminary waivers for resident decedents in New Jersey.

Q: What is a resident decedent?

A: A resident decedent refers to a person who was a resident of New Jersey at the time of their death.

Q: What is a preliminary waiver?

A: A preliminary waiver is a request that allows the executor or administrator of an estate to distribute assets before the final determination of any New Jersey estate tax due.

Q: Why would someone need a preliminary waiver?

A: Someone would need a preliminary waiver to access and distribute estate assets before the final determination of New Jersey estate tax.

Q: Are there any filing fees for Form L-4?

A: No, there are no filing fees for Form L-4.

Q: Is Form L-4 specific to New Jersey?

A: Yes, Form L-4 is specific to the state of New Jersey.

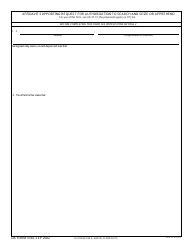

Q: What should I do after completing Form L-4?

A: After completing Form L-4, you should submit it to the New Jersey Division of Revenue and Enterprise Services.

Q: Is legal advice required to fill out Form L-4?

A: While legal advice is not required, it may be helpful to consult an attorney or tax professional when completing Form L-4.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form L-4 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.