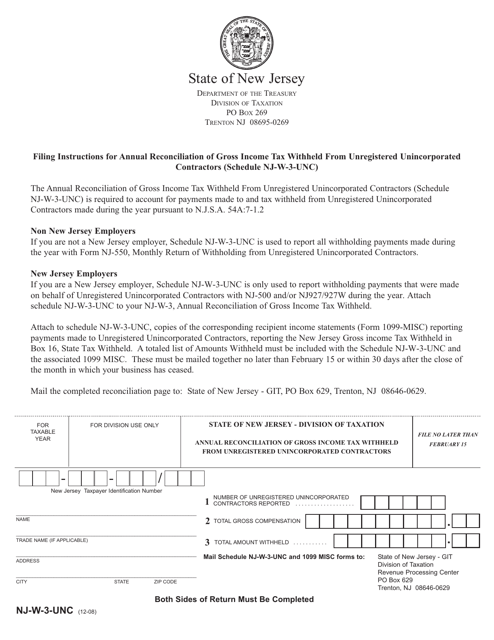

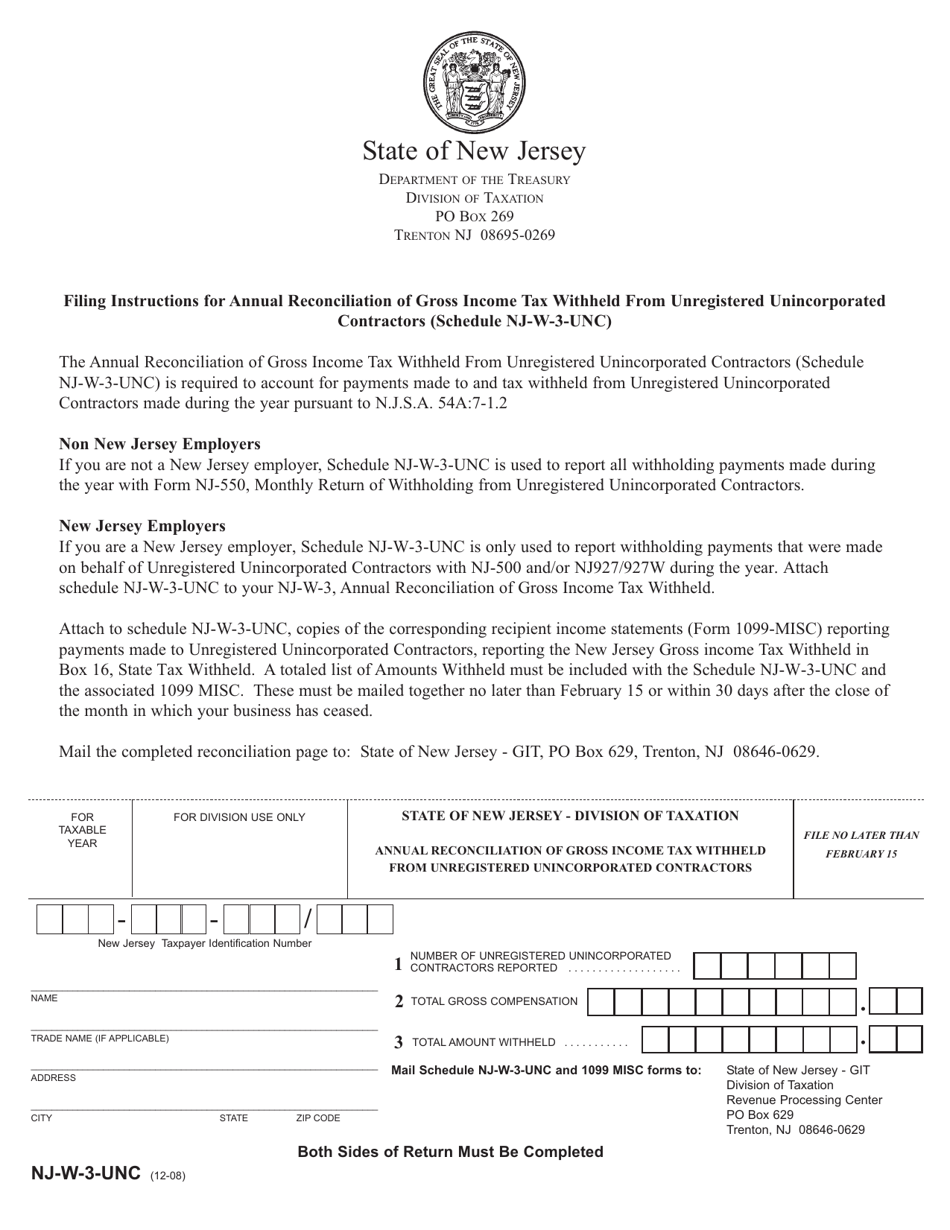

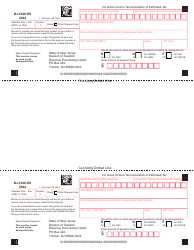

Schedule NJ-W-3-UNC Annual Reconciliation of Gross Income Tax Withheld From Unregistered Unincorporated Contractors - New Jersey

What Is Schedule NJ-W-3-UNC?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule NJ-W-3-UNC?

A: Schedule NJ-W-3-UNC is the annual reconciliation form used in New Jersey to report gross income tax withheld from unregistered unincorporated contractors.

Q: Who needs to file Schedule NJ-W-3-UNC?

A: Employers who have withheld gross income tax from unregistered unincorporated contractors in New Jersey need to file Schedule NJ-W-3-UNC.

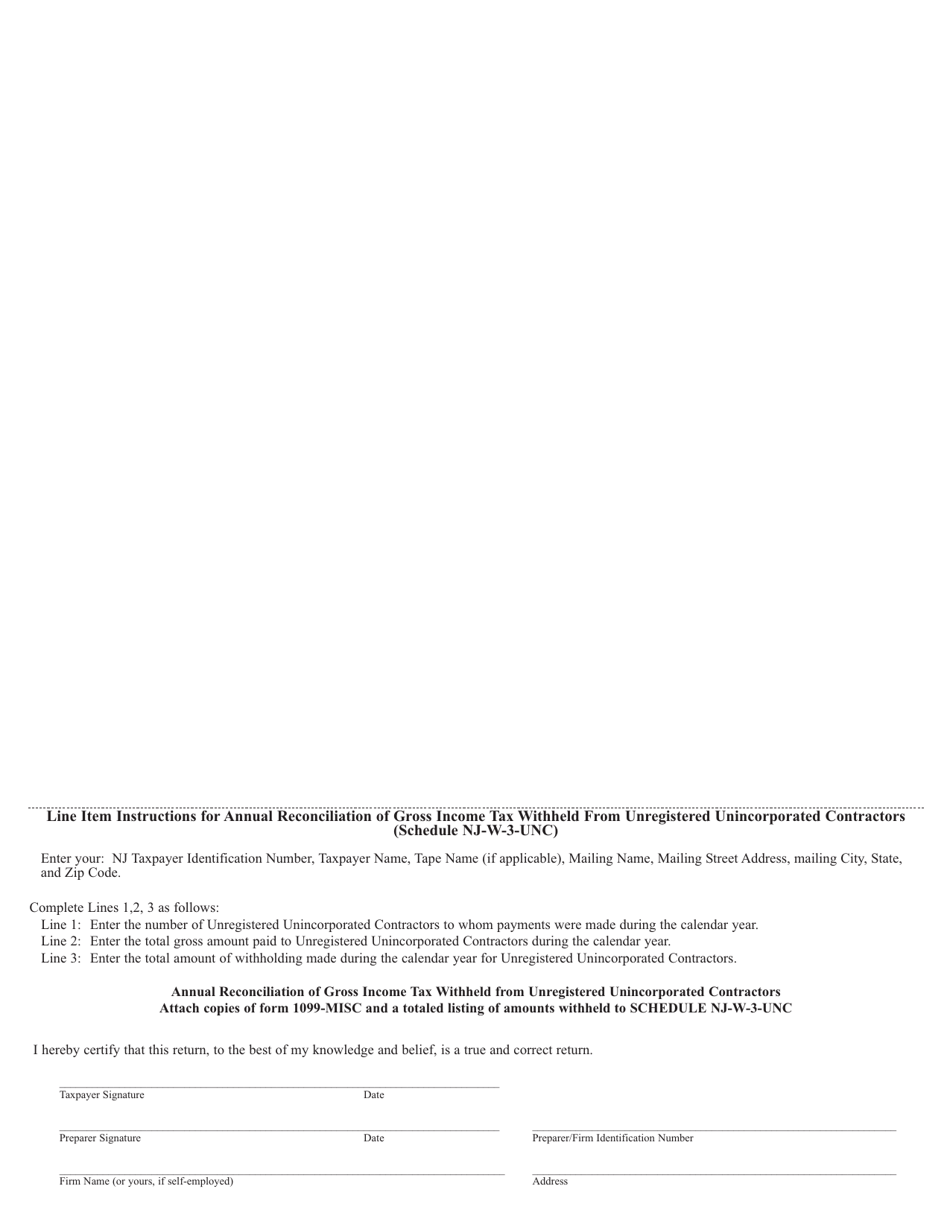

Q: What information needs to be reported on Schedule NJ-W-3-UNC?

A: Schedule NJ-W-3-UNC requires reporting of the total gross income tax withheld from unregistered unincorporated contractors.

Q: When is Schedule NJ-W-3-UNC due?

A: Schedule NJ-W-3-UNC is due on or before January 31 of the following year.

Q: Are there any penalties for not filing Schedule NJ-W-3-UNC?

A: Yes, there are penalties for not filing Schedule NJ-W-3-UNC, including interest charges and additional penalties for late or non-filing.

Form Details:

- Released on December 1, 2008;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule NJ-W-3-UNC by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.