This version of the form is not currently in use and is provided for reference only. Download this version of

Form 38-ES (SFN28723)

for the current year.

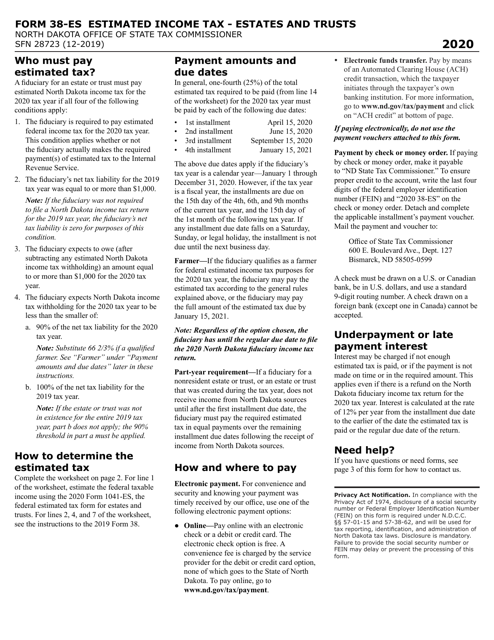

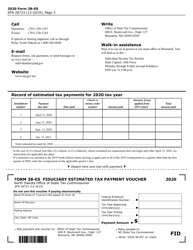

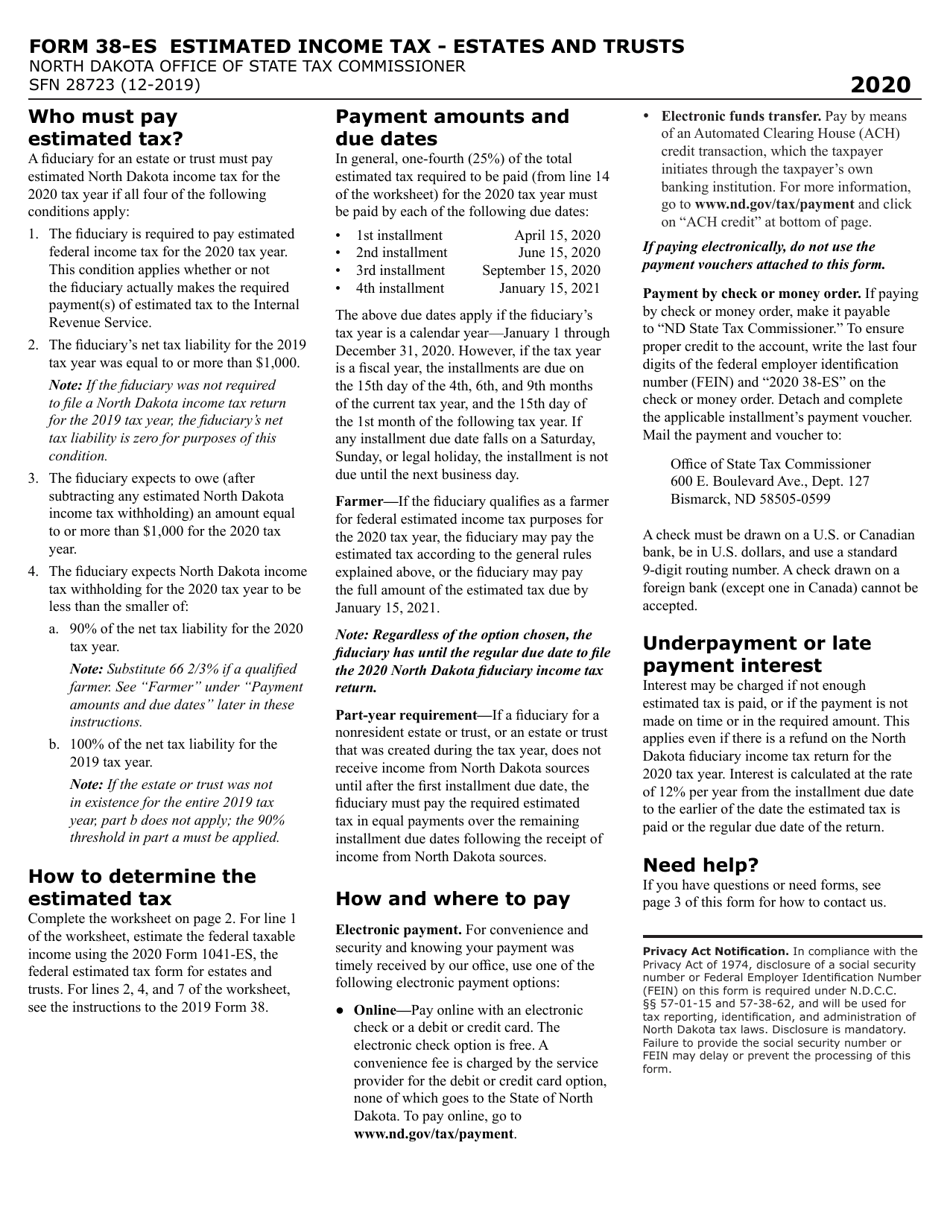

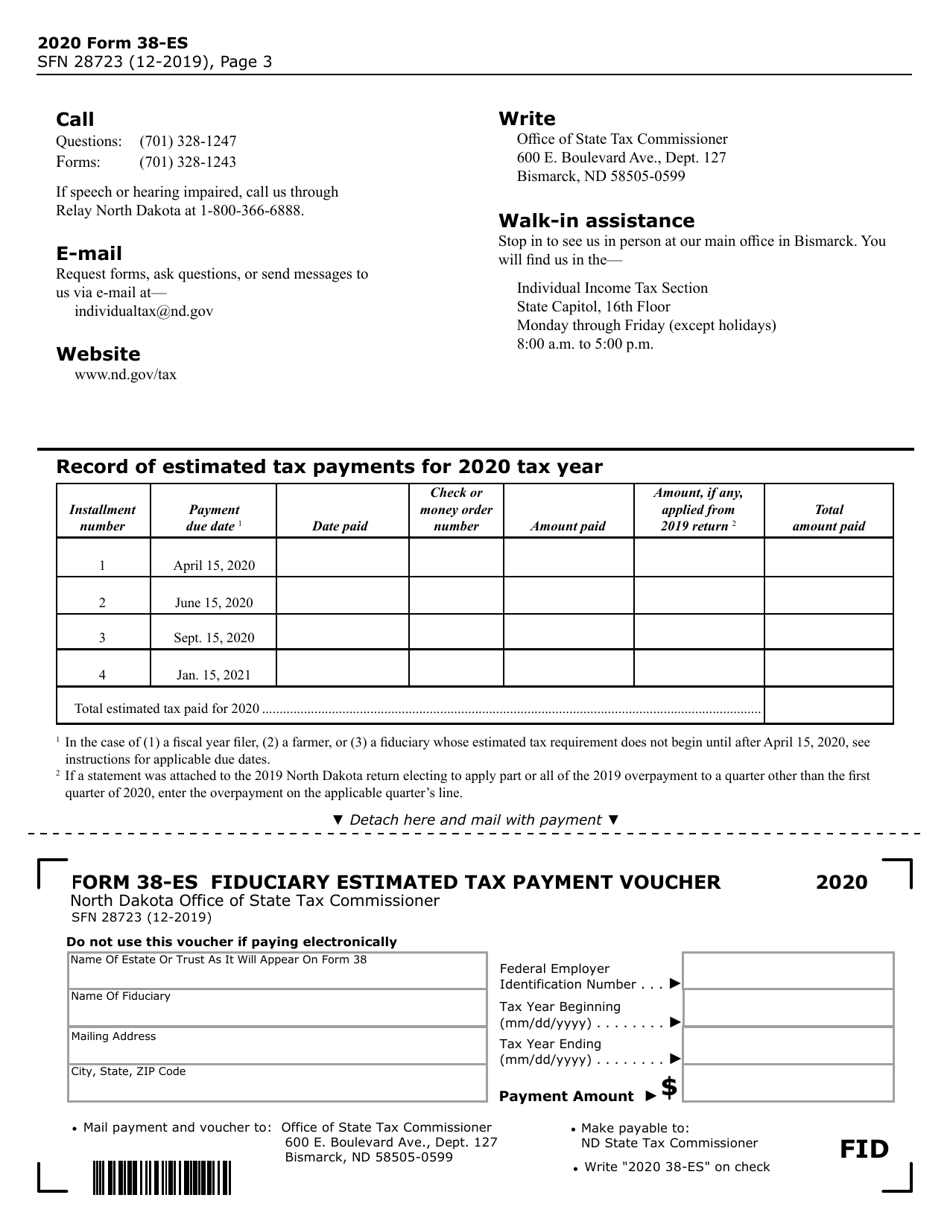

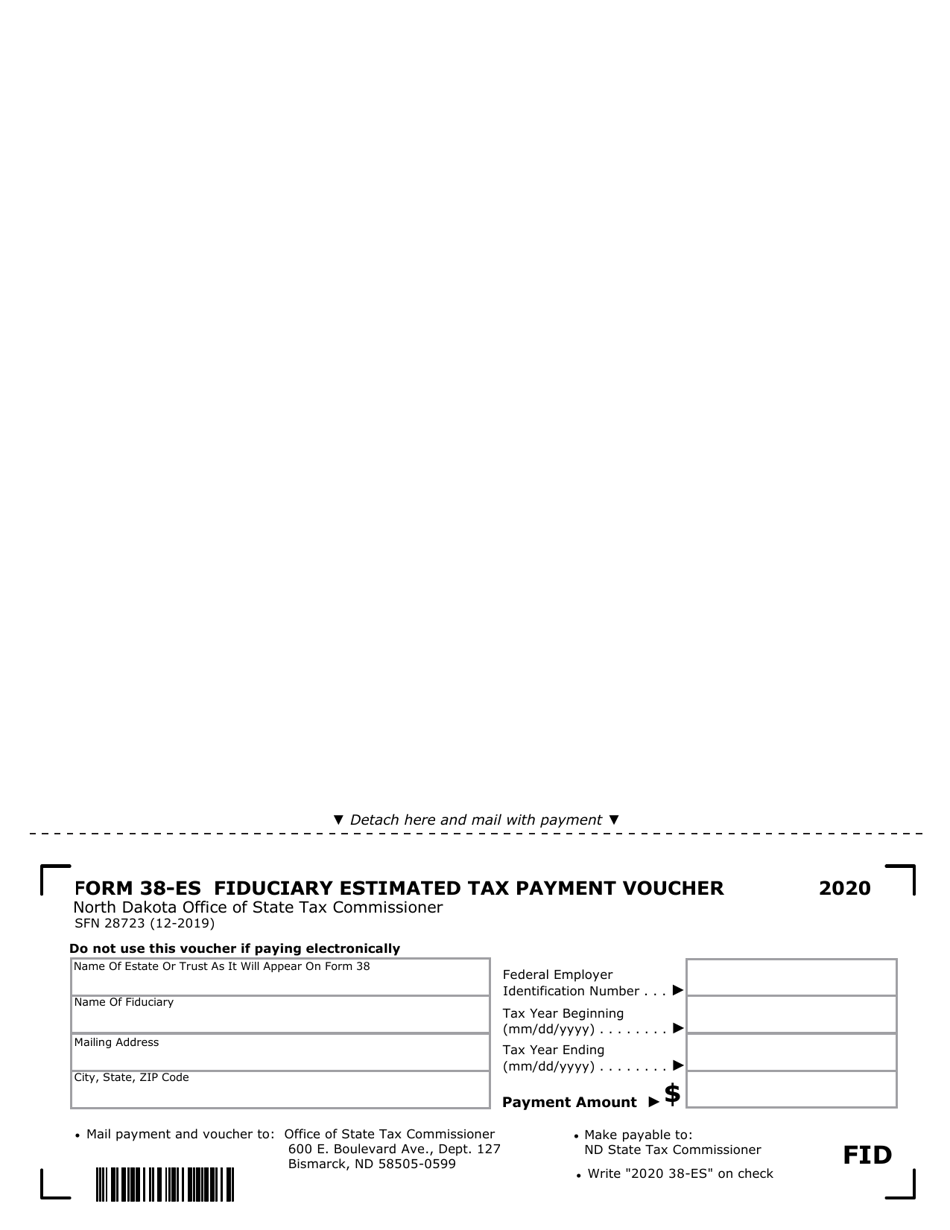

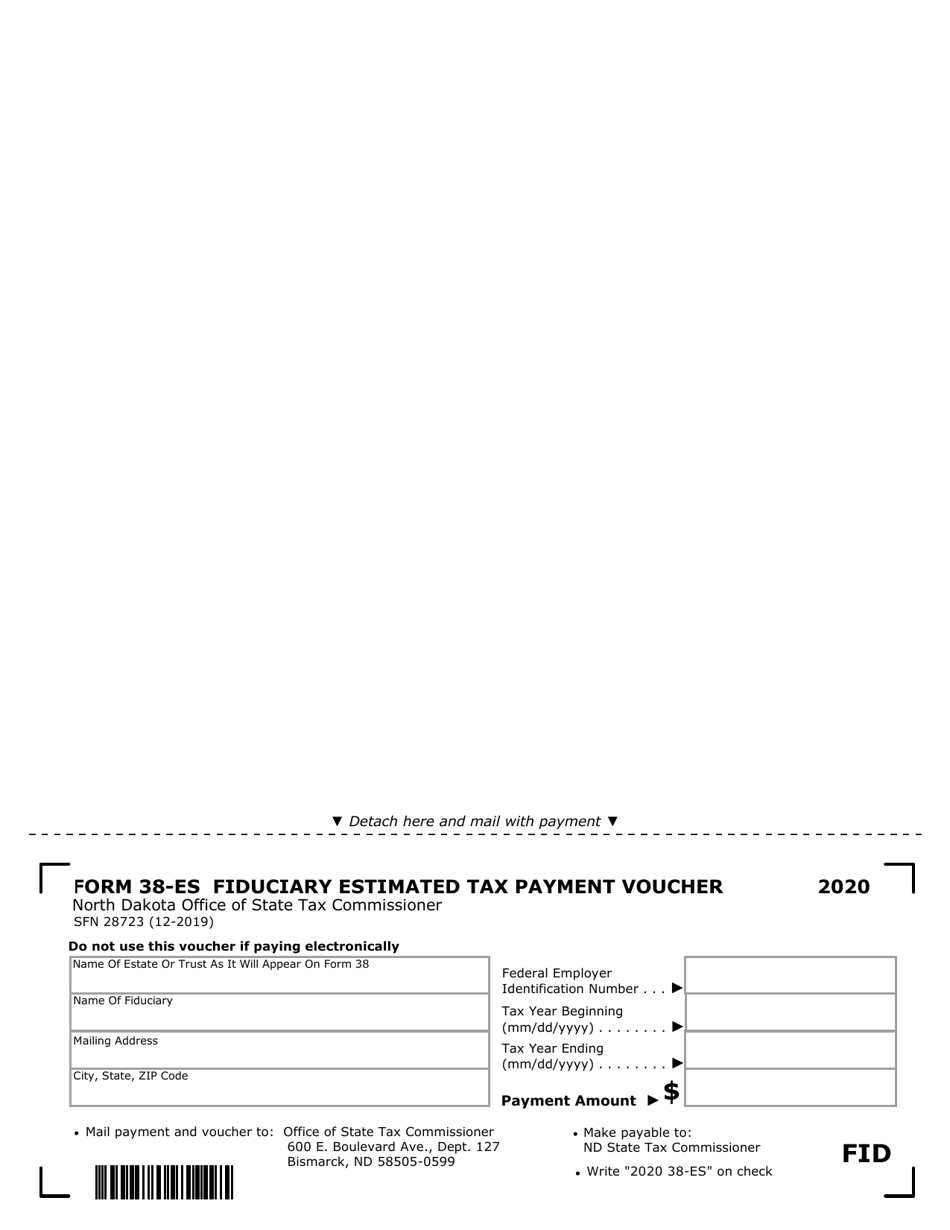

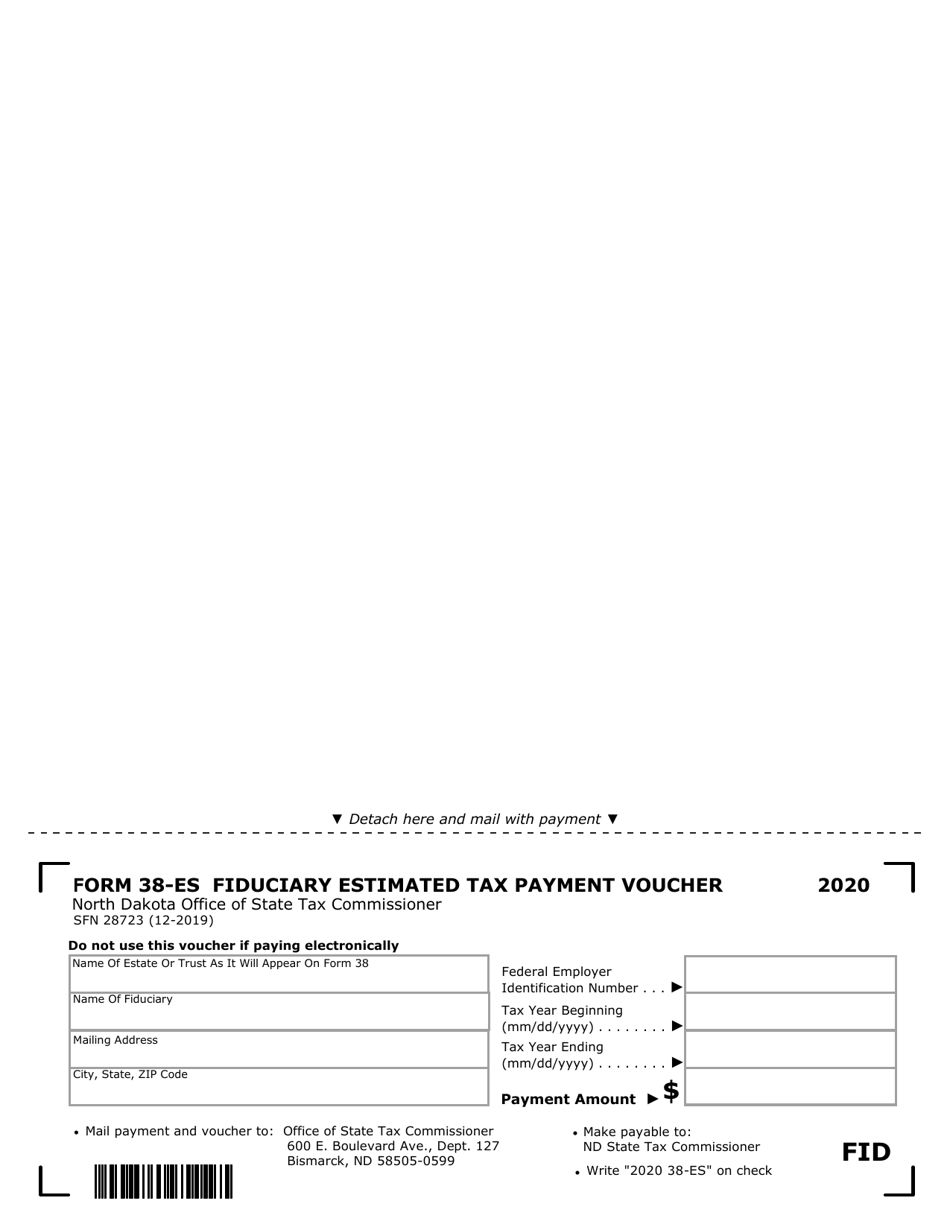

Form 38-ES (SFN28723) Estimated Income Tax - Estates and Trusts - North Dakota

What Is Form 38-ES (SFN28723)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 38-ES (SFN28723)?

A: Form 38-ES (SFN28723) is the Estimated Income Tax form for Estates and Trusts in North Dakota.

Q: Who needs to use Form 38-ES (SFN28723)?

A: Estates and Trusts in North Dakota who have estimated income tax liability are required to use Form 38-ES (SFN28723).

Q: What is the purpose of Form 38-ES (SFN28723)?

A: The purpose of Form 38-ES (SFN28723) is to estimate and pay income tax for Estates and Trusts in North Dakota.

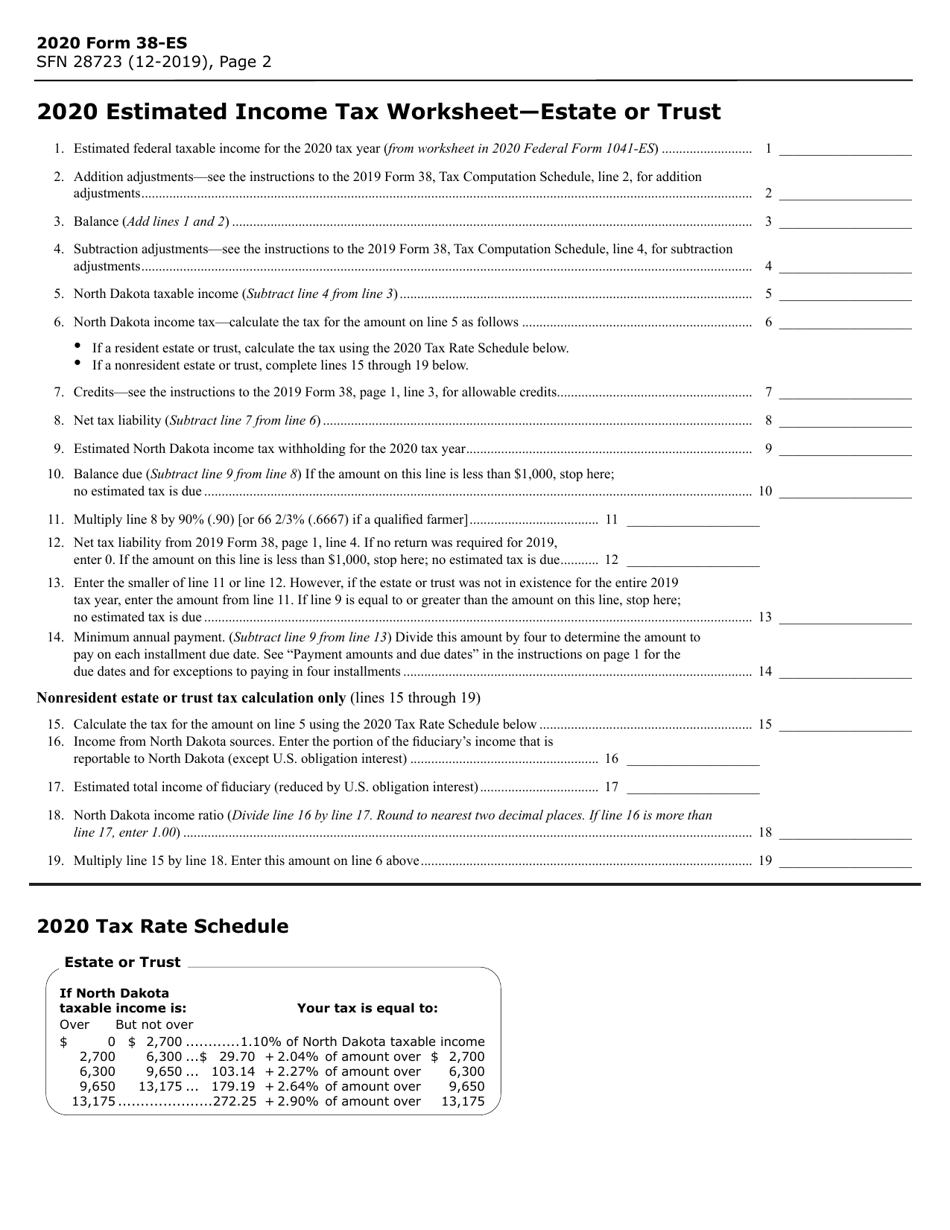

Q: How do I fill out Form 38-ES (SFN28723)?

A: You need to provide information about the estate or trust, estimate your income, calculate the tax due, and submit the form with payment.

Q: When is Form 38-ES (SFN28723) due?

A: Form 38-ES (SFN28723) is generally due on April 15th of the tax year or on the 15th day of the 4th month after the close of the tax year.

Q: What happens if I don't file Form 38-ES (SFN28723) on time?

A: If you don't file Form 38-ES (SFN28723) on time, you may be subject to penalties and interest on the unpaid tax amount.

Q: Are there any special instructions for completing Form 38-ES (SFN28723)?

A: Yes, make sure to carefully follow the instructions provided with the form to ensure accurate completion.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 38-ES (SFN28723) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.