This version of the form is not currently in use and is provided for reference only. Download this version of

Form 40-PV (SFN28752)

for the current year.

Form 40-PV (SFN28752) Corporation Return Payment Voucher - North Dakota

What Is Form 40-PV (SFN28752)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

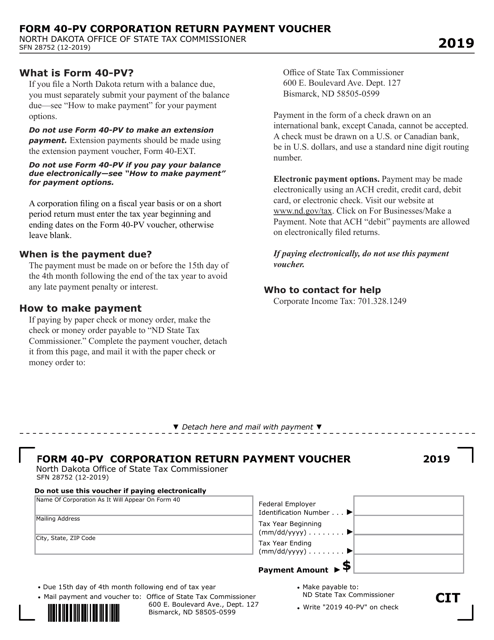

Q: What is Form 40-PV?

A: Form 40-PV is the payment voucher for corporation tax returns in North Dakota.

Q: What is the SFN28752?

A: SFN28752 is the form number for the Form 40-PV.

Q: What is a corporation return?

A: A corporation return is a tax return filed by a corporation to report its income, deductions, and tax liability.

Q: Who needs to use Form 40-PV?

A: Corporations in North Dakota who are filing their tax returns and need to make a payment with their return.

Q: What is the purpose of Form 40-PV?

A: The purpose of Form 40-PV is to provide a voucher for corporations to make a payment with their tax return.

Q: Is Form 40-PV specific to North Dakota?

A: Yes, Form 40-PV is specific to North Dakota and is used for corporation tax returns in the state.

Q: When is Form 40-PV due?

A: Form 40-PV is due on the same date as the corporation tax return, which is typically the 15th day of the 3rd month after the end of the corporation's tax year.

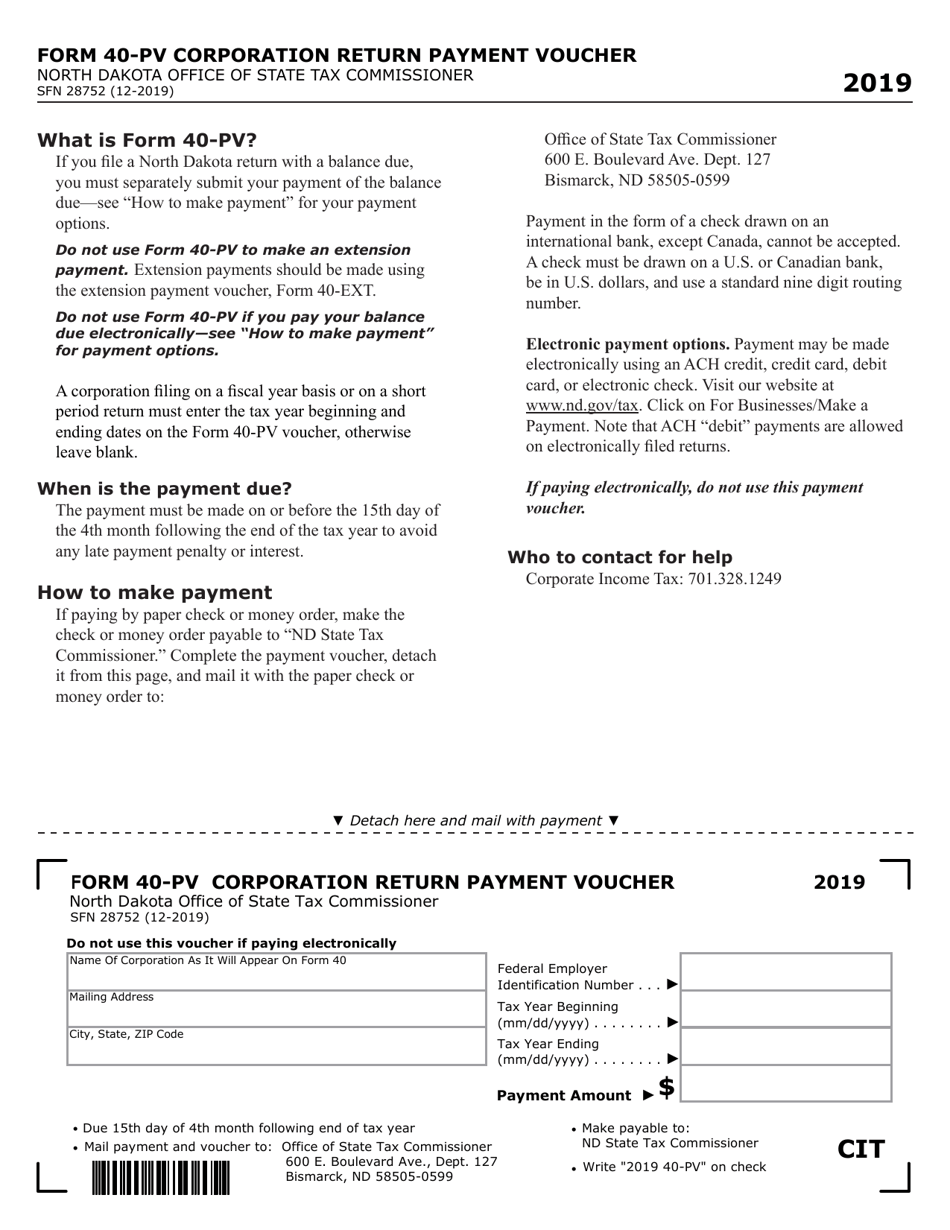

Q: What information is required on Form 40-PV?

A: Form 40-PV requires the corporation's name, address, federal employer identification number (EIN), payment amount, and tax year.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40-PV (SFN28752) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.