This version of the form is not currently in use and is provided for reference only. Download this version of

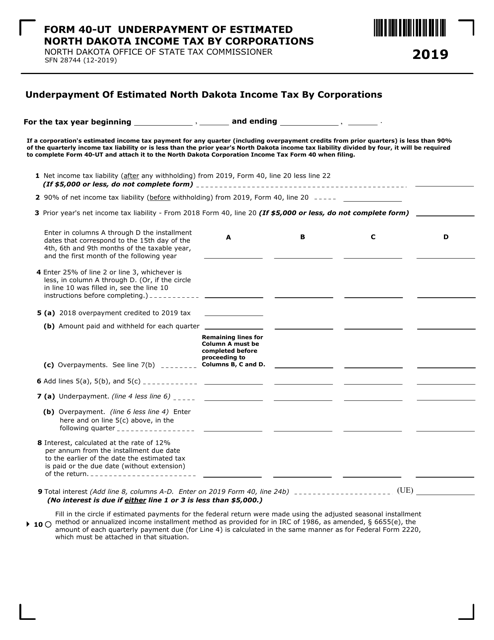

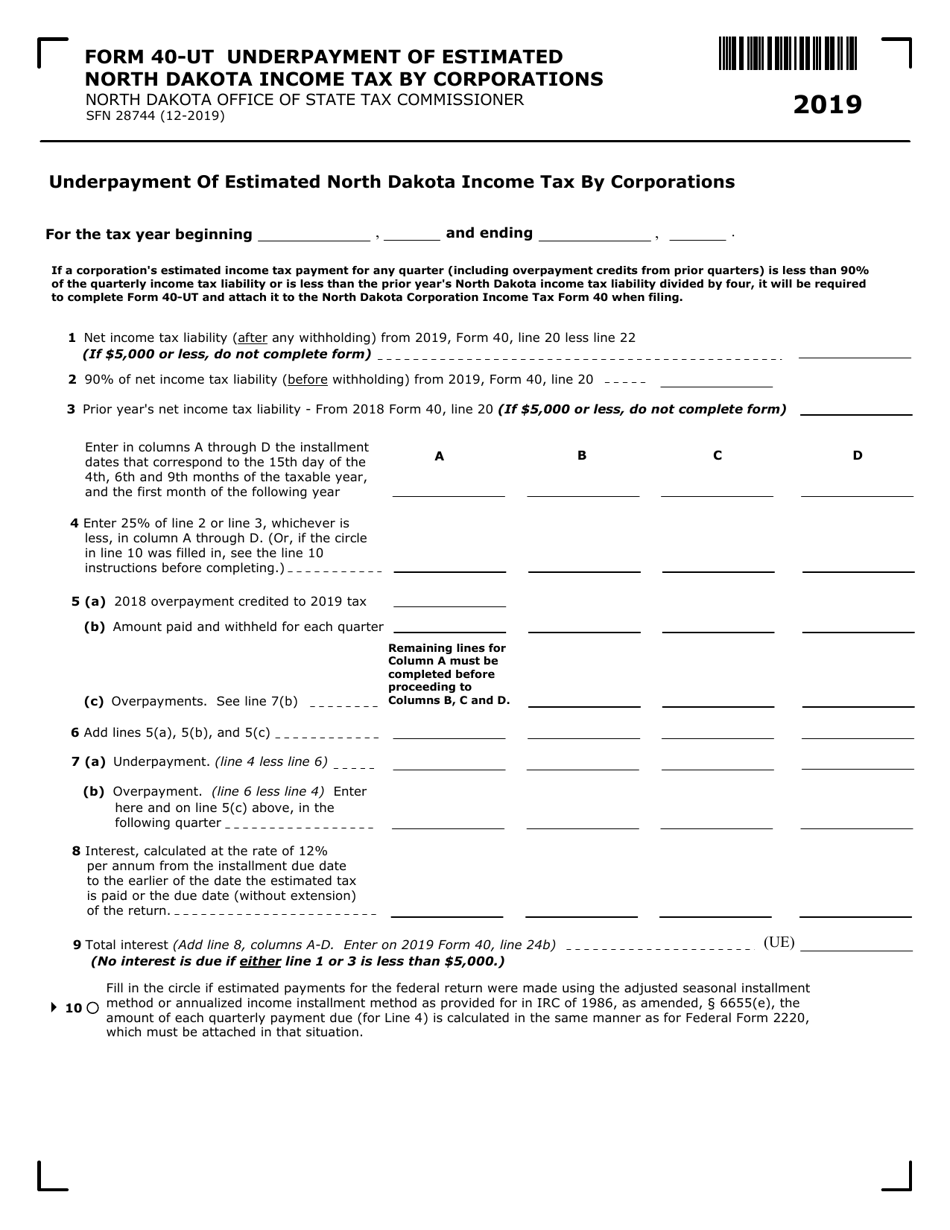

Form 40-UT (SFN28744)

for the current year.

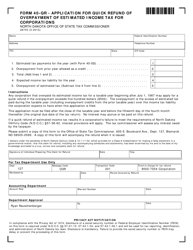

Form 40-UT (SFN28744) Underpayment of Estimated North Dakota Income Tax by Corporations - North Dakota

What Is Form 40-UT (SFN28744)?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 40-UT?

A: Form 40-UT is a tax form used by corporations in North Dakota to report underpayment of estimated income tax.

Q: Who is required to file Form 40-UT?

A: Corporations in North Dakota who have underpaid their estimated income tax are required to file Form 40-UT.

Q: What is the purpose of Form 40-UT?

A: The purpose of Form 40-UT is to calculate and report the underpayment of estimated income tax by corporations in North Dakota.

Q: When is Form 40-UT due?

A: Form 40-UT is due on or before the original due date of the North Dakota corporation income tax return (generally March 15th).

Q: Is there a penalty for not filing Form 40-UT?

A: Yes, there may be penalties for not filing Form 40-UT or for underpaying estimated income tax. It is important to file and pay on time to avoid penalties.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 40-UT (SFN28744) by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.