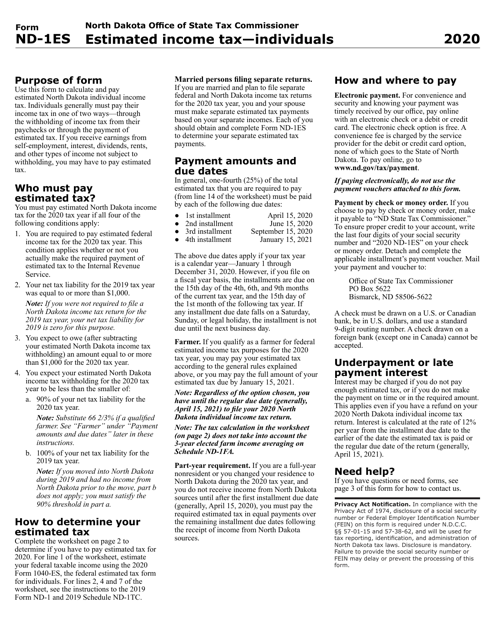

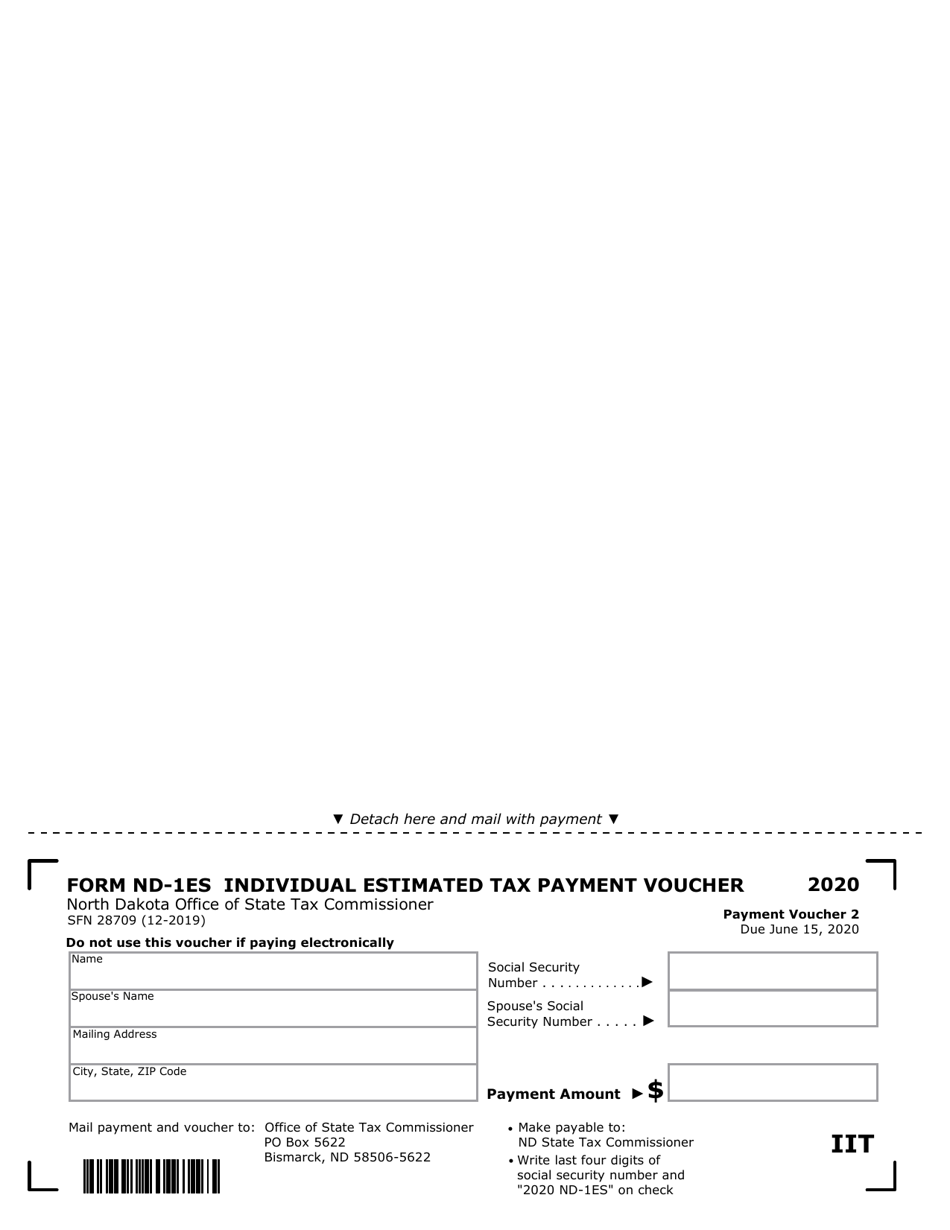

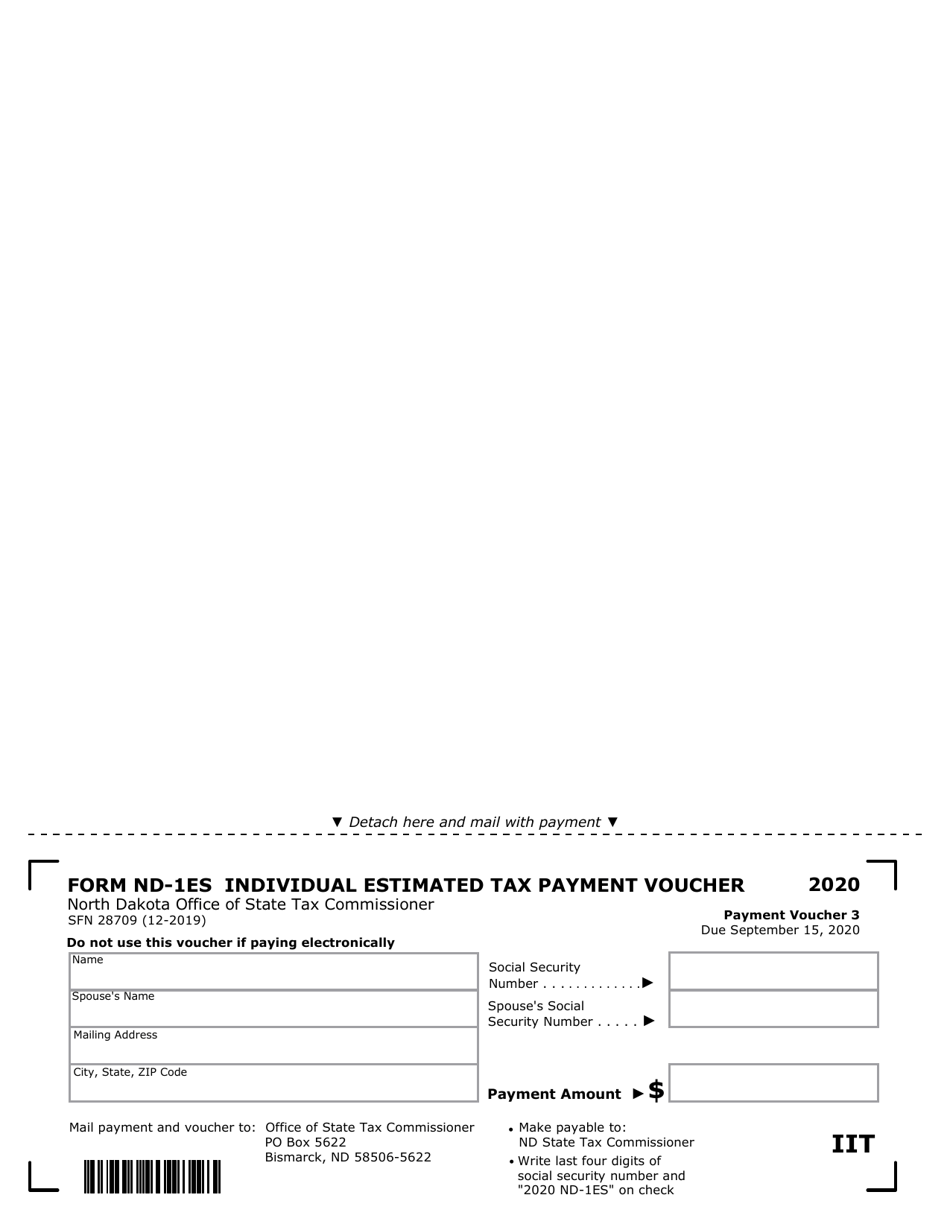

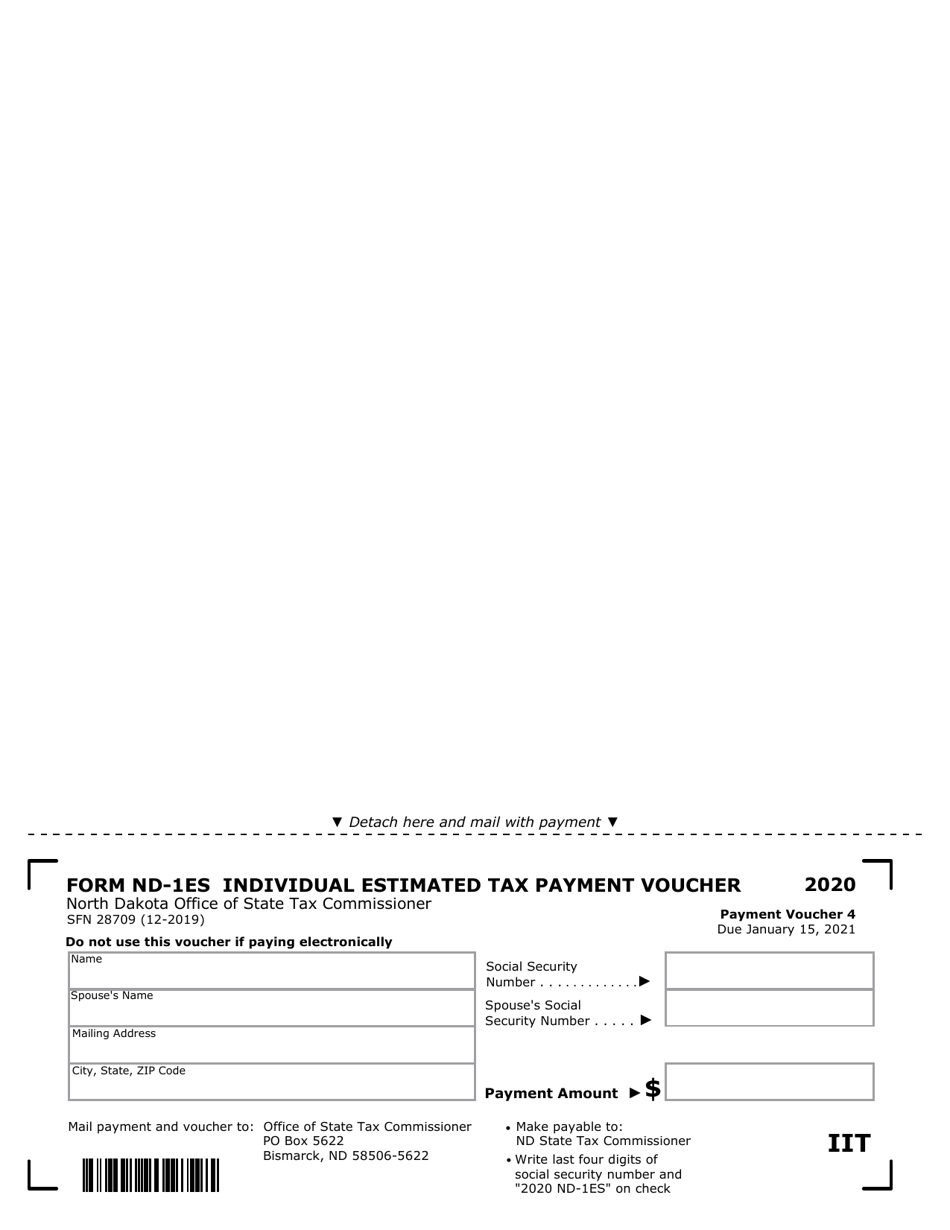

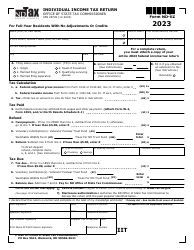

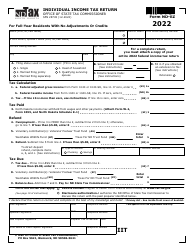

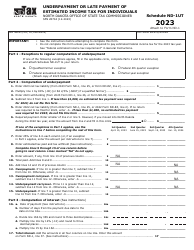

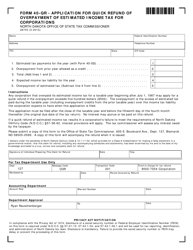

Form ND-1ES Estimated Income Tax - Individuals - North Dakota

What Is Form ND-1ES?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

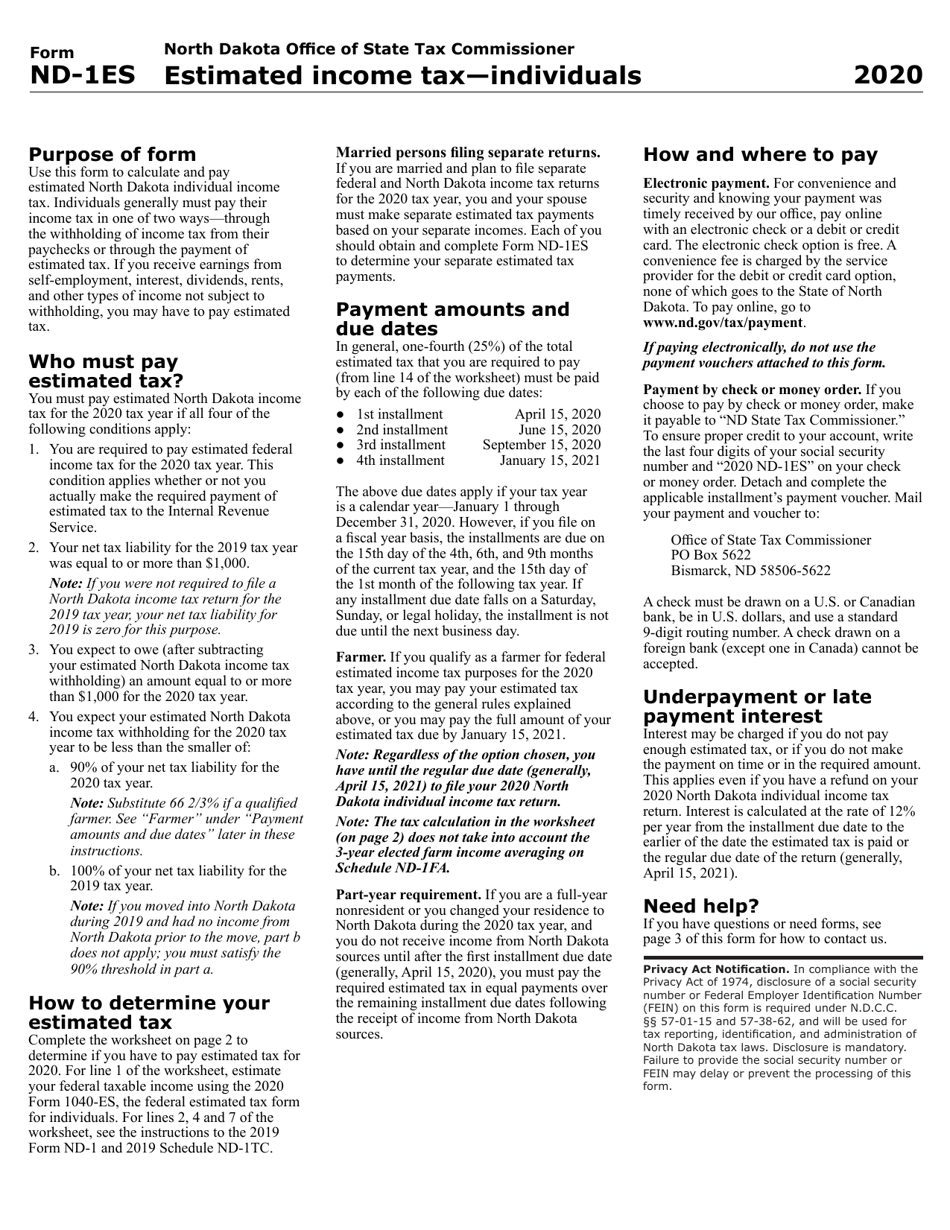

Q: What is Form ND-1ES?

A: Form ND-1ES is the Estimated Income Tax form for individuals in North Dakota.

Q: Who needs to file Form ND-1ES?

A: Anyone who expects to owe North Dakota income tax and wants to make estimated tax payments should file Form ND-1ES.

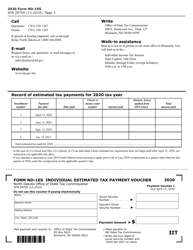

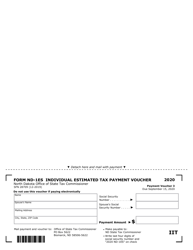

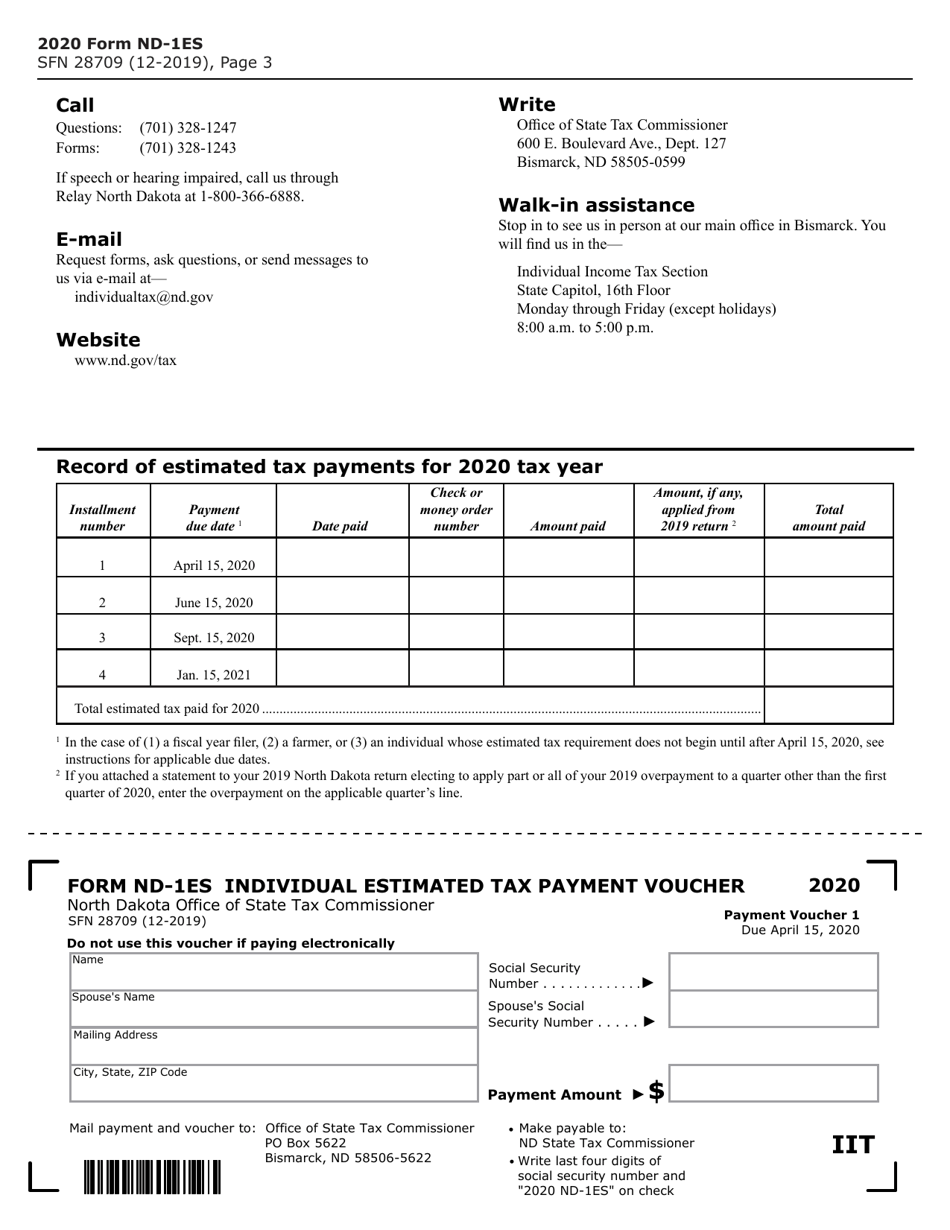

Q: How do I file Form ND-1ES?

A: You can file Form ND-1ES by mail or electronically.

Q: What is the purpose of Form ND-1ES?

A: The purpose of Form ND-1ES is to help individuals estimate their income tax liability for the year and make quarterly estimated tax payments.

Q: When is Form ND-1ES due?

A: Form ND-1ES is due on April 15th of the current tax year.

Q: What happens if I don't file Form ND-1ES?

A: If you don't file Form ND-1ES and make estimated tax payments, you may be subject to penalties and interest on any underpaid tax.

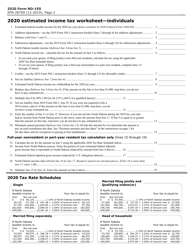

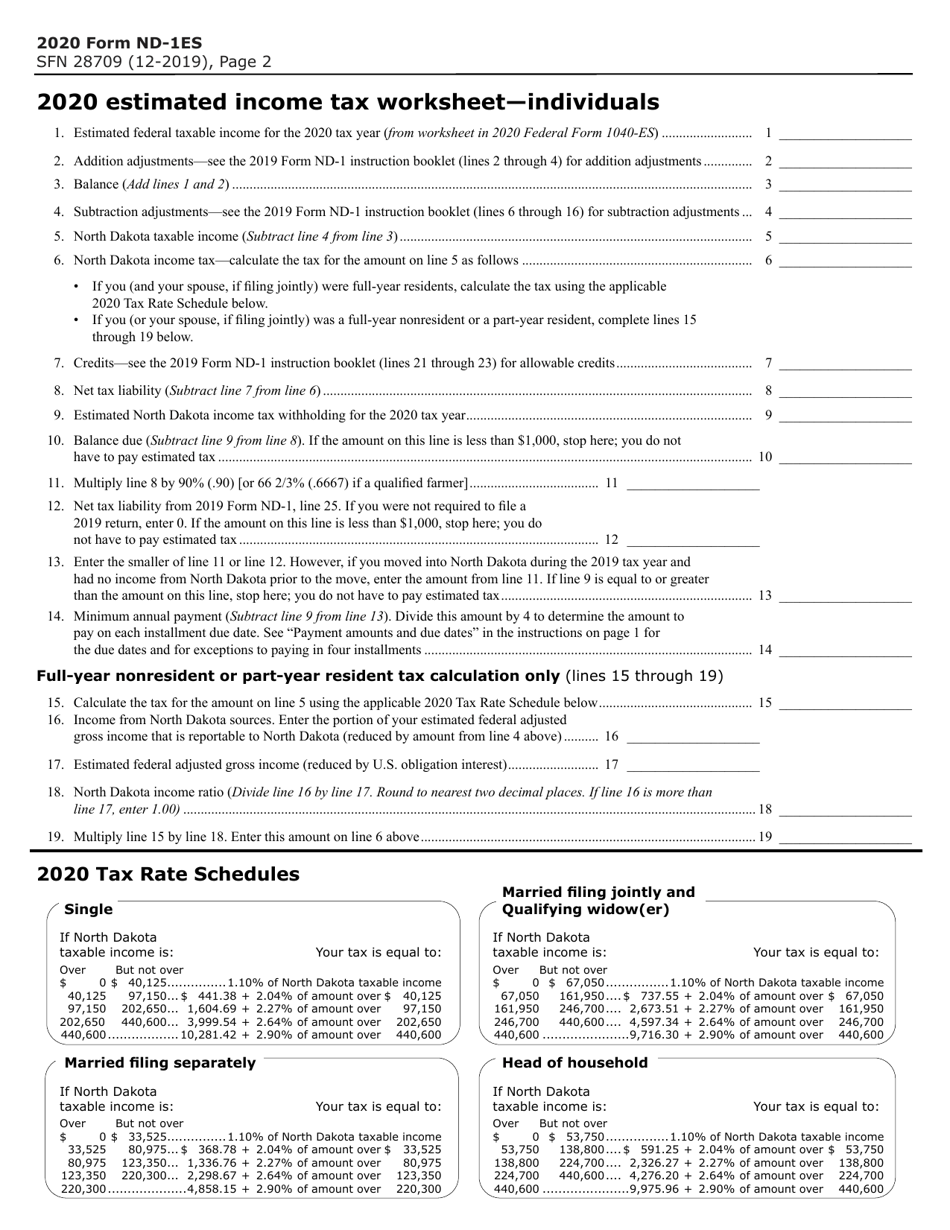

Q: What information do I need to complete Form ND-1ES?

A: You will need to know your estimated income, deductions, and North Dakota tax withholding information in order to complete Form ND-1ES.

Q: Can I make changes to my estimated tax payments?

A: Yes, you can adjust your estimated tax payments throughout the year by filing a new Form ND-1ES with updated information.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1ES by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.