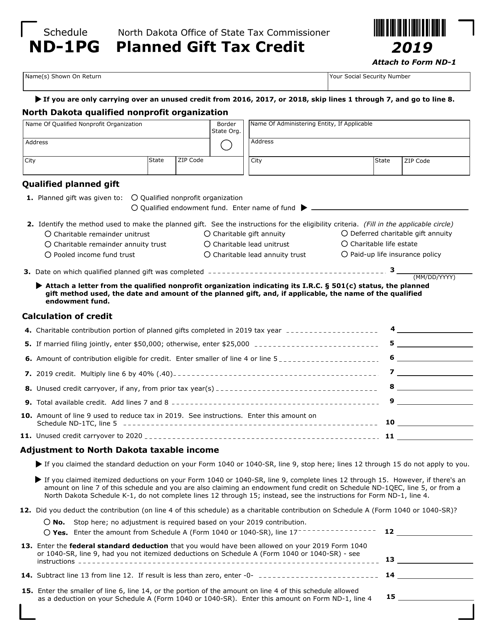

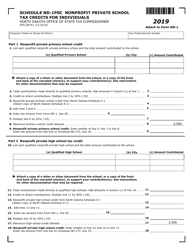

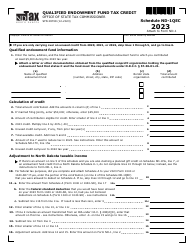

Form ND-1 (SFN28705) Schedule ND-1PG Planned Gift Tax Credit - North Dakota

What Is Form ND-1 (SFN28705) Schedule ND-1PG?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-1 (SFN28705)?

A: Form ND-1 (SFN28705) is a tax form used in North Dakota.

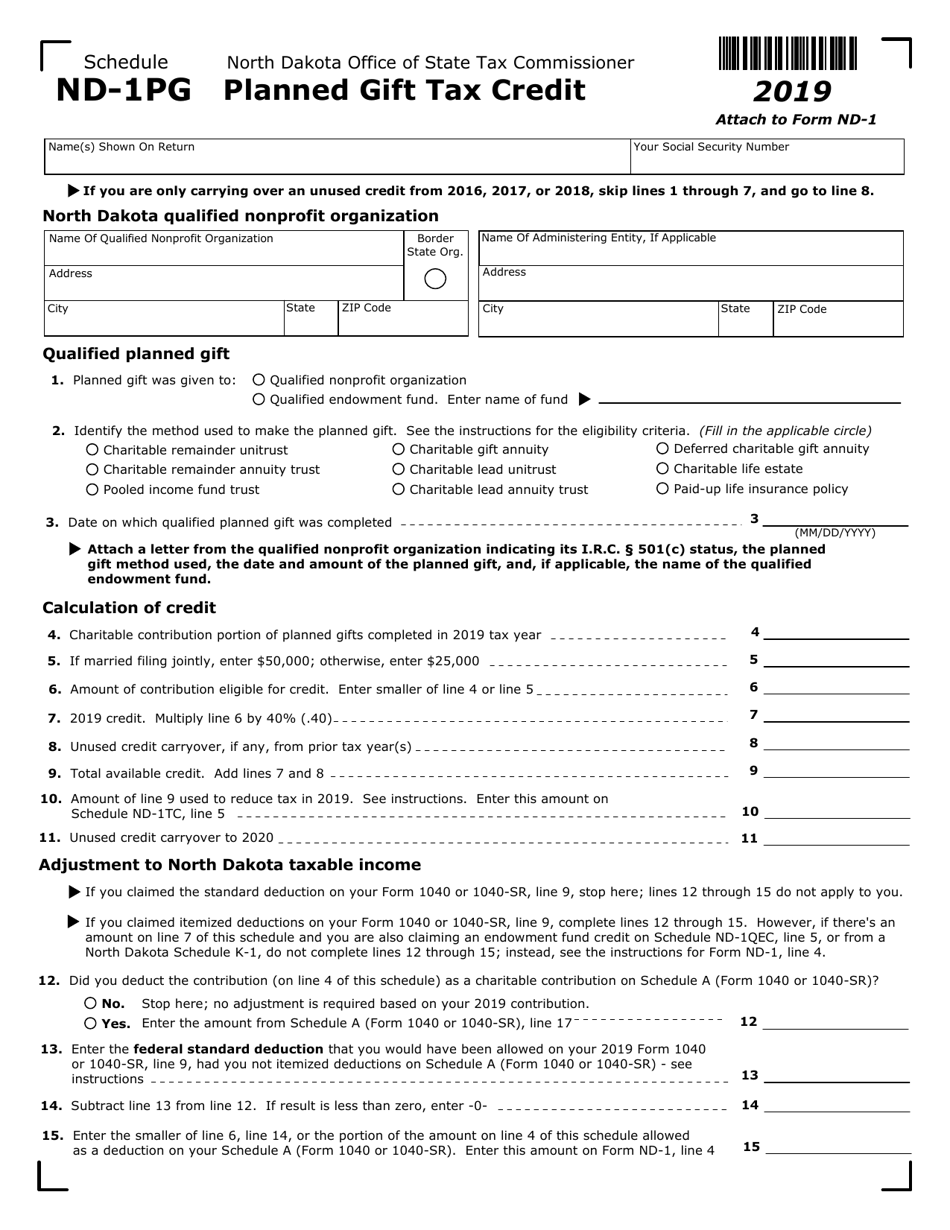

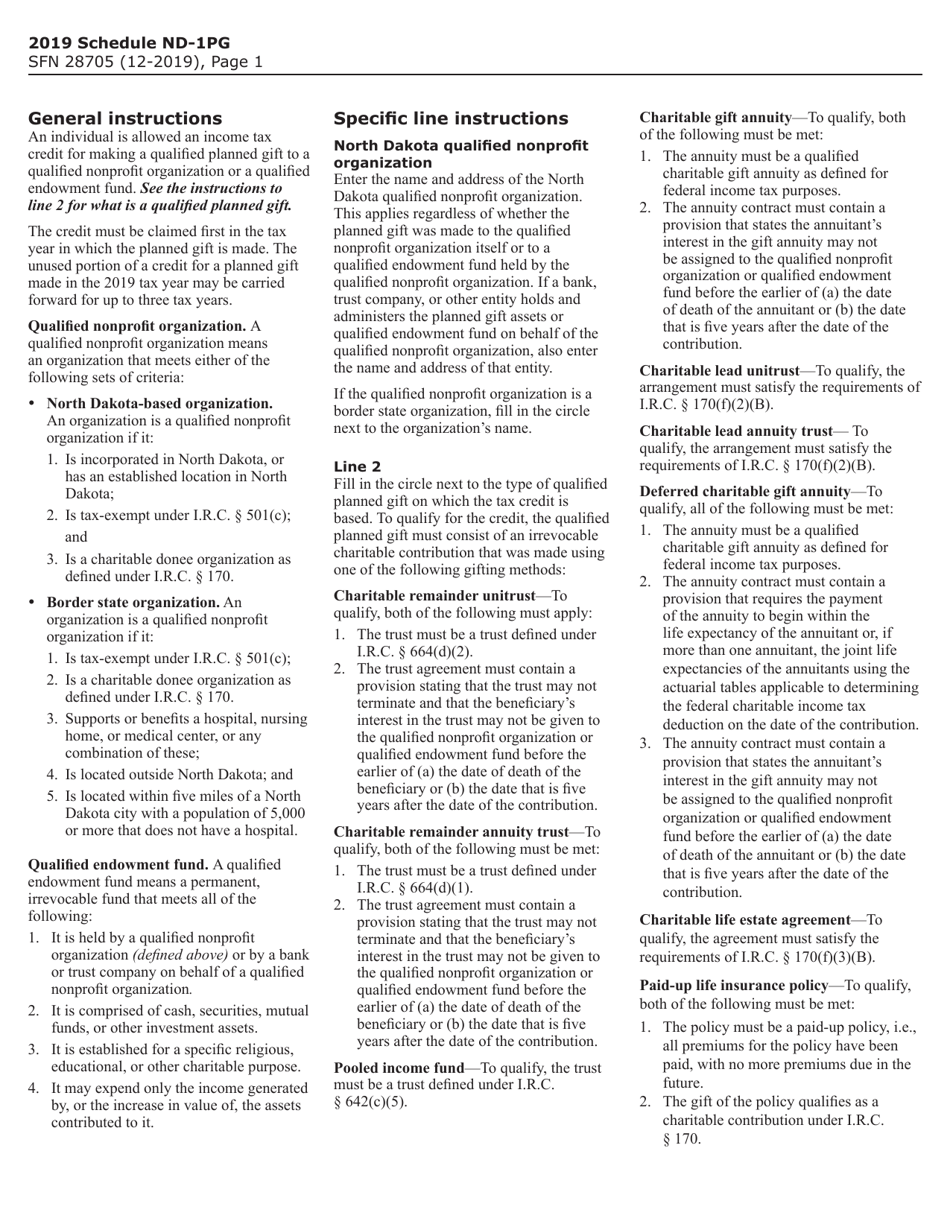

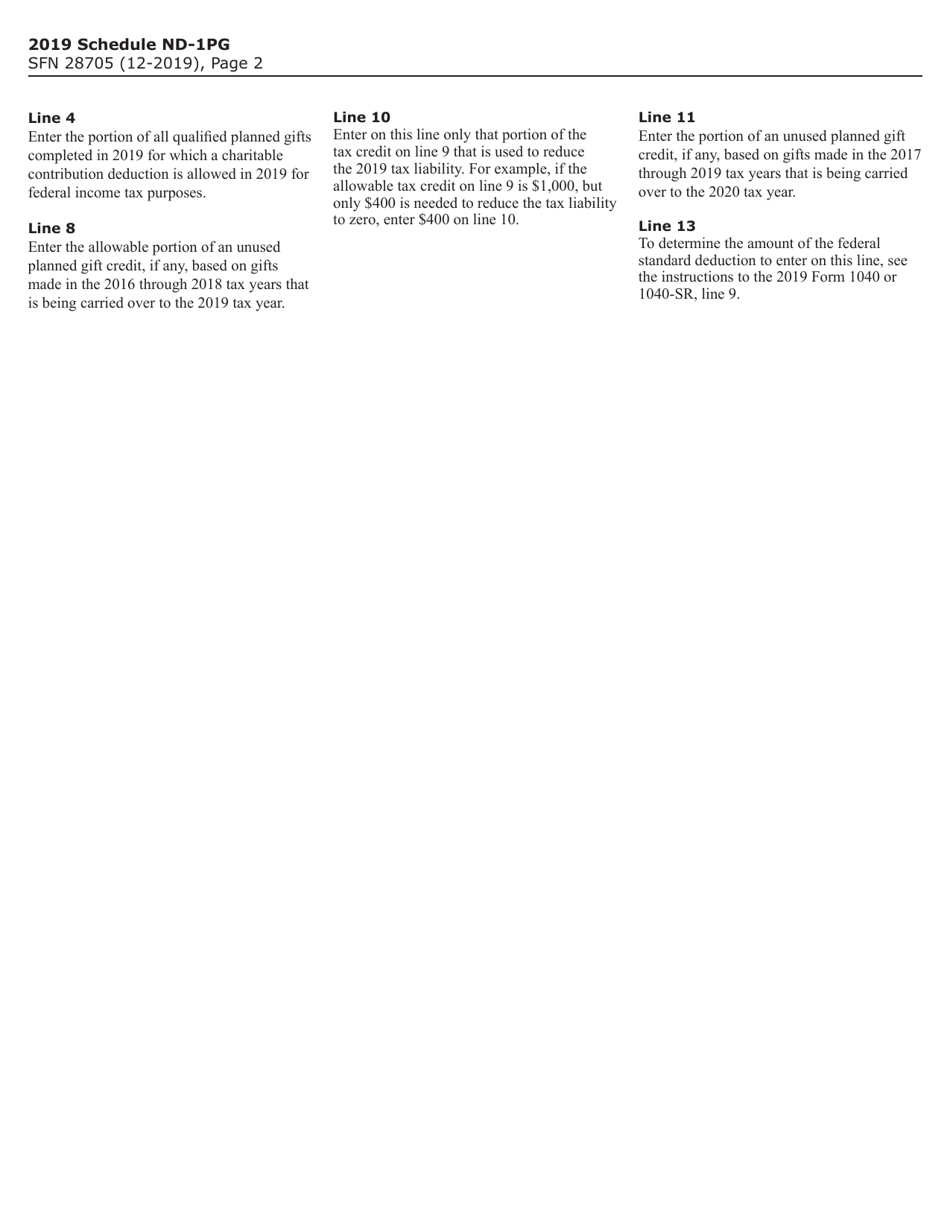

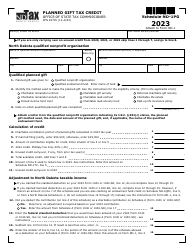

Q: What is Schedule ND-1PG?

A: Schedule ND-1PG is a part of Form ND-1 (SFN28705). It is used to calculate the Planned Gift Tax Credit in North Dakota.

Q: What is the Planned Gift Tax Credit?

A: The Planned Gift Tax Credit is a tax credit available in North Dakota for donations made as part of a planned charitable gift.

Q: Who can claim the Planned Gift Tax Credit?

A: Individuals or businesses who make eligible planned charitable gifts in North Dakota can claim the Planned Gift Tax Credit.

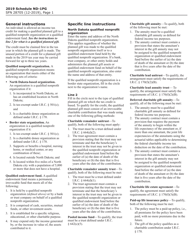

Q: How do I fill out Schedule ND-1PG?

A: You need to provide information about the planned charitable gift, including the amount and the recipient organization, on Schedule ND-1PG.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1 (SFN28705) Schedule ND-1PG by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.