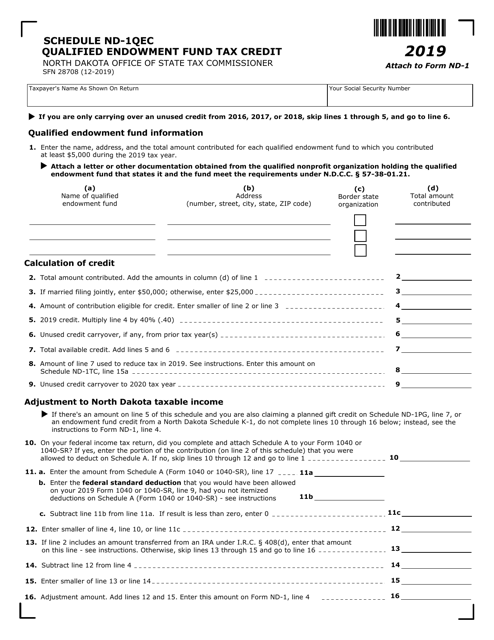

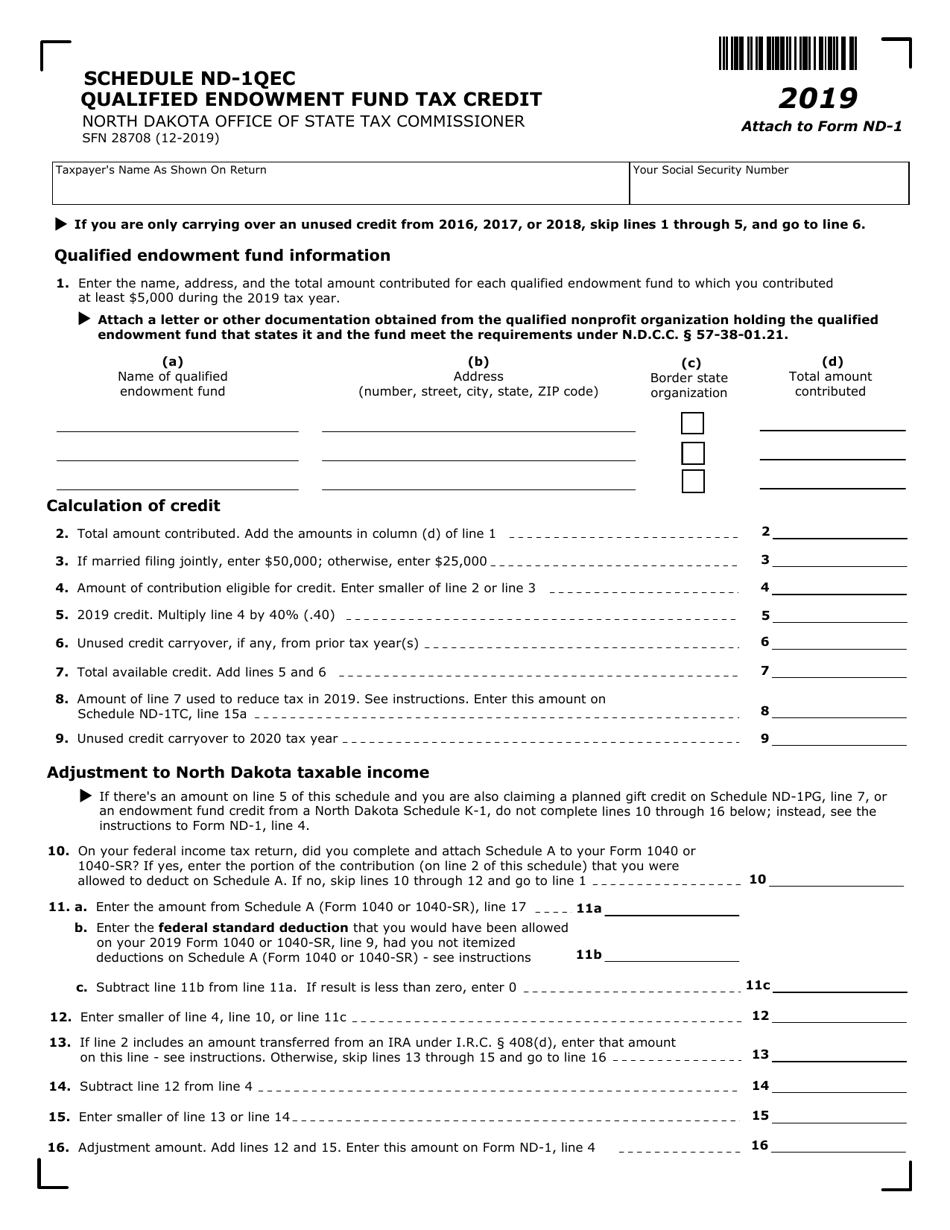

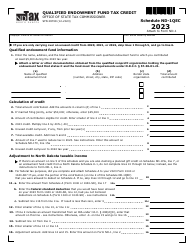

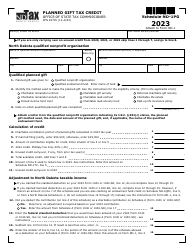

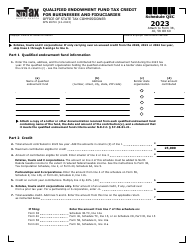

Form ND-1 (SFN28708) Schedule ND-1QEC Qualified Endowment Fund Tax Credit - North Dakota

What Is Form ND-1 (SFN28708) Schedule ND-1QEC?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-1?

A: Form ND-1 is a tax form used in North Dakota.

Q: What is Schedule ND-1QEC?

A: Schedule ND-1QEC is a schedule that calculates the Qualified Endowment Fund Tax Credit in North Dakota.

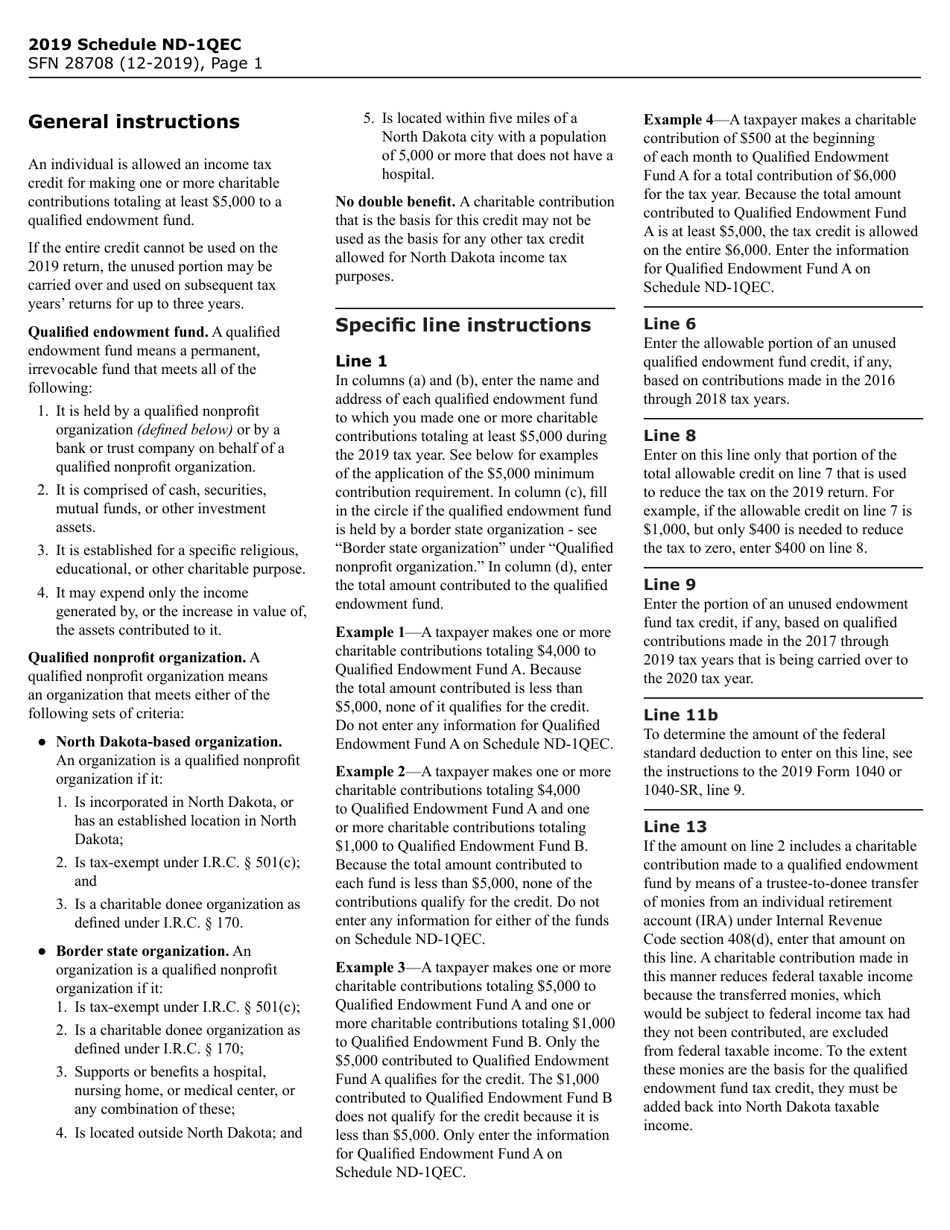

Q: What is the Qualified Endowment Fund Tax Credit?

A: The Qualified Endowment Fund Tax Credit is a tax credit available in North Dakota for contributions made to qualified endowment funds.

Q: Who is eligible for the Qualified Endowment Fund Tax Credit?

A: Individuals and corporations who make contributions to qualified endowment funds in North Dakota are eligible for the tax credit.

Q: What is the purpose of the Qualified Endowment Fund Tax Credit?

A: The tax credit is designed to incentivize donations to qualified endowment funds, which support various charitable and educational organizations in North Dakota.

Q: Is the Qualified Endowment Fund Tax Credit refundable?

A: No, the Qualified Endowment Fund Tax Credit is non-refundable, but any unused credit can be carried forward for up to five years.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1 (SFN28708) Schedule ND-1QEC by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.