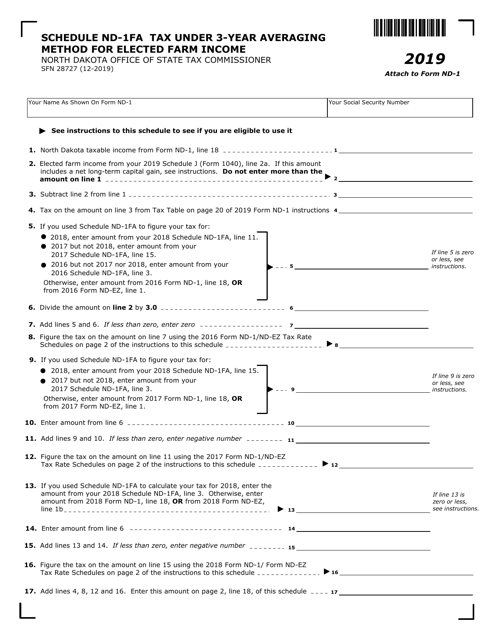

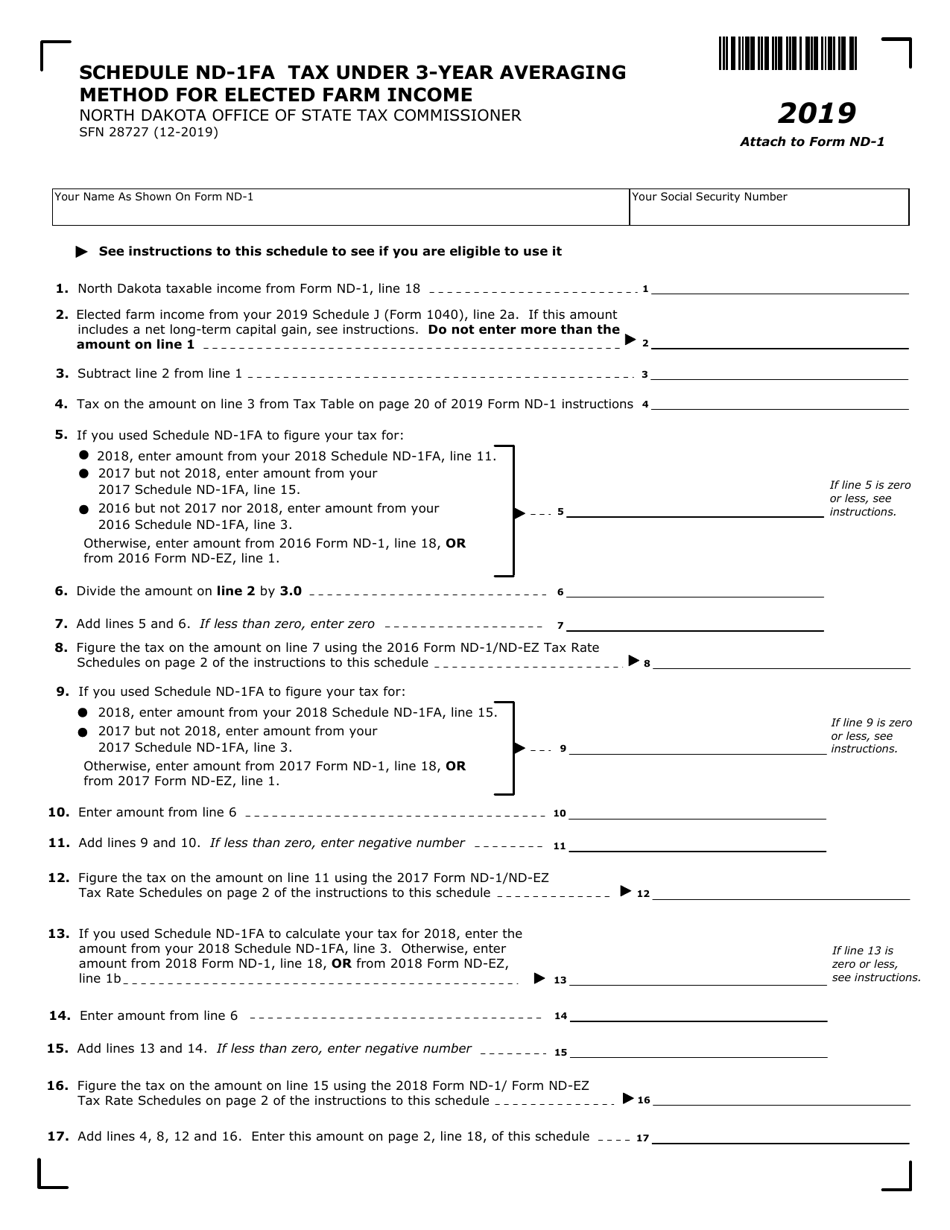

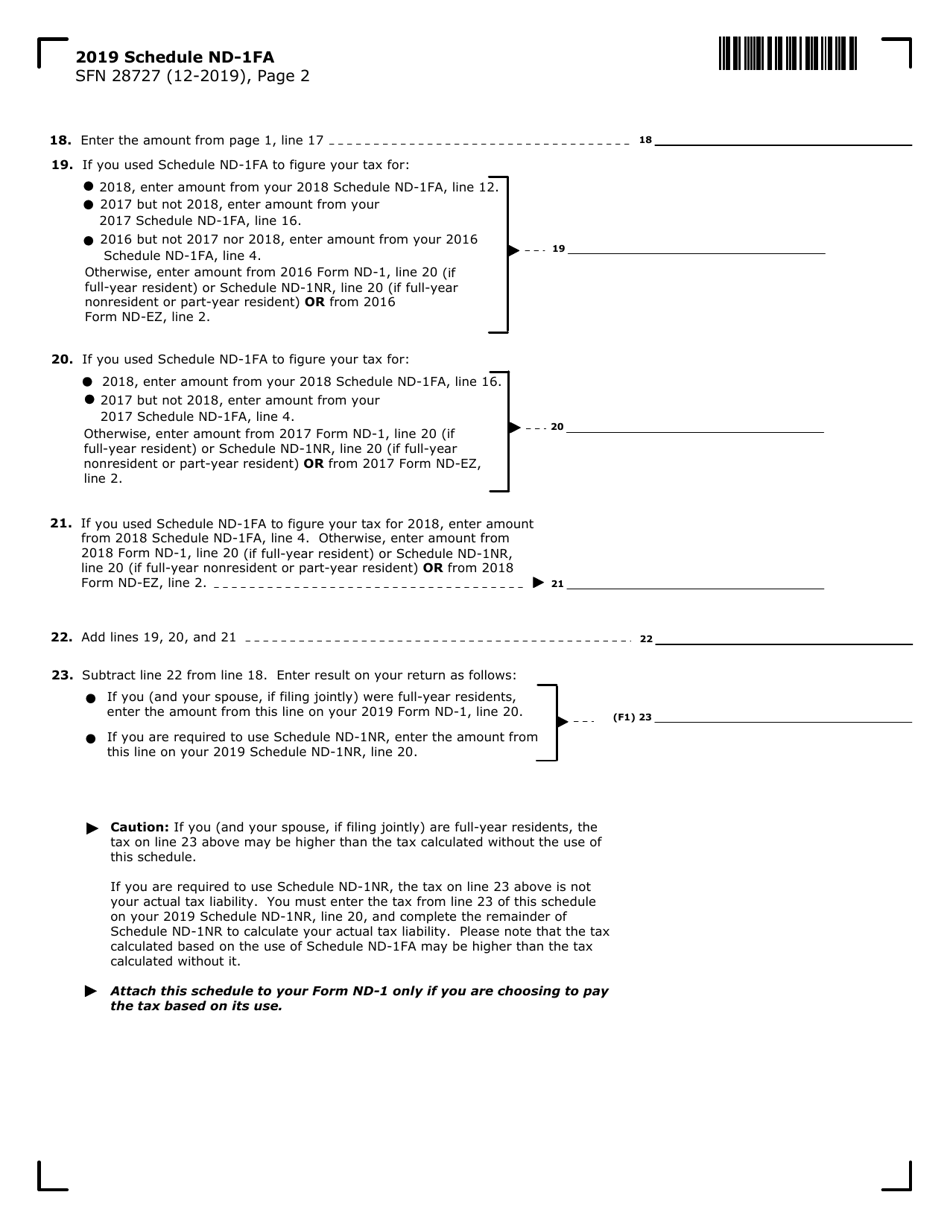

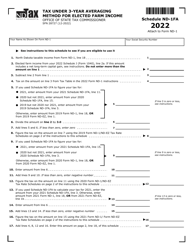

Form ND-1 (SFN28727) Schedule ND-1FA 3-year Averaging Method for Elected Farm Income - North Dakota

What Is Form ND-1 (SFN28727) Schedule ND-1FA?

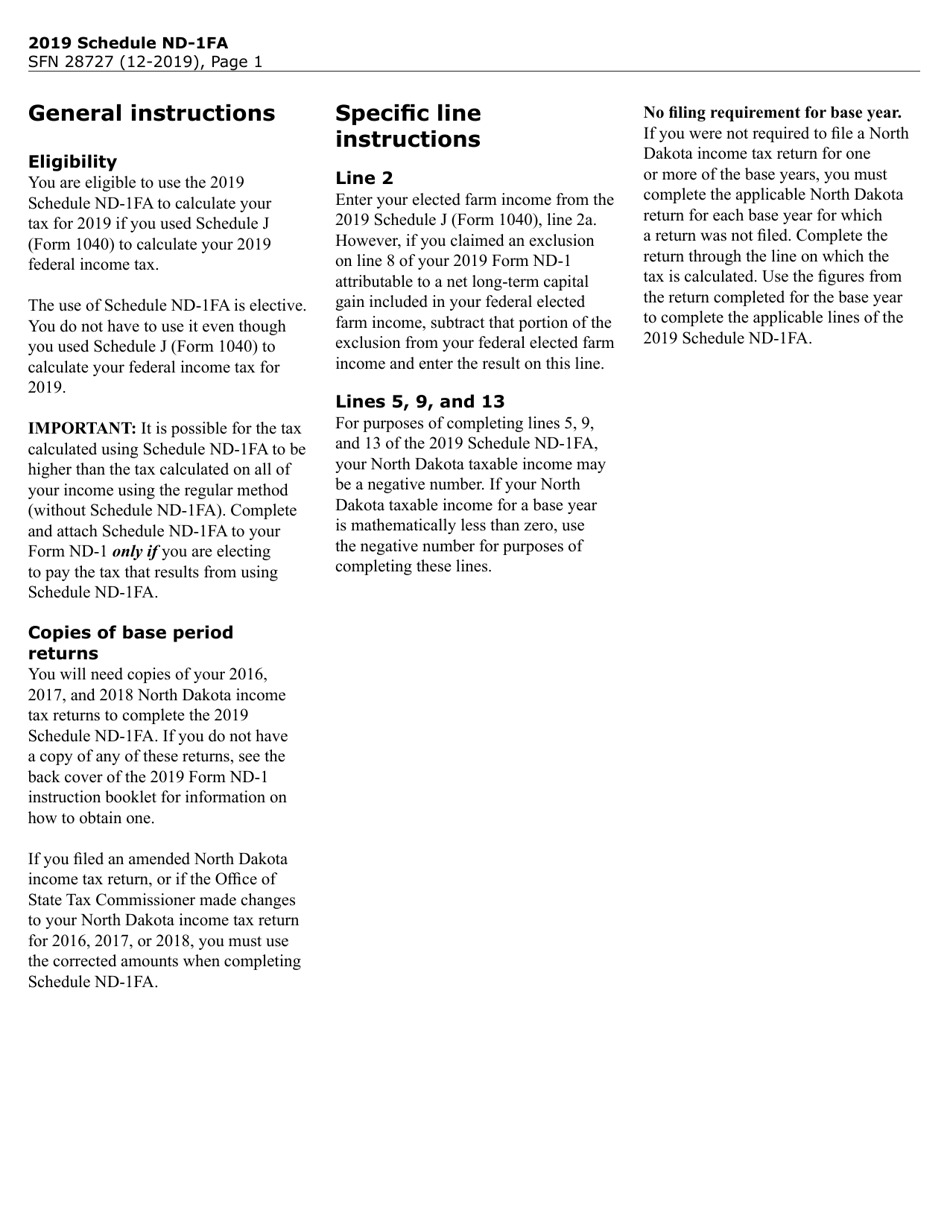

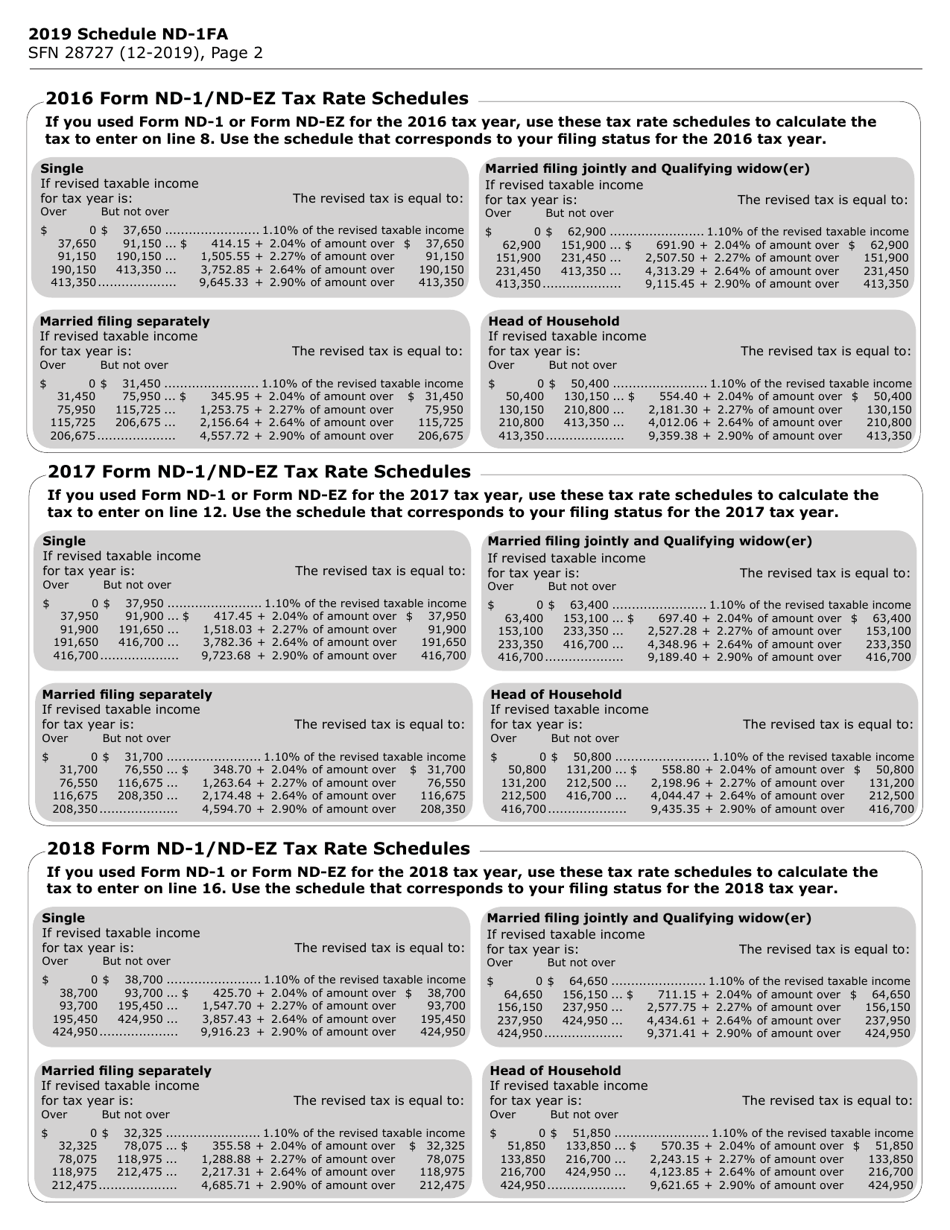

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-1 (SFN28727)?

A: Form ND-1 (SFN28727) is a tax form used in North Dakota.

Q: What is Schedule ND-1FA?

A: Schedule ND-1FA is a form that allows farmers in North Dakota to use the 3-year averaging method for elected farm income.

Q: What is the 3-year averaging method for elected farm income?

A: The 3-year averaging method allows farmers to average their farm income over a period of 3 years for tax purposes.

Q: Who can use the 3-year averaging method for elected farm income?

A: Farmers in North Dakota who meet certain requirements can use the 3-year averaging method for elected farm income.

Q: What is the purpose of Form ND-1 (SFN28727) Schedule ND-1FA?

A: The purpose of Form ND-1 (SFN28727) Schedule ND-1FA is to calculate and report farm income using the 3-year averaging method in North Dakota.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1 (SFN28727) Schedule ND-1FA by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.