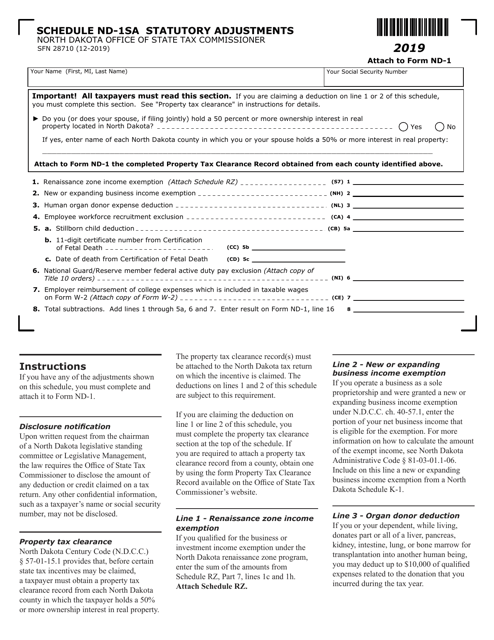

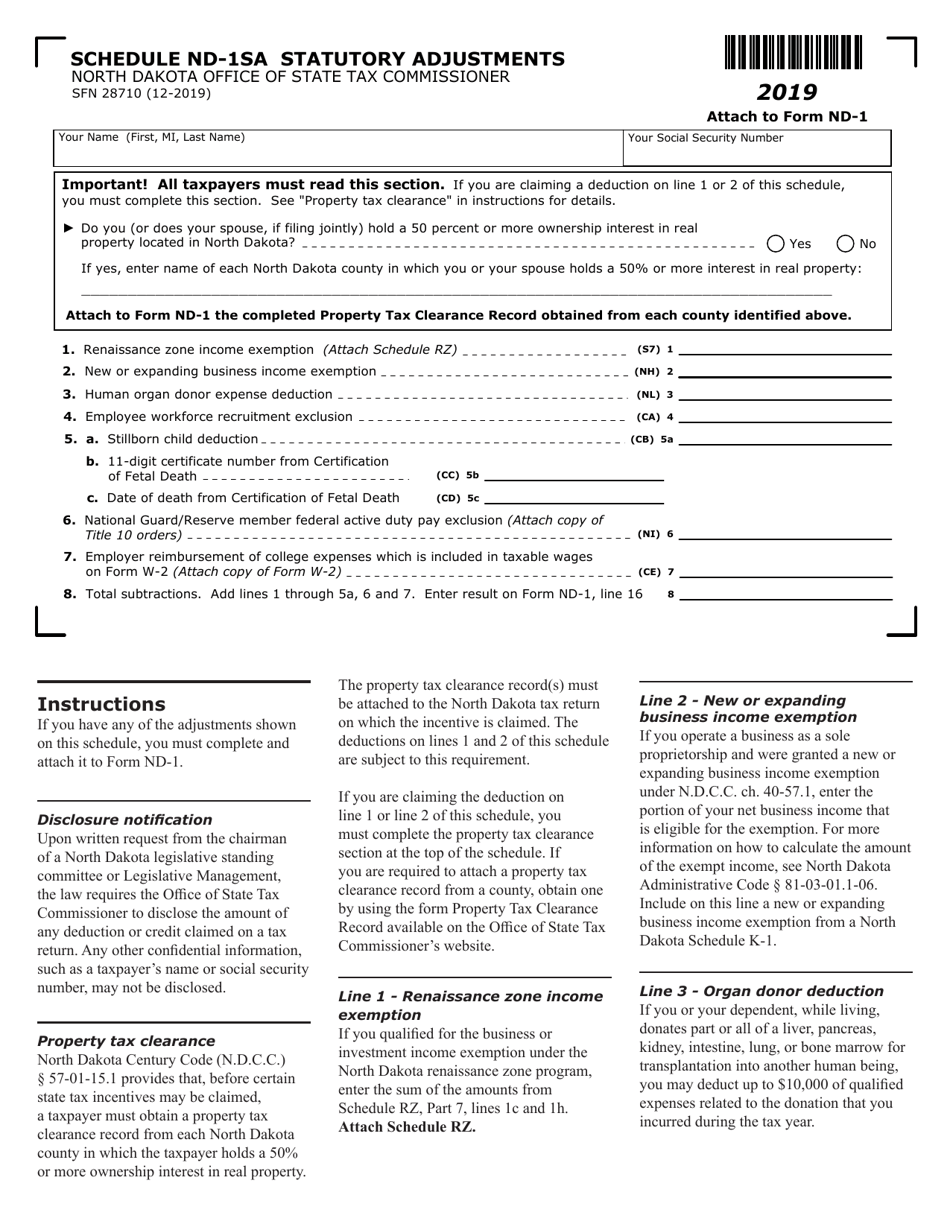

Form ND-1 (SFN28710) Schedule ND-1SA Statutory Adjustments - North Dakota

What Is Form ND-1 (SFN28710) Schedule ND-1SA?

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ND-1?

A: Form ND-1 is a tax form used in North Dakota to report income and claim deductions.

Q: What is Schedule ND-1SA?

A: Schedule ND-1SA is a form attached to Form ND-1 that is used to report statutory adjustments for North Dakota taxes.

Q: What are statutory adjustments?

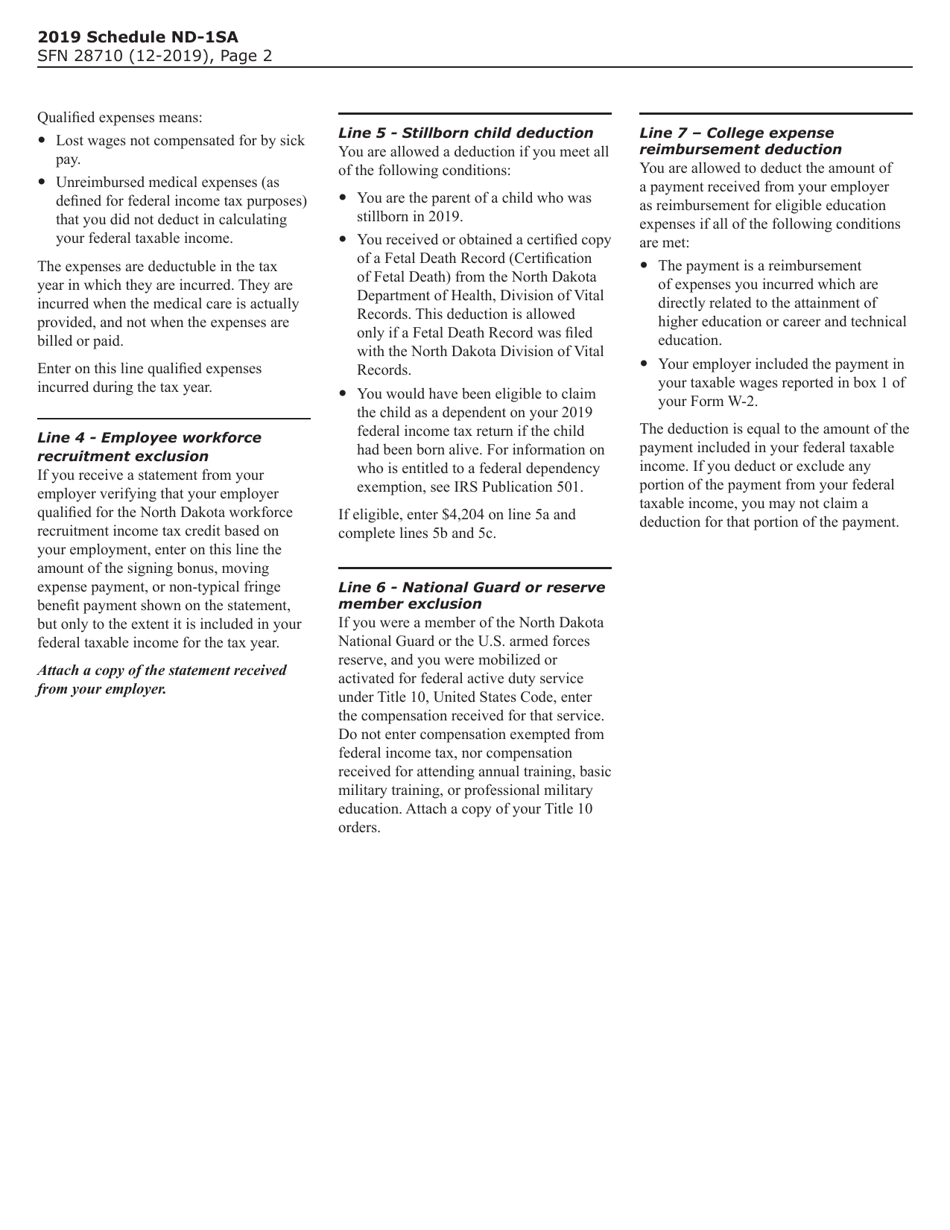

A: Statutory adjustments are specific deductions or addbacks required by the state of North Dakota for tax purposes.

Q: Why do I need to file Schedule ND-1SA?

A: You need to file Schedule ND-1SA to accurately report any required statutory adjustments on your North Dakota tax return.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1 (SFN28710) Schedule ND-1SA by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.