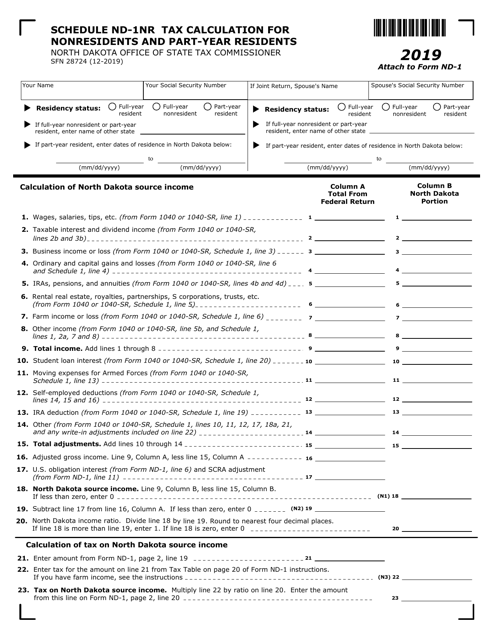

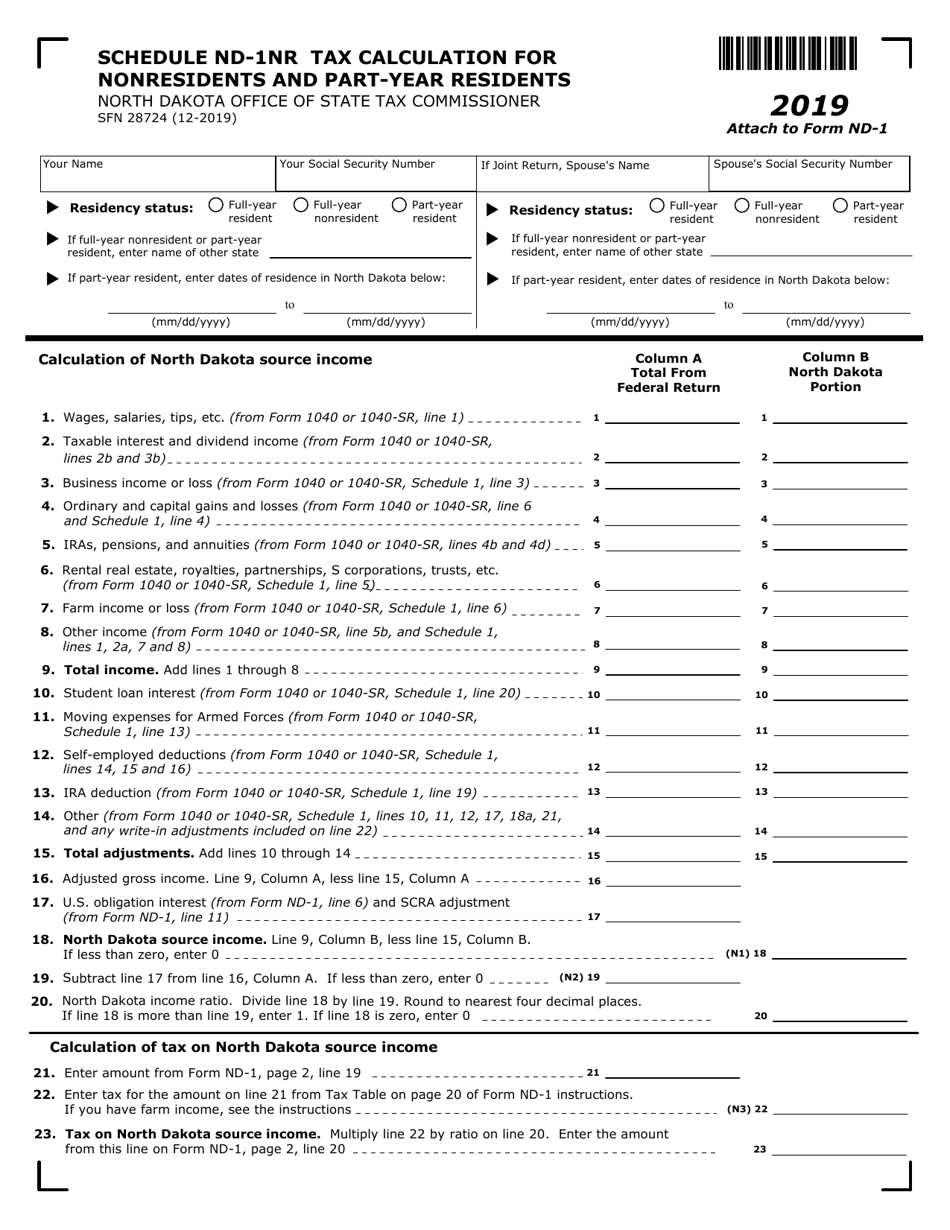

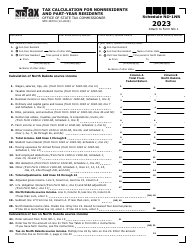

Form ND-1 (SFN28724) Schedule ND-N1NR Tax Calculation for Nonresidents and Part-Year Residents - North Dakota

What Is Form ND-1 (SFN28724) Schedule ND-N1NR?

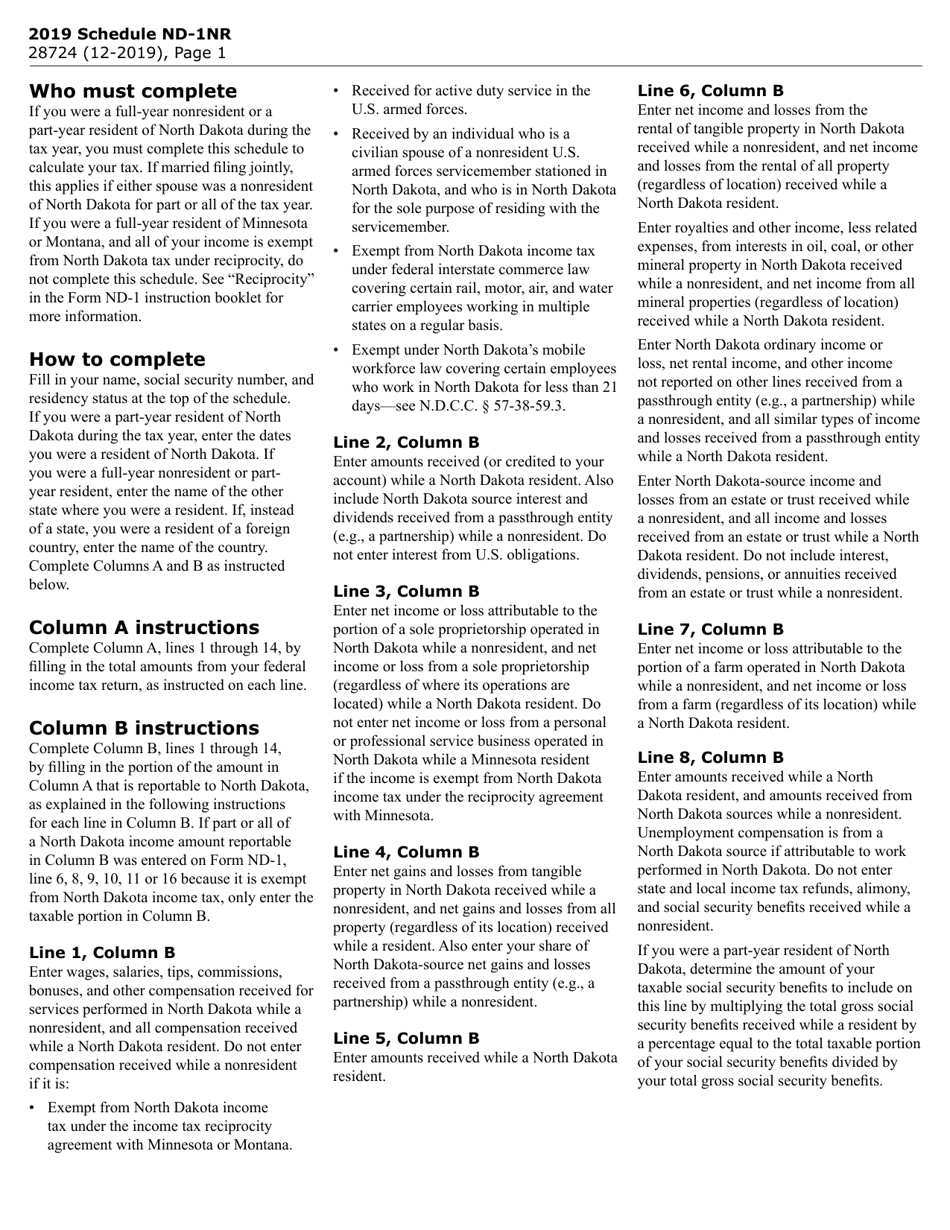

This is a legal form that was released by the North Dakota Office of State Tax Commissioner - a government authority operating within North Dakota. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

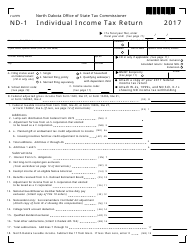

Q: What is Form ND-1 (SFN28724)?

A: Form ND-1 (SFN28724) is the tax form used for filing taxes by nonresidents and part-year residents in North Dakota.

Q: Who is required to file Form ND-1 (SFN28724)?

A: Nonresidents and part-year residents in North Dakota are required to file Form ND-1 (SFN28724).

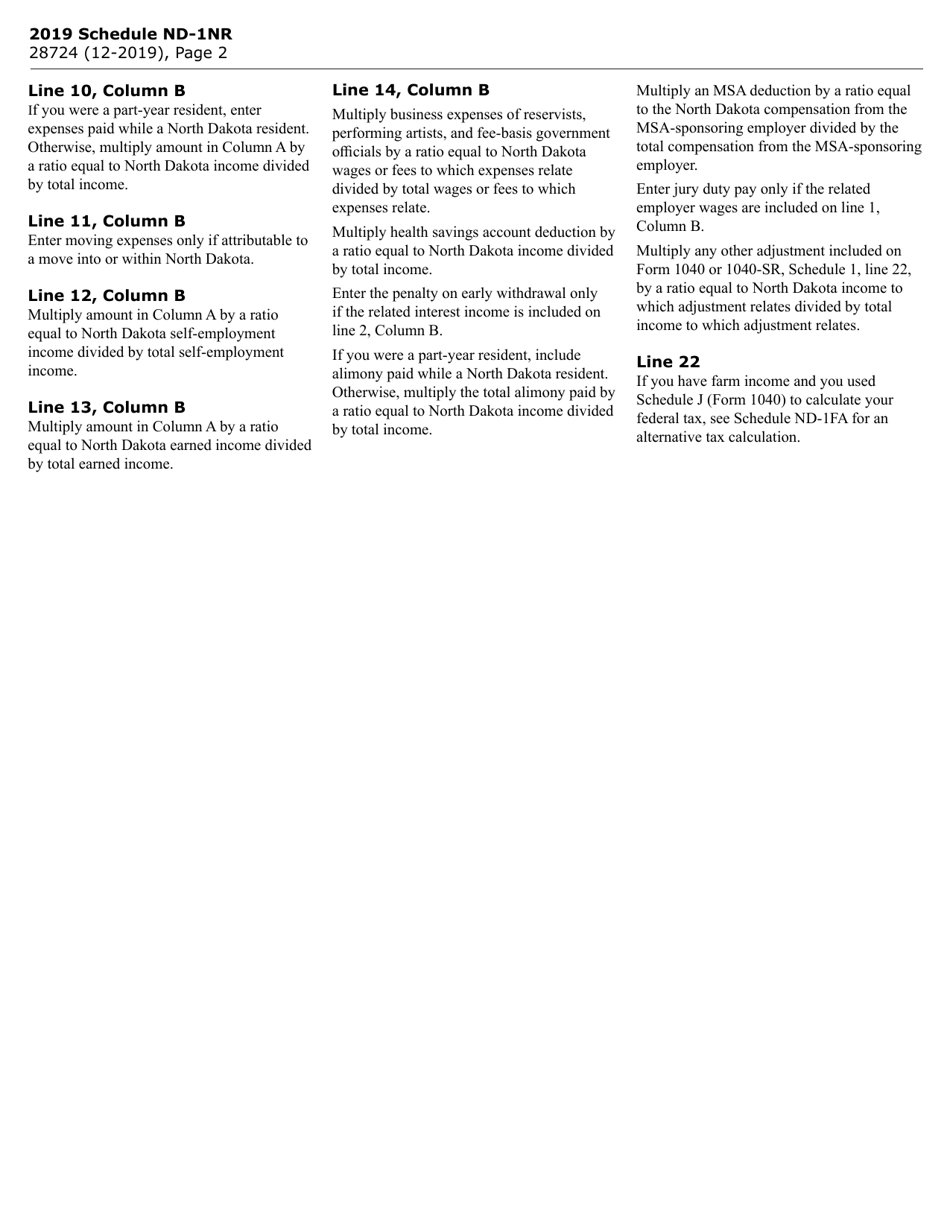

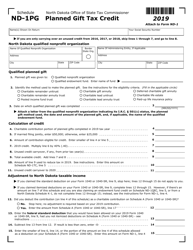

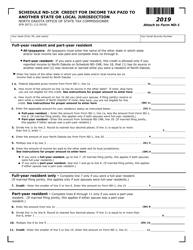

Q: What is Schedule ND-N1NR?

A: Schedule ND-N1NR is a tax calculation form that is used in conjunction with Form ND-1 (SFN28724) for nonresidents and part-year residents in North Dakota.

Q: What is the purpose of Schedule ND-N1NR?

A: The purpose of Schedule ND-N1NR is to calculate the tax liability for nonresidents and part-year residents in North Dakota.

Q: What information do I need to complete Form ND-1 (SFN28724) and Schedule ND-N1NR?

A: You will need information such as your income, deductions, and credits to complete Form ND-1 (SFN28724) and Schedule ND-N1NR.

Q: When is the deadline for filing Form ND-1 (SFN28724) and Schedule ND-N1NR?

A: The deadline for filing Form ND-1 (SFN28724) and Schedule ND-N1NR is typically April 15th, unless an extension has been granted.

Q: Can I e-file Form ND-1 (SFN28724) and Schedule ND-N1NR?

A: Yes, you can e-file Form ND-1 (SFN28724) and Schedule ND-N1NR if you prefer.

Q: Is there a penalty for filing Form ND-1 (SFN28724) and Schedule ND-N1NR late?

A: Yes, there may be penalties for filing Form ND-1 (SFN28724) and Schedule ND-N1NR late, so it's important to file by the deadline.

Form Details:

- Released on December 1, 2019;

- The latest edition provided by the North Dakota Office of State Tax Commissioner;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ND-1 (SFN28724) Schedule ND-N1NR by clicking the link below or browse more documents and templates provided by the North Dakota Office of State Tax Commissioner.