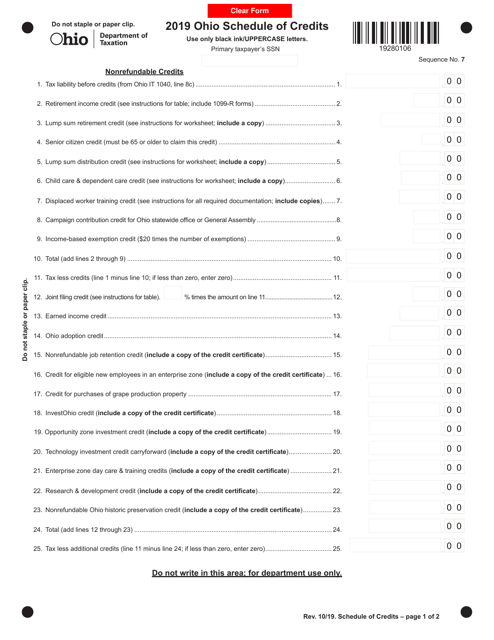

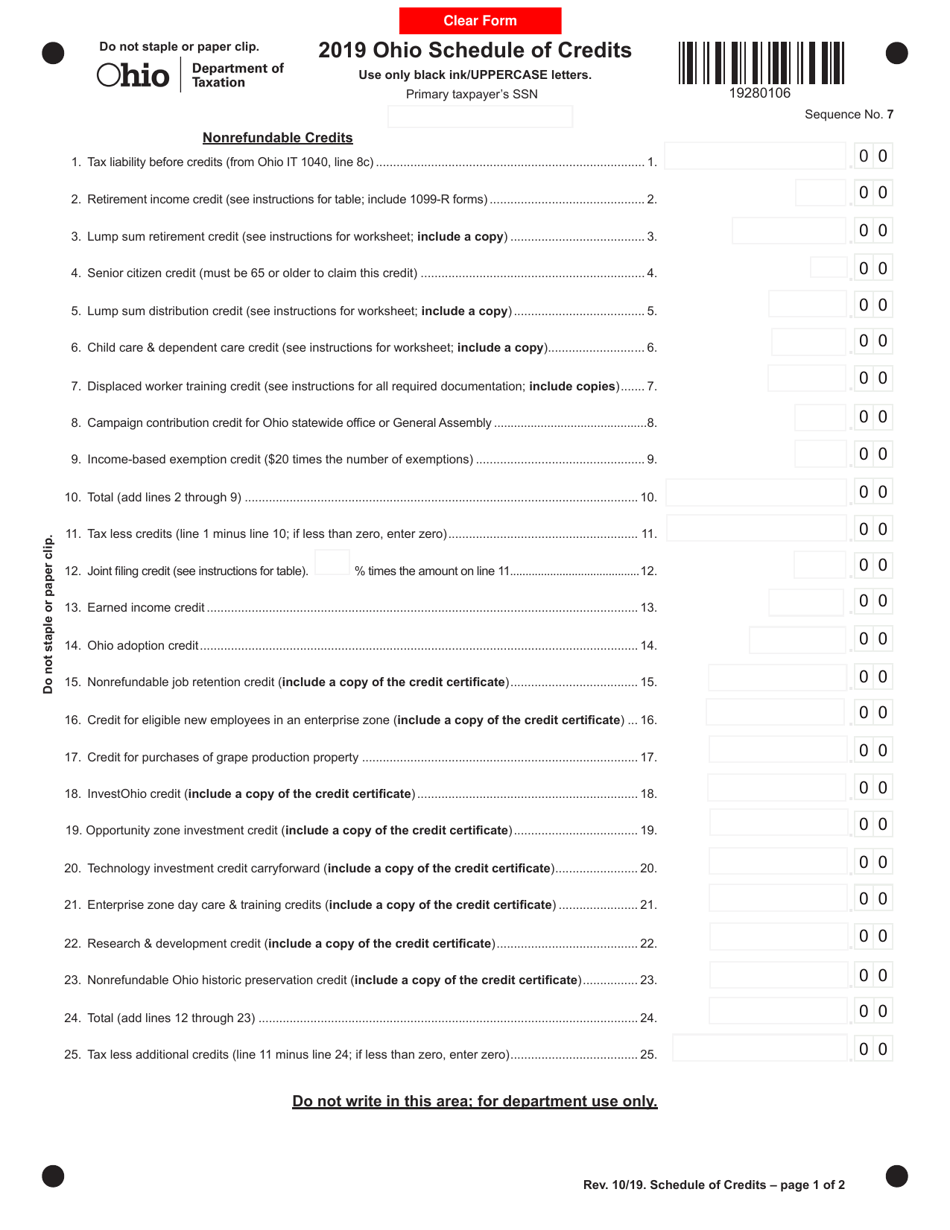

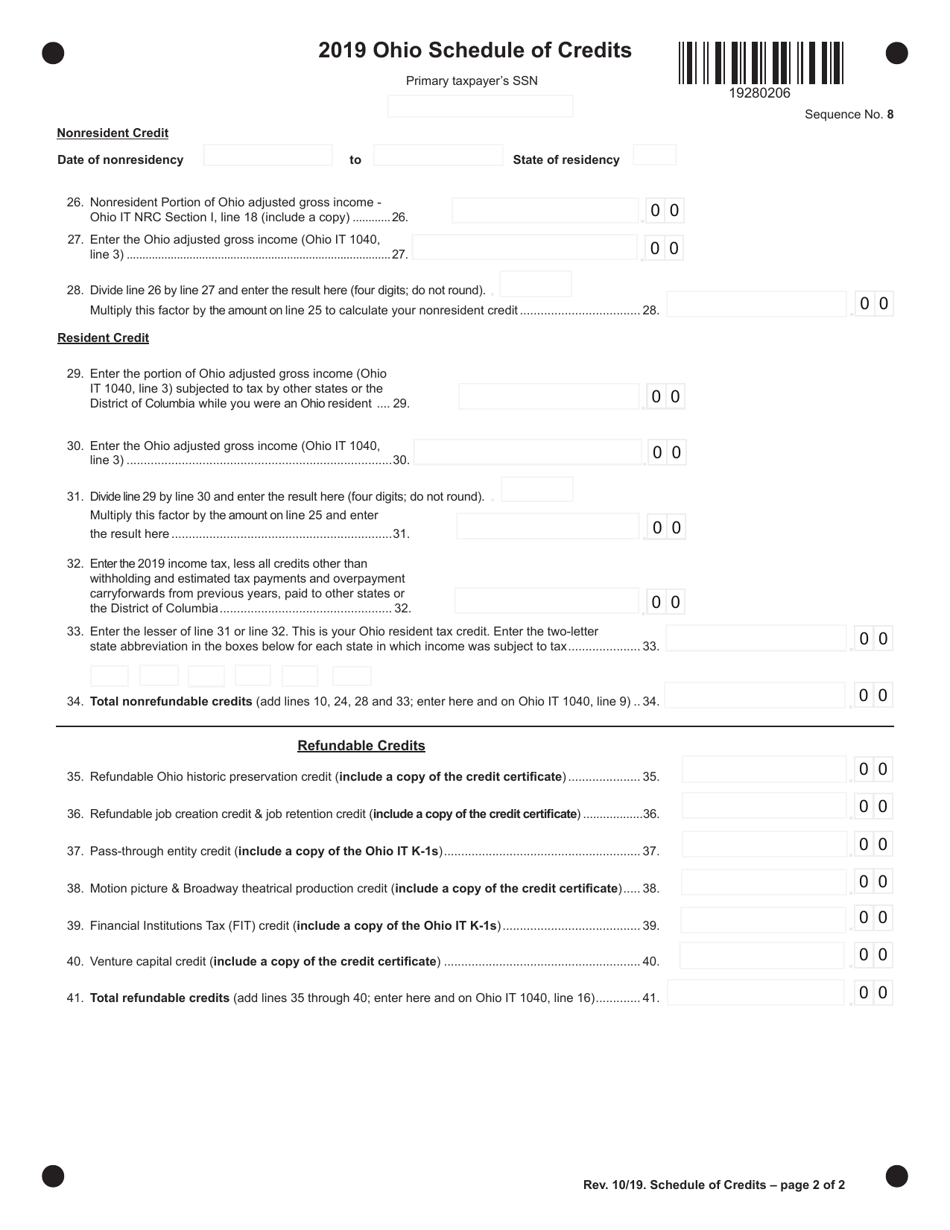

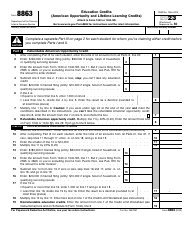

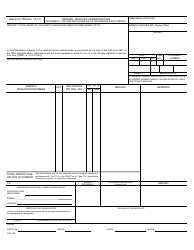

Ohio Schedule of Credits - Ohio

Ohio Schedule of Credits is a legal document that was released by the Ohio Department of Taxation - a government authority operating within Ohio.

FAQ

Q: What is the Ohio Schedule of Credits?

A: The Ohio Schedule of Credits is a document that outlines the tax credits available to taxpayers in the state of Ohio.

Q: Who can claim tax credits on the Ohio Schedule of Credits?

A: Individuals and businesses who qualify for specific tax credits outlined in the Ohio Schedule of Credits can claim them.

Q: What are some of the tax credits available on the Ohio Schedule of Credits?

A: Some of the tax credits available on the Ohio Schedule of Credits include the Earned Income Tax Credit, the Ohio College Opportunity Tax Credit, and the Ohio Motion Picture Tax Credit.

Q: How do I know if I qualify for a specific tax credit on the Ohio Schedule of Credits?

A: Each tax credit on the Ohio Schedule of Credits has its own eligibility requirements. You can refer to the specific tax credit instructions to determine if you qualify.

Q: Do I need to file the Ohio Schedule of Credits with my tax return?

A: If you qualify for any of the tax credits listed on the Ohio Schedule of Credits, you may need to include it with your tax return. However, it is always best to consult with a tax professional or refer to the specific instructions for each tax credit.

Q: Are there any deadlines for claiming tax credits on the Ohio Schedule of Credits?

A: Yes, some tax credits on the Ohio Schedule of Credits may have specific deadlines for claiming. Make sure to review the instructions and requirements for each credit to ensure timely filing.

Q: Can I claim multiple tax credits on the Ohio Schedule of Credits?

A: Yes, you can claim multiple tax credits on the Ohio Schedule of Credits if you meet the eligibility requirements for each credit. However, keep in mind that each credit may have its own limitations and restrictions.

Q: Are the tax credits on the Ohio Schedule of Credits refundable?

A: Some of the tax credits listed on the Ohio Schedule of Credits are refundable, meaning that if the amount of the credit exceeds your tax liability, you may be eligible for a refund of the excess credit.

Q: Is the Ohio Schedule of Credits the same as the federal tax credits?

A: No, the Ohio Schedule of Credits lists state-specific tax credits available in Ohio. Federal tax credits are separate and are claimed on your federal income tax return.

Q: Can I carry forward unused tax credits from the Ohio Schedule of Credits?

A: Each tax credit on the Ohio Schedule of Credits may have its own rules regarding carryforwards. Review the specific instructions for each credit to determine if unused credits can be carried forward to future years.

Form Details:

- Released on October 1, 2019;

- The latest edition currently provided by the Ohio Department of Taxation;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.