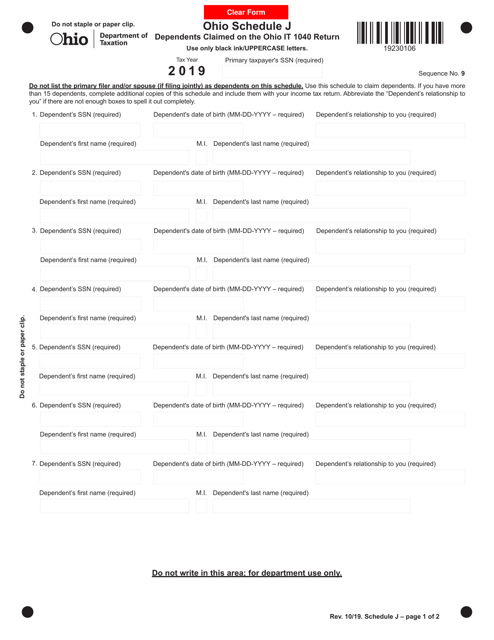

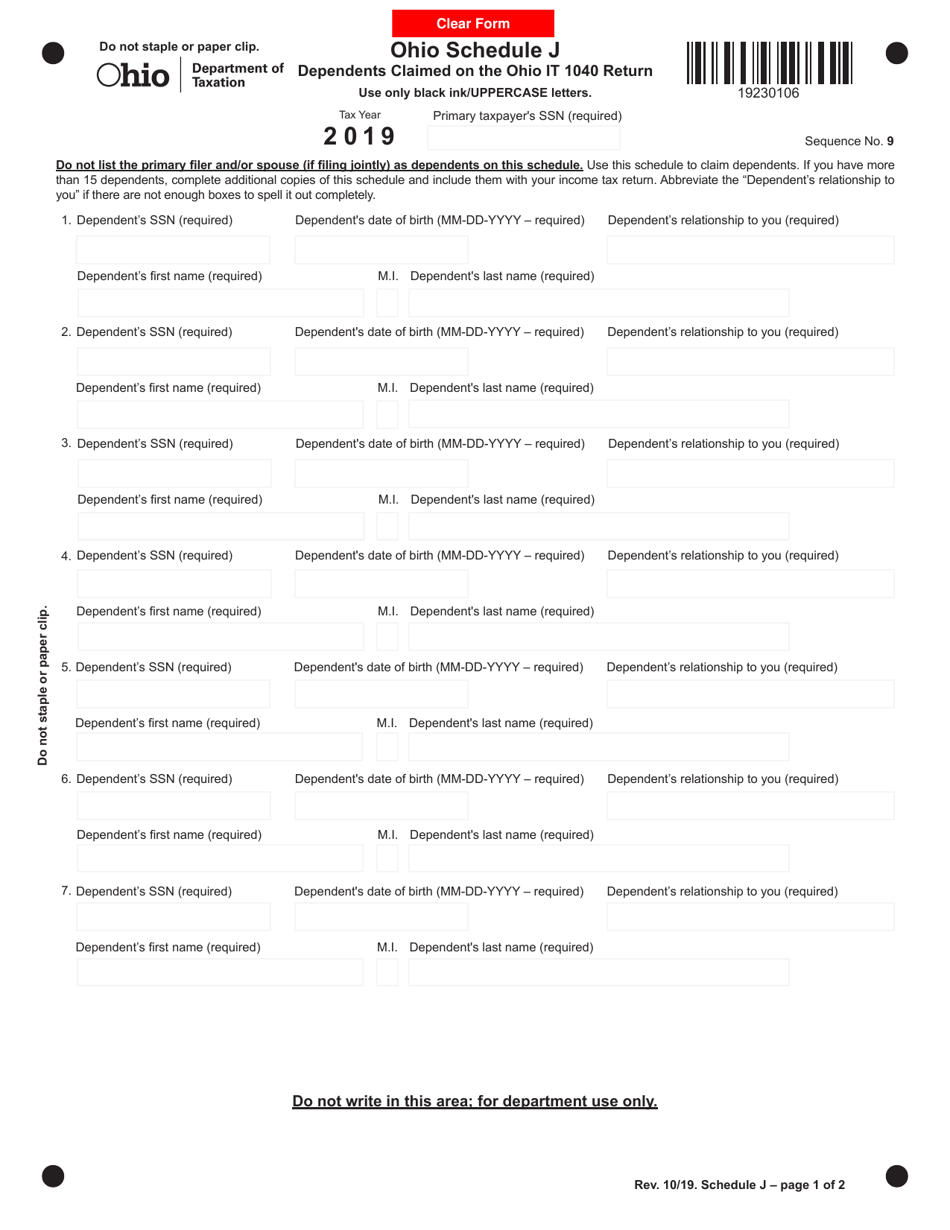

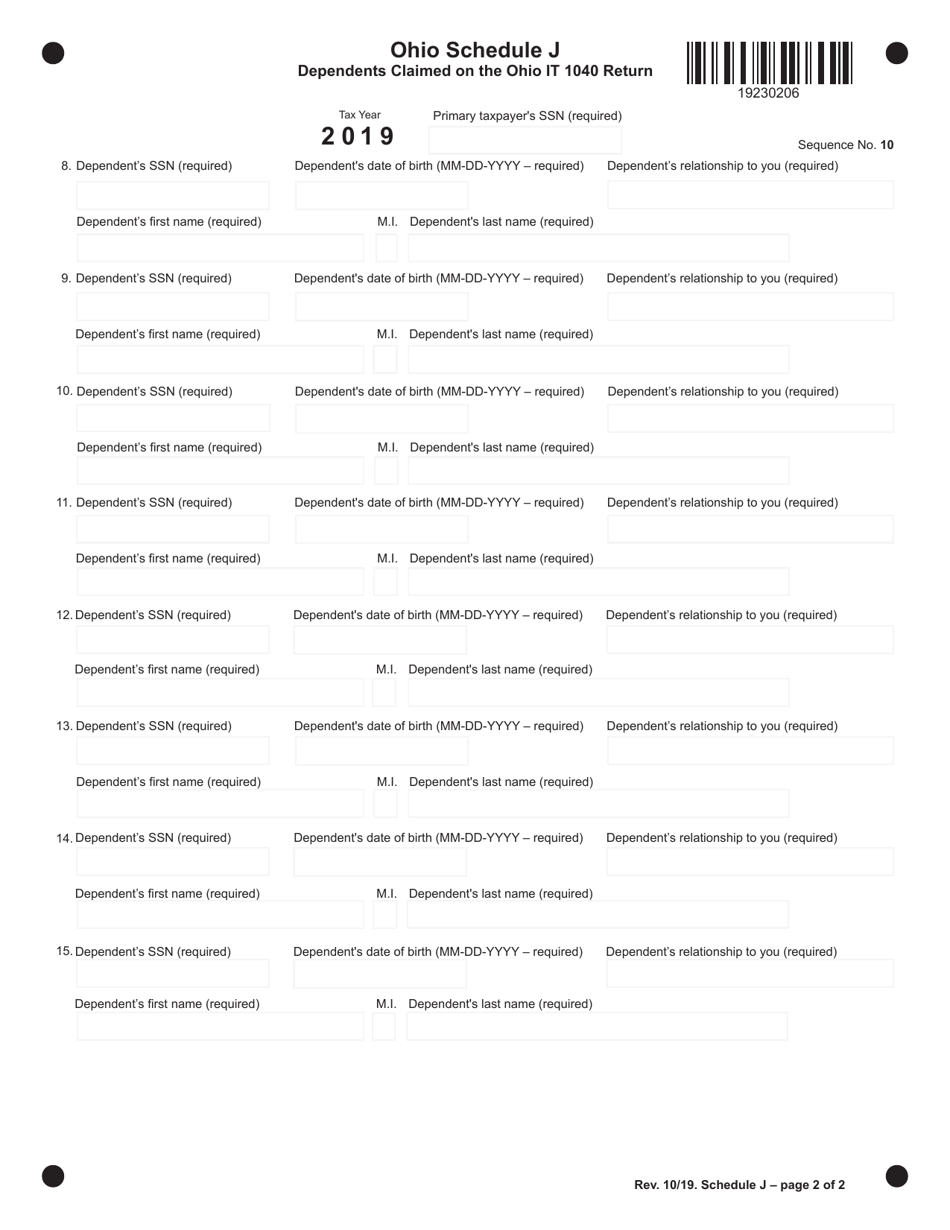

Schedule J Dependents Claimed on the Ohio It 1040 Return - Ohio

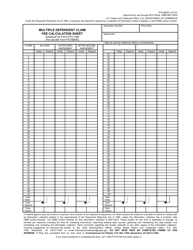

What Is Schedule J?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule J?

A: Schedule J is a form used when filing the Ohio IT 1040 return.

Q: What does Schedule J determine?

A: Schedule J determines the amount of dependents claimed on the Ohio IT 1040 return.

Q: Who needs to fill out Schedule J?

A: Anyone filing the Ohio IT 1040 return and claiming dependents needs to fill out Schedule J.

Q: What information is required on Schedule J?

A: Schedule J requires information about each dependent claimed, including their name, social security number, relationship to the filer, and the number of months they lived with the filer during the tax year.

Q: Are there any income limitations for claiming dependents on Schedule J?

A: No, there are no income limitations for claiming dependents on Schedule J.

Q: Can I claim dependents on Schedule J if I don't live in Ohio?

A: No, Schedule J is specific to the Ohio IT 1040 return, so you can only claim dependents on this form if you are an Ohio resident.

Form Details:

- Released on October 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Schedule J by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.