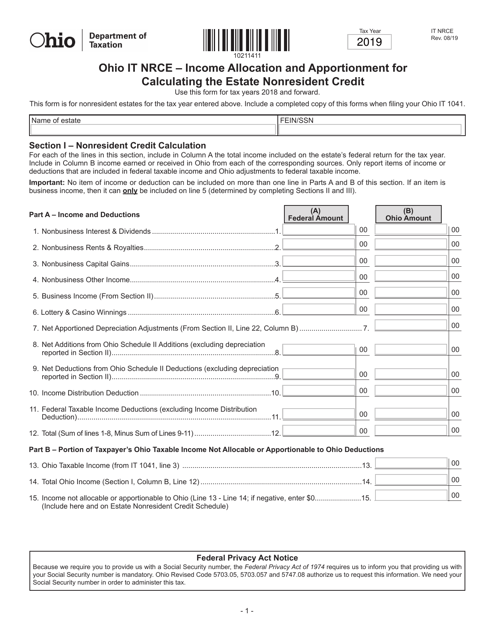

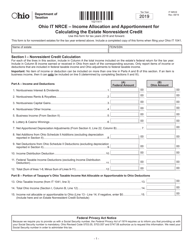

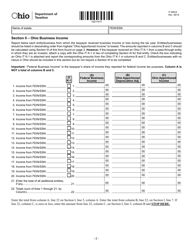

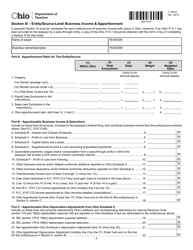

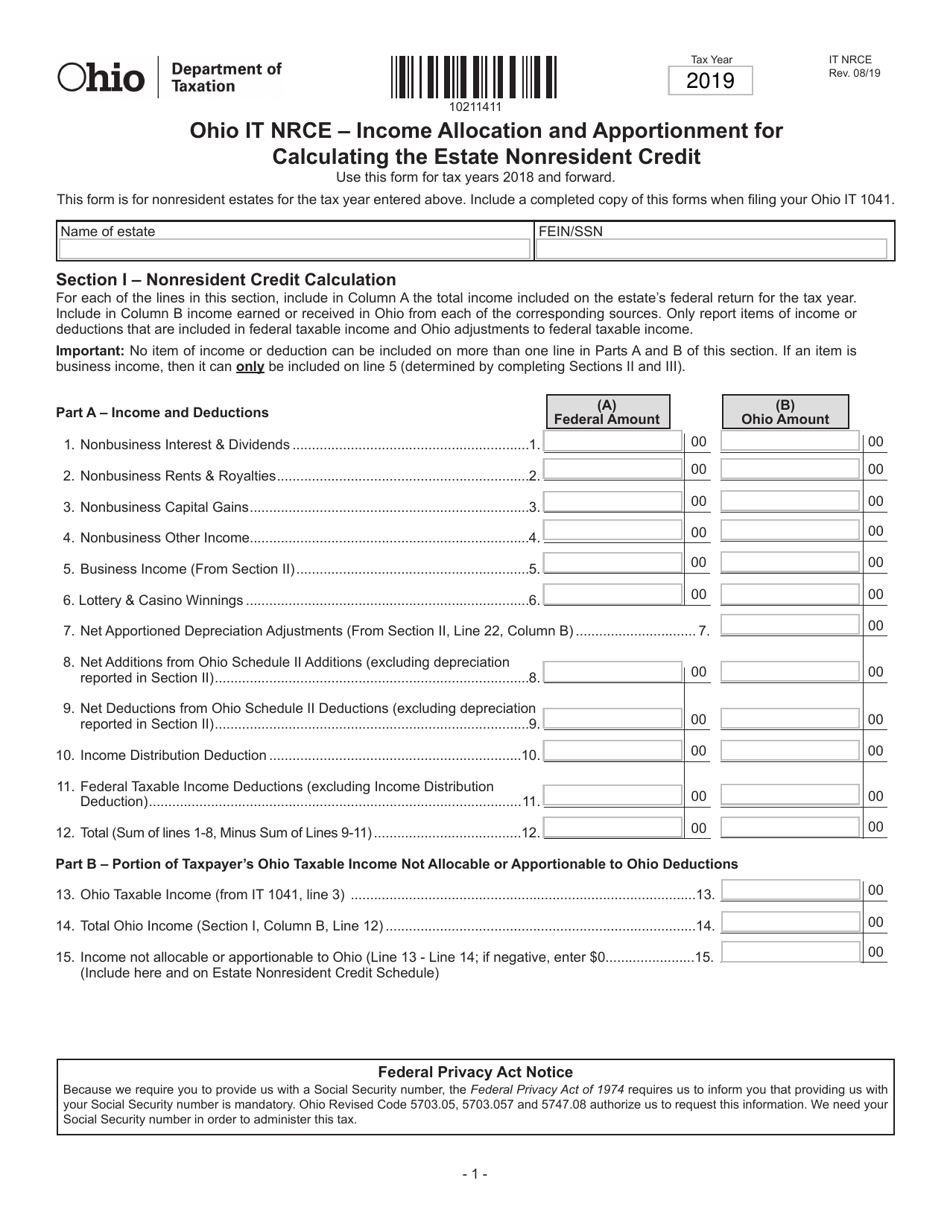

Form IT NRCE Income Allocation and Apportionment for Calculating the Estate Nonresident Credit - Ohio

What Is Form IT NRCE?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the IT NRCE form?

A: The IT NRCE form is used to allocate and apportion income for calculating the Estate Nonresident Credit in Ohio.

Q: What is the Estate Nonresident Credit?

A: The Estate Nonresident Credit is a tax credit available to estates of nonresidents of Ohio to offset their Ohio income tax liability.

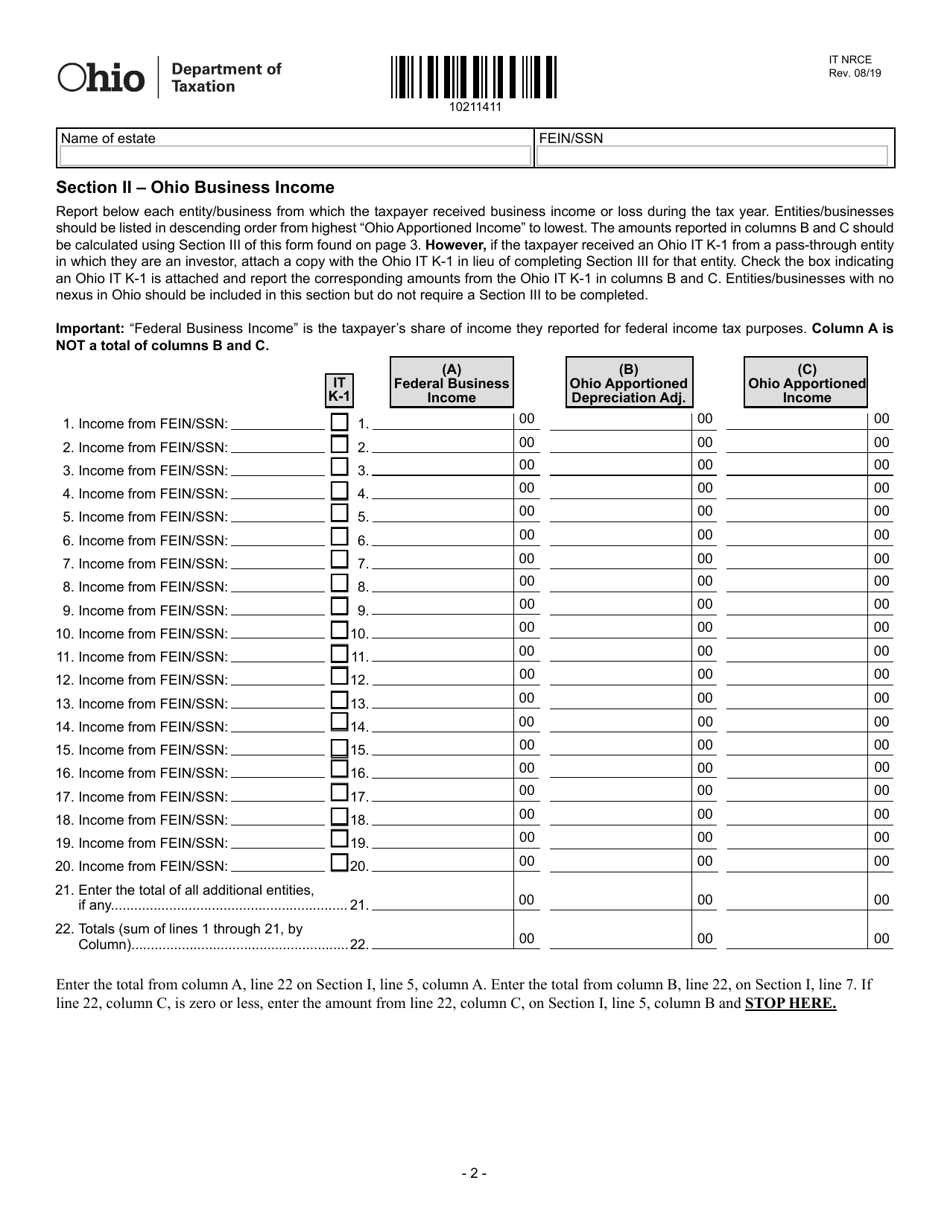

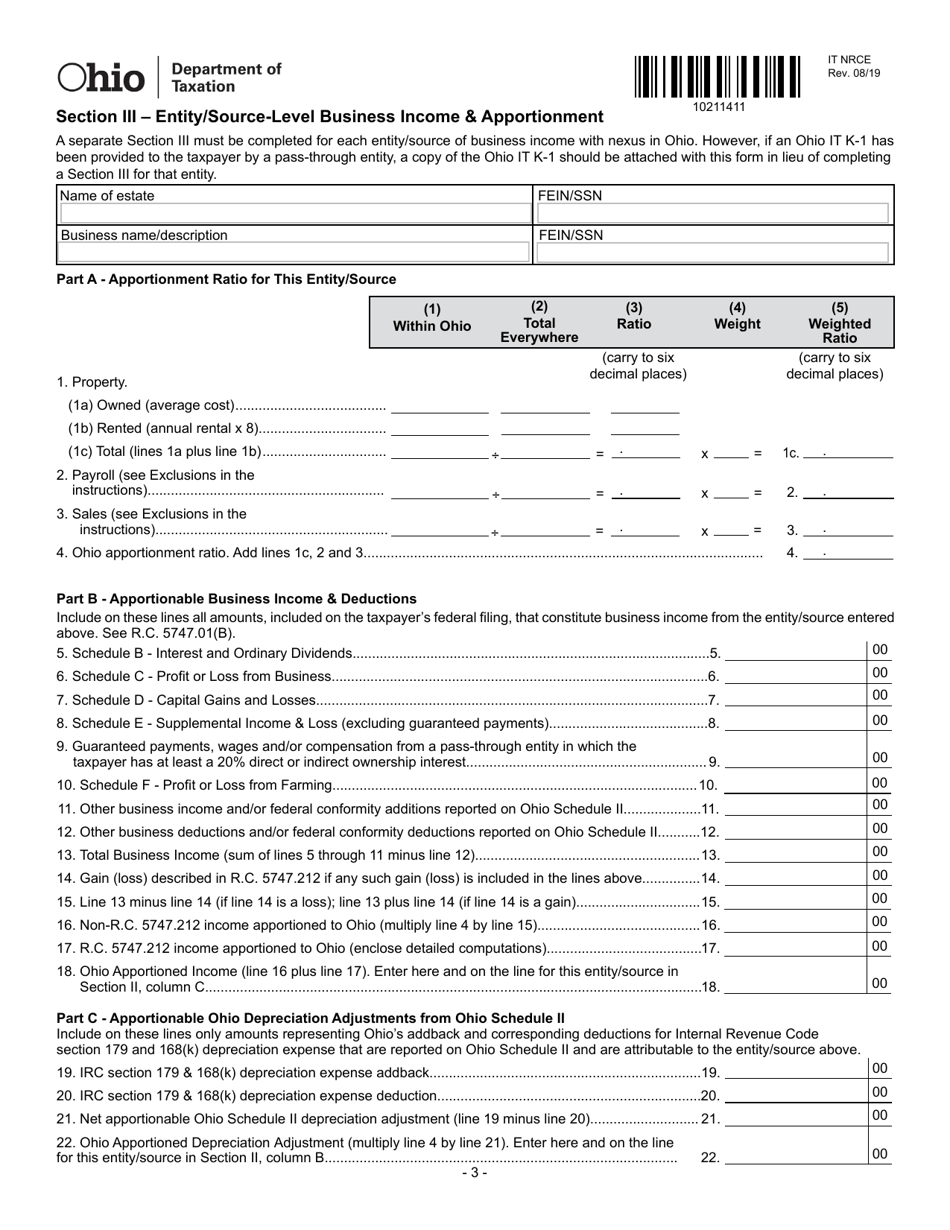

Q: What is income allocation and apportionment?

A: Income allocation and apportionment is the process of determining how much income should be allocated to Ohio and how much should be allocated to other states for tax purposes.

Q: Who needs to use the IT NRCE form?

A: Executors or administrators of estates of nonresidents of Ohio who have income from Ohio sources need to use the IT NRCE form.

Q: What income should be allocated and apportioned?

A: All income earned by the estate, including income from Ohio sources, should be allocated and apportioned.

Q: How is income allocated and apportioned on the IT NRCE form?

A: Income is allocated and apportioned based on a formula that takes into account the percentage of the estate's Ohio property, payroll, and sales compared to its total property, payroll, and sales.

Q: When is the IT NRCE form due?

A: The IT NRCE form is due by the original due date of the Ohio estate tax return, which is generally nine months after the decedent's date of death.

Form Details:

- Released on August 1, 2019;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form IT NRCE by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.